- White House said Trump proceeded with tariffs on imports from Canada and Mexico; reports also noted the extra 10% duty on Chinese goods took effect.

- Canada said it will impose retaliatory tariffs on US imports from Tuesday. China announced additional tariffs of up to 15% on some US goods from March 10th.

- APAC stocks were pressured following the sell-off on Wall St where the S&P suffered its worst day of the year so far.

- European equity futures indicate a negative cash open with Euro Stoxx 50 future down 0.8% after the cash market closed with gains of 0.7% on Monday.

- USD is mixed vs. peers in the aftermath of tariff actions; firmer vs. cyclicals and weaker vs. havens.

- White House official confirmed the US is pausing and reviewing Ukraine aid to assess if it is contributing towards a solution.

- Looking ahead, highlights include, US RCM/TIPP Economic Optimism, Canada and Mexico's US tariff take effect, US President Trump's State of Union Address, RBA’s Hauser & Fed’s Williams, Supply from Netherlands & UK

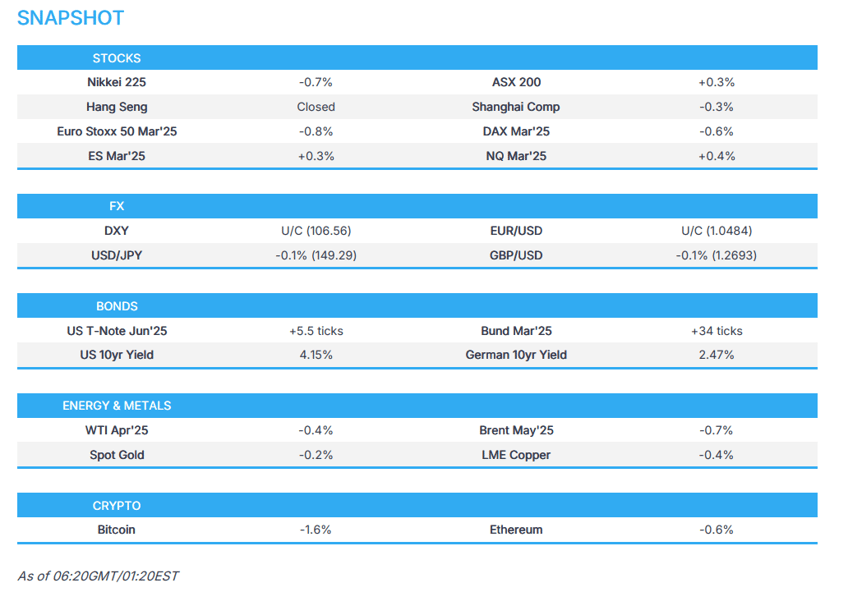

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were pressured and the major indices closed notably in the red after selling off through the duration of the US afternoon on the broader risk-off theme amid poor US data and tariff comments. In terms of the data, Feb ISM Manufacturing PMI disappointed with the headline underwhelming, driven by employment and new orders plunging below 50, but prices paid soared. In the accompanying comments, many mentioned the uncertainties the looming tariffs are causing, while the latest Atlanta Fed GDPnow forecast estimated Q1 real GDP growth at -2.8% from -1.5% following the data. Markets were then later spooked after President Trump said reciprocal tariffs start April 2nd and tariffs on Canada and Mexico are to start on Tuesday with no room left for a deal, while he also announced that China tariffs are to double to 20%.

- SPX -1.76% at 5,850, NDX -2.20% at 20,426, DJI -1.48% at 43,191, RUT -2.81% at 2,102.

- Click here for a detailed summary.

TARIFFS

- White House said President Trump proceeded with tariffs on imports from Canada and Mexico, while reports also noted that the extra 10% duty on Chinese goods took effect as the Tuesday deadline passed with no changes to tariff orders.

- US President Trump said on Monday that reciprocal tariffs start on April 2nd and tariffs on Canada and Mexico are to start on Tuesday, while also commented there is no room left for a deal on tariffs on Mexico and Canada, while he reiterated the plan to double the China tariff to 20% from 10%. Furthermore, Trump said will penalise countries weakening currencies with tariffs and mentioned China when talking about weak currencies and doesn't think China will retaliate too much, while the White House said President Trump signed an order to tariff China at 20%.

- US President Trump posted on Truth “To the Great Farmers of the United States: Get ready to start making a lot of agricultural product to be sold INSIDE of the United States. Tariffs will go on external product on April 2nd. Have fun!”

- Canada said it will impose retaliatory tariffs on US imports from Tuesday if US tariffs go into effect and will start with 25% tariffs on US imports worth CAD 30bln from Tuesday, while it will impose tariffs on an additional CAD 125bln worth of US imports in 21 days. Furthermore, it said tariffs will remain in place until the US trade action is withdrawn and it is in active discussions with provinces and territories to pursue several non-tariff measures if US tariffs do not cease.

