Submitted by Sam Bourgi of CreditNews

The middle class today isn’t what it was even as recently as just a few years ago. After the highest inflation breakout in nearly 50 years, many middle-class families have been priced out of the standard of living that most Americans took for granted not that long ago.

The raging effects of inflation aren’t limited to consumer goods and services but to asset prices as well. In recent years, a growing chorus of politicians and pundits appeared to conclude that homeownership—one of the pillars of the American Dream—is no longer within reach for regular Americans.

To put that theory to the test, Creditnews Research studied the relationship between income distribution and housing costs across the 100 most populous metropolitan areas in the United States.

What we discovered reveals the story of two Americas: one where middle-class families can still qualify for an average home and one where they’ve been priced out entirely.

The good news is there are still pockets of affordability across the country. The bad news is that affordable metros are declining rapidly.

Key findings

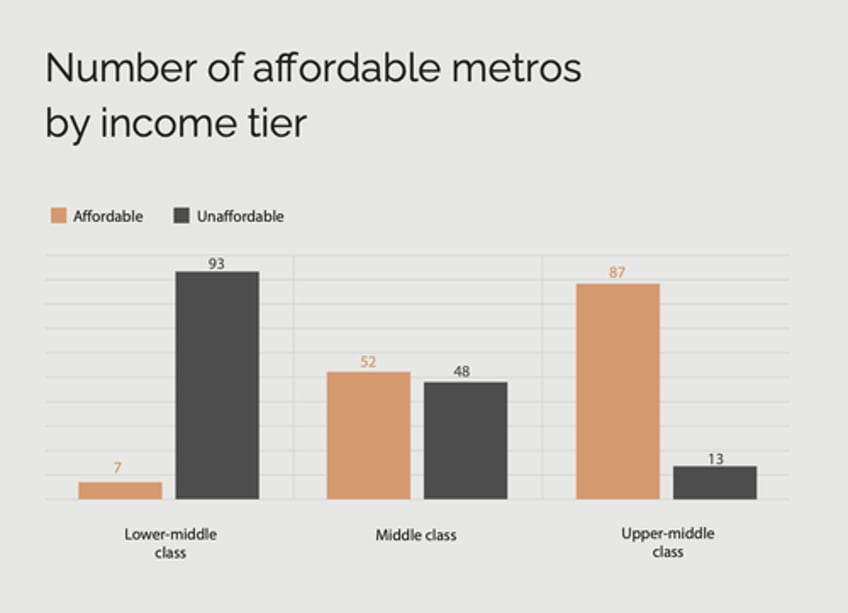

In 2024, the middle class can afford an average home in just 52 of the top 100 metro areas in the United States—a decline from 91 in 2019;

Those in the lower-middle class are priced out of 93 of the top 100 metro areas, up from just 33 in 2019;

The most affordable metros for middle-class families are mainly located in the Midwest, Rust Belt, and parts of Texas. The most affordable metros in 2024 are Youngstown, OH; Toledo, OH; McAllen, TX; Scranton, PA; and Wichita, KS;

The most unaffordable metros for the middle class are mainly concentrated in California and the Tri-State Area—they are San Jose, CA; San Francisco, CA; Los Angeles, CA; San Diego, CA; and Honolulu, HI;

The top five metros that, since Covid, have seen the largest increase in housing costs are all in California; they include San Jose, CA; San Diego, CA; Los Angeles, CA; San Francisco, CA; and Oxnard, CA.

Metros that are affordable for middle-class families are in rapid decline. 39 of the 100 most populous metros became unaffordable since Covid alone.

Housing affordability by income tier

There’s no single definition of the middle class, but one of the most go-to benchmarks is Pew Research’s household income percentile ranges for economic classes, which go as follows:

Lower-middle class: 20th - 40th percentile

Middle class: 40th - 60th percentile

Upper-middle class: 60th - 80th percentile

Based on these percentile ranges, America’s “middle class” households fall into three main income tiers:

Lower-middle class: $30,001—$58,020

Middle class: $58,021—$94,000

Upper-middle class: $94,001—$153,000

Affordability is another variable that carries many assumptions and could be approached in multiple ways.

For this particular study, Creditnews Research assessed affordability by calculating the minimum annual income households need to qualify for a mortgage on a typical home in each metro. A home is considered affordable if the monthly mortgage and housing payment doesn’t exceed 28% of a household’s gross income.

