- Canada said it will impose retaliatory tariffs on US imports from Tuesday. China announced additional tariffs of up to 15% on some US goods from March 10th.

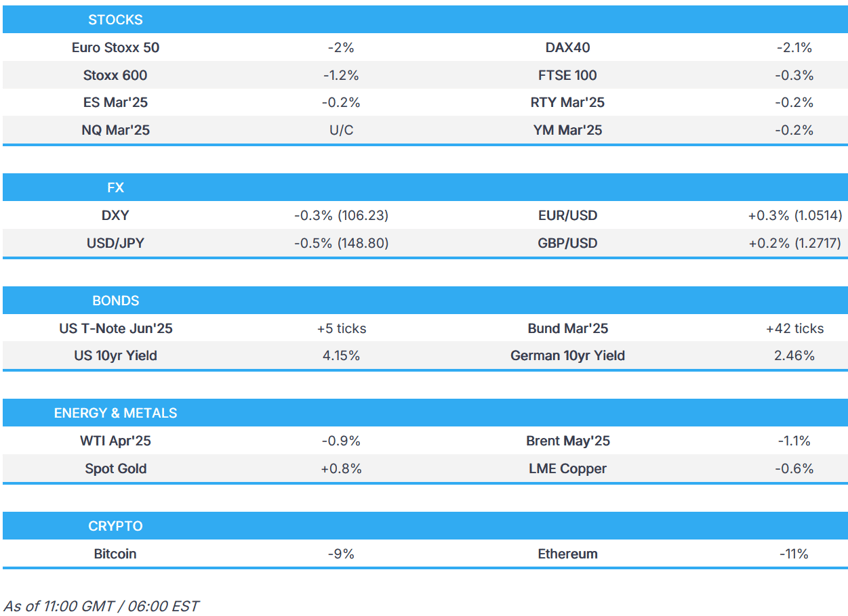

- European bourses hit as the region reacts to the latest Trump tariffs; US futures modestly lower.

- USD remains on the backfoot, EUR digests defence spending pledges, havens firmer.

- Bonds bolstered by growth concerns and tariff updates despite pressure from block trades & EU spending.

- Crude pressured continuing Monday's bearish bias, XAU shines on tariff updates & growth concerns.

- Looking ahead, US RCM/TIPP Economic Optimism, US President Trump's State of Union Address, Speakers including RBA’s Hauser & Fed’s Williams. Earnings from Target, Best Buy, AutoZone & CrowdStrike.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS

- White House said President Trump proceeded with tariffs on imports from Canada and Mexico, while reports also noted that the extra 10% duty on Chinese goods took effect as the Tuesday deadline passed with no changes to tariff orders.

- Canada said it will impose retaliatory tariffs on US imports from Tuesday if US tariffs go into effect and will start with 25% tariffs on US imports worth CAD 30bln from Tuesday, while it will impose tariffs on an additional CAD 125bln worth of US imports in 21 days. Furthermore, it said tariffs will remain in place until the US trade action is withdrawn and it is in active discussions with provinces and territories to pursue several non-tariff measures if US tariffs do not cease.

- China announced additional tariffs on US goods as retaliation for March 4th tariffs in which it is to impose additional tariffs of up to 15% on some US goods from March 10th, while it announced to impose tariffs of 15% on US chicken, wheat, corn, and cotton, as well as tariffs of 10% on US soybeans, sorghum, pork, beef, aquatic products, fruits, vegetables, and dairy products. China also added 15 US entities to the export control list and added 10 US firms to the unreliable entity list and banned Illumina Inc from exporting gene sequencing machines to China from March 4.

- China's MOFCOM earlier stated that China will take countermeasures to firmly safeguard its rights and interests in response to US tariffs, while it urged the US to immediately withdraw its unilateral tariff measures, calling them unreasonable, groundless, harmful to others, and self-serving. Furthermore, it hopes the US will return to the right track of resolving differences through dialogue on an equal footing as soon as possible.

- China releases white paper on controlling fentanyl-related substances, via Xinhua; China fulfils its international anti-drug obligations and opposes acquisitions and shifting of responsibility. China firmly upholds current international drug control system.

- China's Customs suspends imports of US lumber effective immediately; suspends soybean import qualification for three US companies from Tuesday including CHS Inc (CHSCO), Louis Dreyfus Company, EGT (BG).

