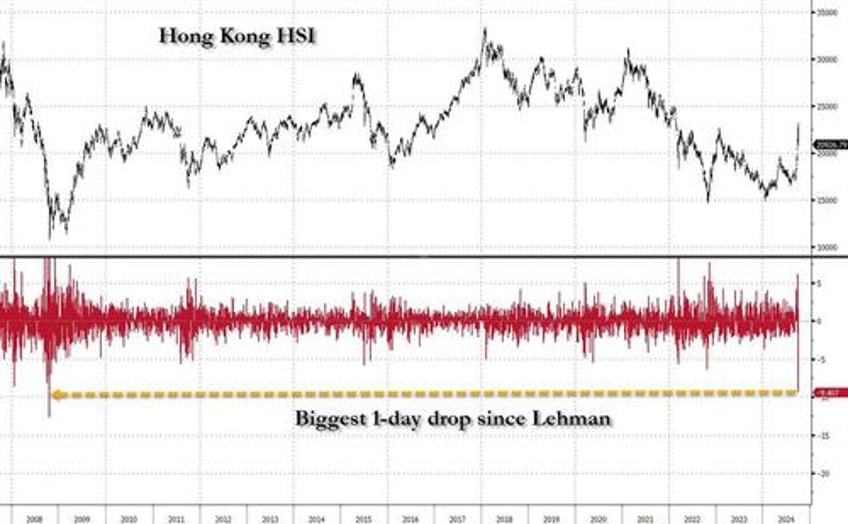

Yesterday when commenting on Goldman's recent upgrade of China's market to Overweight, only after a furious 30% rally had already taken place, we said this suggested that the "move in China has peaked and it's all downhill from here, which incidentally none other than Goldman's trading desk already predicted! Indeed, as we reported this weekend, while Goldman's sellside desk was finally set to recommend China, the bank's much more actionable FICC/S&T desk was already warning that the move in China is over unless Beijing does QE immediately, or else China "will end up in a bigger hole in 12 months." And just a few hours later, that's precisely what happened on Tuesday morning when China A-shares reopened from a week-long holiday and tried to catch up to the meltup only to see their gains slashed. Meanwhile, Hong Kong markets which were open the entire time, and which soared as much as 30% since the Beijing Bazooka was unveiled on Sept 26, cratered the most since the Lehman bankruptcy!

For those who missed it, here is a full rundown of everything that happened in China overnight courtesy of Goldman's trading desk:

1/ What happened

HK shares had their worst single day since Oct 2008 with double-digit percentage losses for major indices as the highly anticipated NDRC press conference added little fresh details on China’s stimulus plans, leaving investors hoping for concrete numbers feeling disappointed (although expectations were high heading into the event).

The HSCEI also recorded its worst day since 2008, plunging 10.2% while CSI300 opened near limit up +10.8%, faded to +2% and managed to bounce and close +5.9%. With that said HSCEI is still up 17% in the past 2 weeks. CSI300 is now up 32% in the past 2 weeks and been up every day.

Indeed, while A-shares markets pared from opening strength they still managed to close with gains on their first day back, suggesting rotation out of HK market drove the losses. The move essentially erased all of HK market gains during the break with HSI -9.4% back to levels seen on Sep 30th. Out of the major indices, all 82 HSI names / 50 HSCEI names / 30 HSTECH names closed in the red, speaking to the breadth of the drawdown today. HSCI, a more broad index that covers 95% of total market cap in HK, has 517 constituents with just 12 gainers. Southbound returned for the first time in more than a week, and it clawed back from outflow of nearly US$1b in the morning to a US$265m of inflow by end of the session suggesting mainland investors started to see value as HK shares sold off aggressively.

Some more details:

- Record volume, again: one week after HK volume made fresh record high of HK$505b, today’s HK$620b absolutely knocked it out of the park again. However, even that pales in comparison to the activity level China’s A-shares market today: it took less than 27 minutes of trading for turnover to break above 1t yuan, and by end of the session over 3.4t yuan of A-shares changed hands. For context, that’s more than the turnover of HK market, every single day from Sep 24th up to today, combined.

