Prospective homebuyers in Manhattan were sidelined last month as the rate on a 30-year mortgage topped 7%. As a result, rents in the borough rose to three-month highs due to sliding housing affordability.

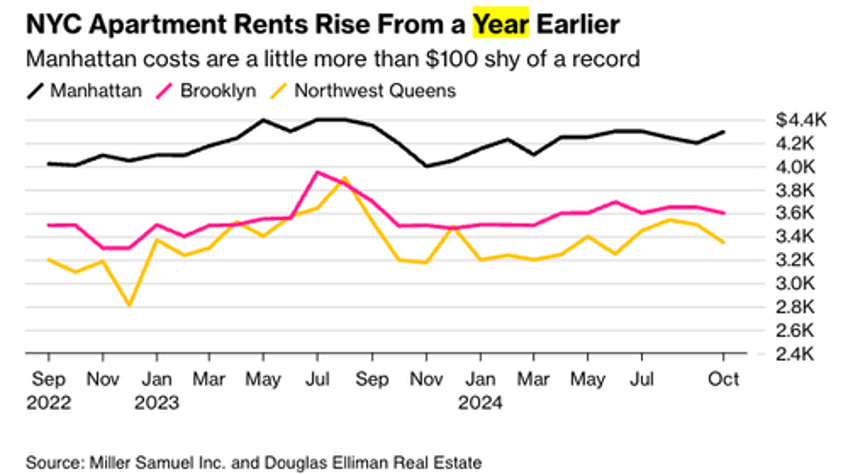

Bloomberg cited new data from brokerage Douglas Elliman Real Estate and appraiser Miller Samuel that showed the median Manhattan apartment rent climbed 2.4% from a year earlier to $4,295. This was the first annual gain since April.

In other surrounding boroughs, new leases signed in Brooklyn last month averaged around $3,600, up 3.2% from a year earlier. In northwest Queens, median rents were up nearly 5% to $3,350.

In recent weeks, the US 10-year Treasury bond yield, which lenders use as a guide to price home loans, jumped in anticipation of a Trump win. Yields soared even after the Federal Reserve cut its benchmark interest rate. This is mostly because traders forecasted elevated inflation under the Trump administration.

Jonathan Miller, president of Miller Samuel, noted that lower mortgage rates lured some renters to purchase homes before the presidential election. However, he noted that rents started to re-accelerate as soon as mortgage rates bottomed in late September and surged through October. He added that a 30-year mortgage rate over 7% has pressured rents higher.

"Rents tend to follow mortgage rates," Miller said, adding, "The higher the mortgage rate, the higher rent."

Miller said newly signed leases jumped 24% last month compared to one year ago. He noted that higher rates have sparked a surge in activity this fall.

"Mortgage rates still aren't coming down," Miller said, pointing out, "Economic policy would not seem to suggest that mortgage rates will fall significantly. If anything, rents will stay where they are, or rise, moving forward."