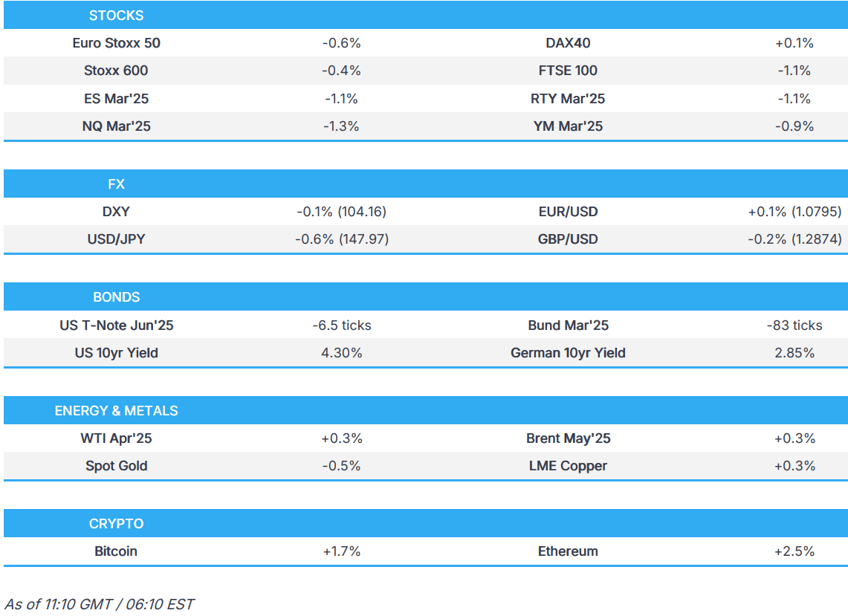

- European bourses are mostly lower, Autos benefit following tariff reprieve; US futures in the red with NQ underperforming.

- DXY remains on the backfoot, EUR underpinned by stimulus hopes as attention turns to ECB.

- Bunds continue to slump on the latest fiscal reports pre-ECB, USTs await data.

- Crude attempts to claw back recent pressure, XAU sits around USD 2.9k/oz.

- Looking ahead, US Initial Jobless Claims, Atlanta Fed GDPnow, Canadian Exports/Imports, ECB Policy Announcement, Special European Council regarding Ukraine and EU Defence, Speakers including ECB President Lagarde, Fed's Waller, Bostic & Harker.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump is reportedly considering agricultural carve-outs for Mexico and Canada tariffs, according to Bloomberg.

- US Secretary of State Rubio discussed trade, borders and the economy with Canada's Foreign Minister Joly, according to Bloomberg. It was also reported that Canada's Foreign Minister said conversations with the US were happening and things were very fluid, while she said Canada could use oil and gas exports as a lever in negotiations if US tariffs continue.

- Mexico's Pemex said it will not give discounts on its oil to US buyers because of tariffs and it is in talks with potential buyers in Asia and Europe amid Trump's tariffs, while potential Chinese buyers are said to be interested in Mexican crude.

- Brazilian Vice President and Minister of Development, Industry, Trade and Services Alckmin is to talk with US Commerce Secretary Lutnik on Thursday.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.5%) opened with a clear positive bias, but as the morning progressed, indices gradually drifted lower to display a more negative picture in Europe.

- European sectors are mixed vs initially opening with a positive bias. Autos is the clear outperformer today with optimism stemming from the White House, which said it will give one month exemptions on any autos coming through USMCA; Stellantis (+2.3%), Porsche AG (+2%). Real Estate is once again towards the foot of the pile, as yields continue to tick higher in the fall out from Germany’s spending plans.