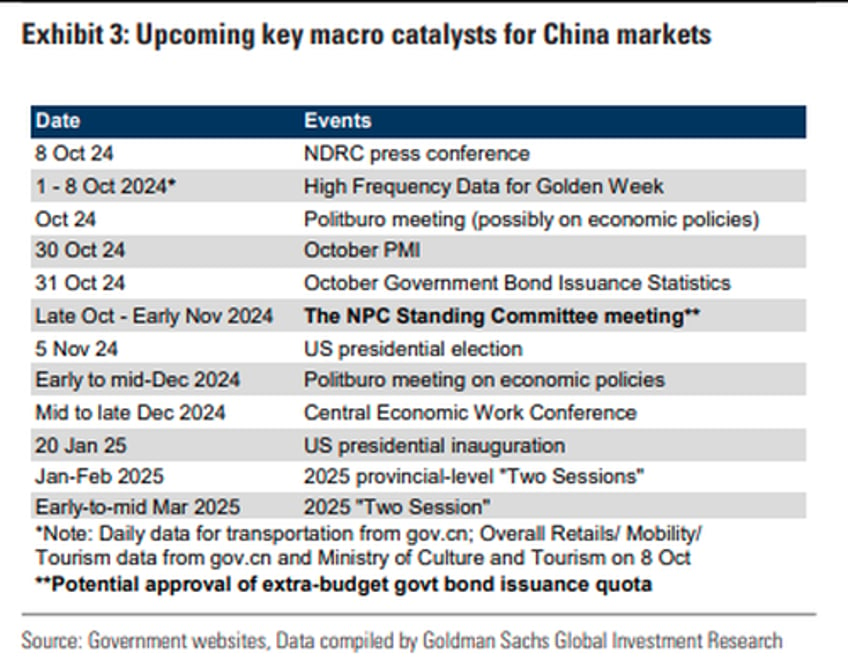

- NDRC disappointment: The NDRC presser at 10am HKT was an reiteration of Politburo’s easing pledge with little fresh details offered. Investors were expecting, or hoping for, more solid numbers regard any fiscal stimulus, but walked away empty handed outside of more pledges and vague policy headers such as increased investment and increase subsidies for low-income groups and students. On new fiscal announcement, very small. Front load the planning of 2025 projects, with 100b yuan strategic and national security projects and 100b yuan on-budget investment front loaded to 2024. So the total 200b yuan is very small compared to 2-3t yuan market expectation for additional fiscal this year. Goldma’s view: any large stimulus package may require joint efforts from many key ministries, and will need to be largely funded by fiscal resources. The bank will be watching for upcoming ad hoc meetings and the next NPC standing committee meeting late October; expect policymakers to approve an additional RMB1-2tn ultra-long-term central government special bond quota by year-end, tap unspent local government bond issuance quota accumulated from previous years to facilitate debt swaps, and maintain their fiscal easing stance in 2025 and even beyond.

- Profit taking & rotation: Just like how the recent rally in HK was fueled by foreign inflows and fast money, today’s sell-off felt profit taking driven by hedge funds and rotations from Long Onlies out of H-shares into A, there was large size inflows into A from LOs from the open. The NDRC meeting this morning was a disappointment vs investors high expectations for China to keep strong stimulus rhetoric and incremental easing going. Note that short sells only made up 12% of the turnover today indicating that most of the selling were long selling / profit taking

- Within thematics, investors were trading policy again with China Semis (+14.4%) and China AI (+13.7%) leading gains while Little Giants (+13.6%) and China EV (+13.2%) rounding out the top performers. Meanwhile strong outperformers during Golden Week like H-listed Fins ex-Banks (-24.1%) and H-listed China Prop (-23.4%) tumbling. There is some equalizing effect there given divergence in A/H move – note that HSAHP now back to 150.9 level, sharply higher from 128.5 level seen yesterday on back of relentless rally in HK while China was out: China Brokers (+8.2%) and China Prop (-3.9%) move was not as aggressive if you include the A-shares components.

