Three weeks ago, when the general public was confused by the relentless selling in crypto following the launch of the long-awaited Bitcoin ETFs, we explained that this was the result of aggressive liquidation by the bankrupt FTX which was dumping billions in previously locked up assets at the GBTC bitcoin trust, which it would then use to fund recoveries for FTX unsecured creditors.

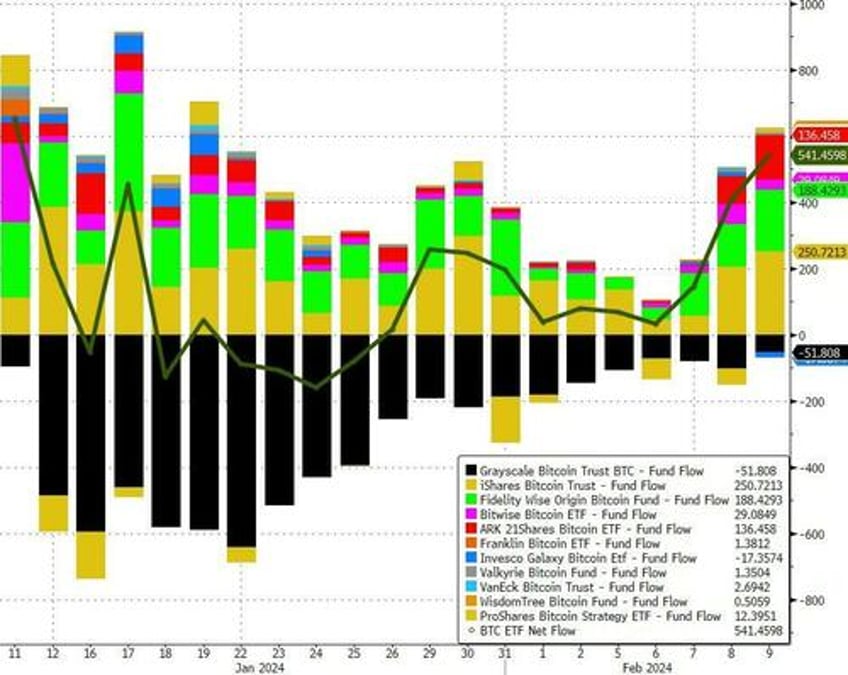

Sure enough, since then GBTC outflows have slowed to a trickle, even as inflows in the various new spot bitcoin ETFs have picked up, and in fact in the latest update this morning, we just saw another surge of inflows into the bitcoin ETF complex - amounting to over $500 million - led by $250MM inflows into the Fidelity FBTC ETF, which have brought the total net inflow (excluding continued GBTC outflows) to the highest level in February, and second highest on record.

