Submitted by QTR's Fringe Finance

The recent selloff in U.S. Treasury bonds—once considered the bedrock of global financial stability—could signal something far deeper than just a market correction.

Yields may not be surging not due to growth optimism — or the basis trade imploding — but also because investors are demanding a higher premium to hold debt issued by a country whose fiscal trajectory is spiraling.

And the trade war has added another layer of geopolitical tension that’s pushing both foreign governments and private institutions to reassess their exposure to dollar-denominated assets.

The long-standing assumption that the U.S. dollar is a safe haven is beginning to crack under the weight of ballooning deficits, weaponized finance, and the political brinksmanship that now routinely defines Washington.

This confluence of market and policy risk is accelerating a quiet but critical exodus from U.S. assets, with foreign central banks reducing their Treasury holdings and global investors seeking alternatives in gold, commodities, and even digital assets like Bitcoin.

The message is clear: the world is beginning to hedge against the dollar.

About a year ago I wrote about one catalyst I thought could ‘standardize’ bitcoin. My idea was the next financial crisis — or the outrage at the ensuing bailout — could drive millions of normal people towards a new perceived ‘safe haven’ like bitcoin.

The phrase “Why I Bitcoin,” which I used as the title of my first article explaining why I was opening up to the idea of bitcoin, came to me instinctively. It echoed something from the 2008 Occupy movement—“Why I Occupy.”

That memory triggered a realization: in the next financial crisis, people could finally have a legitimate, functioning exit ramp from the system in addition to gold: bitcoin.

An “exit ramp” is what so many participants in the GameStop frenzy were unknowingly searching for when they were trying to stick it to Melvin Capital—a decentralized way to opt out of a rigged system.

Back then, people were furious, but they didn’t understand the real enemy. They blamed hedge funds and short sellers instead of the true culprit for their deteriorating quality of life: the Federal Reserve’s monetary policy.

Inflation has made the Fed’s failure more obvious. The Fed printed trillions over the past few years, lied to the public about it being transitory, and now the average American is paying the price through higher costs and eroded savings.

While the rich saw their assets inflate, the rest of us were left behind. I often asked: if the Fed was going to print $7 trillion during Covid, why not divide it equally among all Americans?

But that’s not how the system works—it rewards the elite, socializes losses, and keeps the working class footing the bill. That’s exactly what happened in 2008, and it’s exactly what will happen again when the Fed bails out this basis trade: the Fed will step in to bail out irresponsible leverage from hedge funds, at the cost of the public’s purchasing power.

The difference is, this time, the public will be better informed.

A younger, angrier generation now understands the ideological backbone of Bitcoin. They’ve started to explore Austrian economics and seen through the farce of modern monetary theory. They know inflation is a regressive tax, and they’re fed up with watching toxic companies privatize profits and socialize losses.

This time, when another major “bailout” hits again, there will be no confusion about who’s to blame. And importantly, investors will have both gold and a digital alternative, bitcoin, to seek refuge in.

That realization only deepened recently when I watched dollar assets sell off hard—bonds, equities, commodities—all in tandem. However, gold has been up nearly $100 per day over the last two days and is blowing through all-time highs almost daily now.

The GLD is outperforming the SPY on almost any time horizon dating back almost 5 years now. YTD the GLD is +20.7% versus -10.5% for the SPY. Over the last 12 months, the GLD is up +35.5% versus +2.03% for SPY. And over the last 3 years, the GLD is up +61.1% versus +17.2% for the SPY.

