And they're off.

Moments ago Q1 earnings season kicked off when JPM reported earnings, and while everyone has been focused on the looming apocalypse (at least until the Fed cuts rates and restarts QE sparking another animal spirits frenzy), JPM's earnings were actually rather stellar (with a footnote or two).

While the largest US bank reported both revenue and earnings that beat estimates, it was JPMorgan's record trading revenue that stole the show: yes, once again the recent market turmoil meant that JPM would generate record trading revenues commissions in Q1, just as we expected.

Make Trade Commissions Great Again

— zerohedge (@zerohedge) April 4, 2025

It's official: the biggest volume session of all time https://t.co/ee3uYsA5Cb pic.twitter.com/pqd6PIiiEm

JPM's equities markets revenue exploded 48% to $3.81 billion, smashing analysts’ expectations as well as the firm’s previous stock-trading record set four years ago during the covid crisis. Still, FICC missed fractionally, and CEO Jamie Dimon struck a cautious tone about prospects for the US economy in a statement Friday accompanying the results, and pushed loan loss reserves sharply higher.

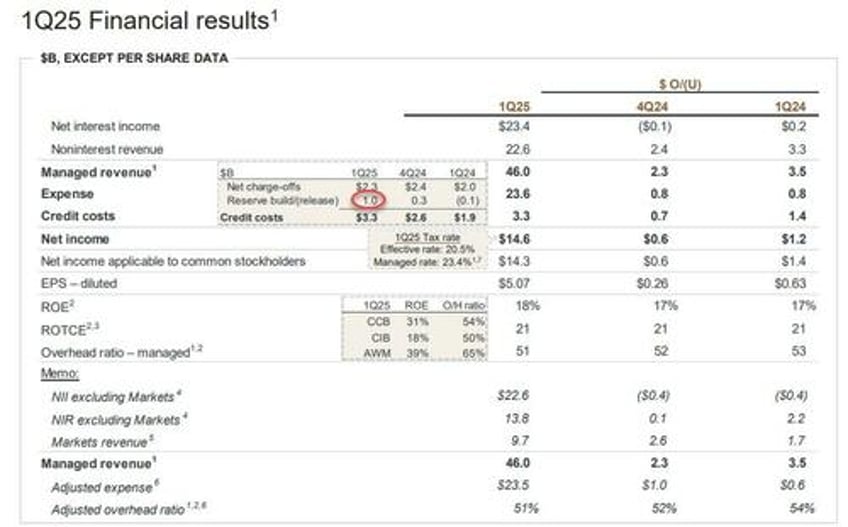

Here is what JPM reported moments ago:

- Q1 EPS $5.07, beating Exp. $4.65

- Q1 Revenue $46.01BN, beating estimate of $44.39BN

- Equities sales & trading revenue $3.81 billion, beating estimate $3.18 billion

- FICC sales & trading revenue $5.85 billion, missing estimates of $5.99 billion

- Investment banking revenue $2.27 billion, missing estimate $2.34 billion

- Advisory revenue $694 million, missing estimate $772.9 million

- Equity underwriting rev. $324 million, missing estimate $415.1 million

- Debt underwriting rev. $1.23 billion, beating estimate $1.05 billion

- Q1 Managed net interest income $23.38 billion, beating estimate $23.16 billion

- Q1 Net yield on interest-earning assets 2.58%, missing estimates of 2.62%

- Q1 Expenses:

- Non-interest expenses $23.60 billion, below estimates $23.78 billion

- Compensation expenses $14.09 billion, above estimates $13.77 billion

- Managed overhead ratio 51%, below estimates 53.2%

And visually:

Some more top line highlights:

