- APAC stocks were mostly subdued after the mixed performance stateside where soft data took centre stage, while participants turned their attention to the BoJ policy announcement.

- The BoJ maintained rates as expected but defied expectations for an immediate reduction of bond purchases, instead, it will decide on a specific bond-buying reduction plan at the next meeting.

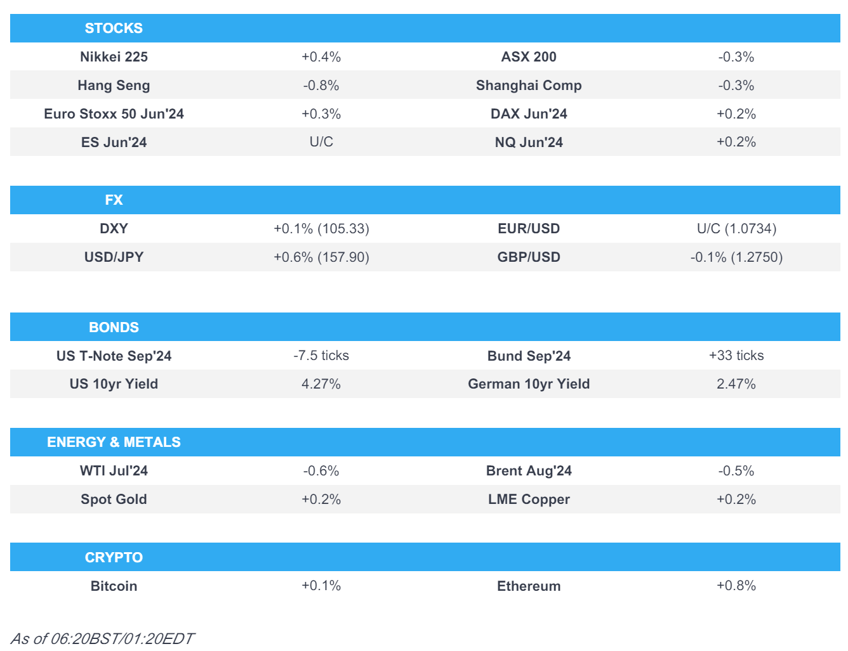

- Nikkei 225 recovered early losses, USD/JPY advanced to just shy of the 158.00 level, and 10-year JGB futures tracked the recent gains in global peers and were further boosted after the BoJ policy announcement.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.3% after the cash market closed lower by 2.0% on Thursday.

- Looking ahead, highlights include Swedish CPI, US UoM Survey, BoE/Ipsos Inflation Attitudes Survey, Comments from BoJ’s Ueda, ECB’s Lane, Schnabel, Lagarde & de Guindos, Fed’s Goolsbee & Cook.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks saw two-way price action as markets digested the latest US data releases including softer-than-expected PPI data and with Initial Jobless Claims at the highest since August last year. The data initially provided tailwinds for stocks which were then pressured following the open before rebounding off their lows to close mixed in which the S&P 500 and Nasdaq posted their fourth consecutive day of record closes.

- SPX +0.23% at 5,434, NDX +0.57% at 19,577, DJI -0.17% at 38,647, RUT -0.88% at 2,039.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US Treasury Secretary Yellen said strong US growth is lifting global growth and that the labour market remains strong, while she added that US labour market pressures have eased and wages are rising more slowly.

- Republican Presidential Candidate Trump said he will cut taxes including income taxes if he is in the White House and will bring back the same economic policies he established in his first term, according to CNBC citing sources.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued after the mixed performance stateside where soft data took centre stage, while participants turned their attention to the BoJ policy announcement.

- ASX 200 was dragged lower by underperformance in tech and commodity-related sectors.

- Nikkei 225 recovered early losses and was underpinned after the BoJ policy decision in which the central bank maintained short-term rates at 0.0%-0.1% and kept bond purchases in accordance with its decision in March, while it announced to trim bond buying but will decide on a specific reduction plan for the next 1-2 years at the next policy meeting.

- Hang Seng and Shanghai Comp. were pressured with the former back below the 18,000 level amid tech and auto weakness, while the mainland is also lacklustre amid Western sanction threats on Chinese entities for supplying Russia's war machine.

- US equity futures traded sideways after yesterday's mixed performance and soft data releases.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.3% after the cash market closed lower by 2.0% on Thursday.

FX

- DXY traded rangebound above the 105.00 level after having swung between gains and losses yesterday with brief headwinds from softer-than-expected PPI data.

