By Ye Xie, Bloomberg Markets Live reporter and strategist

Chinese stocks have been on a stealth bull run, but the renewed market optimism may be built a shaky foundation — especially when it comes to credit.

The MSCI China Index has climbed 24% from its lows in January. The Hang Seng Index has also recovered, so much so that its 9% gain this year is on par with the Nasdaq Composite Index.

A number of factors have helped. The economic data in the first quarter beat expectations, with stimulus starting to gain traction. Valuations were cheap and investors who were bearish in China needed to close some of their underweighted positions to catch up. In addition, the Politburo meeting last week offered some positive surprises, hinting that the government may find ways to deal with unsold properties.

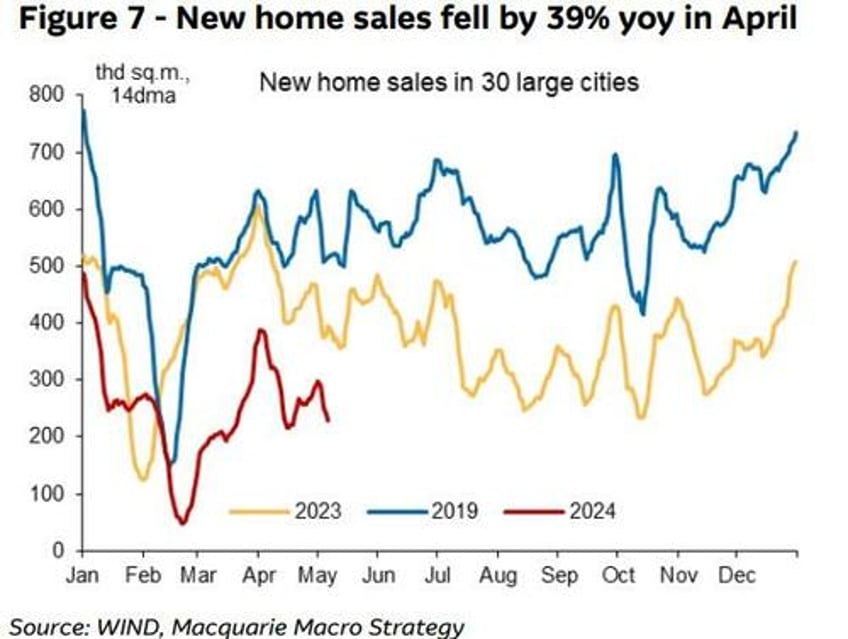

But in the big scheme of things, a lot of structural headwinds haven’t disappeared. The housing market, for instance, remains in deep trouble, with new home sales in big cities down 39% in April.

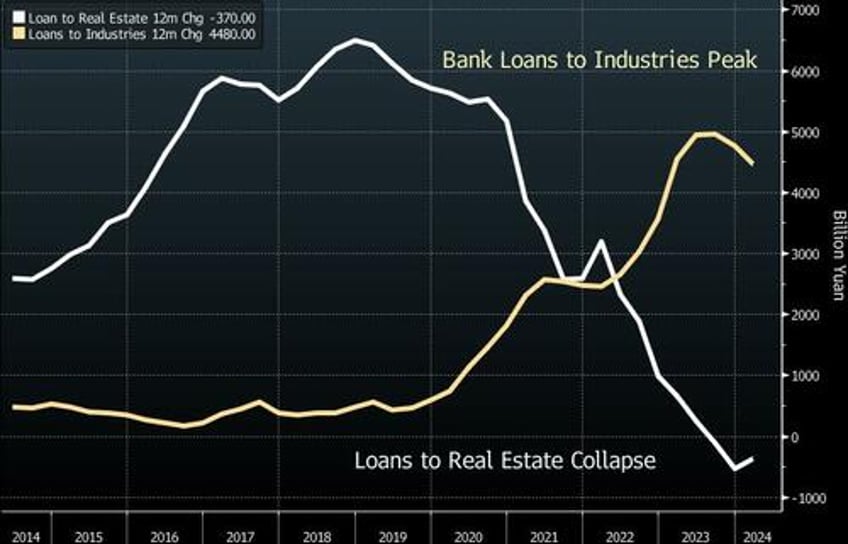

An even bigger risk lies in the broader credit market. Beijing’s strategy has been to shift resources from the speculative housing market to more productive industrial sectors such as electronic vehicles and renewable energy. As a result, bank loans to the housing sector have collapsed, while lending to industries soared.

But there’s a limit to how far such a strategy can go. Some industries are now plagued by overcapacity concerns, while there’s a rising threat of protectionism from foreign countries that have seen a flood of Chinese imports. And in recent months, industrial loan growth has slowed after the epic surge.

As a result, strategists at Clocktower note that China may be in the potentially treacherous position where credit demand from both households and corporations is falling at the same time.

Why that is important? The strategists explained:

A credit collapse will be a death knell for a highly leveraged economy like China. If the public sector does not come to support credit growth in a timely manner, a sharp growth deceleration is likely to occur going forward as economic agents will be forced to cut consumption and investment to meet their debt obligations.

That’s the warning Chinese stock bulls may have to heed.