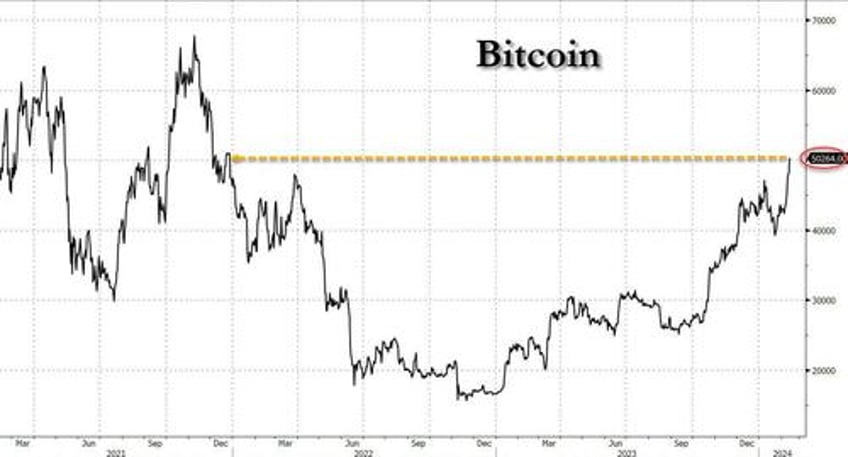

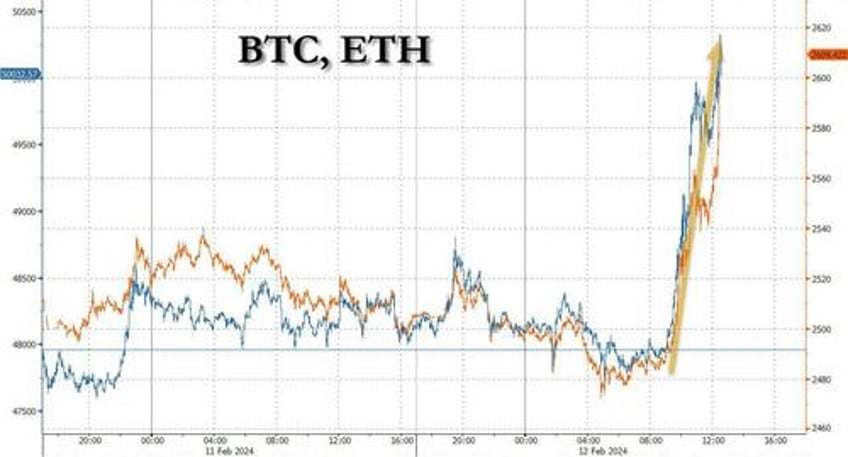

And now that the Bitcoin ETF use case is starting to get daily validation and even Bloomberg is writing that ETFs are "starting to show steady inflows", moments ago Bitcoin topped $50,000 for the first time since Dec 2021 as the continued allocation of cash into the space from various investors is tracking risk appetite rising across financial markets.

As shown below, bitcoin surged as much as 4% to $50,250 on Monday, rising above the YTD high of $48,000 on Jan. 12, the day after the ETFs began trading. After being weighed down initially by outflows from the Grayscale Bitcoin Trust, the funds have seen net inflows for nine consecutive trading sessions through Wednesday, data compiled by Bloomberg show.

“Bitcoin appears set to resume its march up after the Grayscale outflows finally tapered off,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets, and confirming what we said two weeks ago.

“We expect the Bitcoin halving narrative to gather momentum over the next few weeks, which should help drive a rally through the psychologically important $50,000 level,” Mauron said, referencing the event anticipated in April where the blockchain’s network protocol will reduce rewards for verifying transactions by half.

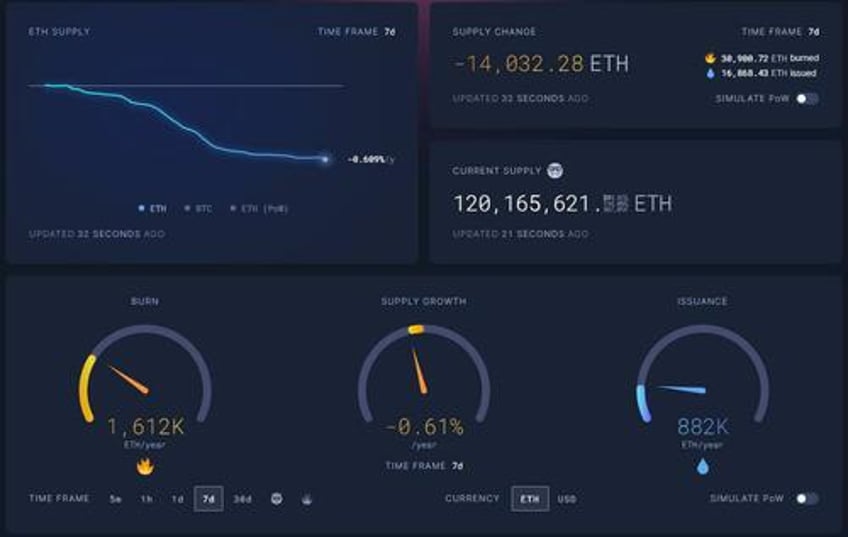

The halving cuts the quantity of Bitcoin that miners receive for operating power-hungry computers that secure the network by solving complex puzzles. Halving is key to capping the supply of Bitcoin at 21 million tokens. Rewards drop to 3.125 coins per block from 6.25 coins in the upcoming event. And while the market is increasingly excited about the bitcoin halving, it appears to have completely forgotten that the supply of ETH tokens is actually declining now due to the burn rate consistantly above the rate of issuance, making ether the first currency whose circulation is decreasing.

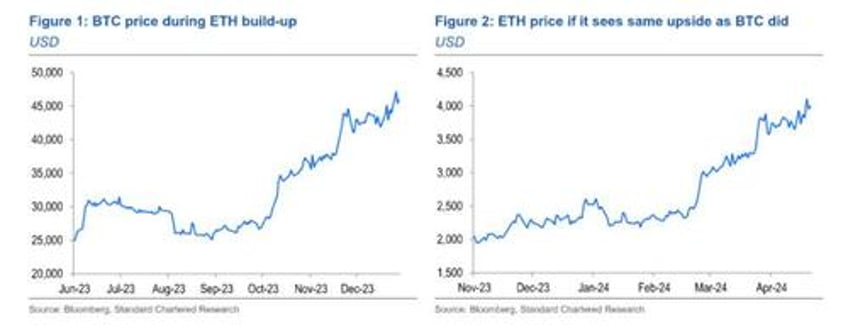

Curiously after hitting a multi-year high of $2700 in January, ether has been lagging, however that may be temporary because as Standard Chartered laid out last week, ETH will likely hit $4,000 by May as the market frontrun the next major ETF approval by the SEC, that of Ethereum ETFs.