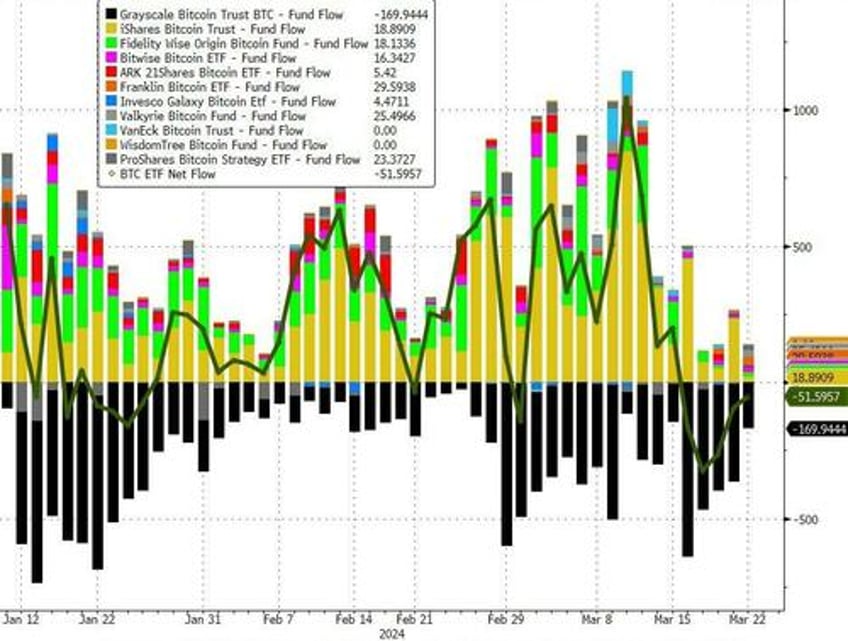

With bitcoin ETFs relentlessly buying the digital currency/commodity/devaluation hedge for the past two months (despite the relentless liquidations taking place at the fee outlier GBTC)...

... and the infamous "Mr. 100" buying up all the bitcoin mined in the last 2 days...

🧮 $120m in 2 days👇 pic.twitter.com/tZl4ZWFot0

— HODL15Capital 🇺🇸 (@HODL15Capital) March 23, 2024

... some were asking: who is selling?

The answer, as those who follow us know very well, was the futures market where as we first discussed last night, the latest week saw the largest Bitcoin CME non-commercial futures shorting/selling since last October.

Where is the selling coming from? Biggest weekly dump in bitcoin futures since October pic.twitter.com/wIxiFpQtpG

— zerohedge (@zerohedge) March 24, 2024

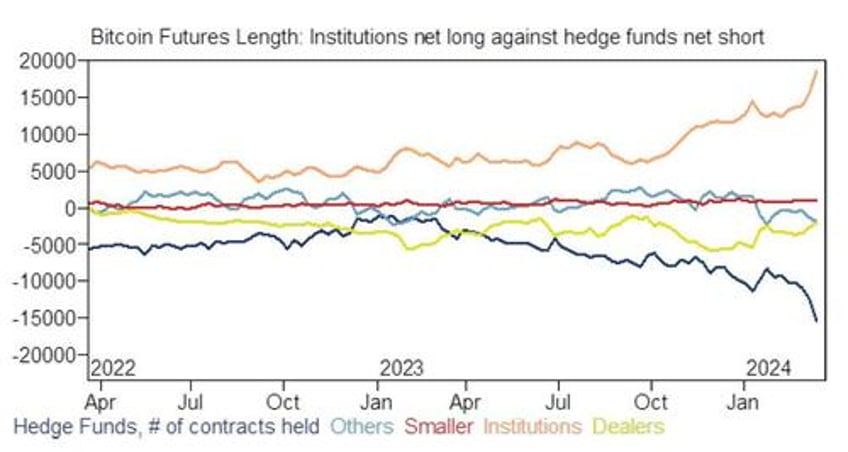

But there was more: as we revealed last night to our pro subscribers in great detail late on Sunday, Goldman's Futures desk observed record after record in bitcoin futures: indeed, as prices hit a record high above $73k, total open interest did as well this week above 33k contracts outstanding or nearly $12bn, as "the total number of organizations holding the contract (in size above the CFTC reportable-trader level) is at a near-record also."

Goldman also observed that in the most recent week – 5-12 March – institutions, a category which is likely to include ETF product usage of Bitcoin futures, were more than 3x std-dev buyers while hedge funds or Leveraged investors, and those who panic cover the moment there is even a modest sustained move higher to avoid margin calls, were offsetting, more than 3x std-dev net sellers.

Finally, Goldman noted that institutional net long and hedge fund net short lengths are at record levels, and the concentration of longs – the percentage of total open interest held by the top 4 net long traders at nearly 60% – is well above average levels. Alongside this, the futures implied funding has also remained elevated, at commonly above 10% annualized since Q4 last year during Bitcoin’s price runup – it started 23Q4 below $30k – and sometimes above 15%.

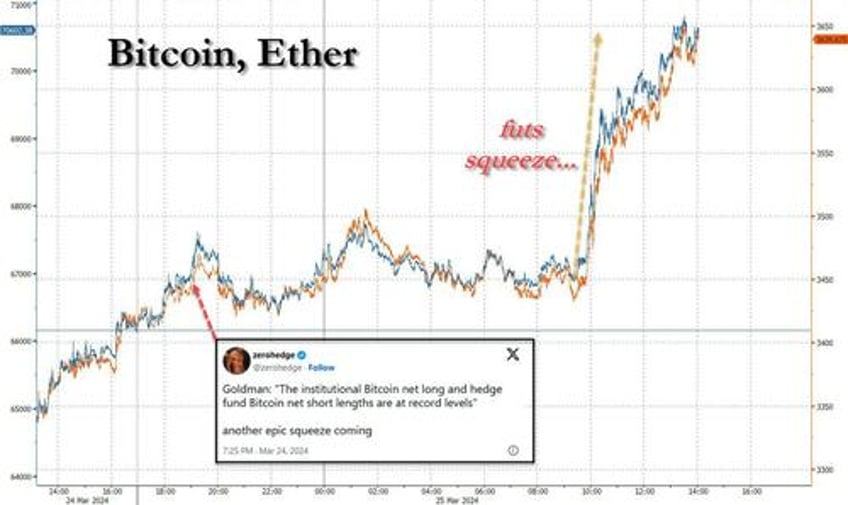

Putting it all together, late on Sunday predicted that "another epic squeeze was coming"...

Goldman: "The institutional Bitcoin net long and hedge fund Bitcoin net short lengths are at record levels"

— zerohedge (@zerohedge) March 24, 2024

another epic squeeze coming pic.twitter.com/l9G2tGitp0

Just a few hours later, an "epic squeeze" in the futures market, where hedge fund shorts confirmed just how much they suck at HODLing their shots following a sharp move higher, is precisely what we got.

More in the full Goldman note available to pro subs in the usual place.