Another quiet macro day, ahead of tomorrow's extravaganza of event risk with CPI and FOMC (Dots), which the vol market is well aware of...

Source: Bloomberg

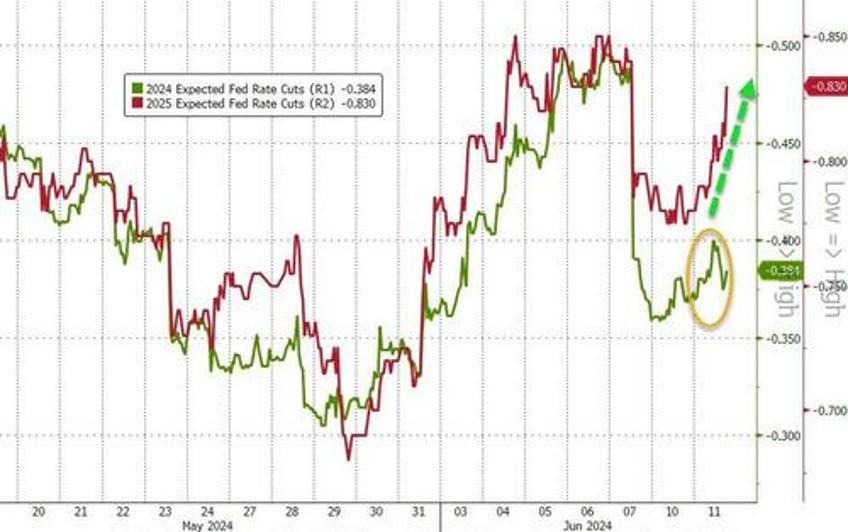

Interestingly, rate-cut expectations for 2025 jumped significantly today but the shift in 2024 rate-cuts was relatively benign...

Source: Bloomberg

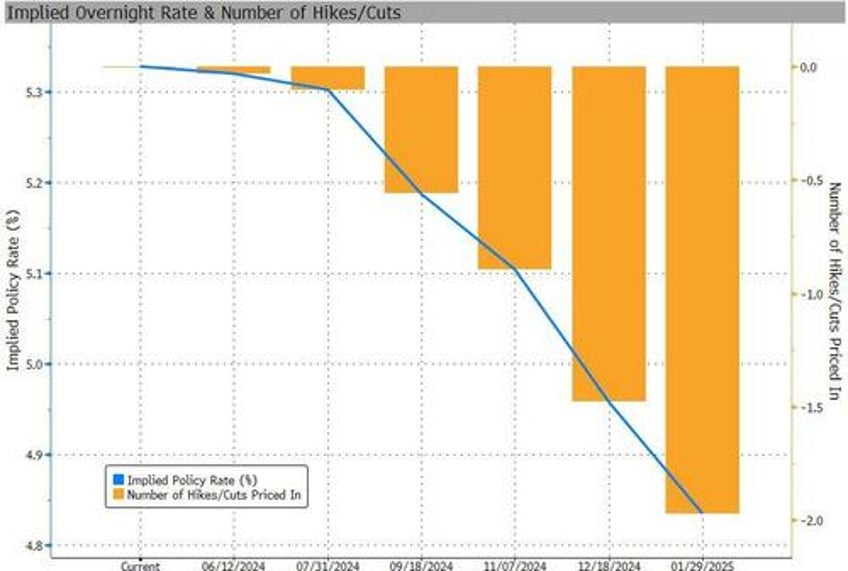

For context, September is when the market is beginning to price in a rate-cut (56%) with November at 90% odds of a cut by then (note that the FOMC meeting is on 11/7, two days after the election)