Although a middle-class income is essential to broadening one’s access to home financing, it’s not enough to close the gap in the country’s largest markets.

Based on the above criteria, middle-class households can afford an average home in just 52 out of the 100 top metros in 2024.

These 52 metros represent a diverse cross-section of America but are mainly located in the Midwest, Rust Belt, Appalachia, and parts of Texas.

For the lower-middle class, there are only seven affordable housing metros in the top 100—while the upper-middle class can afford homeownership in 87 of the top 100 metros.

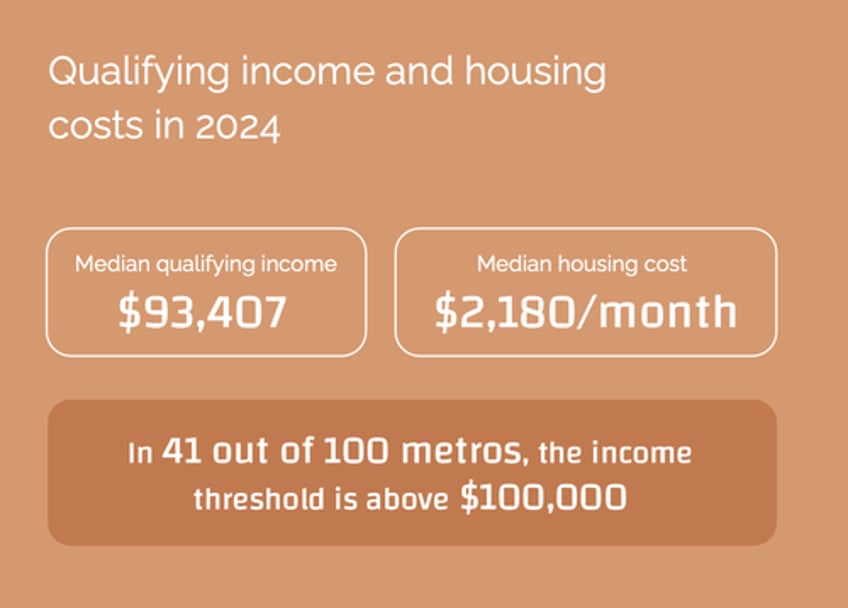

As one might expect, the qualifying income and monthly housing costs vary dramatically by city.

In the most affordable cities across the Midwest and Rust Belt, a household income of below $70,000 is more than enough to qualify for a home. But that’s nowhere near enough along the Pacific Coast, Northeast, the Tri-State Area, and even parts of Florida.

In total, 41 out of the 100 metros in the study require a gross annual income of at least $100,000 to qualify for an average home. Most of these areas are accessible to the upper-middle class. But not all. Thirteen metros require a household income of more than $155,000.

The average monthly housing cost across the 100 metros amounts to $2,180, but again, there’s a huge variance between the lower and upper end of the range.

In the most affordable city, homebuyers can expect to pay a mere $942 a month for their mortgage and related costs. On the flip side, the most expensive metro could set you back an eye-popping $9,931.

Two Americas

Today’s housing market is really a tale of two Americas.

The Midwest and parts of the South continue to offer affordable options even for middle class households, whereas the ultra-desirable coastal cities are out of reach even for affluent buyers.

The root cause of this divide is rather straightforward: in large coastal cities, the supply of housing hasn’t kept up with demand as more people flock to those places for work or lifestyle.

In recent years, Americans have been stymied by the largest housing supply shortage in history—a well-documented contributor to record home prices.

That’s on top of a generational spike in mortgage rates, which has priced many average Americans out of the threshold.

Overall, middle-class households have 52 metros in the top 100 to choose from if they are looking for a home priced within their means. The question is whether they’re prepared to move or put down roots in those regions.

Many Americans bemoan the idea of living in the Midwest or smaller southern cities and would prefer the bright lights of San Francisco, Los Angeles, New York, or Boston.

Unfortunately, these metros are the last places middle-class Americans should be going to buy a home. In fact, the same is even becoming true for the upper-middle class.

As Creditnews Research found, a total of 11 metros have become unaffordable even for upper middle-class households since Covid. Six of those metros are located on the Pacific Coast and three on the East Coast.

The most affordable metro areas

With few exceptions, the majority of middle-class households (including lower-middle-class families) can decidedly qualify for a home in America’s 10 most affordable metro areas.

