- Trump announced he is to charge Mexico and Canada a 25% tariff on all products and will charge China 'an additional 10% Tariff, above any additional Tariffs'.

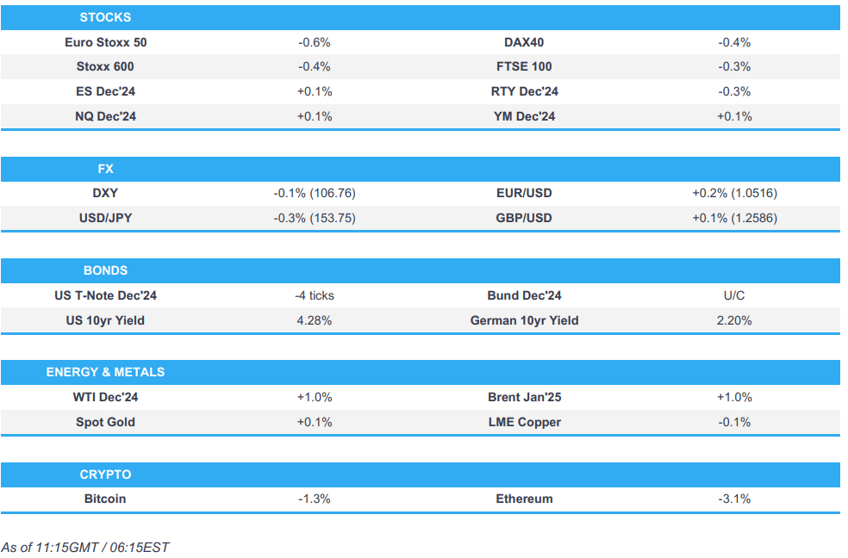

- European bourses in the red on the above, US futures initially pressured but have since made their way back to unchanged/marginally firmer

- USD began on the back foot but has since retreated markedly, JPY outperforms while CAD is the G10 laggard

- Fixed benchmarks in the red pulling back from Monday's gains though did see a shortlived move higher on the tariff announcement

- Crude firmer but action modest after recent ceasefire related pressure; Israel's Cabinet set to meet at 15:30GMT/10:30EST to discuss this

- Looking ahead, highlights include US Building Permits (R), Consumer Confidence, Richmond Fed, FOMC Minutes, Speakers including ECB’s Muller, Kazaks, Centeno, BoE's Pill & BoC’s Mendes, Supply from the US, Earnings from Abercrombie, Kohl's, Best Buy, Analog Devices, Dell, CrowdStrike & HPE

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are lower across the board, Stoxx 600 -0.6%, pressure which comes after US President-elect Trump vowed to impose new tariffs on Mexico, Canada, and China on the first day of his Presidency.

- Pressure is broadbased given the above; stock specifics include Banco BPM/UniCredit/Credit Agricole updates while Roche is pressured after a Phase III trial failed to meet the primary endpoint.

- European sectors in the red, Autos & Parts at the bottom of the pile given exposure to the above and Autos general sensitivity to the global trade environment. Pharma. names lifting on recent reports of Biden proposing Medicare coverage of obesity drugs, via Bloomberg; Novo Nordisk +2%.

- Stateside, futures retreated overnight after Trump's announcement but have been gradually recovering and made their way back modestly into the green, ES +0.1%; updates incl. Qualcomm's (-0.1% pre-market) interest in acquiring Intel (+0.7% pre-market) cooling - later was initially pressured on this but has since recovered on the US finalising a 7bln award to Intel.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY began on the front foot, given Trump's tariff announcement on Canada, China and Mexico with respective currencies pressured. However, USD strength has waned with broader macro updates light. Month-end flows potentially exerting influence.

- DXY back below the 107.00 mark, down to a 106.73 base with Monday's trough in proximity at 106.58.

- EUR ultimately a touch firmer after a shaky start against the USD. Slew of ECB speak thus far and more scheduled, though nothing that has changed the narrative. EUR/USD back above 1.05 (1.0426 trough), but shy of Monday's 1.0530 best.

- JPY has been faring better than peers for much of the session given the risk environment while from a macro perspective digested firmer-than-expected Services PPI data which supports the case for the BoJ to resume policy normalisation. USD/JPY choppy around 154.00 and just within yesterday's 153.55-154.72 band.

- CAD the major laggard across G10 FX, with MXN lagging more broadly, given the tariff announcements; USD/CAD hit 1.4177 overnight while USD/MXN got to 20.75.