- Southbound: In the morning southbound was net selling almost US$1bn, this turned around intraday and ended up being net buyers of ~US$300m.

- Movers:

- Leading the positive moves: China Semis +14.53%, China AI +13.80% and China EV +13.36%

- Selling in China H Real Estate -24.12%, SB Favorites-16.60%, China Consumption -11.87% and HK Tech -12.30%.

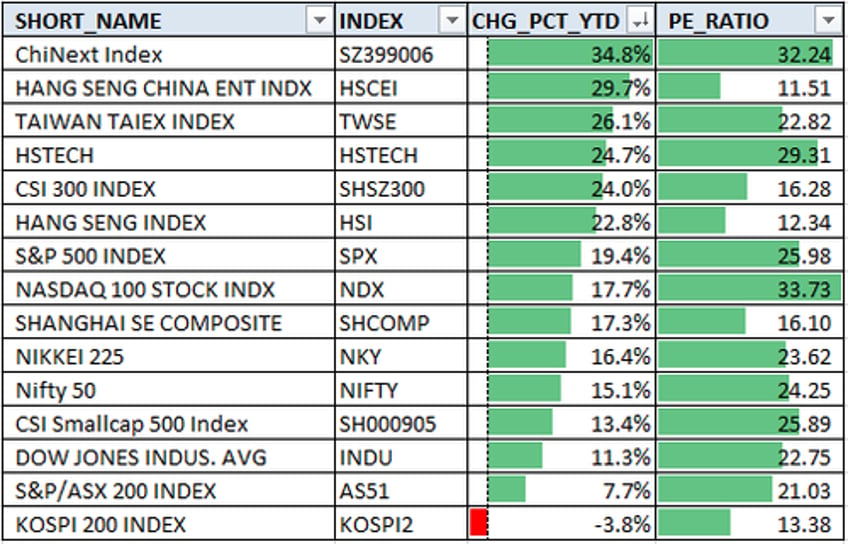

- Putting things in context: huge moves all over the place here with lots of “worst day since...” being thrown out. Bigger picture, after today’s move - ChiNext overtook HSCEI as top performing major index with +34.8% return. All China/HK indices are still outperforming SPX and NDX. CSI500 still lagging large cap counterparts CSI300 on YTD basis.

2/ China retail

Securities times published an article talking about forbidding bank loans to households to go into stock market and former director of the PBOC warning about the risk of blind speculation. I believe China could be getting cautious of the growing soundbites of onshore retail frenzy (record cash transferred into stock trading accounts, explosive amount of broker account opening etc), especially considering the current administration have scar tissues from the 2014/2015 retail frenzy episode. This could potentially make the government more cautious around how they handle further stimulus policy roll-out.

Worth keeping in mind, retail investors who opened new account during the National day holidays are only able to trade from tomorrow and not today (fund transfer settles T+1) article.

3. Now what

In terms of catalyst and events, we have to wait for ad-hoc meetings in the coming days/weeks to re-fuel the stimulus expectations led rally (especially joint ministry or MoF one).

The next focus event is NPC standing committee meeting in late Oct/early Nov, which is when we expect the new fiscal budget to be approved.

In conclusion, Goldman trader William Chan writes that "while I think profit taking is prudent especially if the sharp rally is behind us, I wouldn’t fade the China trade yet. China might want to pace the market, but the retail community hasn’t really started getting involved and the recent change of tone from the government be it on equity market downside, property stabilization or more stimulus is not something I think they will turn 180 on."

And there you have it: Goldman, which this weekend upgraded China to overweight, admits it's a bubble, but it's not a full-fledged bubble with retail participation just yet. When it becomes that, Goldman will be selling hand over feet and, eventually, tell its sellside clients to do the same.