A nothing-burger of a day from a macro (and micro) perspective left stocks and bond yields to drift higher ahead of tomorrow's big inflation print and bank earnings on Friday.

The only thing of note occurred in the last hour when Fed's Williams who appeared to push back against the recent dovish narrative of tapering QT earlier than expected (he was also hawkish on rates)...

*WILLIAMS: DON'T SEEM CLOSE TO POINT OF SLOWING ASSET RUNOFF

*WILLIAMS: NEED TO MAINTAIN RESTRICTIVE STANCE 'FOR SOME TIME'

*WILLIAMS, CITING FED'S BARR, SAYS BTFP EXPECTED TO END MARCH 11!

That wiped lipstick off the equity market 'pig' gains, pushing Small Caps into the red on the day. The SEC approved the spot Bitcoin ETF at the bell and tha seemed to spark a panic bid in stocks, lifting Small Caps back to unchanged and Nasdaq to a strong day...

Today was dominated by 0-DTE Call-buying all day... with barely any solid put-buying or -selling. The call-buying stalled when Williams wrecked the party...

Source: SpotGamma

Despite the surge in stocks, VIX was flat today ahead of the event risk of the next two days...

Source: Bloomberg

Most notably, MAG7 stocks continued to surge, up 5% in the last three day and into the green YTD...

Source: Bloomberg

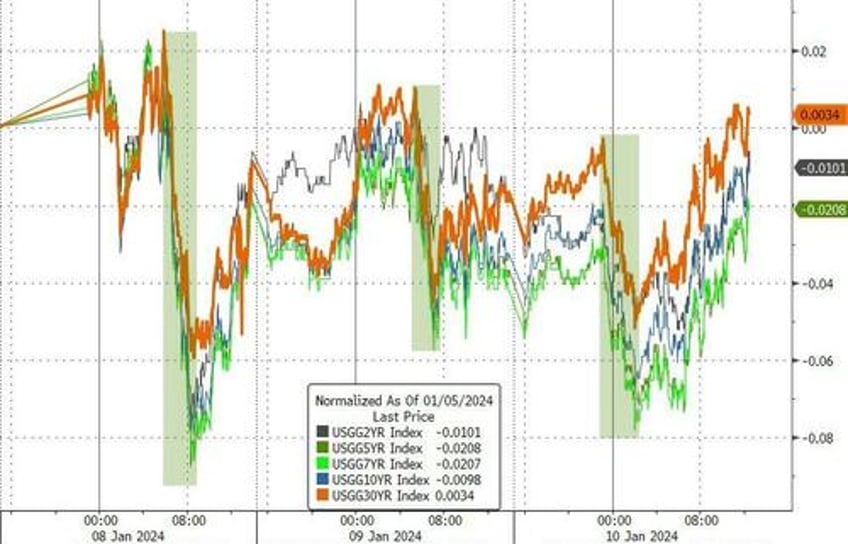

Treasury yields were net modestly higher (+2bps) but the intraday swing was notable. The 30Y yield inched up to be higher on the week while the belly outperforms...

Source: Bloomberg

Another tail at the 10Y auction did not help and yields pushed higher from overnight late-Asia buying lows, and back above 4.00% again...

Source: Bloomberg

The dollar was dead-stick today with barely a blip

Source: Bloomberg

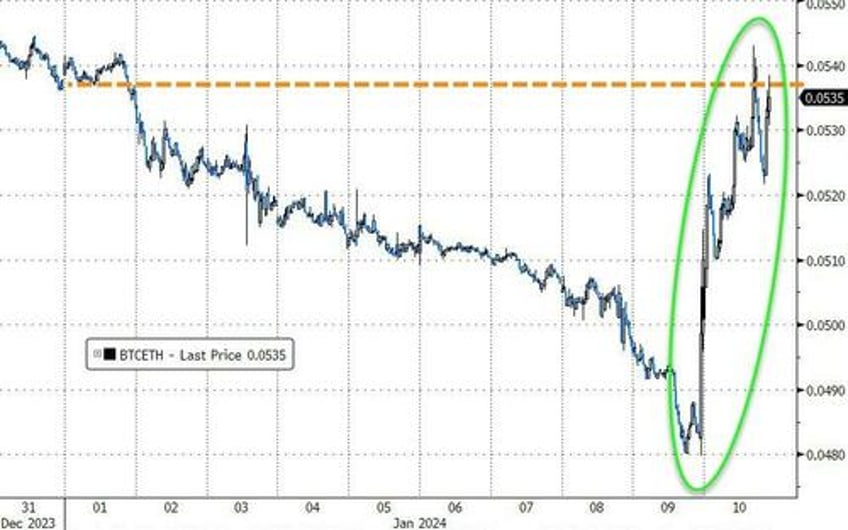

While the world waited in anticipation of the SEC approving a spot bitcoin ETF, Ethereum is dramatically outperforming Bitcoin...

Source: Bloomberg

...erasing all of the relative YTD weakness...

Source: Bloomberg

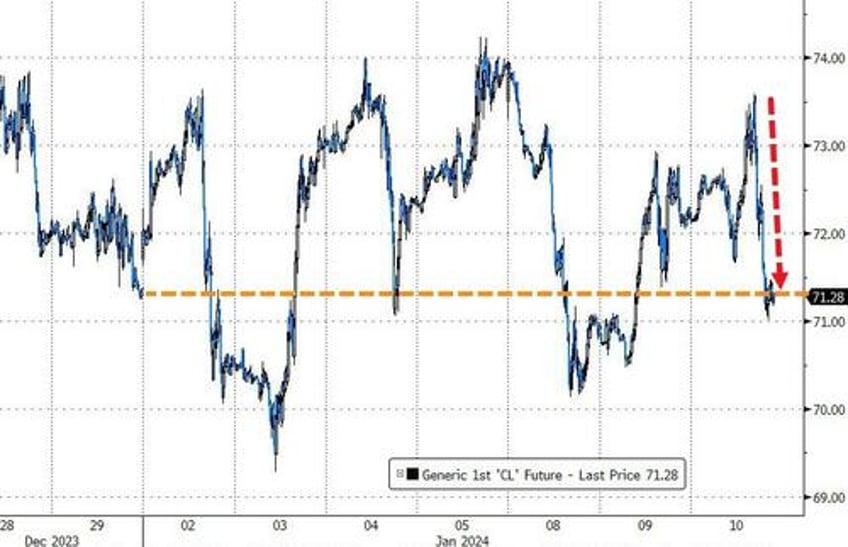

Oil prices pulled back today after testing up towards the top of the YTD range...

Source: Bloomberg

Gold dipped back to $2020 (spot) - key support...

Source: Bloomberg

Finally, VVIX (the implied vol of implied vol) has collapsed in recent days...

Source: Bloomberg

Among the lowest levels of expected vvol in the last 10 years...

Source: Bloomberg

The last time VVIX was this low was right before the SVB collapse.