The fallout from the bridge collapse in the Port of Baltimore is hitting a wide range of companies, from those that export coal to those that import automobiles, tractors, and cheap Chinese goods that are eventually sold on Amazon. The latest troubles come from the Maryland Cruise Terminal, home to Carnival Corp.

On Wednesday, Carnival warned port disruptions will reduce annual adjusted earnings by $10 million. The cruise line operates ships from the terminal year-round that sail through the Caribbean Sea.

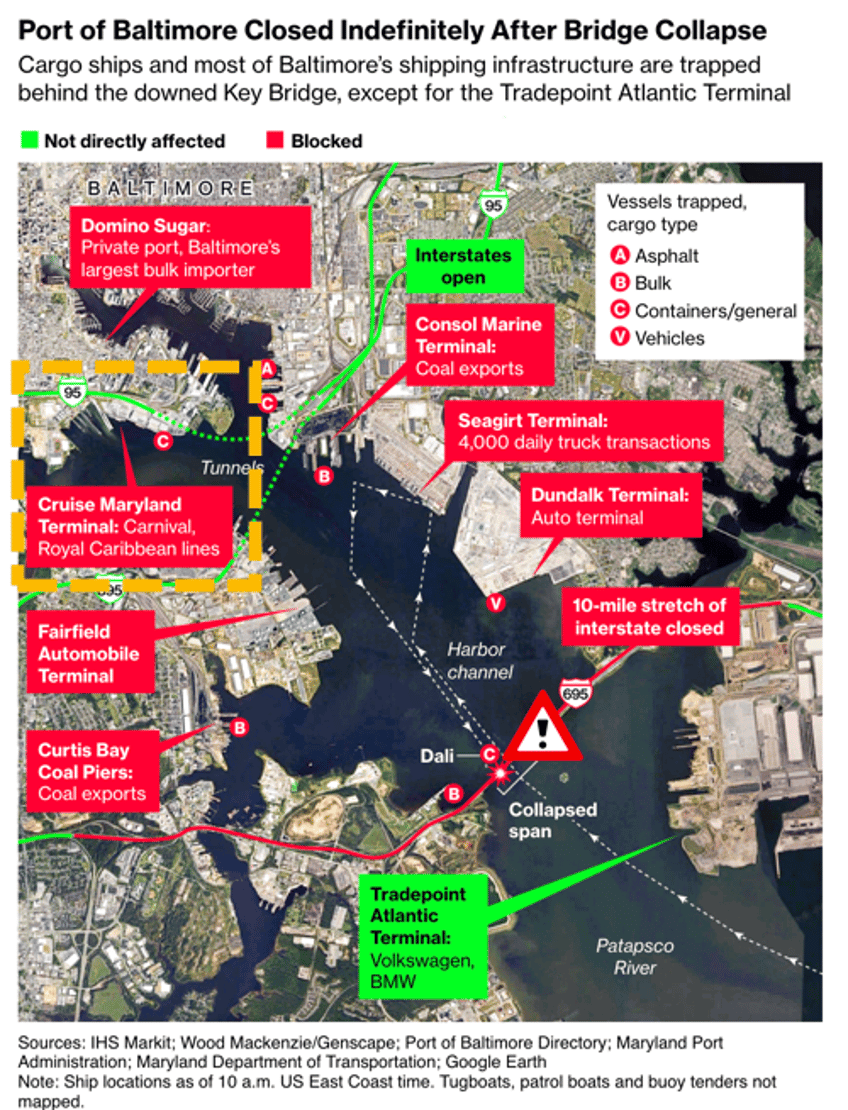

The removal of the massive wreckage left after a container ship rammed into the 1.6-mile-long Francis Scott Key Bridge and sent it crashing into the harbor's only shipping lane, effectively blocking all access to a large swath of the port, could take weeks, if not months.

Stephen Flynn, a professor of political science and civil and environmental engineering at Northeastern University, told USA Today that it could take several weeks or a couple of months for salvage crews to clear the channel.

"It doesn't have to be 100% clear in order to turn the lights back on and have the port moving again," Flynn said, adding it could take a year or more to clear the wreckage completely.

"This is a really hard, messy problem... It's a bit like a really complex, dangerous jigsaw puzzle," he said.

On a conference call with investors, Carnival Chief Executive Josh Weinstein said its Baltimore terminal operations have been moved to a temporary space in Norfolk, Virginia, "which should help to minimize operational changes."

Weinstein said the loss of Baltimore profit hasn't been factored into full-year guidance.

Carnival raised its full-year adjusted profit guidance by five cents to to 98 cents a share. For the first quarter, which ended on Feb. 29, Carnival recorded a loss of about $214 million, or 17 cents a share. This was much better than the $693 million loss, or 55 cents a share, in the same period one year ago.

Besides Baltimore, Carnival is also facing disruptions in the southern Red Sea as Iran-backed Houthis continue attacking commercial vessels with drones and anti-ship missiles.

While mega companies can easily pick up and leave Baltimore, as seen by Carnival, this will have catastrophic consequences for the local economy as layoffs are only beginning.

Sigh, Baltimore City, surrounding counties, and the State of Maryland. We feel for the residents who are losing their jobs because radical Democrats in the state were more concerned about DEI than improving infrastructure.

Many are asking this question: Why didn't the government install protective pilings around the bridge to prevent ship strikes from large vessels?