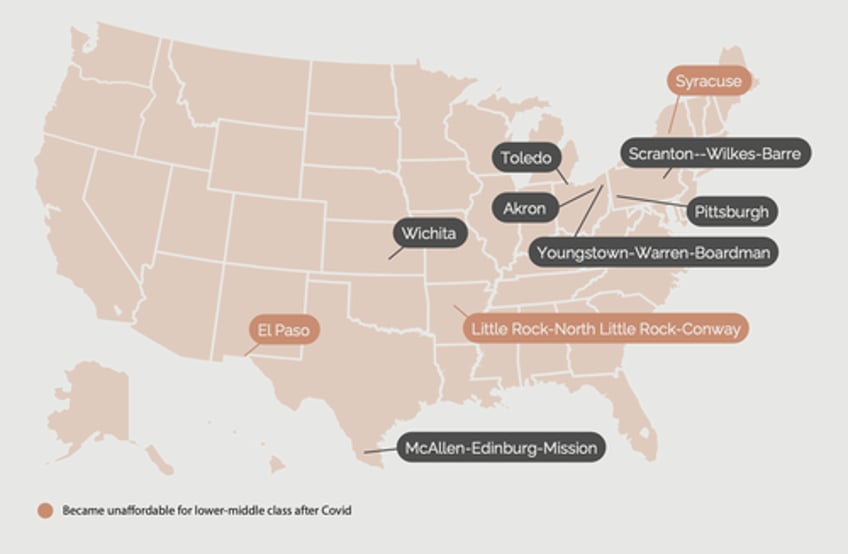

Apart from El Paso, Syracuse, and Little Rock—which became out of reach for the lower-middle class—the following metros have held their own on affordability over the past half-decade.

One state that makes several appearances on our most affordable list is Ohio.

This is due in part to the state’s generous homeowner subsidies in the form of grants and tax credits, coupled with ongoing investments in home construction and affordable housing.

Another catalyst has been the low down payment threshold throughout the Buckeye State, which, at $35,250, is outdone only by Iowa and Mississippi.

Gary Painter, Ph.D, real estate professor at Carl H. Lindner College of Business, stated: “Given the relatively robust economy, a young household’s ability to afford a down payment in Cincinnati and other Ohio cities is quite high relative to regions of similar size across the United States.”

The following cities represent the 10 most affordable metros in America, starting on the low end.

- Youngstown-Warren-Boardman, OH-PA: Youngstown shows up first in our rankings, with a monthly payment below $1,000 ($942) in 2024. To qualify for a typical home, buyers need an income of just over $40,000—well within the range of lower-middle-class and middle-class households. Youngstown’s population has fallen in recent decades but appears to have stabilized; the drop hasn’t been as drastic as peer cities Flint, Michigan, and Gary, Indiana. Housing prices are rising, but poverty in this city surpasses that of the state of Ohio.

- Toledo, OH: Ohio reappears in our rankings with the Toledo metro claiming the No. 2 spot. With an average monthly payment of $1,130, Toledo’s qualifying income for an average home jumps 20% from Youngstown to roughly $48,500. Average monthly housing costs in this metro soared 78% from pre-Covid (2019) levels of $635 to $1,130 in 2024. Even so, all segments of the middle class should be able to afford a house in this area. Catalysts driving Toledo’s real estate market include reasonable prices and a wide range of job opportunities across manufacturing, healthcare, education, and the public sector.

- McAllen-Edinburg-Mission, TX: Rounding out the three most affordable metros is McAllen, where residents must earn just below $50,000 in income to qualify for an average home without stressing their budgets. Qualifying income has roughly doubled since 2019 when it was below $25,000. So has the average monthly payment, hitting $1,156 in that stretch. McAllen’s close proximity to the Gulf of Mexico makes it a less expensive alternative for families who prefer to live by the water. McAllen has come a long way from its beginnings as a private ranch in the late 1800s to a standout economy in the Rio Grande Valley. In a speech given in McAllen in 2023, Texas Governor Greg Abbott touted the state’s massive property tax cuts, which have helped to propel economic development in the region.