- China announced additional tariffs on US goods as retaliation for March 4th tariffs in which it is to impose additional tariffs of up to 15% on some US goods from March 10th, while it announced to impose tariffs of 15% on US chicken, wheat, corn, and cotton, as well as tariffs of 10% on US soybeans, sorghum, pork, beef, aquatic products, fruits, vegetables, and dairy products. China also added 15 US entities to the export control list and added 10 US firms to the unreliable entity list and banned Illumina Inc from exporting gene sequencing machines to China from March 4.

- China's MOFCOM earlier stated that China will take countermeasures to firmly safeguard its rights and interests in response to US tariffs, while it urged the US to immediately withdraw its unilateral tariff measures, calling them unreasonable, groundless, harmful to others, and self-serving. Furthermore, it hopes the US will return to the right track of resolving differences through dialogue on an equal footing as soon as possible.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said the outlook is for continued solid economic growth, but recent consumer and housing data pose some downside risk. Musalem added that restrictive monetary policy is still needed to ensure inflation returns to the 2% target, while a patient approach to policy will help achieve the Fed's goals and sustain economic expansion.

- US Education Secretary McMahon said that President Trump has assigned them the 'final mission' to reduce bureaucratic inefficiencies within the Department of Education.

APAC TRADE

EQUITIES

- APAC stocks were pressured following the sell-off on Wall St where the S&P suffered its worst day of the year so far amid tech selling, weak ISM data and tariff confirmation.

- ASX 200 declined with nearly all sectors in the red and underperformance in energy after the recent drop in oil prices, while mixed data releases provided little to spur risk appetite.

- Nikkei 225 briefly retreated to beneath the 37,000 level amid the early broad risk-off mood and recent currency strength with Seven & I Holdings the worst hit after reports it is to reject Couche-Tard’s buyout proposal.

- Hang Seng and Shanghai Comp were initially pressured after US President Trump signed an order to raise tariffs on China to 20% from 10% and threatened to penalise countries weakening currencies with China also mentioned when talking about weak currencies, while China's MOFCOM later responded that China will take countermeasures to firmly safeguard its rights and interests in response to US tariffs. Nonetheless, the downside in the mainland was limited as China’s annual “Two sessions” gathering began in Beijing with participants anticipating China to outline stimulus plans, while confirmation of the tariffs and China's immediate retaliation did little to derail the resilience in the mainland.

- US equity futures (ES +0.3%, NQ +0.5%) nursed some of the prior day’s losses after suffering from US economic concerns, tech selling and tariffs.

- European equity futures indicate a negative cash open with Euro Stoxx 50 future down 0.8% after the cash market closed with gains of 0.7% on Monday.

FX

- DXY lacked demand after weakening throughout the majority of the prior day amid US economic concerns and with early pressure exacerbated following weaker-than-expected ISM data. The dollar then saw some mild support late on Monday following President Trump's tariff comments in which he stated that reciprocal tariffs start on April 2nd and tariffs on Canada and Mexico are to start on Tuesday, while he signed an order to double the China tariff to 20% from 10% and said will penalise countries weakening currencies with tariffs and mentioned China when talking about weak currencies. The announcement pressured CAD, MXN and CNH although the support for the greenback was only brief with the DXY languishing firmly beneath the 107.00 level.

- EUR/USD plateaued after steadily gaining yesterday amid somewhat improved PMIs and firmer-than-expected EZ HICP data.

- GBP/USD traded rangebound near the 1.2700 level after recently advancing on the back of a softer dollar.

- USD/JPY briefly dropped to sub-149.00 territory after sliding yesterday due to the dollar weakness and haven demand.

- Antipodeans were subdued owing to their high-beta characteristics and after the mixed data releases from Australia.

- PBoC set USD/CNY mid-point at 7.1739 vs exp. 7.2727 (prev. 7.1745).

FIXED INCOME

- 10yr UST futures extended on the prior day’s gains after climbing on the back of weak US ISM data and tariffs.

- Bund futures continued its rebound from Monday’s lows with the help of haven flows.

- 10yr JGB futures initially tracked the upside in global peers but then faltered after a weak 10yr auction.

COMMODITIES

- Crude futures remained subdued after slipping yesterday on reports that OPEC+ will go ahead with the April oil output increase which the group have confirmed.

- OPEC+ confirmed it is to proceed with supply hikes and could pause or reverse the decision based on market conditions, while it sees healthy market fundamentals and a positive outlook.

- Iraq talks with oil firms hit a snag, delaying Kurdistan exports, according to Bloomberg.

- Spot gold traded rangebound and took a breather after gaining yesterday amid a flight to quality.

- Copper futures were subdued amid the risk-averse mood and ongoing tariff war.

CRYPTO

- Bitcoin declined and briefly tested the USD 83,000 level to the downside before rebounding off lows.

