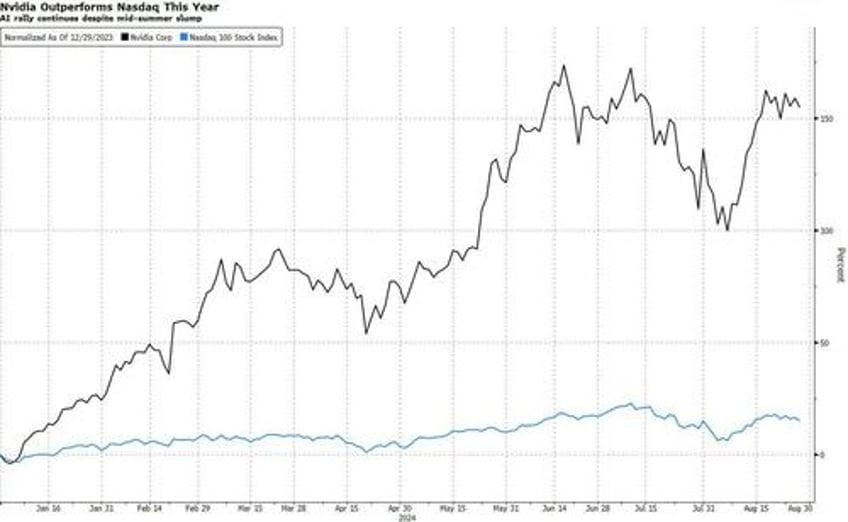

For the second year in a row, Nvidia has been the world's most important company, rising more than 150% YTD to a staggering $3.1 trillion market cap, massively outperforming the Nasdaq, and putting it within spitting distance of becoming the world's largest company (it is currently #2 behind AAPL).

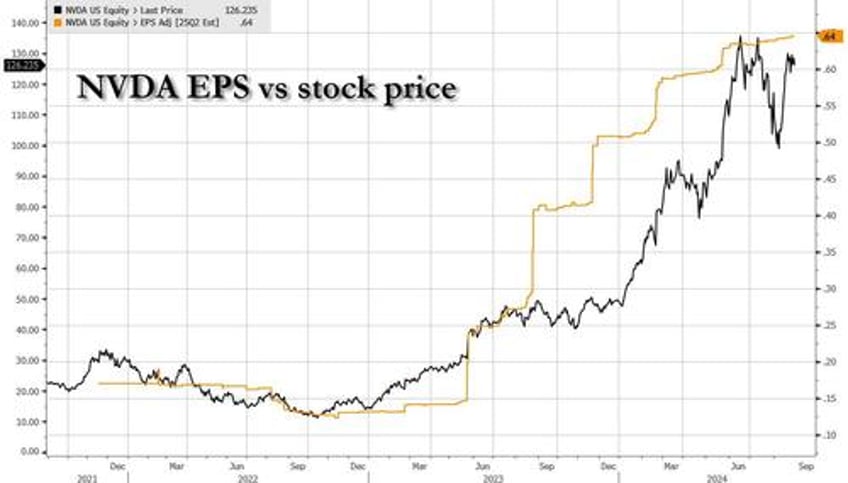

And while the stock price gains have largely been driven by regular raises of the company's forward earnings expectations...

... the question arises: how much more earnings growth is there? We already laid out Wall Street's expectations for what to expect earlier, but with with whisper numbers at nosebleed levels relative to already euphoric guidance and estimates, it's no surprise why the options market is expecting a 10% swing after hours.

A quick look at the past: the company's second quarter wasn’t perfect - the company stopped short of completely denying reports that there are problems with its forthcoming Blackwell product lineup. Analyst reports have dismissed any issues as immaterial given the overall level of demand for existing products - the chip line called Hopper - but management will face questions on the topic.

As a reminder, this is what Nvidia said earlier this month: “As we’ve stated before, Hopper demand is very strong, broad Blackwell sampling has started, and production is on track to ramp in the second half. Beyond that, we don’t comment on rumors.”

