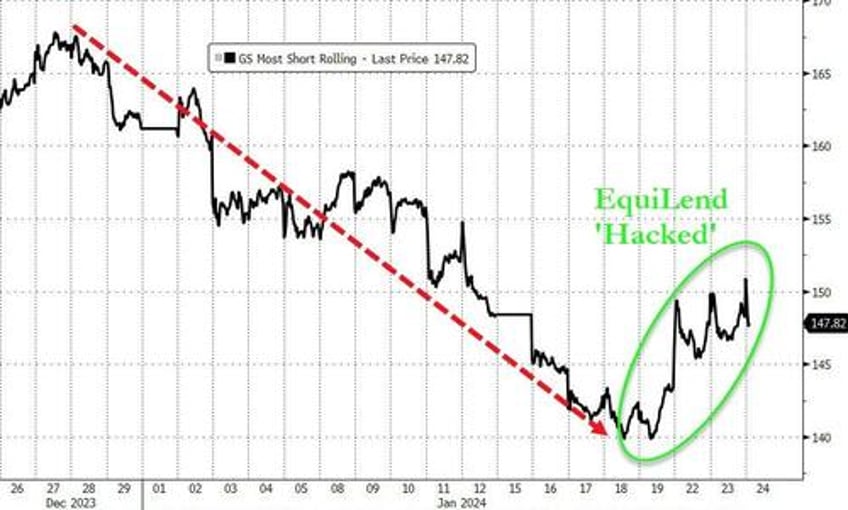

Amid the meltup of most shorted names in the past two days, numerous daytraders were greeted with an unexpected notification from their broker when they tried to short (or re-short) some of these highflying ultra junk names: "rejected."

There was much confusion why so many were unable to short these very popular shorts, especially if the shorts were willing to pay the oftentimes exorbitant Hart To Borrow rates on the shorts, but today we finally got an answer: as Bloomberg reports, EquiLend - a fintech that processes trillions of dollars of securities-lending transactions every month - suffered a cybersecurity attack that shut down some of its operations just days after announcing its sale to a private equity firm.

The company, which has been part-owned by some the world’s biggest financial-services companies until a recent sale to a PE firm, identified a "technical issue" on Jan. 22 that caused portions of its systems to go offline, a spokesperson for New York-based EquiLend told Bloomberg. The cybersecurity incident involved “unauthorized access to our systems,” the spokesperson said.

“We took immediate steps to secure our systems and are working methodically to restore the involved services as quickly as possible,” the spokesperson said.

“We are working with external cybersecurity firms and other professional advisers to assist with our investigation and restoration of service. Clients have been advised that this may take several days.”

Until then, however, anyone who wants to short many of the explosively surging most-shorted trash names is out of luck and will just have to watch them move into the stratosphere, before eventually collapsing.

After incessant shorting year-to-date, and just hours after China announced its short-selling ban, the largest facilitator of shorting stocks suddenly goes offline (sorry was 'hacked')...

EquiLend, which helps facilitate short sales, operates NGT, a securities-lending platform that the firm says processes more than $2.4 trillion of transactions each month. The company, which is owned by financial firms including Goldman Sachs and JPMorgan, announced plans to sell a majority stake to private equity firm Welsh, Carson, Anderson & Stowe last week.

EquiLend was established in 2001 and was owned by 10 of the biggest Wall Street firms, including Goldman Sachs, JPMorgan and BlackRock, which came together to provide a standardized and central global platform for trading and post-trade services. Its technology platform went live the following year.

Securities lending is a significant business for Wall Street banks’ trading units, as hedge funds often borrow shares in short sales in order to bet on them falling in value. Goldman Sachs, for example, had loaned about $55 billion of securities at the end of September.

With over 330 employees, EquiLend offers a centralized global platform for trading and post-trade services and serves about 190 customers globally. It has offices in North America, Europe, the Middle East and Africa and the Asia-Pacific region.