Coming off yesterday's lowest volume (full) session of the year (and Monday was the 2nd lowest), the low level of liquidity was very apparent in today's anxiety-filled session as traders puked back gains ahead of "the most important earnings announcement ever".

Nasdaq was clubbed like a baby seal, but all the majors saw two big legs down intraday. That, of course, was met with a wave of BTFDing as the last hour began

Mag7 stocks were dumped for the fifth day in a row...

Source: Bloomberg

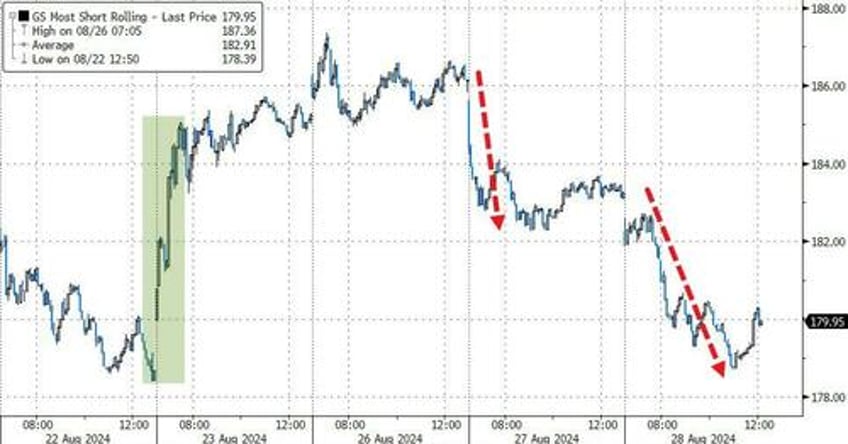

Also, 'most shorted' stocks were dumped, erasing all the post-Powell euphoria...

Source: Bloomberg

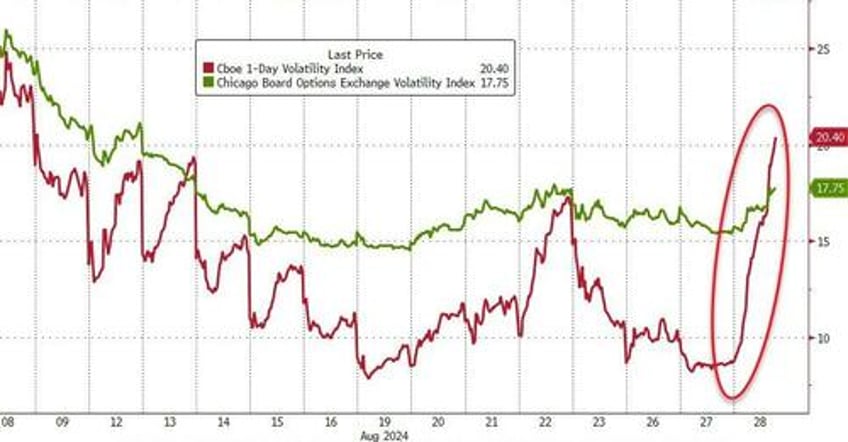

1-Day-VIX soared higher ahead of tonight's earnings news (higher than VIX)...

Source: Bloomberg

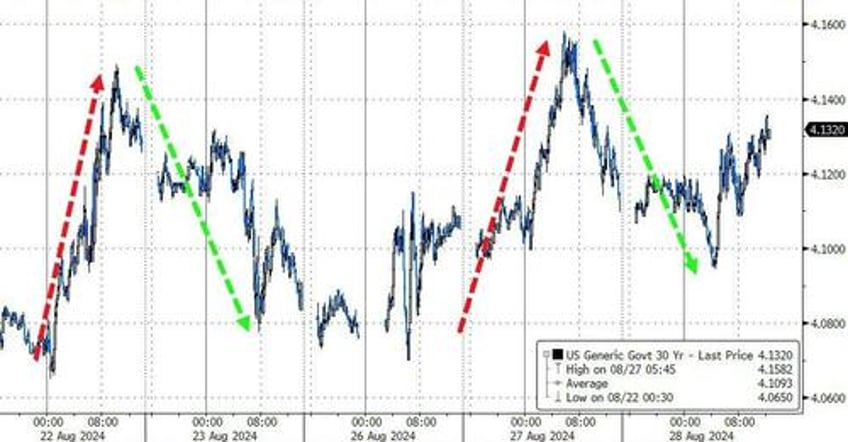

Treasury yields were higher across the curve by 1-2bps on the day with the long-end very modestly underperforming...

