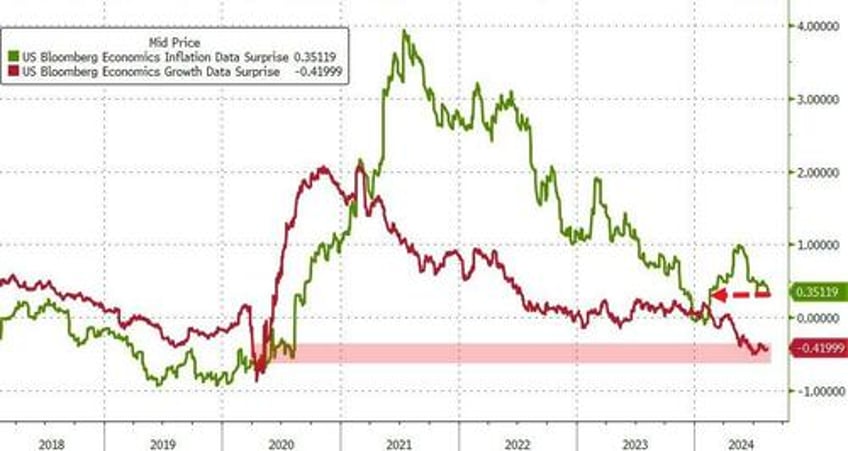

Inflation 'surprise' data continues to drift back lower (at February lows after this morning's CPI) but more problematically macro growth 'surprise' data is hovering near COVID lockdown lows...

Source: Bloomberg

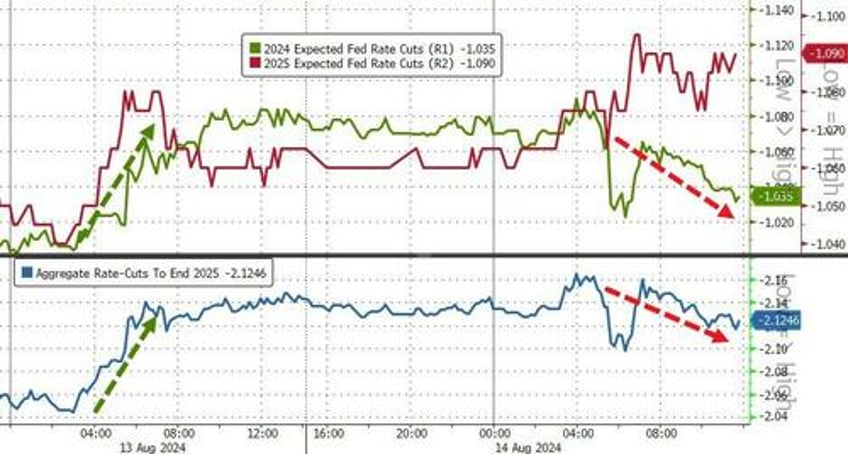

...and it is that potential growth scare that is dominating traders' minds as they reduce rate-cut expectations...

Source: Bloomberg

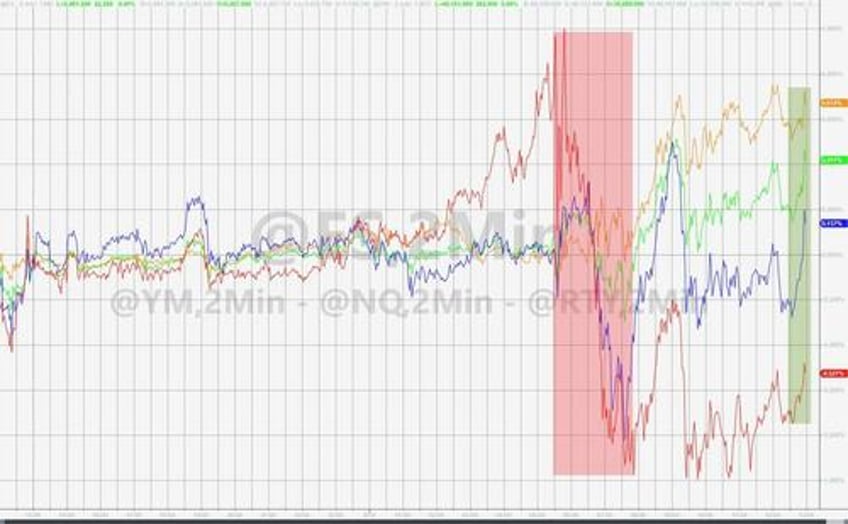

Markets are confused...

