Amazon has abruptly canceled orders for beach chairs, scooters, air conditioners, and other merchandise sourced from China and other Asian countries hit hard by President Trump's tariff blitz last week and reinforced overnight. Meanwhile, Walmart has scrapped its Q1 2025 operating income guidance amid the deepening trade war. The effective tariff rate on Chinese goods imported to the U.S. now exceeds 100%, while Beijing has responded with an 84% effective tax rate on all U.S. imports.

Here's more from Bloomberg:

According to a document reviewed by Bloomberg and people familiar with the matter, the company [Amazon] is reducing its exposure to tariffs imposed by President Donald Trump.

The orders for beach chairs, scooters, air conditioners and other merchandise from multiple Amazon vendors were halted after Trump's April 2 announcement that he planned to levy tariffs on more than 180 countries and territories, including China, Vietnam and Thailand, the people said.

The timing of the cancellations, which had no warning, led the vendors to suspect it was a response to tariffs.

The report offered more additional details about vendor turmoil with sourcing out of China in the wake of the tariffs:

One vendor who has been selling beach chairs made in China to Amazon for more than a decade received an email from the company last week that said it was canceling some purchase orders it placed "in error "and instructed the vendor not to ship them. The email, which was reviewed by Bloomberg, didn't mention tariffs.

The vendor said the $500,000 wholesale order was nixed after the chairs had already been manufactured, leaving this person on the hook to pay the factory and find other buyers. The vendor, who spoke on condition of anonymity for fear of retaliation from Amazon, said the company had never canceled one of its orders in such as manner.

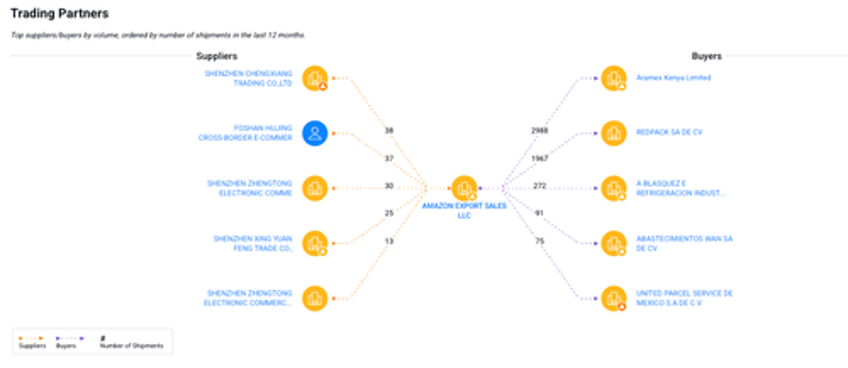

It is unclear how broadly Amazon has cut merchandise orders from Chinese suppliers. What is clear, however, is that many of Amazon's suppliers are based in China—and with an effective tariff rate north of 100%, the barrier to entry into the U.S. market has sharply risen. This development is one of the first signs of tariffs rattling global trade.

Trade data via the supply chain platform Sayari shows that Amazon suppliers are primarily based in China.

Separately from Amazon, but all related, Walmart released a statement earlier that it ditched its outlook for operating income in the first quarter, citing tariffs and mounting macroeconomic headwinds.

"The company expects Q1 sales growth to continue to be in line with its 3-4% outlook, and annual sales and operating income growth guidance remains unchanged," Walmart wrote in the release, adding, "The range of outcomes for Q1 operating income growth has widened due to less favorable category mix, higher casualty claims expense and the desire to maintain flexibility to invest in price as tariffs are implemented."

"History tells us that when we lean into these periods of uncertainty, Walmart emerges on the other side with greater share and a stronger business," John David Rainey, executive vice president and chief financial officer, Walmart, stated.

Rainey added, "We have fundamentally changed our business model through years of thoughtful, strategic investments and now have a financial model that yields much higher returns."

In early March, a Bloomberg report revealed that Walmart asked some Chinese suppliers to absorb the tariff costs to maintain its strategy of offering the lowest prices to U.S. consumers.

Sayari data shows that Walmart's suppliers are spread across Asia and include the usual suspects—most of which have been hit with steep tariffs by President Trump.

If trade tensions are already disrupting giants like Amazon and Walmart, just imagine what's coming down the pipe for the entire retail sector—and anyone else relying heavily on overseas suppliers.

We provided color on this here:

Tariff Shockwave: These Apparel Brands & Retailers Most At Risk Of Price Hikes

Will Hoarders Spark Run On Imported Goods? These Are The Most-Exposed US Retailers

As for those sourcing domestically? They're sitting back and chilling.