- EUR/USD languished beneath the 1.0750 level following the prior day's underperformance.

- GBP/USD was contained near 1.2750 amid light catalysts and after recent failures to reclaim the 1.2800 status.

- USD/JPY advanced to just shy of the 158.00 level after the BoJ caught markets off-guard again in which it defied expectations for an immediate reduction of bond purchases, but instead will decide on a specific bond buying reduction plan at the next meeting.

- Antipodeans traded indecisively amid the cautious risk appetite and absence of tier-1 data releases.

- PBoC set USD/CNY mid-point at 7.1151 vs exp. 7.2620 (prev. 7.1122).

FIXED INCOME

- 10-year UST futures took a breather and slightly pulled back from the prior day's best levels after climbing in the aftermath of the softer-than-expected PPI data and a strong 30-year note auction.

- Bund futures held on to most of their recent US data-driven spoils although had stalled near the 132.00 level.

- 10-year JGB futures tracked the recent gains in global peers and were further boosted after BoJ policy announcement where the central bank kept rates unchanged and essentially kicked the can down the road on tapering bond purchases.

COMMODITIES

- Crude futures were subdued after yesterday's whipsawing amid geopolitical tensions and US data.

- Spot gold just about kept afloat after recently testing the USD 2,300/oz level to the downside.

- Copper futures traded little changed amid the uninspired mood in Asia and after recent soft US data.

CRYPTO

- Bitcoin was ultimately flat on the session after rebounding from an early test of the USD 66,500 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- BoJ kept its short-term policy rates at 0.0%-0.1%, as expected, while it decided to conduct JGB purchases in accordance with the decision at the March meeting but will trim bond buying and decide on a specific reduction plan for the next 1-2 years at the next meeting. BoJ's decision on rates was made by unanimous vote and the decision on JGB purchases was made by 8-1 vote in which BoJ board member Nakamura dissented citing the bank should decide to reduce purchases after reassessing developments in economic activity and prices in the July 2024 outlook report. Furthermore, the BoJ said it will hold a meeting with bond market participants on today's policy decision and it expects that underlying inflation is to gradually accelerate, as well as noted it is necessary to pay due attention to developments in financial and forex markets.

- Japanese Finance Minister Suzuki said they will monitor the impact of China's excess production on the Japanese economy and warned of possible deflationary pressure due to overcapacity in China, according to Reuters.

- Chinese firms have formally applied for an anti-dumping investigation into pork imports from the European Union after the EU decided to impose anti-subsidy duties on Chinese-made EVs, according to Global Times.

GEOPOLITICAL

MIDDLE EAST

- Hamas leader Osama Hamdan told CNN that neither they nor anyone has any idea how many live hostages there are, according to Al Jazeera.

- US President Biden said he hasn't lost hope but Hamas has to step up regarding a Gaza ceasefire.

- US State Department said the recent report issued by the IAEA makes it clear that Iran aims to continue expanding its nuclear program in ways that have no credible peaceful purpose. Furthermore, the US remains in close coordination with partners and allies and they are prepared to continue to increase pressure on Iran should its non-cooperation with the IAEA continue.

- US military said it destroyed two Houthi patrol boats, one unmanned surface vessel, and one drone over the Red Sea.

- US Centcom said Houthis launched two anti-ship cruise missiles into the Gulf of Aden and M/V Verbena reported damage and subsequent fires, according to Reuters.

OTHER

- US President Biden vowed that the US will support Ukraine ‘until they prevail in this war’, while he said Washington will send more Patriot air defence systems to Kyiv as G7 steps up support, according to FT.

- South Korean and US diplomats held an emergency phone call over the possible visit by Russian President Putin to North Korea, while South Korea told the US that Putin's visit to North Korea should not result in deeper military cooperation in breach of U.N. Security Council resolutions, according to the Foreign Ministry.

- Japanese Chief Cabinet Secretary Hayashi said they are poised to soon officially announce a new sanctions package against Russia and are considering new sanctions against organisations in China, India, UAE and others related to Russia.

EU/UK

NOTABLE HEADLINES

- UK Reform Party has overtaken the Conservative party in a poll for the first time, according to a YouGov survey for The Times.

- Budget stand-off reportedly pushes Germany's coalition to the brink, according to FT.

- French left-wing parties issued a joint statement that they have reached an agreement to create a new popular front for the parliamentary election.

- Germany is said to be trying to prevent or soften EU tariffs on Chinese EVs, according to Bloomberg.