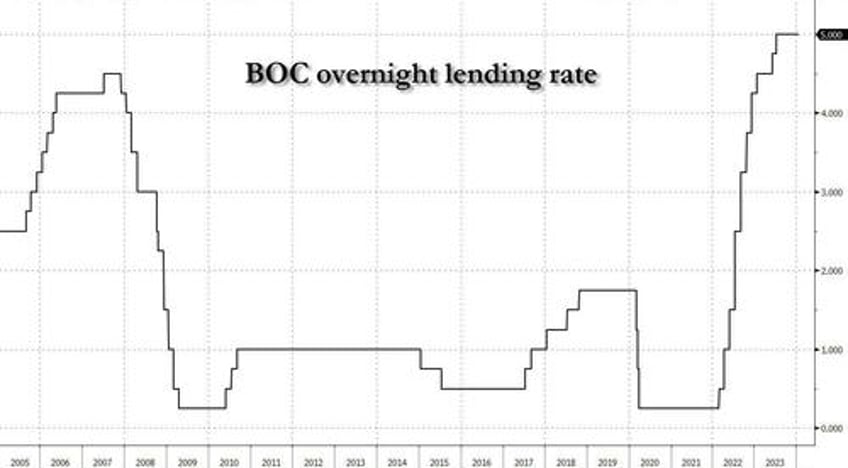

The Bank of Canada held its policy rate at 5% for a fourth consecutive meeting, a pause that was widely expected, and explicitly stated for the first time that it was done with the tightening cycle and won't need to increase it again if the economy evolves in line with its forecasts. BOC officials said the data show economic growth has stalled and will remain slow in the near term, which will help bring inflation back to the bank's 2% target next year.

Here are some highlights from the BOC statement:

- The Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation.

- Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

- The Bank remains resolute in its commitment to restoring price stability.

- Inflation is coming down as higher interest rates restrain demand in the economy.

- Inflation is still too high, and underlying inflationary pressures persist - BoC needs to give these higher rates time to do their work.

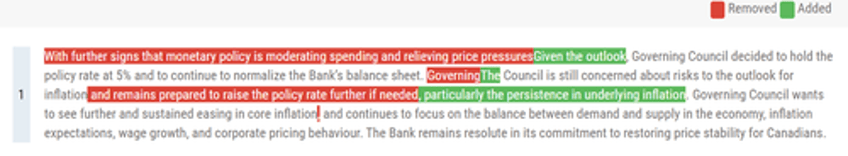

The biggest highlight4 however was the removal of the language that the BOC was "prepared to raise rates further if needed" as the following statement redline shows:

“There was a clear consensus to maintain our policy rate at 5%,” BOC Governor Macklem said in his prepared opening remarks for a news conference scheduled for 10:30 a.m. Ottawa time. “What came through in the deliberations is that Governing Council's discussion about future policy is shifting from whether monetary policy is restrictive enough to how long to maintain the current restrictive stance.”

The dovish message is the clearest hint yet that the bank sees a rapidly slowing economy and believes its past rate increases, some 475 basis points in less than two years, are sufficient to quell inflation. That also opens the door to rate cuts in coming months.

“If the economy evolves broadly in line with the projection we published today, I expect future discussions will be about how long we maintain the policy rate at 5%,” Macklem said, suggesting that just like the Fed, the question now is when the BOC will cut.

As Bloomberg notes, Mecklem reiterated the need to balance the risks of over- and under-tightening, but also noted concerns about the persistence of underlying price pressures, warning that policymakers haven't ruled out further rate increases if new developments push inflation higher. Still, as noted above, the BOC removed language from its previous policy statements that said it remained prepared to hike again.

Officials want to see “further and sustained easing” in core inflation and will continue to focus on the balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing activity, the bank said in its statement.