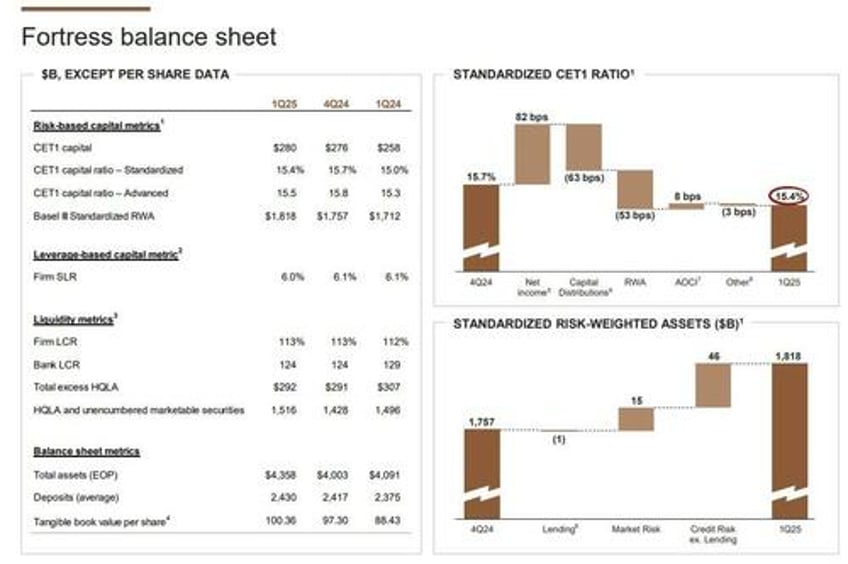

- Return on equity 18%, beating estimate 16.2%

- Return on tangible common equity 21%, beating estimate 19.8%

- Assets under management $4.11 trillion, beating estimate $4.07 trillion

- Tangible book value per share $100.36, beating estimate $98.71

- Book value per share $119.24, beating estimate $118.34

- Cash and due from banks $22.07 billion, missing estimate $23.38 billion

- Standardized CET1 ratio 15.4%, missing estimate 15.7%

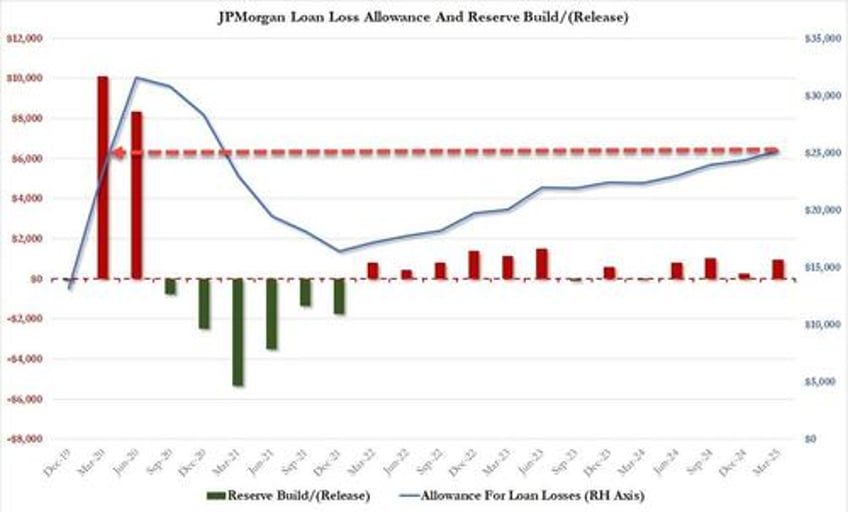

The big highlight up top was the bank's loan loss reserve and credit loss provisions, to wit:

- While net charge-offs of $2.33 billion were below estimates of $2.41 billion...

- Provision for credit losses surged to $3.31 billion, smashing estimates $2.7 billion...

- Driven by a surge in loan loss reserves to $973 million from $267 million in Q4 and a $72 million reserve release in Q1 2024; the number was more than 3 times higher than the $290 million estimated!

- The bank said that “the net reserve build of $973 million included $549 million in Wholesale and $441 million in Consumer and was largely driven by changes in the weighted-average macroeconomic outlook”

- The larger-than-expected reserve build is the latest sign that companies across America are gearing up for an economic downturn

As shown in the chart below, while the reserve surge was troubling, what is also concerning is that the total allowance for loan losses (excluding a $2.2 billion allowance for investment securities) jumped to $25.2 billion, where it was for the first time Q1 2020 during the covid crisis!

Commenting on the quarter, and the economy, Jamie Dimon said that “the economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and ‘trade wars,’ ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility.”

Dimon added that "The U.S. economy has been resilient. Unemployment remains relatively low, and consumer spending stayed healthy, including during the holiday season. Businesses are more optimistic about the economy, and they are encouraged by expectations for a more progrowth agenda and improved collaboration between government and business. However, two significant risks remain. Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II. As always, we hope for the best but prepare the Firm for a wide range of scenarios.”

In his annual shareholder letter released Monday, Dimon urged a quick resolution to the uncertainties sparked by the tariffs, warning that some of the negative effects worsen over time and would be hard to undo. Markets swooned following Trump’s tariff announcement on April 2, prompting recession warnings from top executives in the finance industry and beyond.

Dimon added his voice to the warnings on Fox Business Wednesday, saying a recession is a “likely outcome.” Trump watched the interview, and later that day announced a 90-day pause on country-specific reciprocal tariffs. The move set off the S&P 500’s best day since 2008.

