How powerful are stock buybacks? Think of this way: back on April 22, we bottom-ticked the market when we reported that with the S&P dipping below 5,000, stocks were set to soar as "traders frontrun the end of buyback blackout period."

The S&P took and and hasn't looked back since.

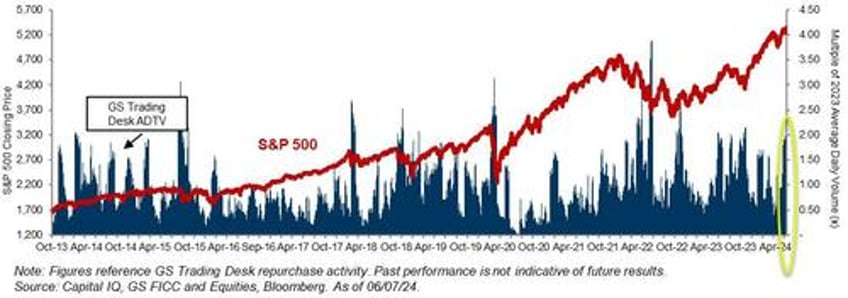

And even though both institutional and retail activity in the period since the end of April had been rather muted, there has been one constant, relentless, price-indiscriminate buyer all the way: corporate buybacks. Yes, there is a reason why frontrunning the end of stock buyback period was such a powerful force, because in this market, buybacks have long ago emerged as the primary buying force, amounting to some $5 billion in daily stock purchases, eclipsing all other natural buyers.

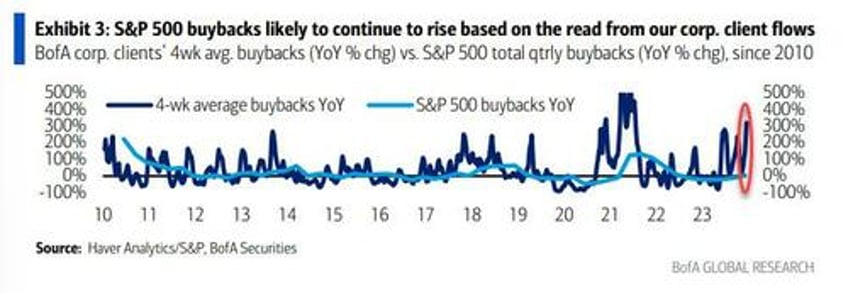

Sure enough, as Bank of America writes in its latest Equity Client Flow Trends report, "client buybacks give an early read on S&P 500 buyback trends and suggest a continued pick-up." According to the bank, corporate buybacks last week "were the second-largest in our weekly history since ‘10, and have been tracking above typical seasonal levels for 13 weeks."

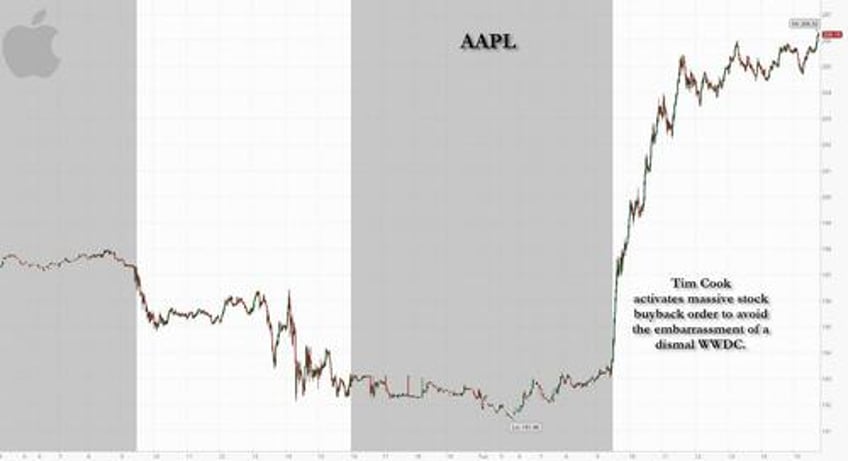

In fact, in 2024, corporate client buybacks as a % of S&P500 mkt. cap are 0.44%, and are well above ‘23 YTD highs 0.34% at this time. And, with the tech sector widely outperforming all others in 2024, it will come as no surprise that "70% of announced S&P 500 buybacks YTD have been in Tech/Comm services," Indeed, one look at Apple's stock today, which has exploded higher, shows what happens when some of the stock's massive $110BN recent buyback authorization is put to use.

There is another reason why tech stocks have been surging in recent days on the back of aggressive stock buybacks: the next buyback blackout period is about the begin, and companies either aggressively pursue buybacks now, or are forced to do nothing for the next 4-6 weeks.

As Goldman's Vani Ranganath writes in her Share Repurchase Weekly Recap note (available to pro subscribers), the bank's buyback desk was almost as busy as Bank of America and "flows were active again with desk volumes finishing 2.0x vs 2023 YTD ADTV and 1.1x vs 2022 YTD ADTV skewed toward Financials, Consumer Discretionary, and Tech."

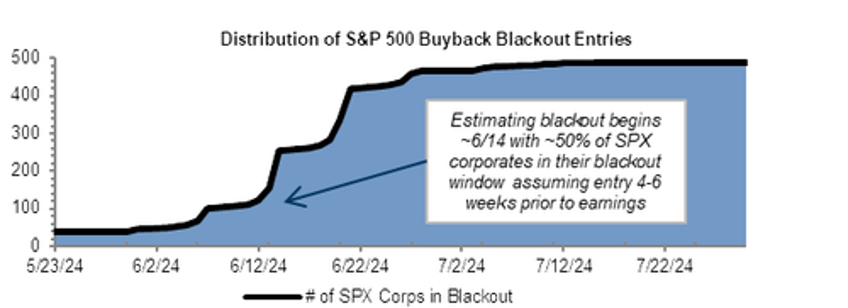

Why? Becuase as Vani explains, "this week is the final week ahead of the estimated blackout period. We estimate the upcoming blackout period will run 6/14 – 7/19." And while as of Monday, Goldman estimates that around ~20% of stocks are in blackout ~50% are set to be prohibited from repurchasing their shares once the blackout period begins on Friday, June 14.

One final point: on the authorization front, 2024 YTD authorizations stand at $621.4B, up 1.3% vs 2023 YTD authorizations...

... and with executions lagging, it appears that most companies waited until he last possible moment.

In other words, companies - such as Apple - are now rushing to buyback as much stock as they can now ahead of the blackout, and spark as much momentum inertia as they can, before the blackout period begins on Friday.

And yes, to those wondering, while the end of buyback blackout period back in May was an extremely bullish catalyst for markets, so the start of the blackout period this Friday will be a bearish trigger, and don't be surprised if stocks end up sliding for the next 4 weeks as the biggest buyer of stocks - companies themselves - is now on forced vacation until mid-July.