- GBP just about firmer against the USD but softer against the EUR, action modest vs both. Specifics thus far light with the docket limited into BoE's Pill.

- Deutsche Bank month-end FX rebalancing model shows USD selling with demand seen for EUR/USD and selling in USD/SEK and USD/CHF

- PBoC set USD/CNY mid-point at 7.1910 vs exp. 7.2357 (prev. 7.1918)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks in the red, pulling back modestly from the rally seen on Monday after Trump’s Treasury Secretary nominee. Stateside, the curve is yield curve is bear-steepening (vs bull-flattening on Monday) though there is some way to go for yields to recoup lost ground.

- Benchmarks saw a jump higher overnight on Trump's tariff update, but this proved shortlived with fixed fading across the board, modestly in the red and toward session lows.

- While pressured, USTs remain closer to the 110-18 WTD peak than the 109-27 trough from Monday, with today’s base at 110-09 thus far.

- Bunds and Gilts both softer on the session, narrative the same as the above; EGBs unreactive to a handful of ECB speakers thus far with the docket ahead containing more while Gilts await BoE's Pill.

- Books opened and have since closed on a 1.25% 2054 Gilt syndication, opening saw some modest Gilt pressure (Gilts currently underperform, -24 ticks) though updates since have had no discernible impact.

- Germany sells EUR 3.35bln vs exp. EUR 4bln 2.5% 2029 Bobl: b/c 1.7x (prev. 2.1x), avg. yield 2.04% (prev. 2.13%) & retention 16.25% (prev. 17.73%)

- Italy sells EUR 2bln vs exp. EUR 1.5 - 2.0bln 3.1% 2026 BTP and EUR 1.75bln vs exp. EUR 1.25 - 1.75bln 1.5% 2029 & 0.10% 2033 BTPei

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are firmer, but with action modest when compared to Monday's ceasefire-related pressure. As it stands, it appears a ceasefire will be agreed today with Israel's Cabinet set to meet at 15:30GMT/10:30EST to discuss this.

- Into this meeting, WTI and Brent are firmer by around USD 0.70/bbl having lifted from USD 68.57/bbl and USD 72.70/bbl respective lows. Action which leaves them markedly shy of Monday’s USD 71.48/bbl and USD 75.38/bbl respective peaks.

- Gold is essentially flat, saw some modest two-way action overnight as markets generally but particularly the USD reacted to Trump’s tariff announcements. Currently holding just shy of the USD 2632/oz peak, having benefited from a more concerted pullback in the DXY during the European session.

- Base metals generally pressured overnight given sentiment around Trump and China performance though equity benchmarks in the region closed off lows. Given this, while base metals are in the red they have recovered from worst levels with 3M LME Copper back just above the USD 9k handle

- JPMorgan (JPM) maintains its multi year-bullish outlook on gold, forecasting prices to rise towards USD 3000/oz next year.

- IEA's Birol says "this year and next year we expect comfortable oil markets unless major geopolitical escalation happens".

- Exxon (XOM) Head of Upstream says it is "unlikely" there will be a radical change in US oil production and not going to see anyone in "drill baby drill" mode; US companies will maintain capital discipline.

- Iraqi PM, Saudi Energy Minister and Russian Deputy PM stress the importance of maintaining the stability of global oil markets.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Shop Price Index YY (Nov) -0.6% (Prev. -0.8%)

- UK CBI Distributive Trades (Nov) -18.0 (Prev. -6.0)

NOTABLE EUROPEAN HEADLINES

- ECB's de Guindos says developments point to growth remaining fragile, via Helsingin Sanomat. Concerns about high inflation have shifted to economic growth. Adds, geopolitical risks are increasing.

- ECB's Villeroy says impact from Trump economic policies on inflation are likely to be limited but interest rates could be impacted.

- ECB's Centeno says Europe must avoid inflation returning to levels well below target as in recent past.

- ECB's Rehn says salary and services inflation remain persistent, maintain risk of inflation moderating more slowly than expected. Should continue to cut rates if fresh data and forecasts support the current inflation and growth view. Assessment is that Europe is moving towards neutral rates during early spring.

- Riksbank's Seim says the long-term neutral rate is likely between 1.5-3.0%. The neutral interest rate is thus assumed to remain at historically low levels. One cannot rule out the possibility of the rate periodically going to near-0%. During an economic slowdown/deep recession, when inflation is far below target, cuts in the order of 1.5-3pps is not particularly exceptional.

