- APAC stocks were mostly higher following the continued gains on Wall St and constructive comments from US President Trump related to China tariffs but with the upside capped as the attention turned to the BoJ which delivered a widely expected rate hike.

- US President Trump said he expects the Fed to listen to him on interest rates and would consider talking to Fed's Powell.

- BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter - USD/JPY ultimately declined, Nikkei 225 pared earlier advances, and 10yr JGB futures ultimately declined; Governor Ueda’s presser due at 06:30 GMT/01: 30 EST.

- Hang Seng and Shanghai Comp were encouraged by the pre-taped comments from US President Trump that conversations with Chinese President Xi went fine and that he would rather not have to use tariffs over China.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed higher by 0.4% on Thursday.

- Looking ahead, highlights include EZ, UK & US PMIs, Speakers including BoJ's Ueda, ECB’s Lagarde & Cipollone, Earnings from Verizon, American Express & Burberry.

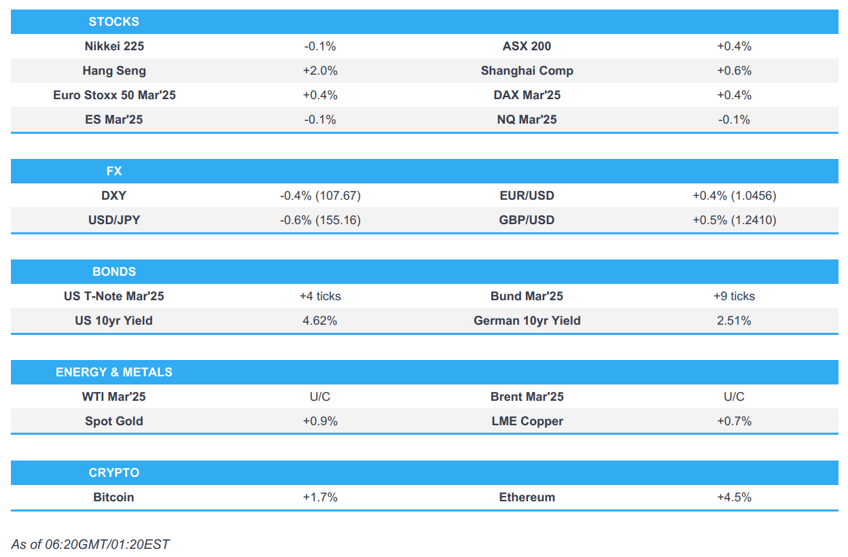

SNAPSHOT

US TRADE

EQUITIES

- US stocks saw upside bias throughout the session and the major indices surged higher into the close in which all sectors closed in the green.

- Health and Industrials sat at the top of the pile, while Tech lagged behind its peers as semiconductor names saw weakness after SK Hynix warned of steeper demand declines in commodity memory chips.

- The main highlight of the day was President Trump's virtual appearance at Davos, whereby he touched on numerous subjects, but notably sent the crude complex lower after noting he will be asking Saudi Arabia and OPEC to bring down the cost of oil.

- SPX +0.53% at 6,119, NDX +0.22% at 21,901, DJIA +0.92% at 44,565, RUT +0.47% at 2,315.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump said he expects the Fed to listen to him on interest rates and would consider talking to Fed's Powell.

- US President Trump said they will bring corporate tax down to 15% if products are made in the US, while they are going to be demanding respect from other nations including Canada and are dealing with Mexico very well.

- US Defense Secretary nominee Hegseth received enough support to advance in a key Senate test vote, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher following the continued gains on Wall St and constructive comments from US President Trump related to China tariffs but with the upside capped as the attention turned to the BoJ which delivered a widely expected rate hike.

- ASX 200 edged mild gains with sentiment helped by the encouraging tariff-related rhetoric by Trump on China.

- Nikkei 225 initially extended above the 40,000 level but then pared its advances after the BoJ hiked rates by 25bps to 0.50% and raised its Core CPI forecasts across the board which disappointed those that were hoping for an overtly dovish hike.

- Hang Seng and Shanghai Comp were encouraged by the pre-taped comments from US President Trump that conversations with Chinese President Xi went fine and that he would rather not have to use tariffs over China, although risk sentiment in the mainland was somewhat tempered after the PBoC's MLF operation resulted in a CNY 795bln drain.

- US equity futures were uneventful but held on to the majority of the prior day's spoils.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed higher by 0.4% on Thursday.

FX

- DXY softened as markets continued to hang on Trump's every word with the attention on the second part of Trump's pre-taped interview with Fox News in which he suggested a preference of not using tariffs on China, while the greenback was also not helped by Trump's recent calls for lower interest rates during his address to the WEF.

- EUR/USD initially lacked direction amid light catalysts for the single currency and after recent oscillations around the 1.0400 level but then gained on the constructive China tariff-related comments from US President Trump.

- GBP/USD extended on gains following the prior day's outperformance with the UK seen to avert the Trump tariff risk.

- USD/JPY ultimately declined after the BoJ hiked rates by 25bps, as expected, which was the most in 18 years.

- Antipodeans strengthened alongside the yuan owing to comments from Trump that he would rather not have to use tariffs on China.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2779 (prev. 7.1708).

FIXED INCOME

- 10yr UST futures were initially lacklustre after recent pressure and curve steepening but then saw some mild upside after Trump commented he would rather not have to use tariffs on China.

