It will only be days now before tariffs of up to 38.1% go into effect on BEVs shipped from China to the EU - the culmination of a monthslong inquiry into how Chinese made EVs have impacted the European auto market.

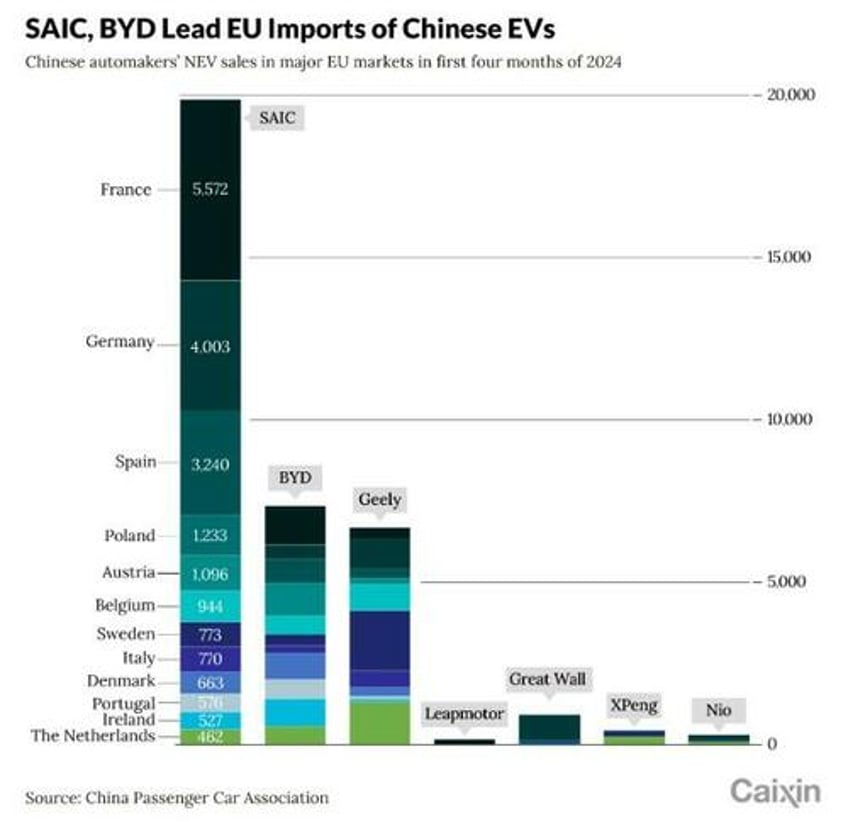

As we noted days ago, SAIC is being hit with a 38.1% tariff and BYD is being hit with a 17.4% tariff, the report says. Geely Auto will face a 20% tariff and all tariffs are on top of the EU's existing 10% tariff.

EV-makers that cooperated with the probe but weren’t in the three-company sample will face an additional 21% duty, while uncooperative ones will incur the full 38.1%. European brands like Mercedes-Benz, BMW, and Renault, which export China-assembled EVs, will also face extra tariffs, according to Caixin.

China’s Ministry of Commerce criticized the decision, stating the EU ignored facts, WTO rules, and objections from China and EU member states. Beijing vowed to protect Chinese companies' rights.

Tesla, importing Model 3 sedans from Shanghai, has requested the EU to impose a lower tariff, arguing it received less state support.

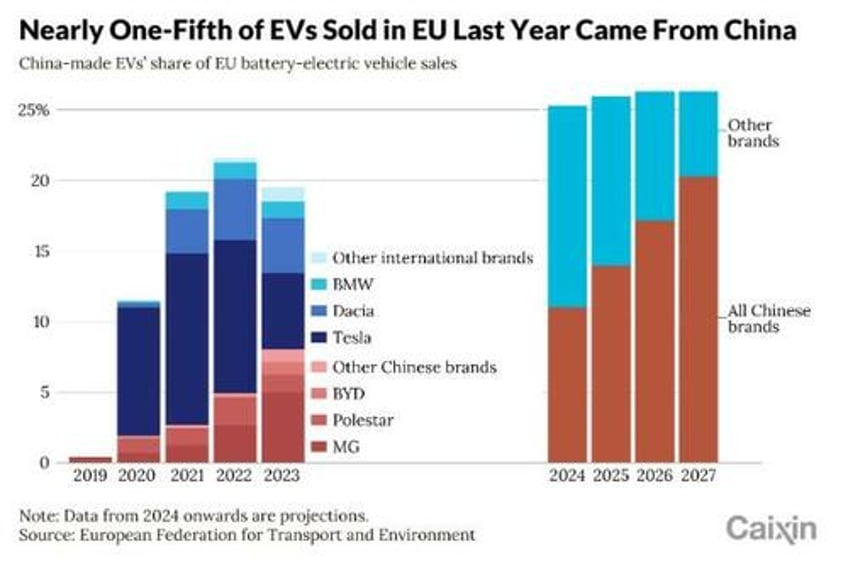

Caixin wrote that last year, nearly 20% (300,000 units) of EVs sold in the EU were made in China, according to the European Federation for Transport and Environment.

A 21% duty is expected to reduce Chinese EV exports to the EU by about 30% short-term, said Liu Yan of the China Automotive Technology and Research Center.

The Kiel Institute for the World Economy warned that a 20% tariff could significantly impact EU-China trade and production, stating in a recent report: “The volume of imported electric cars from China would fall by 25%. Converted to the almost 500,000 (electric) vehicles imported in 2023, this corresponds to an estimated 125,000 units worth almost $4 billion.”

The report added that Chinese manufacturers are boosting investments in European car assembly to mitigate the impact of protectionist trade policies.

In February, BYD signed a deal to build its first European electric car factory in Hungary, set to be operational within three years, producing various eco-friendly models.

In April, Chery Automobile acquired a manufacturing facility in Barcelona, formerly owned by Nissan, to localize production in Spain as part of its European expansion.

SAIC announced plans to build its first European EV factory in July last year. The company expressed disappointment with the EU’s decision, stating it contradicts market economy principles and could harm the global auto industry and Sino-European trade relations.

Recall we wrote days ago that the tariffs were only expected to slow, but not stop, Chinese EV sales in Europe. Nikkei Asia said that manufacturers like BYD will remain competitive against local producers despite the tariffs.

Eugene Hsiao, head of China autos at Macquarie Capital, told Nikkei: "BYD's cost advantage is high enough that they can profitably export even at a 35% tariff."

He continued: "BYD has shown a strong willingness to work with local European partners, including establishing relationships with local dealers, selling batteries to Tesla in Germany, planning production in Hungary, establishing shipping dedicated to the EU and possibly even further partnership in other EU countries like Italy."

Hsiao suggested that BYD's lower rate might be due to its private ownership and backing by Berkshire Hathaway. He noted that BYD aims to gradually establish its brand in the EU and is more cooperative with local regulators.

The report says that SAIC, the top auto exporter from China for eight years, sold over 250,000 vehicles in Europe in 2023. It claims its sales stem from technology innovation, not government subsidies.