America’s dominance of the global stock market is unrivaled, and its share has only grown in the past two years.

The outperformance of the S&P 500 has played a role in America’s leading position, averaging 14.8% compound average returns over the past decade. Global equities, represented by the MSCI ACWI (excluding the U.S.) Index, have returned 7% by comparison.

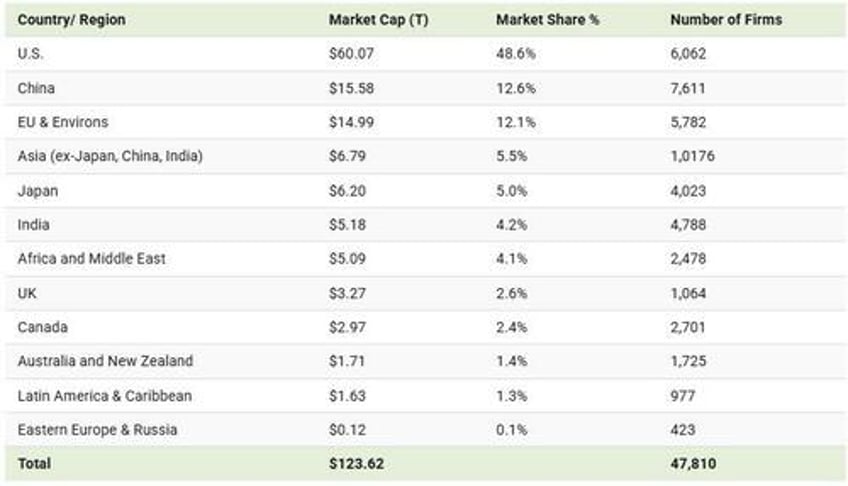

This graphic, via Visual Capitalist's Dorothy Neufeld, shows the world’s publicly-traded companies in 2025, based on data from Aswath Damodaran.

Breaking Down the $124 Trillion in Global Equities

Below, we show the market share of publicly-traded firms around the world at the start of 2025:

The value of the U.S. stock market is roughly equal to all other regions combined, encompassing 6,062 firms collectively valued at $60.1 trillion.

At the end of December 2024, the market capitalization of the Magnificent Seven - Apple, Microsoft, Alphabet, Nvidia, Amazon, and Meta Platforms - was over $18.4 trillion, making up almost 30% of the entire U.S. stock market. Last year, these companies fueled more than half of the S&P 500’s returns. This year, it has been the opposite, fueling the downturn as they have lost over $2.5 trillion...

China ranks as the world’s second-largest stock market, valued at $15.6 trillion across 7,061 publicly-traded companies. While Tencent and Alibaba stand as the largest firms by market cap, several financial firms play a dominant role in China’s stock market.

With a $5.2 trillion market cap, India’s stock market is now larger than the UK and Latin America combined. In 2024, roughly 20% of households owned shares, rising from just 7% in just five years. Notably, the country’s rapid economic growth and digital transformation have driven shares to rise 80% over the period. By contrast, emerging markets have increased by 6%.

To learn more about this topic from a performance perspective, check out this graphic on 30 years of global equity returns.

* * *

We've sold a TON of these lighter / flashlight combos...

Satisfaction guaranteed or your money back