- Bund futures attempted to nurse some of the prior day's losses but with the rebound limited, while EU and German PMI data loom.

- 10yr JGB futures ultimately declined with prices pressured after the BoJ delivered a widely expected rate hike and raised its Core CPI forecasts through to fiscal 2026.

COMMODITIES

- Crude futures were contained after declining yesterday owing to comments from US President Trump who told the WEF in Davos that he will be asking Saudi Arabia and OPEC to bring down the cost of oil.

- US EIA Weekly Crude Stocks w/e -1.0M vs. Exp. -2.1M (Prev. -1.962M).

- Spot gold resumed its advances following recent comments from US President Trump that he will demand that interest rates drop immediately and amid a softer dollar after Trump provided some tariff-related optimism regarding China.

- Copper futures gradually extended on recent gains with bids seen as Chinese commodities trade got underway and on Trump's comments.

CRYPTO

- Bitcoin was choppy overnight but ultimately recovered from a brief dip beneath the USD 104k level.

- US President Trump said he's signing an order related to AI and crypto to develop the national digital asset stockpile and is signing an order related to establishing a commission on science and technology, according to Bloomberg.

NOTABLE ASIA-PAC HEADLINES

- BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter, while it reiterated it will continue to raise rates if the economy and prices move in line with forecasts and it will conduct monetary policy as appropriate from the perspective of sustainably and stably achieving the 2% inflation target. BoJ said real interest rates are at very low levels and inflation expectations have risen moderately, as well as noted the chance of Japan's economy moving in line with the forecast is heightening and that many firms are saying they will offer solid pay hikes in this spring's wage talks. Dissenter Nakamura said the BoJ should decide on changing the guideline for money market operations after confirming a rise in firms' earnings power from sources, and after checking sources such as financial statements and statistics of corporations at the next monetary policy meeting. Furthermore, the Outlook Report projections were somewhat varied as Core CPI forecasts were lifted across the entire horizon period, while the Real GDP projection was cut for Fiscal 2024 but maintained for the subsequent years after.

- PBoC conducted a CNY 200bln 1-year MLF operation and left the rate unchanged at 2.00% for a CNY 795bln drain.

- Monetary Authority of Singapore kept the width of the policy band and level where it is centred unchanged but announced to reduce the slope of SGD NEER policy band, while it stated the measured adjustment is consistent with a modest and gradual appreciation path for the SGD NEER policy band, aiming to ensure medium-term price stability.

DATA RECAP

- Japanese National CPI YY (Dec) 3.6% vs. Exp. 3.4% (Prev. 2.9%)

- Japanese National CPI Ex. Fresh Food YY (Dec) 3.0% vs. Exp. 3.0% (Prev. 2.7%)

- Japanese National CPI Ex. Fresh Food YY (Dec) 2.4% vs. Exp. 2.4% (Prev. 2.4%)

GEOPOLITICS

CHINA

- US President Trump said the conversation with China's Xi went fine and responded he can when asked if he can make a deal with China, while he added he would rather not have to use tariffs over China, via a pre-taped interview with Fox News.

MIDDLE EAST

- Palestinian TV reported large Israeli forces stormed the city of Tulkarm in the West Bank accompanied by military bulldozers, according to Sky News Arabia.

- US President Trump said there will be consequences if the Gaza ceasefire doesn't hold, according to Sky News Arabia.

- US President Trump said it would be nice if issues with Iran could be worked out without Israel striking military facilities.

- Trump administration officials told Israeli officials that he does not intend to start his term with a new war in the Middle East and wants to reach a very strict agreement to prevent Iran from reaching a nuclear weapon, while Trump believes that the Iranians will rush to the negotiating table under his leadership, according to Channel 12.

- UKMTO said it received a report of an incident 86NM northeast of Ras Tanura, Saudi Arabia in which a vessel was approached by a small military craft which kept hailing the vessel to turn to port towards Iranian territorial waters.

RUSSIA-UKRAINE

- US President Trump said he would really like to be able to meet Russian President Putin soon, while he sees US-China relations as being 'very good' and stated they need to have a fair relationship, Furthermore, he said hopefully China can help us stop the war in Ukraine and that he would like to see denuclearisation with Russia and China, as well as stated that Russian President Putin liked the idea of cutting way back on nuclear. It was later reported that President Trump said Ukrainian President Zelensky told him that he's ready to make a deal, while Trump wants to meet immediately with Russia's President Putin and noted that China has a lot of power over Russia.

- Russia's Security Council Secretary Shoigu said risk of an armed clash between nuclear powers is growing and accused NATO of increasing activities on the eastern flank of Russia and Belarus and of rehearsing offensive operations there, according to TASS.

- Moscow's Mayor announced that air defence units southeast of Moscow repel attacks by drones headed for the capital, while the Governor of Russia's Ryazan region southeast of Moscow announced that emergency services were responding to an air attack.

Other

- US President Trump said not sure they should be spending anything on NATO and that they're protecting NATO but it is not protecting the US.

- US Secretary of State Rubio reinforced US commitment to NATO in a call with the NATO Secretary General and discussed the importance of "real burden sharing", as well as the importance of ending Russia's war in Ukraine and the need for a peaceful solution.

EU/UK

DATA RECAP

- UK GfK Consumer Confidence (Jan) -22.0 vs. Exp. -18.0 (Prev. -17.0)