Source: Bloomberg

The dollar extended its rebound gains, erasing 75% of the post-Powell plunge...

Source: Bloomberg

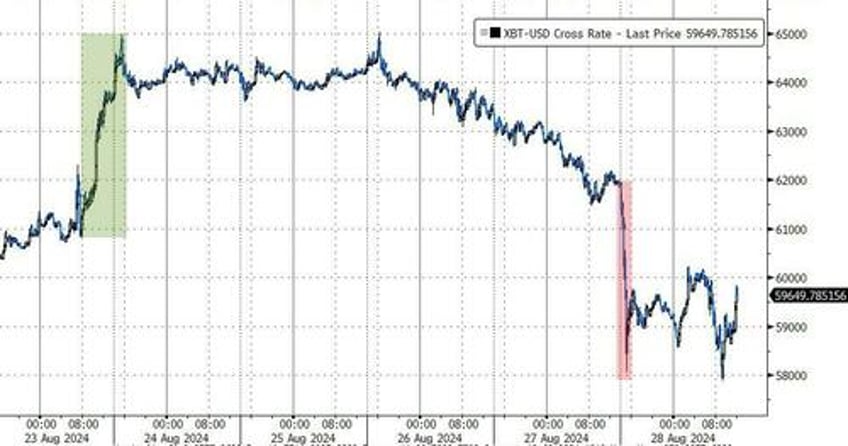

Bitcoin was battered today with a big puke shortly after yesterday's equity cash market closed. The cryptocurrency found support at $58,000 and tested back up to $60,000...

Source: Bloomberg

Gold also tumbled on the day, only to find support at $2500...

Source: Bloomberg

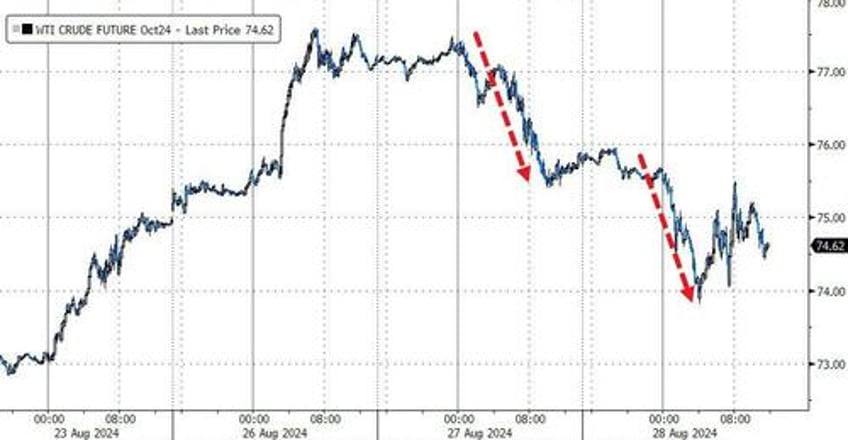

Oil prices dipped for the second day with WTI holding above $74...

Source: Bloomberg

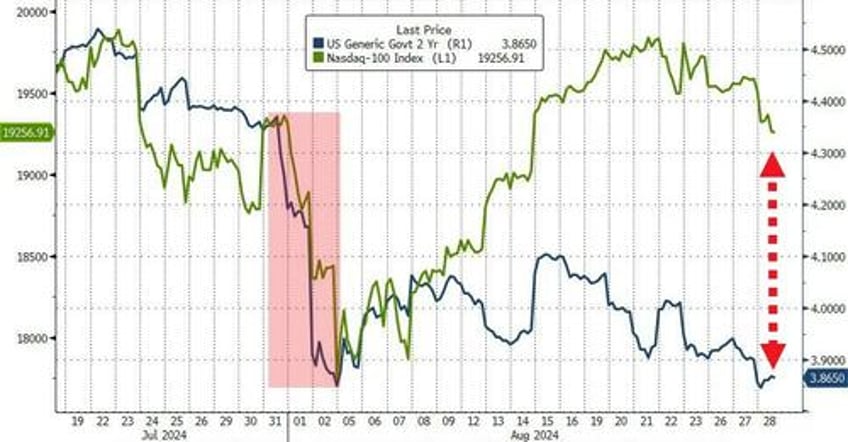

Finally, is it time for stocks to catch back down to bonds' reality?

Source: Bloomberg

...and will NVDA be the trigger?