As the final week of September (and Q3) begins, two large tail risks loom over the market (and economy): government shutdown and student-loan-payment resumption.

Both could trigger notable declines in GDP: Goldman estimates that a government-wide shutdown would reduce quarterly annualized growth by around 0.2pp for each week it lasts after accounting for modest private sector effects; and expect the resumption of student loan payments to subtract 0.5pp from quarterly annualized GDP growth.

And just to pile on, as growth could slow, inflation threats are re-asserting themselves (via commodities) and hurting sentiment optically and actually via soaring gasoline prices.

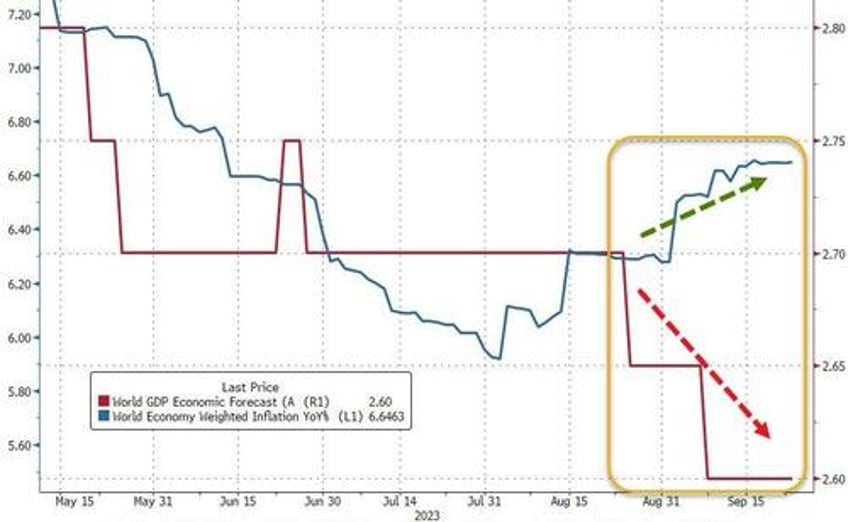

That stagflationary impulse is clearly evident in forecasts for next year...

Source: Bloomberg

Safe-haven cash demand ahead of the potential shutdown helped send the dollar higher - breaking out to its highest since Dec 2022. Today was the biggest jump in the dollar in 3 weeks, and is up 4 days in a row...

Source: Bloomberg

Bonds were sold with both hands and feet today with the long-end dramatically underperforming (30Y +13bps, 2Y +2bps)...

Source: Bloomberg

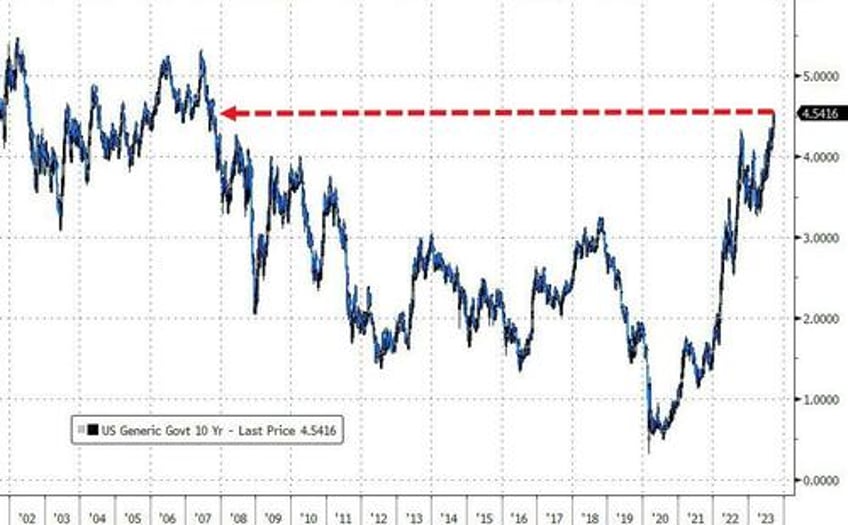

The 10Y Yield reached its highest since Oct 2007...