... Small Caps up, Dow down; Short-end of yield curve higher in yield, long-end lower; dollar flat as rate expectations slide; growthy Mag7 stocks rally while growthy commodities tumble...

Source: Bloomberg

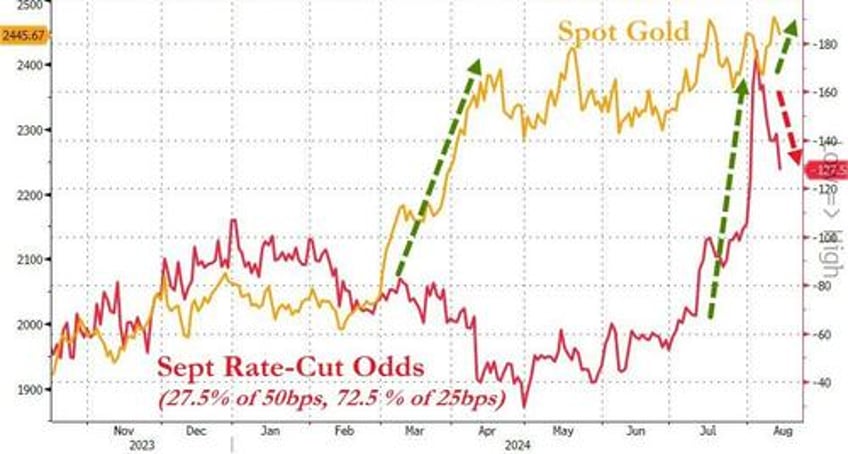

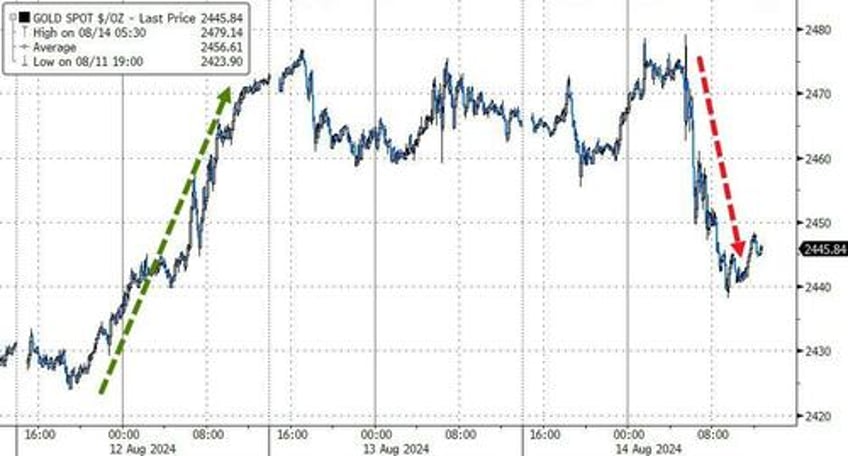

...and gold and crypto slammed with dollar unch (though gold seemed to see this coming way early)...

Source: Bloomberg

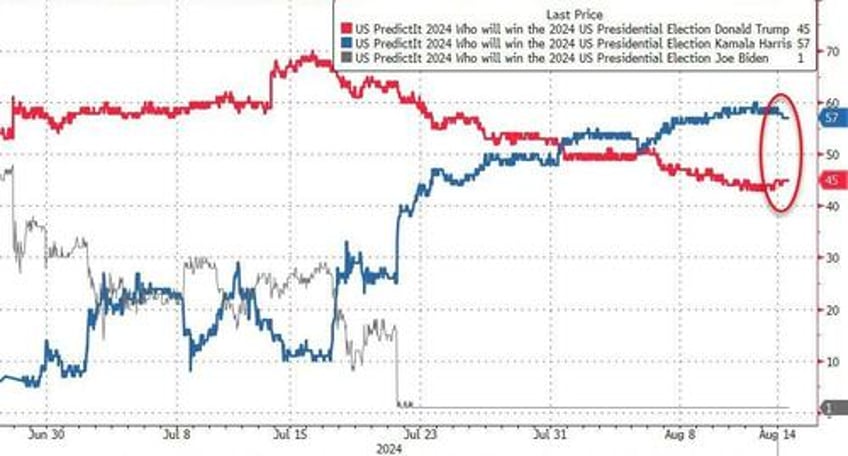

...and distracted...