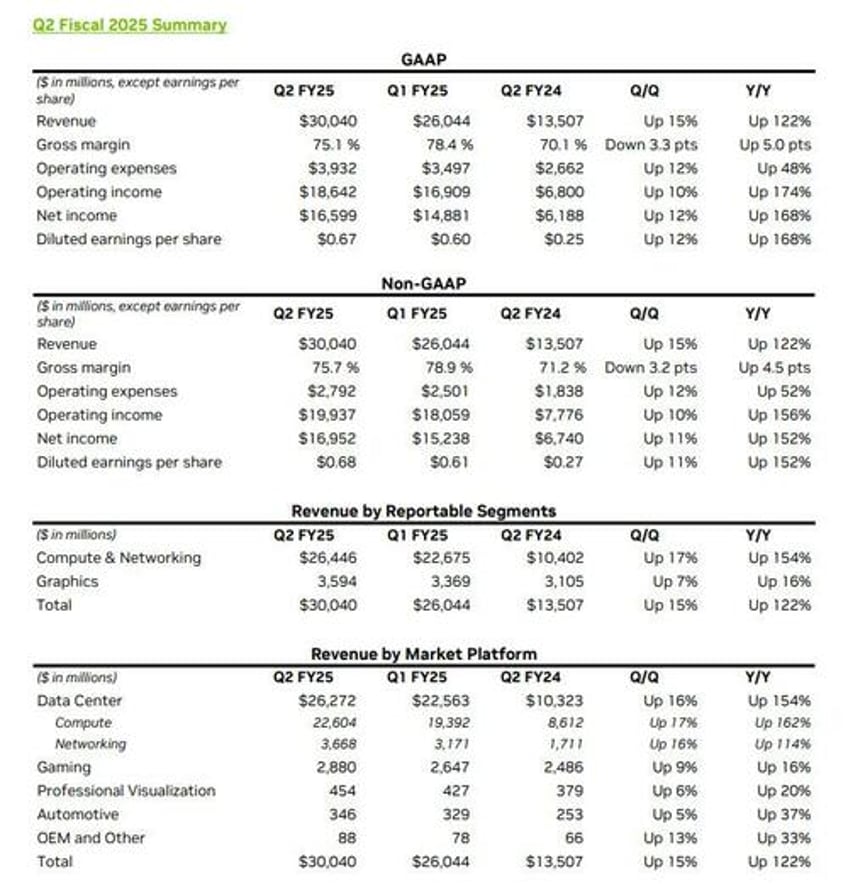

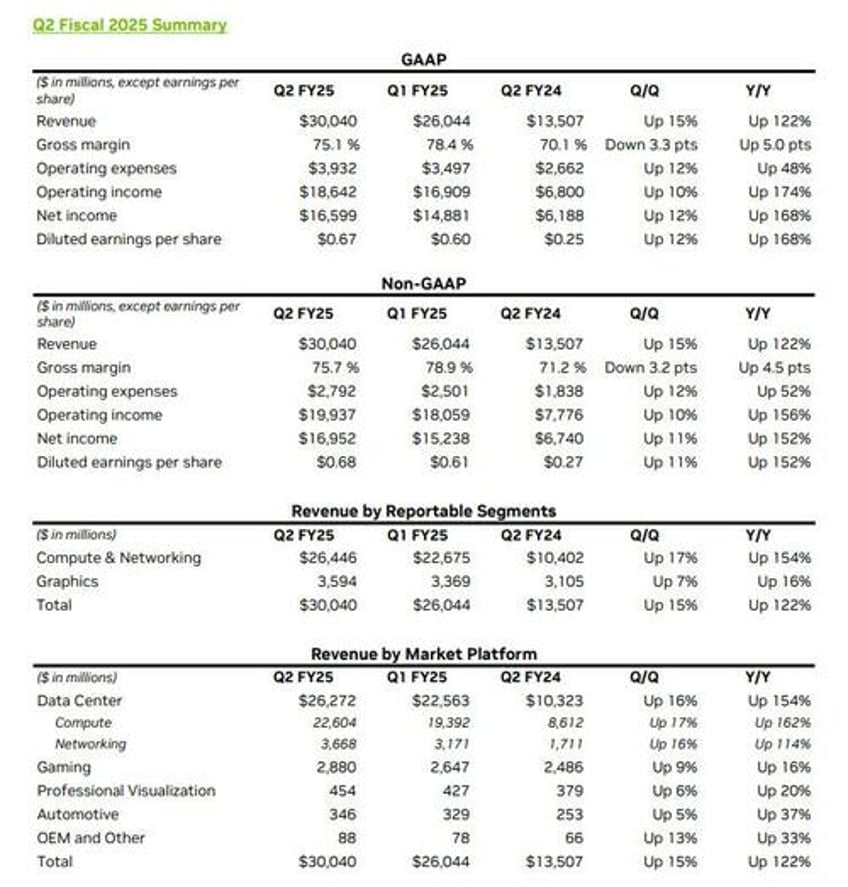

And so, amid skyhigh expectations for the current quarter, even loftier expectations for the company's guidance with questions about its main product line, here is what NVDA reported moments ago for the second quarter:

- Q2 Rev. $30.04B, up 122% YoY, beating estimates of $28.86B, and beating not only the upper end of the guidance ($27.44BN-$28.56BN) but also above the JPM whisper number of $29.85BN.

- Q2 Data Center Revenue $26.3B, beating exp. $25.08B

- Q2 EPS $0.68, up 152% YoY, beating exp. $0.64

- Q2 Gross Margin 75.7%, up 4.5% YoY from 71.2, beating exp. 75.5%, but down from 78.9% in Q1. Peak margins?

The revenue trend, as expected, is impressive especially at the Data Center level where all the growth is.

And here is a full breakdown of recent results:

While the Q2 earnings were impressive, beating both estimates and the even loftier whisper numbers across the board, there was just a touch of weakness in the company's guidance: NVDA projected Q3 revenue will be $32.5 million, +/- 2%. While this was above the average estimate was $31.9 billion, it was below JPM's whisper of $32.95BN and certainly below the most optimistic sellside prediction of $37.9 billion.

Perhaps anticipating the potential market revulsion to the modest guidance disappointment, NVDA tried to appease investors by announcing a massive new $50 billion buyback .

The company also tried to preempt questions about its reportedly troubled Blackwell chips, saying “samples are shipping to our partners and customers” and says that it expects to ship several billion dollars of Blackwell revenue in Q4 even as it admits in its earnings release that it needs to improve Blackwell production, to wit:

We shipped customer samples of our Blackwell architecture in the second quarter. We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue. Hopper demand is strong, and shipments are expected to increase in the second half of fiscal 2025.

While initially NVDA shares bounced on the big beat, the since dipped on the disappointing guidance, sliding as much as 6% after hours, and have since whiplashed by the results as the stock is still fighting for direction, swinging between gains and losses as traders digest the earnings. As a reminder, options markets had priced in a swing of 10% after hours, so for now the reaction is positive tame relative to expectations.

The big question: are the results good enough for Jensen to keep signing tits? The answer - you bet.