Turning to the most important JPM segment, the banks commercial and investment bank, here results were mixed: on one hand equity sales and trading revenues were off the chart, and at $3.814BN, or up a whopping 48% ("driven by higher revenue across products, with particularly strong performance in Derivatives amid elevated levels of volatility") were the highest on record, and smashed estimates of $3.18BN, but on the other FICC (which increased 8% or by $421MM YoY "predominantly driven by higher revenue in Rates and Commodities") missed estimates of $5.99. And speaking of misses, both total investment bank, advisory and equity underwriting all missed as well, with only debt underwriting surprising to the upside.

- Equities sales & trading revenue $3.81 billion, beating estimate $3.18 billion

- FICC sales & trading revenue $5.85 billion, missing estimates of $5.99 billion

- Investment banking revenue $2.27 billion, missing estimate $2.34 billion

- Advisory revenue $694 million, missing estimate $772.9 million

- Equity underwriting rev. $324 million, missing estimate $415.1 million

- Debt underwriting rev. $1.23 billion, beating estimate $1.05 billion

And some more details:

- IB revenue of $2.3B, up 2% YoY;

- IB fees up 12% YoY, driven by higher debt underwriting and advisory fees, partially offset by lower equity underwriting fee

- Payments revenue of $4.6B, up 2% YoY; excluding the net impact of equity investments

- Revenue up 3%, driven by higher deposit balances and fee growth, predominantly offset by deposit margin compression

- Lending revenue of $1.9B, up 11% YoY, driven by lower losses on hedges of the retained lending portfolio, partially offset by lower loan balances

- Securities Services revenue of $1.3B, up 7% YoY, driven by fee growth on higher client activity and market levels as well as higher deposit balances, partially offset by deposit margin compression

The bank's trading/Ibanking expense were $9.8B, up 13% YoY, "driven by higher compensation, including higher revenue-related compensation and growth in employees, as well as higher brokerage expense and higher legal expense, primarily due to the absence of a legal benefit from the prior year."

Finally, credit costs of $705mm were "predominantly driven by reserve builds related to credit quality changes on certain exposures and net lending activity, in addition to changes in the weighted-average macroeconomic outlook"; The net reserve build was $528mm, with NCOs of $177mm.

And visually:

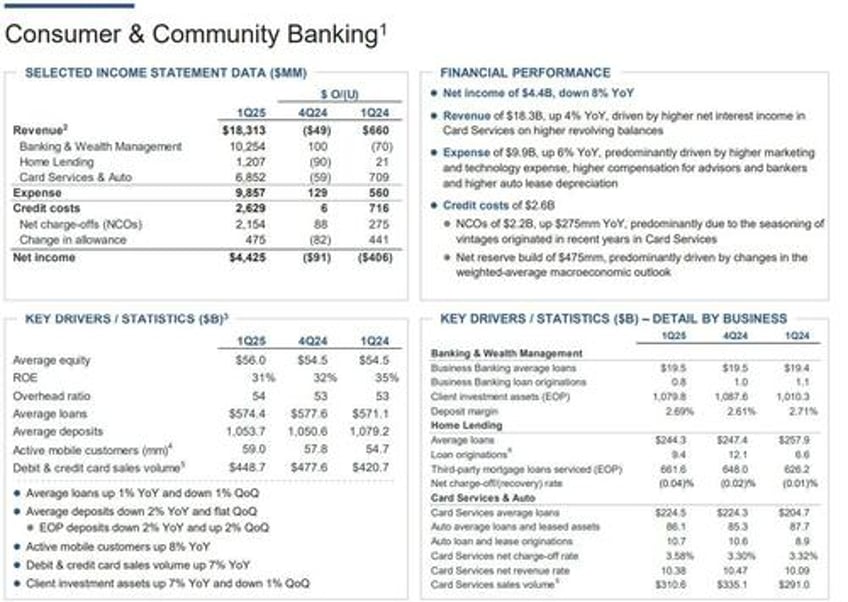

Looking at the consumer bank, total Loans were $1.36 trillion, beating estimate $1.35 trillion while total deposits $2.50 trillion, beating estimate $2.42 trillion.

Finally, looking ahead, the bank now sees net interest income of $94.5BN for full year 2025; it previous had seen $94BN, although expect this number to rise dramatically once more small US banks start failing as the basis trade collapse becomes systemic and JPM is once again presented the best market assets on a silver platter while the FDIC is left footing the costs.

JPM stock first spiked after hours as algos focused only on the top and bottom line beats, but as attention shifted to the surge in reserve build and the misses inside trading, the stock has started to leak and is now back to unchanged.

The full earnings presentation is below (pdf link).