- Scranton-Wilkes-Barre, PA: Scranton takes the fourth spot in our rankings, representing Pennsylvania’s debut on our list. Households must earn a qualifying income of just over $52,000 to afford an average home in this metro and keep costs at 28% of earnings. Monthly housing expenses in 2024 hover at $1,215, a massive 80% jump versus 2019 when they were below $700. But the entire middle class should still be able to afford a house in this metro. Scranton’s housing market has become more competitive of late, with home prices climbing 4% in Q1 2023. Scranton’s population currently hovers at approximately 376,000 but is projected to reach nearly 400,000 by 2031 despite rising property taxes. Scranton is considered among the top metros in the country for economic development in its comp set and has gained a reputation as one of the best places in the U.S. to retire, owing in part to housing options.

- Wichita, KS: Kansas enters the most affordable housing fray thanks to Wichita, which claims the No. 5 spot. Given Wichita’s qualifying income of $55,243, middle-class households can afford this metro without breaking the bank with monthly payments of roughly $1,300 in 2024. But it’s a far cry from 2019’s qualifying income of below $23,000 and monthly housing costs of only $532. Wichita hasn’t been able to escape the real estate market headwinds of late, which has weighed on deal activity, but economic activity in the state has been growing hand over fist. In Q3 2023, Kansas’s GDP grew by nearly 10%, fueled by a booming farming community.

- Pittsburgh, PA: The northeast revisits our rankings with Pittsburgh in the No. 6 spot. Pittsburgh’s qualifying income of $55,457 for an average home places it in the same ballpark as the Wichita metro. With a monthly payment of slightly below $1,300, the entire middle class should be able to afford a home in this area. But that doesn’t mean affordability hasn’t deteriorated over the years. Monthly housing costs have soared 66% since 2019 when they were below $800. With approximately 303,000 residents, Pittsburgh’s population is about half of where it was in the 1950s, the collapse of which is aligned with the decline of the country’s steel industry. Home sales in Allegheny County, where Pittsburgh is located, sank 25% between 2021 and 2023 to an all-time low amid the high interest rate and low inventory environments.

- Akron, OH: Demonstrating its prominence among the most affordable cities, Ohio is back with Akron—the Rubber Capital of the World—snagging the No. 7 spot. Households must earn a qualifying income of $56,743 to afford an average home in this metro, a 44% jump compared with 2019 levels. But with an average monthly payment of just over $1,300, the middle class wouldn’t feel cash strapped owning a home in this area. Akron’s housing demand remained strong even throughout the latest industry downturn, buoyed by an emerging tech hub that makes the city an attractive destination for jobs.

- El Paso, TX: El Paso lassoed the No. 8 spot in our rankings, strengthening the Southwest’s grip among the most affordable metros. As the first metro in our rankings to exclude the lower-middle class, El Paso’s affordability has been slipping away since Covid. The city’s qualifying income and monthly housing costs have roughly doubled to $58,114 and $1,356, respectively, since the pandemic, making it increasingly difficult to afford. El Paso’s per capita income has been on the rise, a trend that is expected to persist into 2025, with a housing market that’s been fueled of late by out-of-state buyers hunting a bargain of late.

- Syracuse, NY: As the first metro to represent New York, Syracuse claims the No. 9 spot in our rankings. Syracuse joins El Paso as the second metro where the lower-middle class was priced out since Covid, with the qualifying income soaring from $30,228 to $58,157 in that period. Similarly, the average monthly payment has nearly doubled from about $700 to $1,357 since 2019. But Syracuse’s days among the most affordable metros are probably limited as the housing market continues to draw comparisons to Manhattan and San Francisco. The city has become a hotbed for tech startups and jobs, including the rise of Micron Technology’s semiconductor plant in nearby Clay, NY that’s projected to create 50,000 jobs.

- Little Rock-North Little Rock-Conway, AR: Rounding out the top 10 most affordable metros is Little Rock, where once again the middle class is getting squeezed. Residents must earn a qualifying income of $58,286 to comfortably afford a home in this area, a whopping 41% increase compared with 2019. Monthly costs have jumped a steeper 69% to $1,360. Even with that sharp rise, Little Rock is affordable enough to make it into the top 10. While affordability has been waning in this metro, the economy is buzzing with job growth as of Q4 2023 exceeding pre-pandemic levels.

The least affordable metro areas

America’s least affordable metro areas won’t come as too much of a shock, with luxurious Pacific Coast metros dominating the rankings.

Half of the metros in this category are located in the state of California. Not to be outdone, Hawaii also makes an appearance, along with a trio of metros on the Eastern seaboard.

America’s middle class is priced completely out of each of these metro areas, including the upper end of the income range at $153,000.