NOTABLE ASIA-PAC HEADLINES

- China's NPC spokesperson announced that the 2025 annual parliamentary session will begin March 5th and conclude on March 11th, while there be three press conferences held on diplomacy, economy and livelihood. NPC spokesperson also said the Chinese government attaches high importance to the development of AI and its risk prevention and that China opposes overstretching the concept of national security or politicising economic and technological issues. The spokesperson said that the country’s economic operations face numerous difficulties and challenges, citing insufficient domestic demand, as well as production and operational struggles for some businesses, as well as noted that rising economic and political uncertainties internationally make it hard to stabilise external demand but also stated China's economy has a solid foundation, many advantages, strong resilience, and large potential.

- RBA Minutes stated the Board judged the case to cut rates was, on balance, the stronger one although it agreed decision did not commit them to further cuts in the cash rate and members expressed caution about the prospect of further easing. Furthermore, members placed more weight on the downside risks to the economy and were particularly mindful of the risk of keeping policy too tight for too long, while it was stated that if inflation proved persistent, rates might stay at 4.1% for an extended period or be raised.

DATA RECAP

- Japanese Unemployment Rate (Jan) 2.5% vs. Exp. 2.4% (Prev. 2.4%)

- Japanese Jobs/Applicants Ratio (Jan) 1.26 vs. Exp. 1.25 (Prev. 1.25)

- Australian Current Account Balance SA (Q4) -12.5B AU vs. Exp. -11.9B AU (Prev. -14.1B AU)

- Australian Net Exports Contribution (Q4) 0.2% vs. Exp. -0.1% (Prev. 0.1%)

- Australian Retail Sales MM Final * (Jan) 0.3% vs. Exp. 0.3% (Prev. -0.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli ground forces launched a major incursion into south Syria with a helicopter airdrop and armoured convoys headed to Tel al-Mal & al-Mashara in Quneitra & Daraa, according to a source on X.

- Israel is to resume the Gaza war in 10 days if the impasse persists, N12 reported.

- US State Department spokesperson said US Middle East Envoy Witkoff plans to return to the region in the coming days and Witkoff will work out either a way to extend Phase One of the ceasefire deal between Israel and Hamas or advance to Phase Two.

RUSSIA-UKRAINE

- Ukrainian President Zelensky posted on X "We continue our work with partners. We have already had talks and other steps to come soon."; "It is very important that we try to make our diplomacy really substantive to end this war the soonest possible", while he also stated "We are working together with America and our European partners and very much hope on US support on the path to peace. Peace is needed as soon as possible".

- Ukraine’s parliament said the country’s security is ensured by US support and described President Trump’s peacekeeping efforts as ‘decisive’ in ending the war.

- US President Trump said he will give an update on the Ukraine minerals deal on Tuesday night and doesn't think the Ukraine minerals deal is dead, while he added that Ukrainian President Zelensky should be more appreciative.

- US President Trump posted an AP article on Truth titled "Ukraine’s Zelensky says end of war with Russia is ‘very, very far away’"; adds "This is the worst statement that could have been made by Zelensky, and America will not put up with it for much longer".

- White House official confirmed the US is pausing and reviewing Ukraine aid to assess if it is contributing towards a solution. It was also previously reported that the US is hitting the brakes on the flow of arms to Ukraine in which the Trump administration stopped financing new weapons sales to Ukraine and was considering freezing weapons shipments from US stockpiles, according to WSJ.

- US Vice President Vance said it is important for Ukrainian President Zelensky and Russian Putin to come to the negotiating table but added that Zelensky is still not willing to engage and President Trump is taking a realistic perspective on the Russia-Ukraine war. Vance said a minerals deal with Ukraine shows the US has a long-term investment in the country and leaders in Ukraine and Europe acknowledge privately that the Russia-Ukraine war cannot go on forever. Furthermore, Vance said Europeans need to be realistic on the Russia-Ukraine war and need to be saying to Zelensky that the war cannot go on forever.

- US is drawing up a plan to potentially give Russia sanctions relief as President Trump seeks to restore ties with Moscow and stop the war in Ukraine, according to Reuters citing sources.

- European official said the suspension of military aid to Ukraine will cause unnecessary civilian casualties and Ukraine will not be able to counter Russian raids after running out of air defence missiles, according to CNN.

- Europe's biggest powers are swinging behind efforts to seize over EUR 200bln of frozen Russian assets, as they draw up plans for a ceasefire deal in Ukraine, according to FT.

- Russia's Kremlin said it is premature to determine the location for the next round of Russia-US talks and that Russia-US talks on Ukraine are unlikely to resume until both countries' embassies return to full operational capacity. It was also reported that Russia’s envoy to international organisations said Russia is categorically against the deployment of European troops to Ukraine.

EU/UK

DATA RECAP

- UK BRC Shop Price Index YY (Feb) -0.7% (Prev. -0.7%)