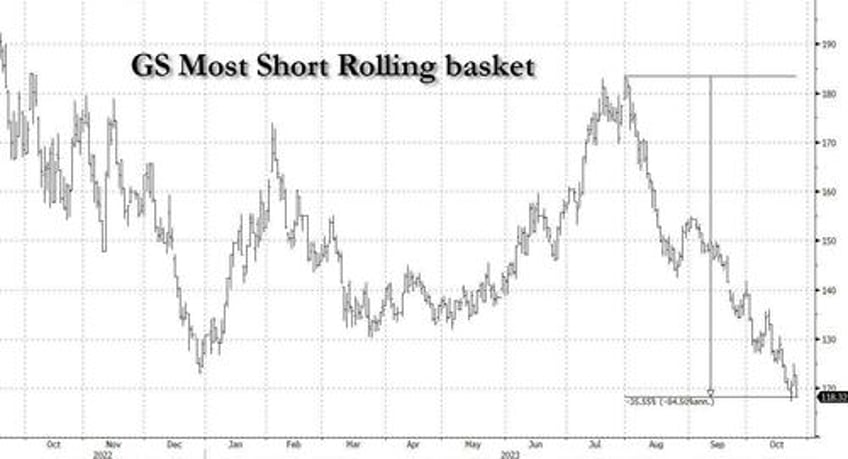

On a day when brutal liquidations across the megacap sector including the worst selloff for Google since March 2020 sent shockwaves across markets, stocks finished sharply lower with the Nasdaq suffering the worst day in 2023, as the selloff in rates returned and we saw another sharp bear steepening session in yields as oil spiked higher again. As JPMorgan notes, 4 megacap tech stocks (GOOGL, AMZN, META, NVDA) contributed over 50% of the index’s decline (GOOGL's 9.6% drop accounted for ~25% of NDX’s decline today amid disappointing cloud growth, while AMZN, NVDA and META contributed another 25%). Naturally, shorts are working with the Goldman most shorted basket tumbling 4% (a -2.4 sigma move).

What did today's carnage look like from the front line? Below, we first share some thoughts from JPM TMT trader Ron Adler (excerpted from the full report available to pro subscribers):