- APAC stocks traded mixed albeit with a predominantly positive bias after the constructive handover from Wall St.

- White House said they will give a one-month exemption on any autos coming through USMCA.

- US President Trump is reportedly considering agricultural carve-outs for Mexico and Canada tariffs, according to Bloomberg.

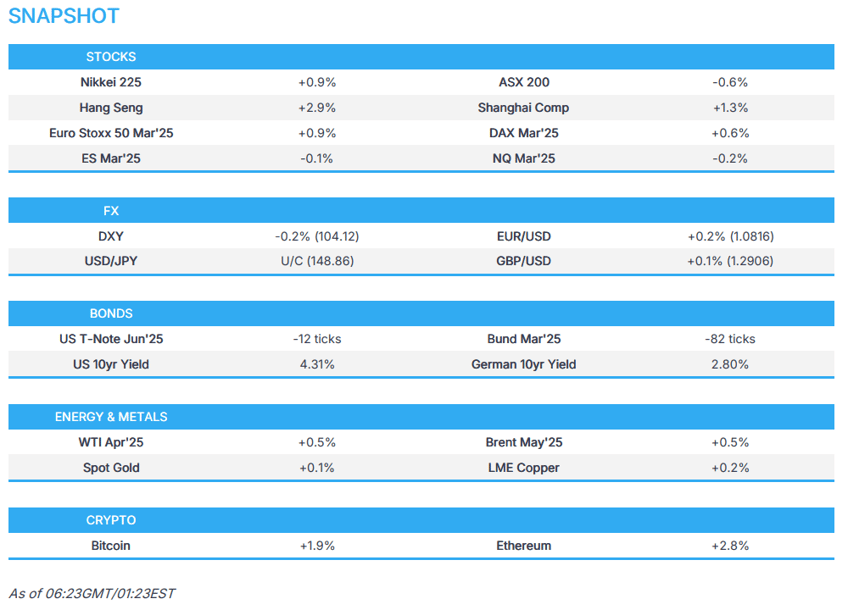

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 0.7% after the cash market closed with gains of 1.9% on Wednesday.

- DXY remains on the backfoot, EUR/USD has extended its rally onto a 1.08 handle, Cable has breached 1.29 to the upside.

- Bund futures continued its downward slide after German yields surged by the most in a day since the 1990s.

- Looking ahead, highlights include Swedish CPI, EZ Retail Sales, US Initial Jobless Claims, Atlanta Fed GDPnow, Canadian Exports/Imports, ECB & CBRT Policy Announcements, Special European Council regarding Ukraine and EU Defence, BoE DMP, ECB President Lagarde, Fed's Waller, Bostic & Harker, Supply from Spain, France & US.

- Earnings from Deutsche Post, Merck, Lufthansa, Zalando, Reckitt, Admiral, Rentokil, Entain, Melrose, JD.com, Kroger, Broadcom, Costco & Gap.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ultimately finished in the green on what was a choppy day, while T-notes were sold across the curve and the Dollar plummeted as the Euro and Bund yields climbed. The focus of the session was on US trade updates in which the US decided to delay auto tariffs on Canada and Mexico by 30 days, although President Trump told Canadian PM Trudeau that they had not done enough on fentanyl imports into the US, albeit progress on borders has been reasonable, while participants also digested mixed data releases including a dismal ADP jobs report and better-than-expected ISM Non-Manufacturing PMI.

- SPX +1.11% at 5,843, NDX +1.36% at 20,628, DJI +1.14% at 43,007, RUT +1.02% at 2,101.

- Click here for a detailed summary.

TARIFFS/TRADE

- White House said they will give a one-month exemption on any autos coming through USMCA and reciprocal tariffs will still go into effect on April 2nd, while it added that President Trump sees an increase in fentanyl flow through the Canadian border and there needs to be repercussions, although it was also stated that Trump is open to hearing about additional tariff exemptions.

- US President Trump is reportedly considering agricultural carve-outs for Mexico and Canada tariffs, according to Bloomberg.