Source: Bloomberg

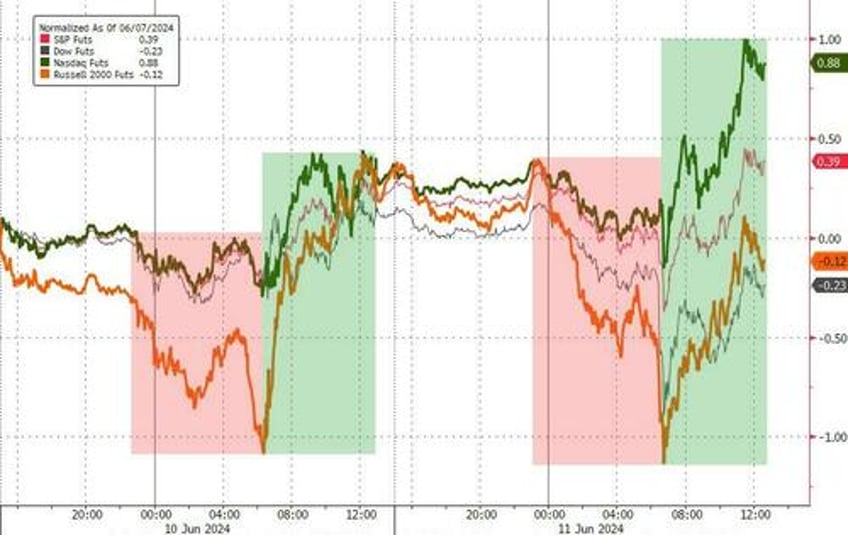

Today's equity markets followed a very similar path to yesterday's with weakness overnight into the US equity cash open and then a buying-fest...

Source: Bloomberg

However, today was less of a bounce with Nasdaq outperforming (+0.5%) (thanks to AAPL), S&P managing to cling to unchanged, while The Dow and Small Caps lagged (-0.5%)

Source: Bloomberg

Tech was the only sector to close green today. Financials were the big laggards...

Source: Bloomberg

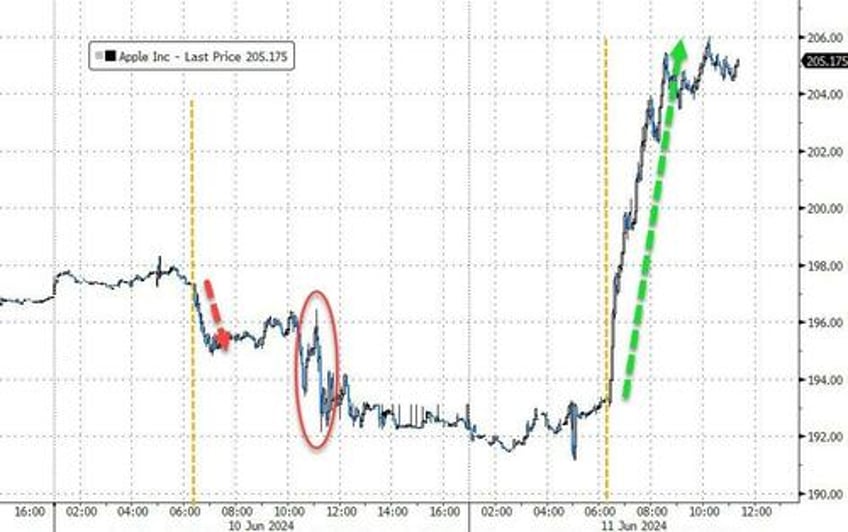

Mainly... thanks to the ridiculous surge in AAPL which began at the US cash open (buybacks anyone)...