- US equity futures are entirely in the red, with clear underperformance in the tech-heavy NQ (-1.2%); sentiment for the index is hit following Marvell results; the co. beat on headline metrics but its Q1 guidance disappointed – shares are lower by 15% in pre-market trade.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY remains pressured and has extended its losing streak to a fourth session in a row. Recent price action has largely been a EUR story which has had a mechanical impact on the USD, with the JPY today also acting as a drag. From a US lens, this week has been characterised by soft US data and tariff angst given actions taken earlier in the week. From a US lens, this week has been characterised by soft US data and tariff angst given actions taken earlier in the week. On the latter, Trump has offered some tentative olive branches in the past 24 hours by providing a one-month exemption on any autos coming through the USMCA and reportedly considering agricultural carve-outs for Mexico and Canada. If downside in DXY extends, focus is on a test on 104; not breached since 6th Nov (103.70 was the low that day).

- EUR/USD has pulled back a touch in recent trade but ultimately remains buoyed by the latest stimulus efforts from Germany. The German 10yr yield is up around 50bps since the start of the week with ING writing that "risks are probably skewed to the 3% handle in 10-year bunds". Subsequently, EUR/USD hit another YTD peak overnight at 1.0821. Today, the ECB is expected to deliver another 25bps rate cut. Greater attention lies on whether policymakers will still view policy as restrictive in lieu of recent economic developments.

- JPY is the best performer across the majors and even outpacing the rampant EUR. USD/JPY was already softer in early European trade before extending the move to the downside after news that Rengo, Japan's largest labour union, is seeking a wage hike of 6.09% for 2025 (sought 5.85% in 2024). USD/JPY has printed a fresh YTD low at 147.78 with the next target coming via the 8th Oct low at 147.34.

- Cable has made its way onto a 1.29 handle for the first time since November 2024 before fading gains. It remains the case that fresh macro drivers for the UK have been on the light side and as such the pair is taking its cues from the broad softness in the USD. The latest DMP release showed the 1-year ahead inflation expectation rise to 3.1% from 3.0% with the 3-year metric holding steady at 2.8%.

- The recent rally in the Antipodeans vs. the USD has extended once again. Overnight, AUD/USD was unreactive to the mostly better-than-expected Australian data and instead tracked the cautious mood in APAC trade.

- PBoC set USD/CNY mid-point at 7.1692 vs exp. 7.2386 (prev. 7.1714).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds once again under marked pressure with losses of over 100 ticks at worst to a 129.64 low vs the 131.71 opening level for the week. Action which has lifted the 10yr yield to a 2.93% peak into the ECB. Into that, markets are fully pricing a 25bps cut with focus on the labelling of restrictive or not and what the trajectory is thereafter.

- For EGBs, pressure today stems in a continuation of recent German-led action and on recent reports in Politico that Germany is expected to propose an idea of loosening the Stability and Growth Pact (the pact which keeps debt to 60% of GDP and deficits to 3%). Updates on this could come from today’s EU leaders meeting and/or the Finance Minister gathering on Monday.

- Gilts and USTs follow suit, but to slightly less degrees with downside of around 30 and 10 ticks respectively. Updates from the UK include the latest BoE DMP where the one-year inflation view was lifted modestly.

- For USTs, focus is on updates on the tariff/trade front as always while the region awaits data post-ECB in the form of weekly jobs (does not match the BLS survey period), Q4 labour revisions and wholesale inventory/trade data; following the latter points, the Atlanta Fed will update its GDPnow model for Q1 which was last tracking at -2.8% on March 3rd.

- Spain sells EUR 5.3bln vs. Exp. EUR 4.5-5.5bln 3.10% 2031 & 3.15% 2035 Bono & EUR 0.514bln EUR 0.25-0.75bln 0.7% 2033 I/L Bono.

- France sells EUR 13bln vs. Exp. EUR 11-13bln 4.00% 2035, 3.20% 2035, 1.75% 2039, and 2.50% 2043 OAT.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing attempting to pare back some of the pressure seen this week; the complex was pressured in early European trade, in tandem with a dip in risk sentiment, but the downside has since subsided. Brent May'25 currently around USD 69.50/bbl.