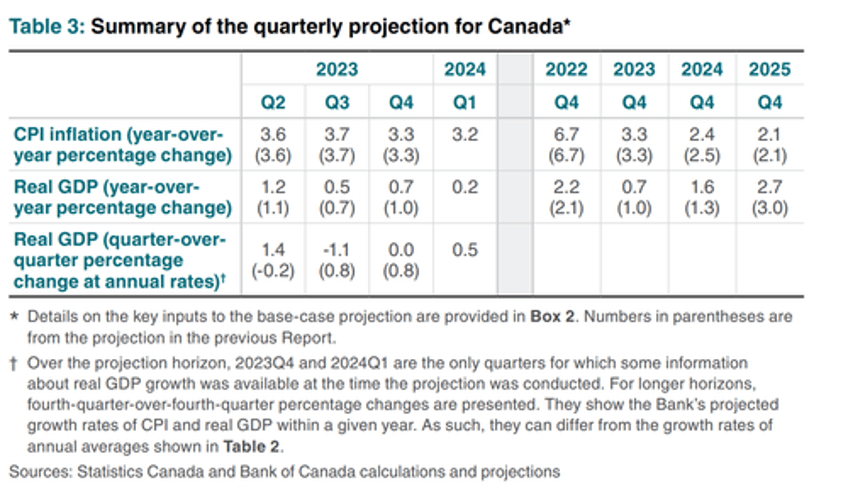

Its forecasts suggest the economy is now in “modest excess supply” and it trimmed its economic growth projection to 0.8% this year, from 0.9%. Still, the Bank of Canada's base case remains a soft landing, with growth picking up around the middle of the year.

The central bank also expects inflation to remain close to 3% over the first half of 2024 before declining to around 2.5% by the end of the year and returning to the bank’s 2% target next year. Here are the bank's full projections:

CPI:

- 2023 CPI: 3.9% (vs BoC prev. forecast of 3.9%)

- 2024 CPI: 2.8% (vs BoC prev. forecast of 3.0%)

- 2025 CPI: 2.2% (vs BoC prev. forecast of 2.2%)

GDP:

- 2023 GDP GROWTH: 1.0% (vs BoC prev. forecast of 1.2%)

- 2024 GDP GROWTH: 0.8% (vs BoC prev. forecast of 0.9%)

- 2025 GDP GROWTH: 2.4% (vs BoC prev. forecast of 2.5%)

Neutral Rate/Output Gap

- The BoC estimates that the midpoint of the neutral range in 2-3% (prev. 2-3%.)

- The BoC estimates that the output gap is between -0.25% and -1.25% (prev. -0.75% and 0.25%)

The CPI accelerated to a 3.4% yearly pace in December, and has been stuck above the 3% cap of the central bank’s target operating band for 32 of the past 33 months. A closely watched measure of the Bank of Canada’s preferred core metrics also spiked.

“Over the projection horizon, ongoing excess supply in the economy continues to weigh on prices, and corporate pricing behavior and inflation expectations gradually return to normal,” the bank said in its monetary policy report.

Wage growth, which is still rising at a 4% to 5% yearly pace, is expected to slow, falling closer in line with inflation and modest productivity growth, the bank said.

Shelter price inflation, however, is expected to remain “elevated for some time,” with growth in mortgage interest costs seen slowing gradually as financial conditions ease and the impact of additional households renewing and taking on new mortgages decreases. Rental price inflation, which is supported by strong demand for housing and tight supply, is forecast to moderate due to a slowdown in population growth and an expected increase in new housing construction.

Still, a stronger-than-expected rise in house prices is one of the main risks that could drive inflation higher than expected, the bank said.

As Bloomberg notes, canada’s economy is more rate-sensitive than its peers due to higher debt loads and shorter-duration mortgages. Most economists see the Bank of Canada cutting the policy rate by June, and traders in overnight swaps are placing similar bets.

In kneejerk response, despite the BoC sounding cautious on inflation, the decision to delete language that it is prepared to raise rates further if needed, saw upside in USD/CAD with the pair jumping from 1.3435 to 1.3450 before extending the move to 1.3459.