...as Kamala's prediction market odds are now 12 pts above Trump's...

Source: Bloomberg

By the end of the day, The Dow was up, Small Caps down, Nasdaq unch... until a late-day panic-bid put some lipstick on the pig ahead of tomorrow's retail sales data...

VIX was clubbed like a baby seal back to a 16 handle...

Treasuries were mixed with the short-end lagging (2Y +3bps, 30Y -4bps), but all yields are down on the week...

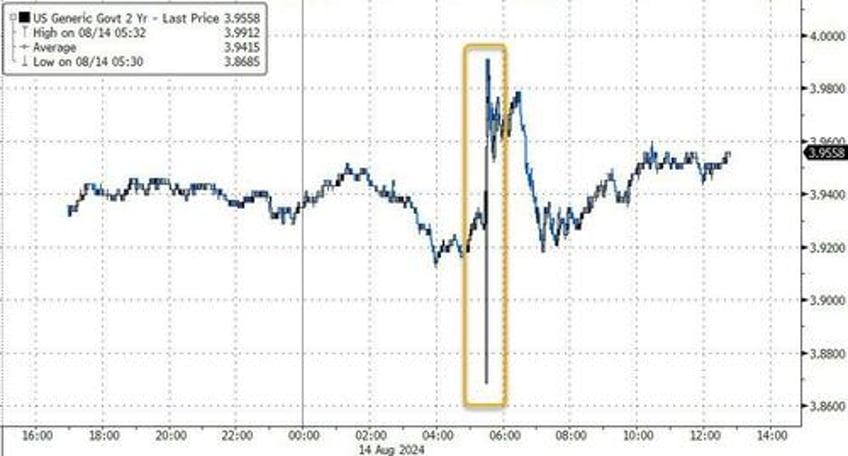

Source: Bloomberg

Today's price action was a little wild in bond land with the CPI print sending 2Y up to 4.00% where it was firmly rejected...

Source: Bloomberg

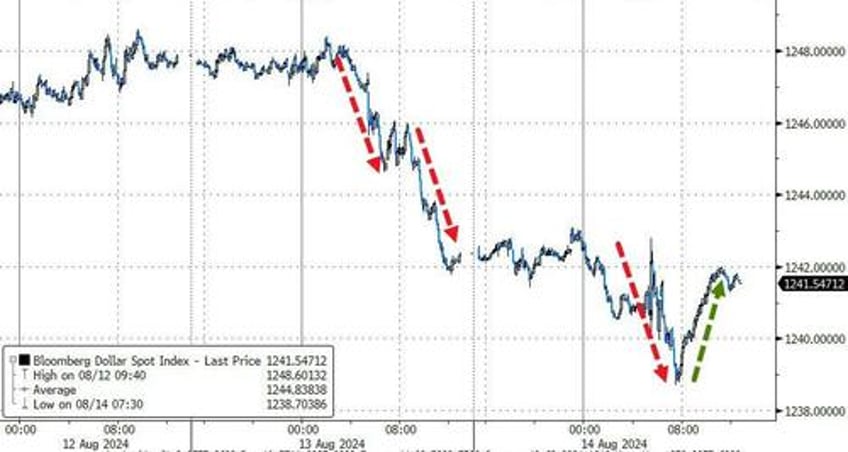

The dollar was dumped overnight and through CPI, only to retrace those losses to end unchanged on the day...

Source: Bloomberg

While the dollar was unchanged, gold prices tumbled, erasing much of Monday's gains...