Source: Bloomberg

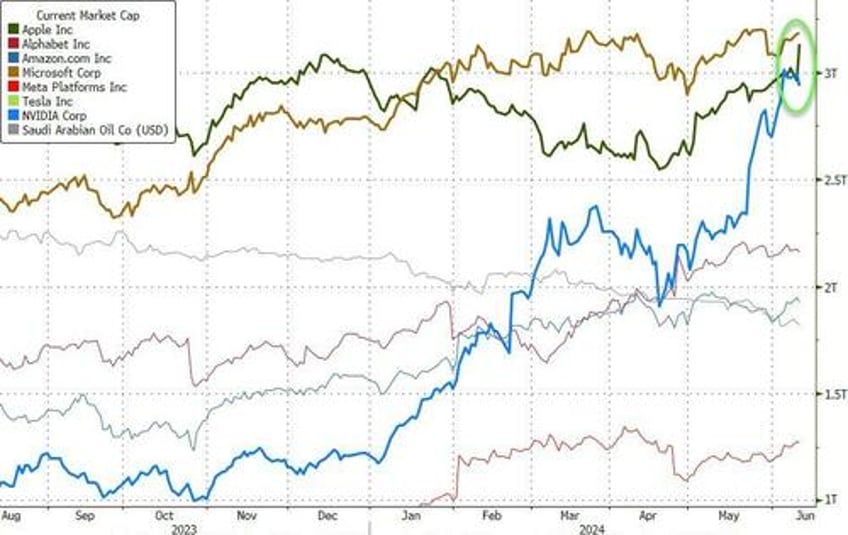

AAPL overtook NVDA once again as the second largest market cap company...

Source: Bloomberg

One more thing before we move on to non-equity markets, we note that since The Powell Pivot, the Magnificent 7 stocks alone have added over $5 trillion in market cap...

Source: Bloomberg

Treasury yields were all lower today (5-6bps), legging down on a very strong 10Y auction, which pulled them all lower on the week...

Source: Bloomberg

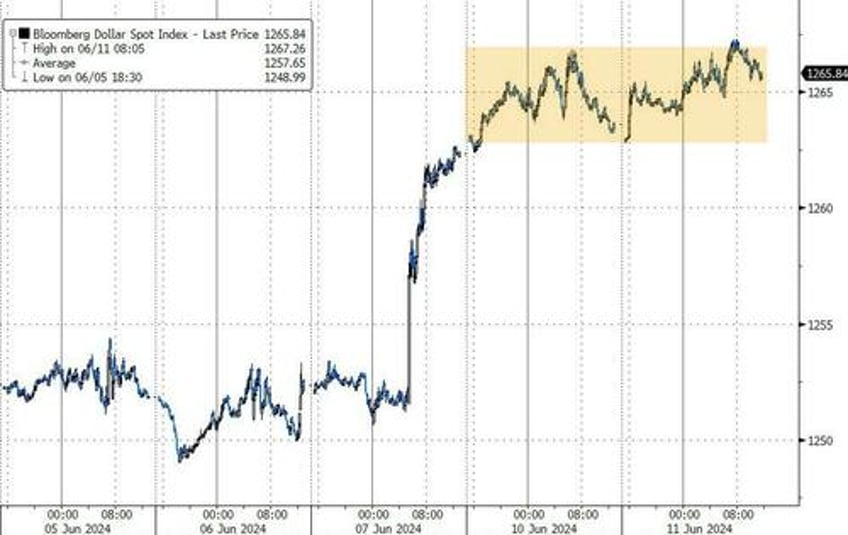

The dollar levitated modestly within yesterday's range...

Source: Bloomberg

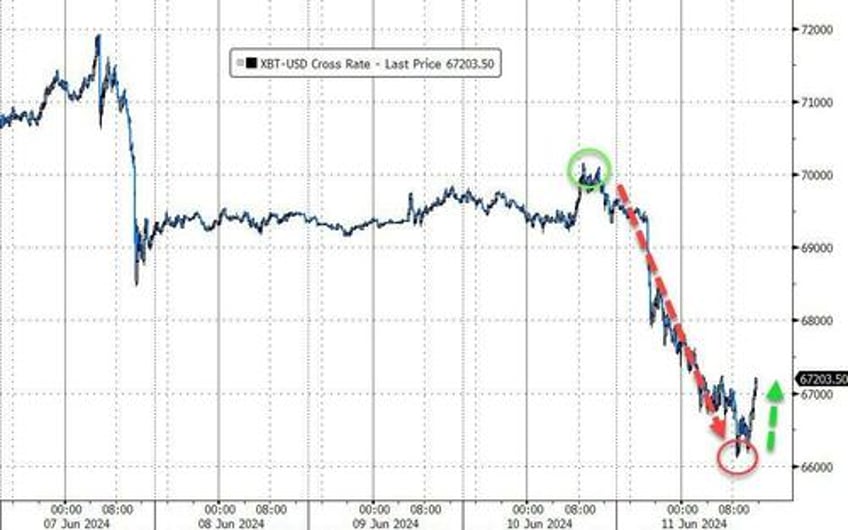

Bitcoin was clubbed like a baby seal (after the first BTC ETF net outflow in 19 days). Having topped $70k yesterday, BTC tumbled to test $66k before bouncing back a little late on...