- Spot gold is now trading around the USD 2.9k/oz mark; overnight price action was rangebound, but did dip lower in European trade; currently trades within a USD 2,891.41-2,926.20/oz range.

- Base metals are mixed; 3M LME Copper is a little firmer today, benefiting from the commentary from PBoC Governor Pan who noted that rates will be cut at an "appropriate" time.

- A global aluminium producer is reportedly seeking a USD 245/T April-June premium in Japan discussions, via Reuters citing sources; +7% Q/Q.

- UBS expects platinum to be undersupplied by 500k/oz in 2025, keeping the metal in a deficit for a third consecutive year; targets platinum price of USD 1100/oz by mid-2025. Expects Platinum to lag Gold until lower rates support stronger industrial activity.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish CPIF Flash YY (Feb) 2.9% vs. Exp. 2.7% (Prev. 2.2%); ex-Energy Y/Y 3.0% vs. Exp. 2.7% (Prev. 2.7%)

- EU HCOB Construction PMI (Feb) 42.7 (Prev. 45.4); German HCOB Construction PMI (Feb) 41.2 (Prev. 42.5); Italian HCOB Construction PMI (Feb) 48.2 (Prev. 50.9); French HCOB Construction PMI (Feb) 39.8 (Prev. 44.5)

- UK S&P Global Construction PMI (Feb) 44.6 vs. Exp. 49.5 (Prev. 48.1)

- EU Retail Sales MM (Jan) -0.3% vs. Exp. 0.1% (Prev. -0.2%); Retail Sales YY (Jan) 1.5% vs. Exp. 1.9% (Prev. 1.9%, Rev. 2.2%)

NOTABLE EUROPEAN HEADLINES

- Goldman Sachs expects the ECB's benchmark interest rate to reach 2% by June 2025 but no longer expects a 25bps cut in July. Goldman Sachs raised Germany's 2025 economic growth forecast by 0.2 percentage points to 0.2% citing higher public spending on defence and infrastructure and raised the euro area's 2025 economic growth forecast by 0.1 percentage point to 0.8%, while it sees some spillovers from Germany into neighbouring countries and now expects the rest of the euro area to step up military spending somewhat more quickly in response to the German shift.

- BoE Monthly Decision Maker Panel data - February 2025. Expectations for CPI inflation a year ahead rose from 3.0% to 3.1% in the three months to February. The corresponding measure for three-year ahead CPI inflation expectations was 2.8% in the three months to February, which was unchanged from the three months to January. Expected year-ahead wage growth remains unchanged at 3.9% on a three-month moving-average basis in February.

- Germany's lower house to start discussing debt brake reform on March 13, via Reuters citing sources; to vote on debt brake reform on March 18.

- Turkish CBT Weekly Repo Rate (Feb) 42.5% (Prev. 45.0%)

NOTABLE US HEADLINES

- New York Fed's Perli said balance sheet drawdown has been smooth and financial system reserves remain abundant but flagged the challenge of managing balance sheet cuts amid debt ceiling debate. Perli added that the Fed’s reverse repos can likely shrink further and the Fed may bring back early morning SRF operations at quarter-end. Furthermore, he said market liquidity is still ample and that comments suggest balance sheet cuts have more room, as well as stated that if the Fed pauses quantitative tightening, it would not alter the endgame.

- US President Trump said he is collaborating with House Republicans on a Continuing Resolution to fund the government through September. It was separately reported that Trump is expected to issue an executive order as soon as Thursday aimed at abolishing the Education Department, according to WSJ.

- BofA card spending (March 1st): 1.4% Y/Y (1.9% January average), spending growth -0.3%

GEOPOLITICS

MIDDLE EAST

- Discussions took place Wednesday evening between US President Trump's envoy, Hamas leaders and mediators from Egypt and Qatar, according to Reuters sources. Sources say American-Egyptian talks discussed governance of Gaza after end of war, names of who would manage the strip. Notes that discussions ended positively, and indicate a near transition to a second phase of the Gaza ceasefire agreement.