NOTABLE US HEADLINES

- US President-elect Trump said as one of his many first executive orders, he will charge Mexico and Canada a 25% tariff on all products coming into the US which will remain in effect until drugs, in particular Fentanyl, and all 'Illegal Aliens' stop invading the US.

- US President-elect Trump stated on Truth Social that he would charge China “an additional 10% Tariff, above any additional Tariffs, on all of their many products coming into the United States of America” until drugs stop pouring into the US.

- US President-elect Trump spoke with Canadian PM Trudeau about trade and border security, while they had a good discussion and agreed to stay in touch, according to a Canadian source cited by Reuters. It was also reported that Canadian Deputy PM Freeland noted in a statement that Canada places the highest priority on border security and the integrity of the shared border with the US, while she added the relationship today is balanced and mutually beneficial, particularly for American workers.

- US President-elect Trump is considering AI Czar, according to Axios.

- US President Biden proposes Medicare and Medicaid coverage of obesity drugs, according to Bloomberg. An updated which has bolstered the obesity-related drugmakers in European trade and the US pre-market

- Fed's Kashkari (2026 voter) said the government must take steps to achieve a sustainable fiscal path, while he added that the natural rate may be higher and policy not as restrictive. Kashkari said geopolitical risks remain at the forefront of the economic outlook and that tit-for-tat tariffs may lead to inflation. Furthermore, he said it reasonable to consider a rate cut next month and said they are still considering a 25bps cut in December which is a reasonable debate for them to have.

GEOPOLITICS

MIDDLE EAST

- Israel Broadcasting Corporation quoted an Israeli political official stating the agreement with Lebanon is not an end to the war, but a ceasefire that will be evaluated daily, according to Sky News Arabia.

- Israeli Channel 12 reported rocket shelling from southern Lebanon on Nahariya, according to Sky News Arabia. There were also reports of two Israeli raids on Lebanon's southern city of Nabatieh, according to Al Jazeera

- Israeli Broadcasting Authority said discussions on demarcating the border with Lebanon will take place 60 days after the ceasefire, according to Al Arabiya.

- Heavy Israeli strikes hit the southern suburb of Beirut, according to Guy Elster citing local reports.

RUSSIA-UKRAINE

- Ukraine's Kyiv was under multi-wave Russian drone attacks, according to the Mayor, while it was separately reported that Russian air defences destroyed 39 Ukrainian drones overnight, according to Russian news agencies.

- Russia's Kremlin says the possibility of western countries giving Ukraine nuclear weapons is "Absolutely irresponsible"; the west should carefully listen to Putin. Elsewhere, Russia's Spy Chief says Russia are completely against a freeze in the conflict, need a long lasting peace, according to IFAX.

CRYPTO

- On the backfoot, Bitcoin has retreated from a USD 95k session high to a test of USD 92k to the downside. A correction from highs that is now in its third consecutive session, after BTC approached but failed to print at the USD 100k mark last week.

APAC TRADE

- APAC stocks were ultimately mixed but with early jitters seen following Trump's tariff remarks against Canada, Mexico and China in which he announced to charge Mexico and Canada a 25% tariff on all products and will charge China 'an additional 10% Tariff, above any additional Tariffs'.

- ASX 200 declined with weakness seen in energy, gold stocks and financials after the recent drop in underlying commodity prices and yields.

- Nikkei 225 underperformed as firmer-than-expected Services PPI data supports the case for the BoJ to resume policy normalisation.

- Hang Seng and Shanghai Comp kept afloat in rangebound trade amid the latest Trump tariff threat but with the downside cushioned as increased tariffs would also likely be met with further policy support measures by China, while the PBoC recently pledged measures to promote tech including prioritising policy support for private, small and medium firms.

NOTABLE ASIA-PAC HEADLINES

- China's Embassy in Washington said China believes China-US economic and trade cooperation is mutually beneficial in nature and said no one will win a trade war or a tariff war.

- China's Ambassador to Australia Xiao Qian said US policy on trade with China and other countries will have an impact, while he expects China and the US to engage with each other to talk about each other's policies on how to manage the relationship. Furthermore, he said he looks forward to a constructive relationship with Australia irrespective of what happens elsewhere.

- Shanghai Securities News cited analysts stating that the reduction in the MLF operation raises the possibility of a RRR cut and a 25bps-50bps RRR cut is expected in December.

DATA RECAP

- Japanese Services PPI (Oct) 2.90% vs. Exp. 2.50% (Prev. 2.60%)