Source: Bloomberg

Gold limped higher once again, but remains well down from pre-payrolls...

Source: Bloomberg

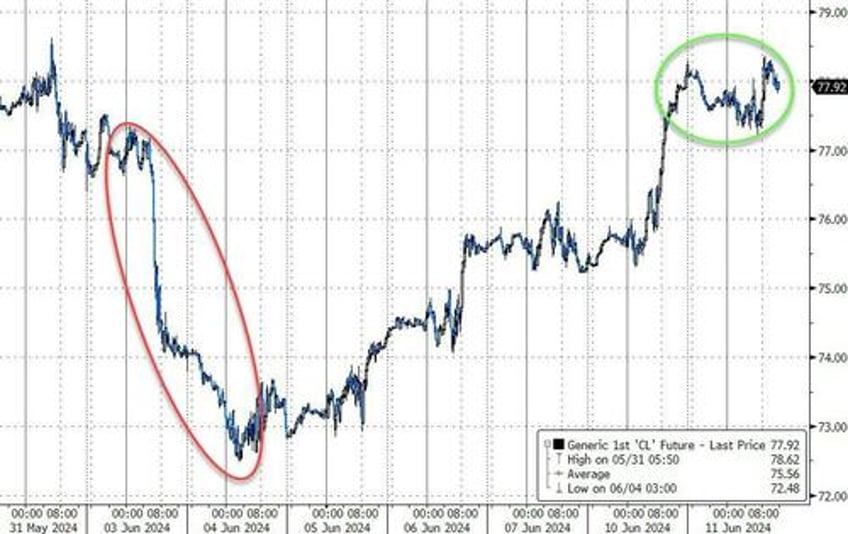

Oil prices held gains around $78 (WTI)...

Source: Bloomberg

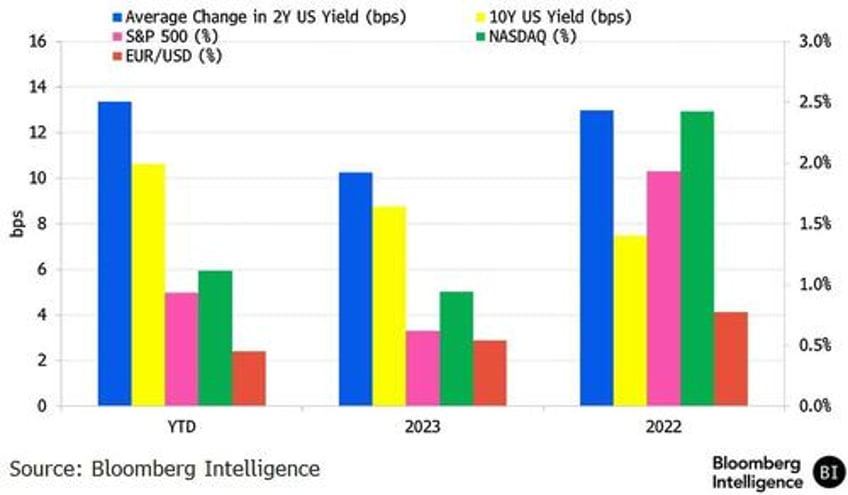

Finally, as we await tomorrow's fun and games, Bloomberg's Jeffrey Chaffa notes that the bond market remains more volatile to macro data than equities, but yields are range bound overall.

With rates acting as the shock absorber, the stock market is dominated by the secular theme of AI and high dispersion, contributing to lower index volatility, according to Bloomberg Intelligence chief global derivatives strategist Tanvir Sandhu.

The average move of two-year yields on CPI data-release days is 13.4 bps year-to-date, which is about 3 bps higher versus 2023 and close to the 2022 average. The S&P 500 average realized move is 0.93% year-to-date, much lower than 2022 at 1.93%.