- US President Trump posted on Truth that "Justin Trudeau, of Canada, called me to ask what could be done about Tariffs. I told him that many people have died from Fentanyl that came through the Borders of Canada and Mexico, and nothing has convinced me that it has stopped. He said that it’s gotten better, but I said, “That’s not good enough.” The call ended in a “somewhat” friendly manner! He was unable to tell me when the Canadian Election is taking place, which made me curious, like, what’s going on here? I then realized he is trying to use this issue to stay in power. Good luck Justin!"

- US Secretary of State Rubio discussed trade, borders and the economy with Canada's Foreign Minister Joly, according to Bloomberg. It was also reported that Canada's Foreign Minister said conversations with the US were happening and things were very fluid, while she said Canada could use oil and gas exports as a lever in negotiations if US tariffs continue.

- Alberta Premier Smith said Alberta is to alter procurement practices amid US tariffs and that the US can't be dominant without Canada, while Smith added that Alberta is to focus on energy exports to non-US markets.

- Mexico's Pemex said it will not give discounts on its oil to US buyers because of tariffs and it is in talks with potential buyers in Asia and Europe amid Trump's tariffs, while potential Chinese buyers are said to be interested in Mexican crude.

- Brazilian Vice President and Minister of Development, Industry, Trade and Services Alckmin is to talk with US Commerce Secretary Lutnik on Thursday.

NOTABLE HEADLINES

- Fed Beige Book stated overall economic activity rose slightly since mid-January and that six Districts reported no change, four reported modest or moderate growth, and two noted slight contractions, while consumer spending was lower on balance, with reports of solid demand for essential goods mixed with increased price sensitivity for discretionary items, particularly among lower-income shoppers.

- New York Fed's Perli said balance sheet drawdown has been smooth and financial system reserves remain abundant but flagged the challenge of managing balance sheet cuts amid debt ceiling debate. Perli added that the Fed’s reverse repos can likely shrink further and the Fed may bring back early morning SRF operations at quarter-end. Furthermore, he said market liquidity is still ample and that comments suggest balance sheet cuts have more room, as well as stated that if the Fed pauses quantitative tightening, it would not alter the endgame.

- US President Trump said he is collaborating with House Republicans on a Continuing Resolution to fund the government through September. It was separately reported that Trump is expected to issue an executive order as soon as Thursday aimed at abolishing the Education Department, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks traded mixed albeit with a predominantly positive bias after the constructive handover from Wall St where stocks ultimately gained in a choppy session amid mixed data and after the US decided to delay auto tariffs on Canada and Mexico by 30 days.

- ASX 200 retreated to a fresh YTD low amid underperformance in the energy and utilities sectors, while better-than-expected building approvals and a larger trade surplus failed to inspire.

- Nikkei 225 advanced at the open as the yen faded some of its recent gains and with the index unfazed by the rise in yields.

- Hang Seng and Shanghai Comp resumed their upward momentum amid the ongoing “Two Sessions” and recent spending announcements, while participants also awaited a press briefing by China’s central bank, finance and securities chiefs.

- US equity futures (ES -0.2%, NQ -0.3%) are a touch softer after yesterday’s gradual pick-up which was helped by the one-month delay of US auto tariffs on Canada and Mexico, while reports noted that President Trump is also considering agricultural carve-outs for Mexico and Canada tariffs.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 0.7% after the cash market closed with gains of 1.9% on Wednesday.

FX

- DXY is a touch lower and lacked demand after slumping yesterday for the third consecutive day and fell to levels last seen in November 2024 as the recent soft dollar themes persisted with EUR recently surging on German CDU leader Merz's investment announcement, while US data releases were mixed in which the latest ADP report significantly fell short of expectations but ISM Services unexpectedly rose further into expansionary territory.

- EUR/USD marginally extended on this week’s rally and reclaimed the 1.0800 handle with upside facilitated alongside the recent surge in German bond yields and with the attention now turning to Thursday’s ECB rate decision.

- GBP/USD held on to the prior day’s spoils and attempted to reclaim the 1.2900 handle after gaining on the back of the softer dollar, while the latest rhetoric from BoE officials lacked any fireworks.

- USD/JPY gradually rebounded from the prior day’s trough and returned to 149.00 territory.

- Antipodeans held on to this week’s gains although further upside was capped amid the mixed risk appetite in the region and with little reaction seen to the mostly better-than-expected Australian data.

