EV competition in Europe is going from fierce to cutthroat.

BYD, the leading Chinese electric vehicle manufacturer, is set to inaugurate its first factory in Southeast Asia on Thursday, according to a new report from Nikkei.

The $486 million facility, located in Thailand's Rayong province, will be accompanied by significant price cuts for local buyers.

The expansion comes at a time where competition in both Asia and the EU has ramped meaningfully higher. We've also noted that, due to the competition from Asia, the EU is imposing new tariffs on EVs being imported into Europe.

To celebrate the opening, BYD will slash prices for its Atto 3 SUV by up to 340,000 baht ($9,234), the report says, noting that the aggressive pricing strategy highlights the intense competition among EV producers and other automakers in Thailand, where an economic slowdown and increasing car loan rejections are impacting sales.

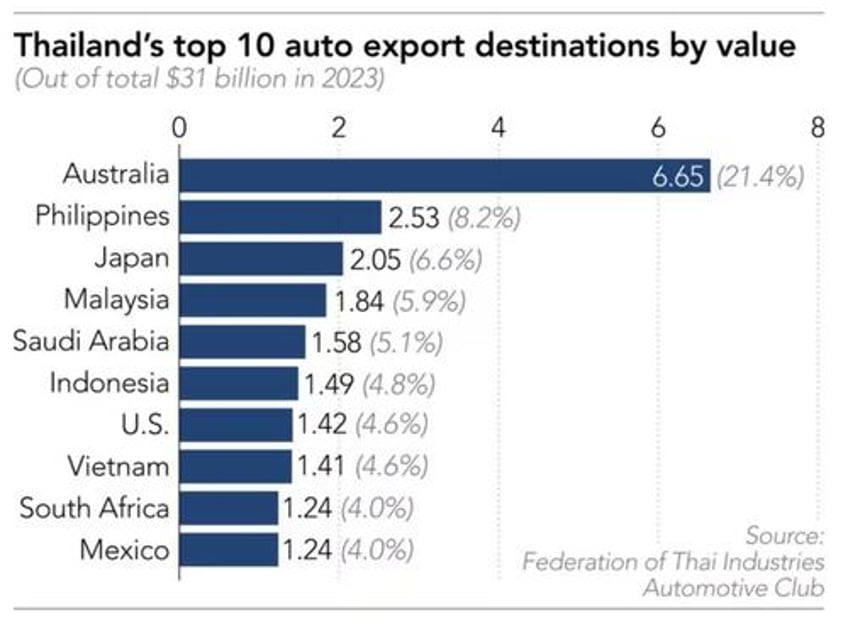

The factory's primary purpose is not solely to cater to the local market. BYD plans to export the majority of its 150,000 annual production capacity to other Southeast Asian countries and Europe, as originally announced when the plant was first revealed.

The inauguration coincides with the first day that Chinese EV manufacturers will face new tariffs in Europe, a crucial export market for China.

SAIC is being hit with a 38.1% tariff and BYD is being hit with a 17.4% tariff, we wrote last month. Geely Auto will face a 20% tariff and all tariffs are on top of the EU's existing 10% tariff.

EV-makers that cooperated with the probe but weren’t in the three-company sample will face an additional 21% duty, while uncooperative ones will incur the full 38.1%. European brands like Mercedes-Benz, BMW, and Renault, which export China-assembled EVs, will also face extra tariffs, according to Caixin.

China’s Ministry of Commerce criticized the decision, stating the EU ignored facts, WTO rules, and objections from China and EU member states. Beijing vowed to protect Chinese companies' rights.

Krungsri Securities analyst Naruedom Mujjalinkool said: "China is still destocking. There might be more cars sent to Southeast Asia because they can't send them to Europe, and there is zero [additional] tariff in Thailand."

By the end of last year, BYD captured 40% of the local EV market in Thailand, driven by attractive pricing and effective marketing from its distributor, Rever Automotive. Competitors Neta and Great Wall Motor held 17% and 16% market shares, respectively.

Neta has recently reduced the price of its V-II SUV by 50,000 baht, an 8% discount. BYD's new Dolphin hatchback models are now 18% to 26% cheaper than their launch prices last year. Despite these reductions, Thai prices remain about $2,700 higher than in China, suggesting BYD could offer further discounts.

BYD's new Rayong factory, with an annual capacity of 150,000 cars, might not reach full production in its first year. Competitors' local plants have a combined monthly output of fewer than 1,000 units. Additionally, a BYD subsidiary is constructing a 3.89 billion baht plant for electric and plug-in hybrid vehicle batteries, aiming to complete it before the tariff exemptions expire in 2026.