- San Jose-Sunnyvale-Santa Clara, CA: San Jose takes first place with a qualifying income of $425,614 just to afford an average home. With an average home price of $1.5 million, the San Jose metro could see some relief from dwindling land on which to build. Surrounded by Silicon Valley, this metro area has been hit by a slow return to offices at tech companies like Zoom, PayPal, and X Corp, threatening to trigger a wave of out-migration and create what’s known as a “donut city” where residents and businesses relocate to the suburbs.

- San Francisco-Oakland-Berkeley, CA: It comes as no surprise that the tech capital of California is the country’s second least affordable metro for the middle class. With an average home price of $1.1 million, average monthly payments are just over $7,200, up from $4,679 five years ago. As part of California’s Bay Area, San Francisco has a reputation as one of the country’s most expensive real estate markets. Billions of dollars in investment continue to pour into this high-tech region, making it unlikely that housing prices will retreat anytime soon.

- Los Angeles-Long Beach-Anaheim, CA: Continuing with the California trend, Los Angeles rounds up to the top three least affordable metros. LA is the first city on our list to become unaffordable to the upper-middle class since Covid, with a $112,329 increase in qualifying income to $256,286. LA’s average home price hovers at $935,800, resulting in monthly housing costs of nearly $6,000. LA’s financial district is transforming into high-end apartments due to waning demand for offices.

- San Diego-Chula Vista-Carlsbad, CA: With an average home price of $924,365, San Diego is out of reach for every segment of the middle class, including the upper-middle class. Monthly payments for an average home are more than $5,900. Market dynamics don’t appear to be improving. San Diego led the nearly two-dozen cities tracked in the latest Case Shiller rankings, owing to an 11.2% increase in housing prices in the 12-month period ending in January 2024. Despite having a vibrant economy and a pristine climate, the vast majority of families couldn’t make it here.

- Urban Honolulu, HI: Honolulu rounds out the top five, joining the list of cities that have become too pricey for the upper-middle class. With an average home price of approximately $860,000, very few households outside of the wealthy can afford property here. A one-two punch of a tourism slowdown and recent wildfires have contributed to slower economic growth in Hawaii. But that hasn’t kept real estate values from rising amid strong demand for Honolulu’s beaches, rainforests, and spectacular views.

- Oxnard-Thousand Oaks-Ventura, CA: Located in California’s Ventura County, Oxnard takes the No. 6 spot in our rankings. With an average home price of nearly $850,000, monthly payments have soared 77% since 2019 to $5,425. Ventura County has strict land-use rules, pressuring inventory and resulting in a shrinking population, including Oxnard’s middle class, a trend that’s forecast to persist in the coming years.

- Seattle-Tacoma-Bellevue, WA: Representing Puget Sound in the Pacific Northwest, Seattle claims the No. 7 spot in our rankings. This metro’s qualifying income has more than doubled over the past decade and is no longer affordable to the upper-middle class. For everyone else in the middle class, Seattle is simply too rich for household budgets. With an average home price of $719,217, monthly payments are almost $4,600. New residents have been flocking to Seattle—the location of e-commerce giant Amazon’s corporate headquarters—for employment opportunities and income growth.

- Boston-Cambridge-Newton, MA-NH: The Northeastern city of Boston ranks eighth on our list. Boston’s qualifying income of $181,971 reflects an increase of nearly $80,000 since the pandemic, reserving this metro for high-income households. With an average property price of $664,491, monthly housing costs are now about $4,246, up 77% since 2019. The Boston metro, which extends to Massachusetts cities Cambridge and Newton, plus the neighboring state of New Hampshire, boasts one of the highest in-migration rates among Gen Zers in the country.

- New York-Newark-Jersey City, NY-NJ-PA: The New York, New Jersey, and Pennsylvania metros make the cut as the least affordable areas. With a qualifying income of $173,786, New York became out of reach for even the upper-middle class after the pandemic. With an average home price of $634,651, monthly housing costs have climbed 65% higher since 2019 to $4,055. New York Mayor Eric Adams has made affordable housing a priority in the city, increasing financing for new construction and the preservation of affordable homes by 80% in 2023 year-over-year.