Source: Bloomberg

Smashing the yield curve (2s30s) dramatically steeper (less inverted) -now at its least-inverted since May...

Source: Bloomberg

And remember, the re-steepening is the bad part, as BofA CIO Michael Hartnett - the most vocal bear at Bank of America - made an important observation, pointing out that at a time when everyone is predicting a soft landing, the hard landing “tells” are lining up: yield curve steepening -110bps to -67bps, unemployment rate up 3.4% to 3.8%, personal savings rate up 3% to 4-5% YTD, and maybe most importantly, HY defaults are up 1.6% to 3.2%, credit card delinquencies are up by half, from 0.8% to 1.2%, while auto delinquencies are soaring, up 5.0% to 7.3%.

The dollar's gains were gold's losses as the precious metal tumbled back to last week's lows...

Oil prices also lagged on the day with WTI back below $90...

Bitcoin tumbled back down to $26,000 and found support...

Source: Bloomberg

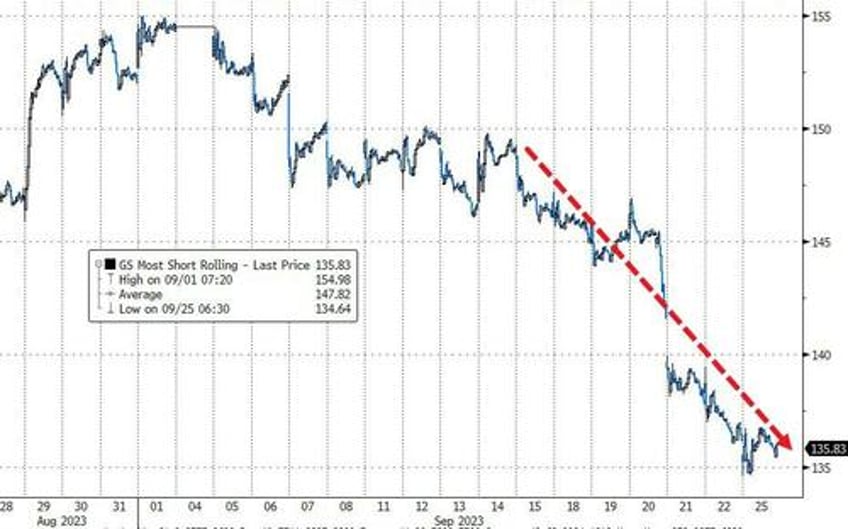

For a change, we end with stocks where 'most shorted' names fell for the 7th straight day (despite a good try for a squeeze early on...

Source: Bloomberg

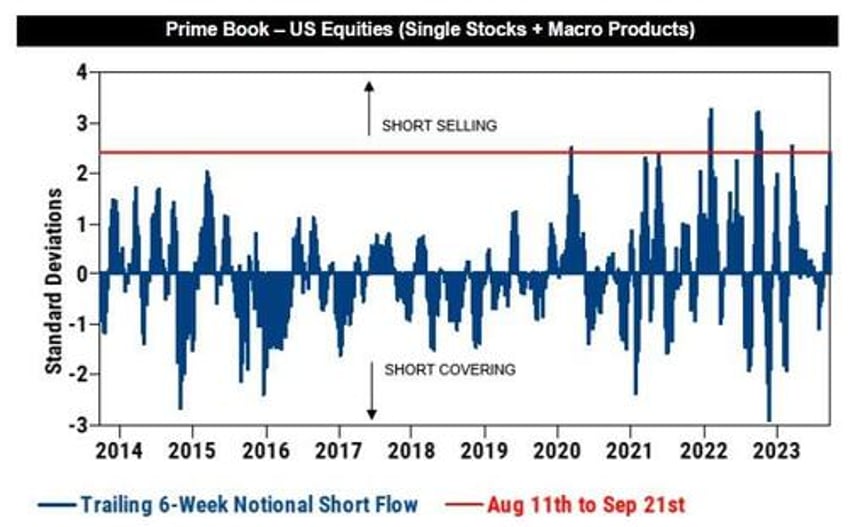

And as we noted earlier, the last six weeks have seen the most intense 'shorting' by hedge funds since Sept-Oct 2022...