Source: Bloomberg

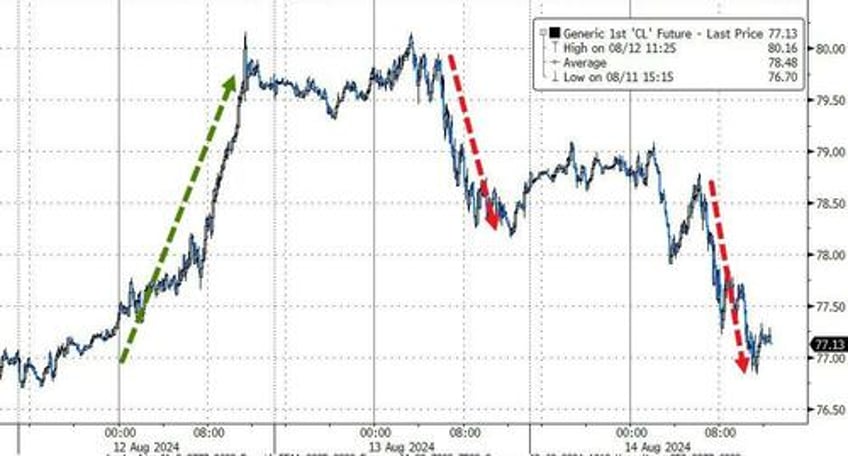

Oil prices followed a similar trajectory, with WTI dropping to a $76 handle intrday (after an unexpected crude build)...

Source: Bloomberg

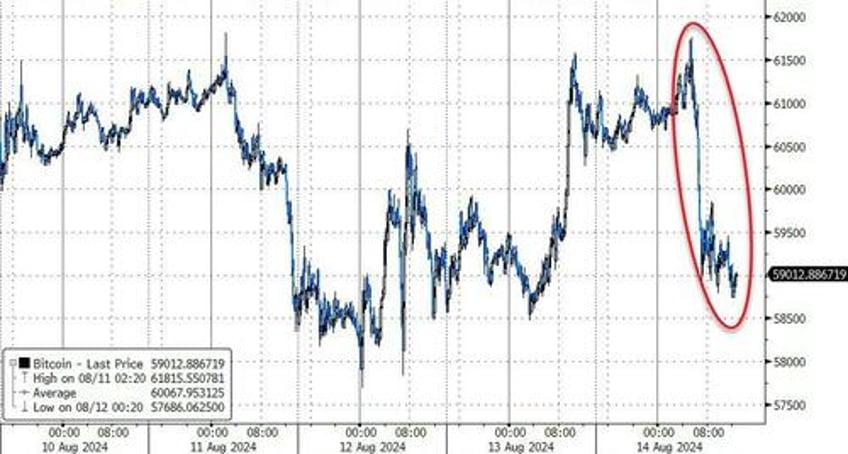

Bitcoin was battered back down to $59k after CPI and reports that Kamala's administration is dumping more Silk Road seizures...

Source: Bloomberg

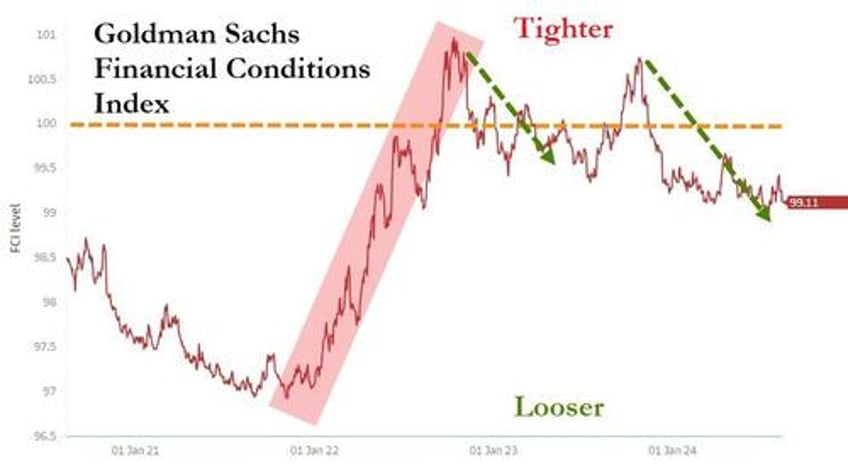

Finally, market-driven financial conditions have eased dramatically in the last few months...

Source: Goldman Sachs

...clearly the market is demanding 200bps of cuts this year...or else, Kamala loses!.