- Bridgeport-Stamford-Norwalk, CT: Rounding out our top 10 least affordable metros is Bridgeport, CT. This metro, which also extends to Stamford and Norwalk, has a qualifying income of $163,371. With an average home price of almost $600,000, monthly housing costs hover at $3,812. Connecticut has been on the receiving end of an in-migration trend, adding 81,000 residents in 2022. With Connecticut Governor Ned Lamont implementing the biggest income tax deduction that the state has ever seen and lifting a tax credit for low-income workers, the trend is unlikely to reverse anytime soon.

Housing affordability: Pre-Covid vs. 2024

The fact that housing became more expensive after Covid is hardly breaking news. The question is, by how much?

Our analysis shows that average Americans have to earn almost twice as much today compared to pre-Covid to qualify for an average home.

Thanks to the doubling of qualifying income thresholds, 39 out of 100 of America’s most populous metros dropped out of middle-class affordability.

Taking into account lower-middle-class families, that figure balloons to a staggering 60 metro areas.

Perhaps predictably, the metropolitan areas witnessing the sharpest increases in income thresholds and housing expenses since Covid eerily match the 10 most unaffordable metros in 2024.

- San Jose-Sunnyvale-Santa Clara, CA: In addition to being the most unaffordable metro in the country for the middle class, San Jose real estate has seen the largest increase since pre-Covid times. Home prices are up a whopping 73% versus 2019 levels. Average monthly payments in this metro are unnervingly close to $10,000 compared with pre-Covid levels of $5,716.

- San Diego-Chula Vista-Carlsbad, CA: Not only does San Diego make the top four least affordable metro areas, but it’s also seen one of the biggest spikes since the pandemic. San Diego has experienced a 95% increase in qualifying income since 2019 to $253,157.

- Los Angeles-Long Beach-Anaheim, CA: While Los Angeles was never really affordable for the middle class, since Covid, housing affordability has gone off the deep end. Between 2019 and 2024, housing costs in LA have soared by $112,329. Over that period, average monthly payments have increased by a staggering 78%.

- San Francisco-Oakland-Berkeley, CA: San Francisco joins the other major California metros with a massive spike in qualifying income standards since Covid, rising $109,492 since 2019 to $310,000 in 2024. But although residents here command a high income, even the upper-middle class doesn’t make enough to afford the average home.

- Oxnard-Thousand Oaks-Ventura, CA: Oxnard is one of several California metros that have become out of reach for even the upper-middle class after Covid. Since the pandemic, qualifying income in this metro has soared almost $101,200, making it unaffordable even for those earning above $150,000.

- Urban Honolulu, HI: This Hawaii metro experienced a 64% jump in qualifying income since 2019 to $235,543. Over the past half-decade, Honolulu real estate has priced out even the upper-middle class with monthly payments nearing $5,500.

- Seattle-Tacoma-Bellevue, WA: Since the pandemic, this metro’s qualifying income has increased by $88,253 to $196,971, pricing America’s entire middle class out of the Seattle market.

- Boston-Cambridge-Newton, MA-NH: Known for its red-hot housing market, this New England city has become unaffordable for the middle-class homebuyer. In fact, even the upper-middle class has been priced out since Covid. Since the pandemic, Boston’s qualifying income has increased by $88,253 to $196,971.

- Bridgeport-Stamford-Norwalk, CT: Bridgeport doesn’t have the name recognition as other major metros on the list, but its affordability crisis has worsened since Covid. The qualifying income for an average home has increased by more than $77,400 since 2019. Monthly housing costs are up a massive 90% from pre-Covid levels.

- Riverside-San Bernardino-Ontario, CA: Due to large population growth and close proximity to LA, Riverside’s housing market has soared over the past half-decade. Since 2019, buyers need to earn $75,114 more to qualify for an average home in this metro.

Can homeownership become more attainable?

This study serves as yet another piece of evidence that America’s middle class isn’t what it once was—certainly from a homeownership point of view.

In previous generations, being able to own a home was almost taken for granted. Not anymore. And considering the steep drop in affordability since Covid alone, housing is unlikely to become more attainable anytime soon.

The good news is that the housing affordability crisis hasn’t gone unnoticed.

The issue is top of mind at the White House, with the Biden administration proposing tax credits and other home buying initiatives to make it easier for the middle class to enter the market.

Some builders are also set to convert empty office space into residential units—a promising, albeit limited, plan to improve housing access.

In the meantime, a growing number of metro areas are becoming out of reach for middle-class homeowners—thanks to elevated mortgage rates, sky-high house prices, and scarce inventory.

When, or if, housing could become more attainable is yet to be seen.