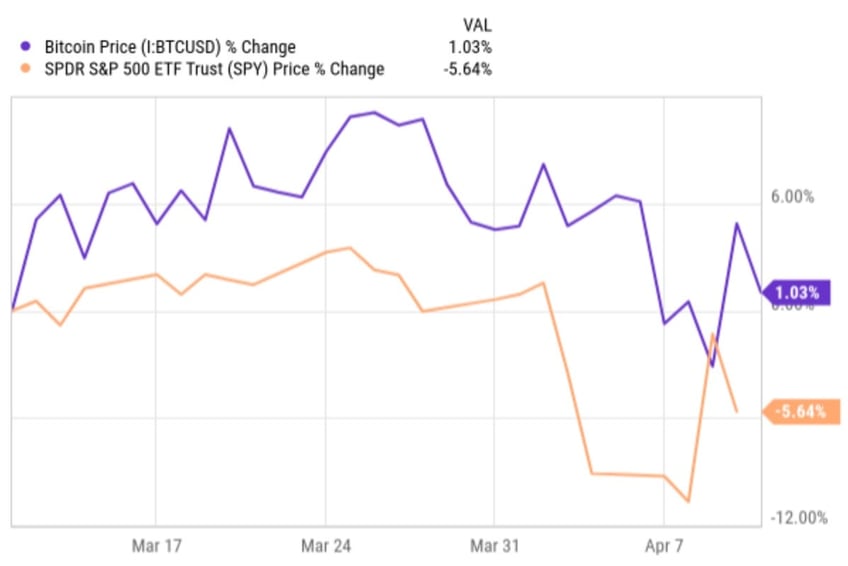

And even bitcoin has held it’s ground the last few weeks with the market volatility. It slipped, but relatively to how the SPY traded, it held up. Usually, bitcoin would be down a multiple of the percentage the NASDAQ and S&P would be. This go round, bitcoin didn’t sell off as much as markets did.

Compare the last month this year…

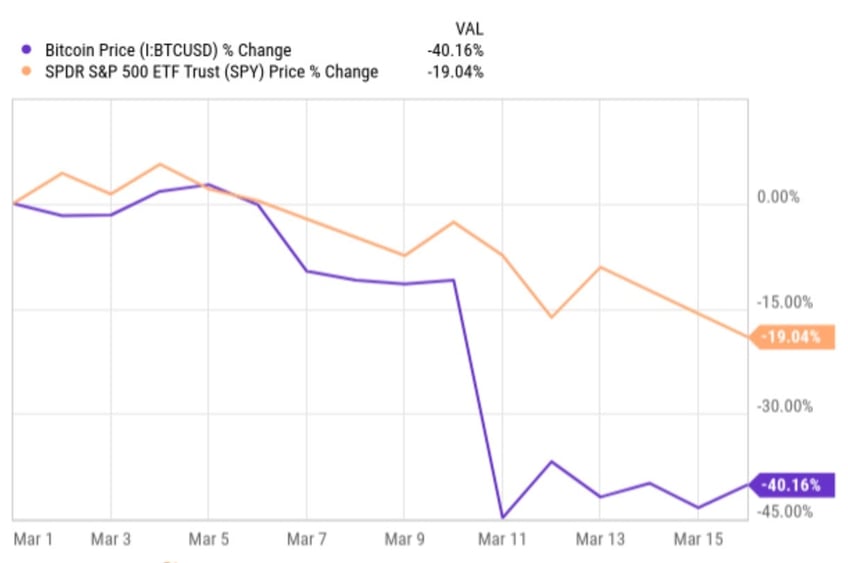

…to bitcoin far outpacing the S&P’s selloff the first few weeks of March 2020, during the Covid selloff:

To be frank, this last month is the first time I saw Bitcoin not behave like the typical risk-on asset it’s long been lumped in with. It didn’t act like quite the safe haven gold has, but it has firmed up in its beta with the overall market.

I want to be clear: it’s still early, and this trend could reverse on a dime. But this month has felt like a potential break in the pattern—like we might be witnessing the first glimmer of Bitcoin decoupling from risk on, and drifting towards safe haven.

And it may not just be in retail behavior, but potentially also in global capital flows. The selloff in U.S. bonds and the escalation of a trade war are triggering something deeper: a global revaluation of the dollar itself. The once-unquestioned role of U.S. Treasuries as the global safe asset is being called into doubt. Foreign governments and major institutions are pulling back from dollar-denominated assets—not out of preference, but self-preservation.

As deficits explode and Washington turns fiscal irresponsibility into bipartisan policy, trust in the U.S. financial system is deteriorating. That shift isn’t just about inflation anymore. It’s about the loss of global confidence in American stewardship.

And if the world is now searching for an exit ramp from dollar hegemony, just like retail investors have from Wall Street’s rigged game, then both gold and bitcoin could wind up being part of a plan for an international escape hatch.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.