- PBoC set USD/CNY mid-point at 7.1692 vs exp. 7.2386 (prev. 7.1714).

FIXED INCOME

- 10yr UST futures were lacklustre after retreating in tandem with a slump in Bunds on German debt and spending plans.

- Bund futures continued its downward slide after German yields surged by the most in a day since the 1990s.

- 10yr JGB futures followed suit to the losses in global peers as Japanese yields climbed which saw the 10-yr yield touch 1.50% for the first time since 2009, while prices were also not helped by a weaker 30yr JGB auction.

COMMODITIES

- Crude futures partially nursed some of this week’s losses and rebounded from around a six-month low after recently suffering amid weak economic data and tariff uncertainty.

- Spot gold eked slight gains with price action rangebound amid an uneventful dollar.

- Copper futures remained afloat amid the mostly positive risk appetite and held on to the prior day's spoils after upward momentum was spurred by Trump’s suggestion of 25% tariffs on imports of foreign aluminium, copper and steel.

CRYPTO

- Bitcoin continued its rebound and gradually climbed back above the USD 92,000 level.

NOTABLE ASIA-PAC HEADLINES

- A team from China recently unveiled its general-purpose AI Agent product, Manus, which is said to outperform the OpenAI model of the same level, according to Shanghai Securities News.

DATA RECAP

- Australian Building Approvals (Jan) 6.3% vs. Exp. 0.5% (Prev. 0.7%, Rev. 1.7%)

- Australian Balance on Goods (Jan) 5,620M vs. Exp. 5,500M (Prev. 5,085M)

- Australian Goods/Services Exports (Jan) 1.3% (Prev. 1.1%)

- Australian Goods/Services Imports (Jan) -0.3% (Prev. 5.9%)

GEOPOLITICS

MIDDLE EAST

- US President Trump posted on Truth Social a warning for Hamas to release all hostages now not later and return all the dead bodies or it is over for them. Trump stated "only sick and twisted people keep bodies, and you are sick and twisted! I am sending Israel everything it needs to finish the job, not a single Hamas member will be safe if you don’t do as I say. I have just met with your former Hostages whose lives you have destroyed. This is your last warning! For the leadership, now is the time to leave Gaza, while you still have a chance."

- Hamas said US President Trump's threats demonstrate the US administration's insistence on continuing as a partner in genocide against their people.

- US Treasury Secretary Bessent and Israel’s Minister of Finance Smotrich held a meeting to discuss the ongoing economic partnership between the US and Israel.

RUSSIA-UKRAINE

- Ukrainian President Zelensky anticipates positive outcomes from US cooperation next week. It was also reported that Zelensky’s top aide discussed with the US National Security Advisor steps to achieve just peace, while Ukraine and the US agreed on a meeting in the near future.

- Four senior members of Trump's entourage have held secret discussions with some of Kyiv’s top political opponents to Ukrainian President Zelensky, according to Politico.

- White House Press Secretary said National Security Adviser Waltz has been talking to his Ukrainian counterparts and they are reconsidering funding for Ukraine, while talks on the mineral deal are happening and Trump is committed to a peace deal.

- French President Macron said he wants to believe the US will remain at their side but have to be ready if they are no longer by their side and France will hold a meeting of all European army chiefs next week in Paris. Macron also stated they will have to make more investments in defence and will open the debate to extend the French nuclear umbrella to European partners.

OTHER NEWS

- Eight were hurt after a shell dropped on a civilian town at Pocheon, South Korea during a live-fire military drill, according to Reuters citing a fire official.

EU/UK

NOTABLE HEADLINES

- UK finance and defence trade bodies agreed to submit joint policy recommendations to the government for increasing funding to the defence industry.

- Goldman Sachs expects the ECB's benchmark interest rate to reach 2% by June 2025 but no longer expects a 25bps cut in July. Goldman Sachs raised Germany's 2025 economic growth forecast by 0.2 percentage points to 0.2% citing higher public spending on defence and infrastructure and raised the euro area's 2025 economic growth forecast by 0.1 percentage point to 0.8%, while it sees some spillovers from Germany into neighbouring countries and now expects the rest of the euro area to step up military spending somewhat more quickly in response to the German shift.