- Click for the latest analysis piece

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.9%) opened in the red and have continued to trundle lower, as markets digest the latest tinderbox of uncertainty, which include; Trump tariff updates, the US stock market rout and increased EU defence spending.

- European sectors hold a strong negative bias, with most of the cyclical industries populating the bottom of the pile, given the risk tone. Food Beverage and Tobacco is buoyed by post-earning upside in Lindt (+5.3%). Energy and Autos are by far the clear underperformers in today’s session. The former hit by the sink in oil prices (OPEC+ confirmed oil hike) and Autos hampered on Trump tariff fears.

- US equity futures are modestly lower across the board, ES -0.1%, continuing to build on the considerable pressure seen in the prior session where the S&P 500 had its worst day this year.

- Amazon (AMZN) said to be building own AI model with reasoning capabilities to compete with Anthropic and OpenAI, according to Business Insider; offering tentatively scheduled to launch by June under the Nova brand.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is once again on the backfoot as the support from Trump's tariff announcements yesterday proved to be shortlived. Selling in early European trade picked up alongside an appreciation of the EUR as EU's von der Leyen provided an update on the bloc's defence spending intentions. Today's docket is light in terms of data, however, Trump will be delivering his State of the Union address 21:00EST. DXY now down as low as 106.15 with the YTD trough in touching distance at 106.12

- EUR/USD is up for a second session in a row as prospects of increased European defence spending overshadow concerns over the global trade war in which Europe is a clear target of the Trump administration. European yields experienced another boost in early European trade after EU Commission President von der Leyen proposed a new instrument that will provide EUR 150bln of loans for defence spending.

- JPY has benefitted from the risk-aversion seen in the wake of Trump's decision to proceed with tariff hikes on Mexico, Canada and China as well as reaffirming that reciprocal tariffs will start on April 2nd. JPY has also been underpinned by dynamics in the domestic bond market with the 30yr yield hitting its highest level since October 2008. 148.61 is the low print for USD/JPY today with the YTD trough just below at 148.56.

- Cable is once again on the front foot after a solid showing yesterday which brought the pair from a 1.2577 low to a YTD peak at 1.2726. Fresh macro drivers for the UK are on the light side asides from a 0.7% contraction in the BRC shop price index overnight. As such, it may be the case that the USD leg of the equation provides the greater source of traction in the near-term. If yesterday's 1.2726 YTD peak is breached, the 200DMA kicks in at 1.2785.

- Antipodeans are both were knocked lower by Trump's decision to proceed with tariffs on Canada and Mexico as well as doubling tariffs on China to 20%. China's decision to retaliate to the US also added to the trade angst. Overnight data releases for Australia (retail sales and current account) were mixed and provided little traction for AUD.

- PBoC set USD/CNY mid-point at 7.1739 vs exp. 7.2727 (prev. 7.1745).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Despite a lack of scheduled events USTs were in the driving seat early doors with a huge block trade sparking a bout of selling pressure in the benchmark and reverberating through the broader complex as well. Specifically, a 78k 10yr block at 111-19 hit at 07:33GMT when USTs themselves were trading at 111-23. Thereafter, the benchmark recovered a touch and got back towards earlier levels before then moving lower with EGBs.

- Given the ongoing bullish bias, with USTs firmer in a 111-13 to 111-28+ band, yields are lower across most of the curve aside from at the 20yr point which is essentially flat. Focus ahead is on the fallout of President Trump's allowing the tariff pause to end, and also on his State of the Union address this evening.

- Bunds are bid, benefitting from the tepid European tone as the region reacts to the imposition of tariffs by the US on Canada, China and Mexico. Note, nothing specific for Europe was announced by the US. Action which helped Bunds hit a 132.85 peak in the early morning with yields lower across the curve and the German 10yr moving back below the 2.5% mark after surmounting it on Monday; currently down to a 2.42% base and holding just within Monday’s 2.41-2.51% band.

- The morning’s main mover has been remarks from EU Commission President von der Leyen, who said that Europe is ready to “massively” boost defence spending, a plan labelled ReArm Europe which could mobilise as much as EUR 800bln for defence. This weighed on Bunds, trimming nearly 30 ticks over the course of around five minutes. Little reaction was seen despite a relatively weak 2030 Bobl outing.

- Gilts are firmer in-fitting with the above points and as the risk tone in the UK market is also weighed on by the latest measures from Trump. Action which has taken Gilts past yesterday’s 93.39 best by 11 ticks thus far. No sustained reaction to the morning’s DMO tap with Gilts continued to trade in proximity to Monday’s high.