- US President Trump posted on Truth Social a warning for Hamas to release all hostages now not later and return all the dead bodies or it is over for them. Trump stated "only sick and twisted people keep bodies, and you are sick and twisted! I am sending Israel everything it needs to finish the job, not a single Hamas member will be safe if you don’t do as I say. I have just met with your former Hostages whose lives you have destroyed. This is your last warning! For the leadership, now is the time to leave Gaza, while you still have a chance."

- Hamas said US President Trump's threats demonstrate the US administration's insistence on continuing as a partner in genocide against their people.

- US Treasury Secretary Bessent and Israel’s Minister of Finance Smotrich held a meeting to discuss the ongoing economic partnership between the US and Israel.

RUSSIA-UKRAINE

- Russian Foreign Minister Lavrov says a "solution in Ukraine is possible within weeks if the West stops supporting Kiev", via Sky News Arabia.

- Ukrainian President Zelensky anticipates positive outcomes from US cooperation next week. It was also reported that Zelensky’s top aide discussed with the US National Security Advisor steps to achieve just peace, while Ukraine and the US agreed on a meeting in the near future.

- Four senior members of Trump's entourage have held secret discussions with some of Kyiv’s top political opponents to Ukrainian President Zelensky, according to Politico.

OTHER NEWS

- Eight were hurt after a shell dropped on a civilian town at Pocheon, South Korea during a live-fire military drill, according to Reuters citing a fire official.

CRYPTO

- Bitcoin is on a firmer footing and sits just above USD 91k; Ethereum also a little firmer, and just shy of USD 2.3k.

APAC TRADE

- APAC stocks traded mixed albeit with a predominantly positive bias after the constructive handover from Wall St where stocks ultimately gained in a choppy session amid mixed data and after the US decided to delay auto tariffs on Canada and Mexico by 30 days.

- ASX 200 retreated to a fresh YTD low amid underperformance in the energy and utilities sectors, while better-than-expected building approvals and a larger trade surplus failed to inspire.

- Nikkei 225 advanced at the open as the yen faded some of its recent gains and with the index unfazed by the rise in yields.

- Hang Seng and Shanghai Comp resumed their upward momentum amid the ongoing “Two Sessions” and recent spending announcements, while participants also awaited a press briefing by China’s central bank, finance and securities chiefs.

NOTABLE ASIA-PAC HEADLINES

- JD.Com (JD / 9618 HK) Q4 (CNY) EPS 7.42 (prev. 5.30 Y/Y), Revenue 347bln (exp. 332.4bln), EBITDA 12.5bln (exp. 11.2bln)

- PBoC Governor Pan says they will study, establish new structural policy tools, will cut interest rates and Bank's RRR at appropriate time. Wil prevent FX rate overshooting risks. Will roll out tech board on the debt market. Will expand relending facility for tech sector. Will expand relending facility from CNY 500bln to CNY 800bln-1tln.

- Rengo, Japan's largest labour union, is seeking a wage hike of 6.09% for 2025 (sought 5.85% in 2024)

- A team from China recently unveiled its general-purpose AI Agent product, Manus, which is said to outperform the OpenAI model of the same level, according to Shanghai Securities News.

- China's State Planner, on the 2025 GDP target, says external uncertainties are increasing and domestic demand is not sufficient; complete confidence in attaining the growth target.

- China's Finance Minister, on fiscal policy, says China has ample policy room in the scenario of possible uncertain factors bother external and internal.

DATA RECAP

- Australian Building Approvals (Jan) 6.3% vs. Exp. 0.5% (Prev. 0.7%, Rev. 1.7%)

- Australian Balance on Goods (Jan) 5,620M vs. Exp. 5,500M (Prev. 5,085M)

- Australian Goods/Services Exports (Jan) 1.3% (Prev. 1.1%)

- Australian Goods/Services Imports (Jan) -0.3% (Prev. 5.9%)