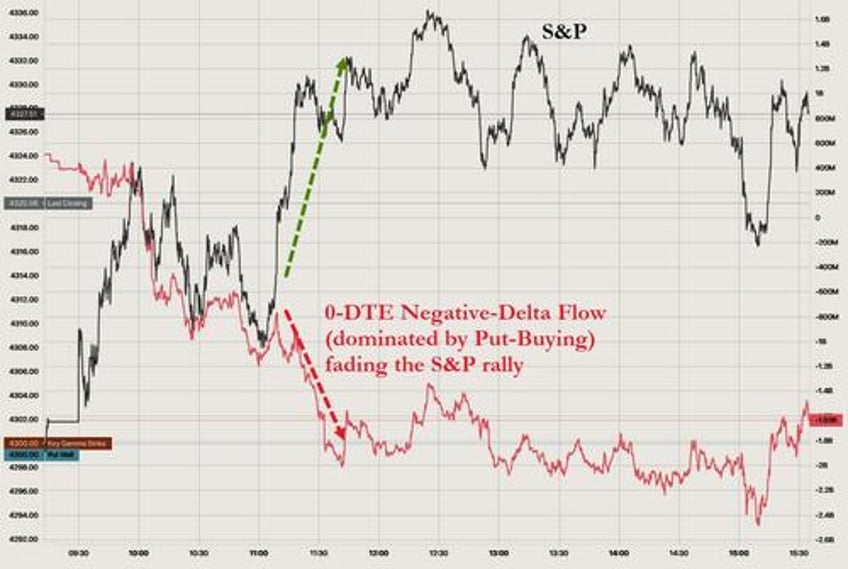

The market is very much in a negative gamma environment...

Source: SpotGamma

And while the negative gamma typically exaggerates the intraday moves, 0-DTE is battling that trend, with its mean-reverting tendency...

Source: SpotGamma

All of which saw equity markets' early weakness (during the early European session) whipped back into positive territory as US opened, then oscillate in a narrow range for the rest of the day. The Dow was the laggard (around unch) while the rest of the majors managed modest gains...

The Dow bounced at its 200DMA...

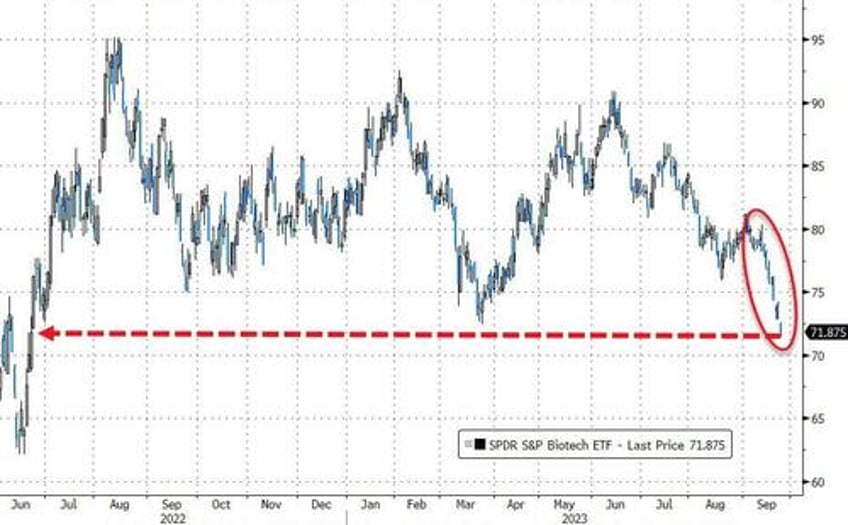

Biotech stocks made headlines, down for the 8th day of the last 9 to its lowest since June 2022...

Source: Bloomberg

VIX slipped back below 17...

Finally, as real rates reach a new cycle high, so the valuations on stocks are starting to wake up to that reality (no pun intended)...

Source: Bloomberg

How much of that 5-turn collapse in the S&P 500 will The Fed stand for before it steps in? That's the bet.