- UK sells GBP 2.25bln 4.375% 2054 Gilt Auction: b/c 2.85x (prev. 2.75x), average yield 5.104% (prev. 5.198%) & tail 0.2bps (prev. 0.3bps)

- Germany sells EUR 3.505bln vs exp. EUR 4.5bln 2.40% 2030 Bobl: average yield 2.40% (prev. 2.17%), b/c 1.7x (prev. 1.96x) & Retention 22.1% (prev. 24.6%)

- Click for a detailed summary

COMMODITIES

- WTI and Brent are on the backfoot but around USD 0.62/bbl and USD 0.88/bbl respectively, continuing the pressure seen in the pressure which was sparked by OPEC+ confirming that they will go ahead with the planned output hike in April. Furthermore, sentiment in Europe has been hit as markets digest the imposition of tariffs on China, Mexico and China.

- Precious metals are bid, benefiting from its haven status, given the risk-off sentiment seen today; XAU breached overnight highs in early European trade and currently sits at the upper end of a USD 2,882.14-2,921.27/oz range.

- Base metals are generally pressured, as the latest Trump tariffs hit sentiment, with China's levy doubled to 20%. 3M LME Copper currently lower by around 0.4% at USD 9,377.

- Kazakhstan Energy Ministry says they plan to increase oil exports via the Caspian CPC pipeline by 12% in March vs Feb to 6.7mln T.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Shop Price Index YY (Feb) -0.7% (Prev. -0.7%)

- UK grocery inflation 3.3% in the four weeks to February 23rd, via Kantar

- EU Unemployment Rate (Jan) 6.2% vs. Exp. 6.3% (Prev. 6.3%, Rev. 6.2%)

NOTABLE EUROPEAN HEADLINES

- Morgan Stanley (MS) has changed its ECB rate call, now sees the central bank cutting rates in April.

- French Finance Minister Lombard says "we" must spend more on defence and faster, to spend more we will have to make efforts elsewhere. Do not want to increase tax on companies, want to look at how the wealthiest legally tax optimise

- EU Commission President von der Leyen says Europe is ready to "massively" boost defence spending; will propose to activate the national escape clause of the stability and growth pact & propose a new instrument that will provide EUR 150bln of loans. Propose that member states will be able to decide if they want to use the cohesion policy programmes to increase this spending. Rearm Europe that could mobilise close to EUR 800bln for a safe and resilient Europe. Aim to mobilise private capital through EIB, savings and investment union

- UK Chancellor Reeves says she will announce an intention to reduce unnecessary red tape which slows down the procuring of defence equipment.

NOTABLE US HEADLINES

- US Education Secretary McMahon said that President Trump has assigned them the 'final mission' to reduce bureaucratic inefficiencies within the Department of Education.

GEOPOLITICS

MIDDLE EAST

- Israeli ground forces launched a major incursion into south Syria with a helicopter airdrop and armoured convoys headed to Tel al-Mal & al-Mashara in Quneitra & Daraa, according to a source on X.

- Israeli Foreign Minister Sarr declines to comment on reports of a deadline for resuming the war in Gaza, says "if we went to, we will do it". We are ready to continue to Phase Two of the ceasefire, but need an agreement to release hostages to extend framework.

RUSSIA-UKRAINE

- Russia's Kremlin says it is "obvious that the US was the main supplier of the war" and if the US stops, it will be the best contribution to the cause of peace. Seems as if European countries will try to compensate Ukraine for the apparent loss of US military aid. Need to see how the situation develops on the ground. Too early to comments on reports of "White house seeks plans for Russian sanctions relief". To normalise relations, the sanctions need to be lifted.

- Finland's Intelligence Service says the biggest concern in the Baltic Sea is the Russian shadow flee. Russian sabotage actions are taking increasingly dangerous forms.

- Ukraine’s parliament said the country’s security is ensured by US support and described President Trump’s peacekeeping efforts as ‘decisive’ in ending the war.

- US President Trump said he will give an update on the Ukraine minerals deal on Tuesday night and doesn't think the Ukraine minerals deal is dead, while he added that Ukrainian President Zelensky should be more appreciative.

- White House official confirmed the US is pausing and reviewing Ukraine aid to assess if it is contributing towards a solution. It was also previously reported that the US is hitting the brakes on the flow of arms to Ukraine in which the Trump administration stopped financing new weapons sales to Ukraine and was considering freezing weapons shipments from US stockpiles, according to WSJ.

