The (establishment) world and his pet rabbit has been screaming at you for weeks that the American consumer is about to suffer the worst hyperinflationary hell ever (according to UMich survey respondents) as President Trump attempts to even up the score among its 'allies' over trade policies.

The last 24 hours have thrown a couple of curve balls at the established view - supporting the Trump administration's presumption that ultimately other countries will eat the tariffs... and that companies selling into the US will not want to piss off their biggest customer with demand-sucking price-hikes.

First we saw Sony decide NOT To hike prices on US consumers (while piling price hikes on select markets in Europe, Middle East and Africa (EMEA), Australia and New Zealand).

A "tough decision" apparently for management but its the first anecdotal evidence that Trump's view may be right - firms wont scupper their market share or biggest customer demand unless they really have to (forcing margins lower or offsetting US price stability for non-US customer pain).

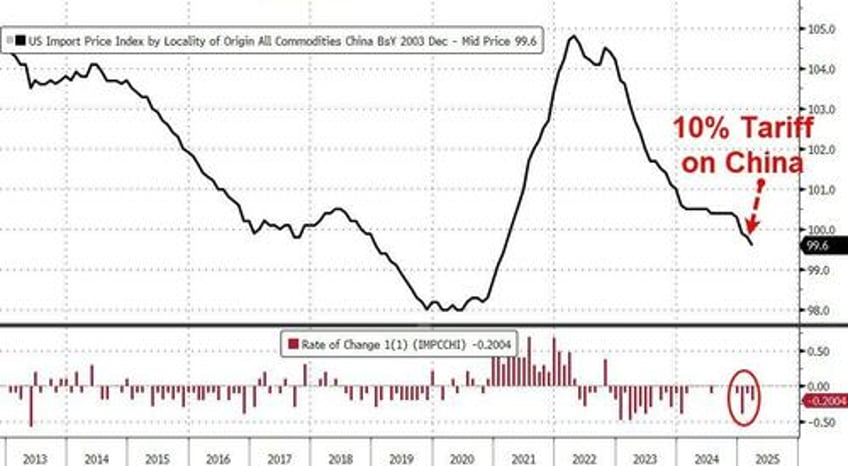

Second, and more systemic, we saw US import prices DROP 0.1% MoM in March - the first decline in import prices since September 2024...

This decline comes a month after US imposed 10% tariffs on China (at the start of February)

Goldman summarizes the details:

Import prices declined 0.1% in March, against consensus expectations for a flat reading.

Import prices ex-petroleum were flat, also below expectations.

Prices declined for industrial supplies (-0.6%), consumer goods ex autos (-0.2%), and autos (-0.1%), and rose for food and beverages (+0.1%) and capital goods (+0.3%).

The airfares component, which serves as source data for core PCE, edged down 0.2% (SA by GS).

That's not supposed to happen - prices are supposed to soar for American consumers, right?

Based on the details in the import prices report, Goldman estimates that the core PCE price index rose just 0.08% in March (vs. our expectation of 0.08% prior to today's import prices report), corresponding to a year-over-year rate of +2.67%.

Additionally, they expect that the headline PCE price index were unchanged in March, or increased 2.32% from a year earlier. We estimate that market-based core PCE rose 0.02% in March.

Ultimately this supports (for now) what Trump has been saying:

Yes, tariffs will raise actual input purchase prices BUT to avoid losing market share, the underlying prices - which are captured by import prices - will have to drop to offset the surcharge.

So you have two dynamics: import price (pre-tariff) dropping as tariffs are layered on top of that 'lower' price.

In Trump's ideal world, its a wash with US pocketing the upside and Chinese exporters getting hit on margins.

Will Sony's decision be copied by Nike, others? Who knows. But for now China (and/or its companies) is eating the initial tariff charge by Trump... not the American consumer.