- US Vice President Vance said it is important for Ukrainian President Zelensky and Russian Putin to come to the negotiating table but added that Zelensky is still not willing to engage and President Trump is taking a realistic perspective on the Russia-Ukraine war. Vance said a minerals deal with Ukraine shows the US has a long-term investment in the country and leaders in Ukraine and Europe acknowledge privately that the Russia-Ukraine war cannot go on forever. Furthermore, Vance said Europeans need to be realistic on the Russia-Ukraine war and need to be saying to Zelensky that the war cannot go on forever.

- European official said the suspension of military aid to Ukraine will cause unnecessary civilian casualties and Ukraine will not be able to counter Russian raids after running out of air defence missiles, according to CNN.

- Europe's biggest powers are swinging behind efforts to seize over EUR 200bln of frozen Russian assets, as they draw up plans for a ceasefire deal in Ukraine, according to FT.

- Russia's Kremlin said it is premature to determine the location for the next round of Russia-US talks and that Russia-US talks on Ukraine are unlikely to resume until both countries' embassies return to full operational capacity. It was also reported that Russia’s envoy to international organisations said Russia is categorically against the deployment of European troops to Ukraine.

- China's Ministry of Ecology and Environment says it is collecting public opinion towards the regulation of the import of black mass for lithium-ion batteries and recycled steel materials.

CRYPTO

- Bitcoin is on the back foot with sentiment hit alongside equity markets after US President Trump proceeded with planned tariffs on China, Mexico and Canada.

APAC TRADE

- APAC stocks were pressured following the sell-off on Wall St where the S&P suffered its worst day of the year so far amid tech selling, weak ISM data and tariff confirmation.

- ASX 200 declined with nearly all sectors in the red and underperformance in energy after the recent drop in oil prices, while mixed data releases provided little to spur risk appetite.

- Nikkei 225 briefly retreated to beneath the 37,000 level amid the early broad risk-off mood and recent currency strength with Seven & I Holdings the worst hit after reports it is to reject Couche-Tard’s buyout proposal.

- Hang Seng and Shanghai Comp were initially pressured after US President Trump signed an order to raise tariffs on China to 20% from 10% and threatened to penalise countries weakening currencies with China also mentioned when talking about weak currencies, while China's MOFCOM later responded that China will take countermeasures to firmly safeguard its rights and interests in response to US tariffs. Nonetheless, the downside in the mainland was limited as China’s annual “Two sessions” gathering began in Beijing with participants anticipating China to outline stimulus plans, while confirmation of the tariffs and China's immediate retaliation did little to derail the resilience in the mainland.

NOTABLE ASIA-PAC HEADLINES

- China's NPC spokesperson announced that the 2025 annual parliamentary session will begin March 5th and conclude on March 11th, while there be three press conferences held on diplomacy, economy and livelihood. NPC spokesperson also said the Chinese government attaches high importance to the development of AI and its risk prevention and that China opposes overstretching the concept of national security or politicising economic and technological issues. The spokesperson said that the country’s economic operations face numerous difficulties and challenges, citing insufficient domestic demand, as well as production and operational struggles for some businesses, as well as noted that rising economic and political uncertainties internationally make it hard to stabilise external demand but also stated China's economy has a solid foundation, many advantages, strong resilience, and large potential.

- RBA Minutes stated the Board judged the case to cut rates was, on balance, the stronger one although it agreed decision did not commit them to further cuts in the cash rate and members expressed caution about the prospect of further easing. Furthermore, members placed more weight on the downside risks to the economy and were particularly mindful of the risk of keeping policy too tight for too long, while it was stated that if inflation proved persistent, rates might stay at 4.1% for an extended period or be raised.

DATA RECAP

- Japanese Unemployment Rate (Jan) 2.5% vs. Exp. 2.4% (Prev. 2.4%)

- Japanese Jobs/Applicants Ratio (Jan) 1.26 vs. Exp. 1.25 (Prev. 1.25)

- Australian Current Account Balance SA (Q4) -12.5B AU vs. Exp. -11.9B AU (Prev. -14.1B AU)

- Australian Net Exports Contribution (Q4) 0.2% vs. Exp. -0.1% (Prev. 0.1%)

- Australian Retail Sales MM Final * (Jan) 0.3% vs. Exp. 0.3% (Prev. -0.1%)