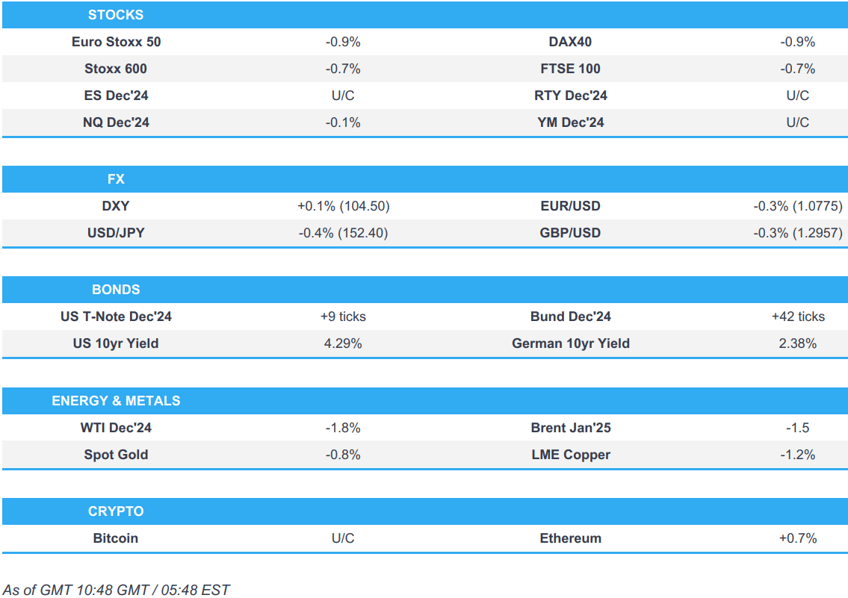

- European bourses are entirely in the red, with sentiment hit after China’s NPC press conference disappointed markets; US futures remain flat.

- DXY is slightly firmer, with the JPY strong whilst the Antipodeans lag given the lack of fresh stimulus measures from China.

- Bonds are on a firmer footing, with modest outperformance in Gilts and as USTs await Fed speak from Bowman & Musalem.

- Crude oil, XAU and base metals are all on the backfoot, following the underwhelming Chinese NPC press conference.

- Looking ahead, Canadian Jobs, US UoM Inflation Prelim/Sentiment, Speakers including BoC's Gravelle, Fed's Bowman & Musalem.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.7%) are entirely in the red and to varying degrees vs futures initially indicating a positive open. Sentiment was hit following the China’s NPC press conference, where it largely refrained from providing specific details on fiscal stimulus, but did promise more forceful fiscal policy in next year. Bourses continued to trundle lower and currently reside just off worst levels.

- European sectors hold a negative bias; Healthcare takes the top spot, lifted by AstraZeneca after it reported a positive update on one of its treatments. Basic Resources and Consumer Products sit at the foot of the pile, with the former hampered by losses in underlying metals prices whilst the latter is weighed on by poor results from Richemont. Additionally, sentiment across these China-exposed sectors was hit given the lack of fresh stimulus measures from China’s NPCSC.

- US equity futures (ES -0.1%, NQ U/C, RTY U/C) are flat/incrementally lower, but have been edging ever so slightly lower in recent trade, given the weakness also seen in Europe.

- TSMC (2330 TT) has reportedly informed Chinese customers that it will be suspending production of some of their AI and high-performance chips, via Nikkei citing sources; as the Co. increases efforts to comply with US export controls

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is slightly higher, with USD stronger vs. most peers (DXY is sluggish on account of JPY strength). DXY has been as high as 105.44 post-election but has since returned to a 104 handle.

- EUR is on the backfoot vs. the USD with the pair unable to hold above the 1.08 mark after venturing as high as 1.0824 on Thursday. For now, today's session low is at 1.0762 is still comfortably above yesterday's base at 1.0712.

- GBP softer vs. the USD to a similar magnitude as peers. Downside for Cable is limited relative to Thursday's moves with the current session low at 1.2936.

- JPY is the only of the majors to be up against the USD in an extension of yesterday's price action. Markets seem willing to fade some of the post-election rally seen in USD/JPY with Japanese officials out in full force attempting to jawbone the pair lower. USD/JPY has been as low as 152.28 with the next targets coming via the 200 and 21DMAs at 151.67 and 151.66 respectively.

- Antipodeans are both softer vs. the USD after yesterday's post-election recovery vs. the USD. Today it is likely that some of the disappointment surrounding the Chinese NPC meeting is acting as a drag on both pairs.

- Yuan is on the backfoot vs. the USD with the outcome of the Chinese NPC meeting judged to be somewhat of a damp squib as some expectations for bazooka stimulus were left disappointed.

- PBoC set USD/CNY mid-point at 7.1433 vs exp. 7.1452 (prev. 7.1659).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in the green, as markets digest the 25bps move from the Fed and continued data-dependent and meeting-by-meeting guidance alongside Powell saying he intends to serve the entirety of his term (mid-2026). Given the cut, yields are lower across the curve though there is no overt flattening/steepening bias currently. USTs at a 110-16+ peak, just off the 110-21+ WTD high. No real follow through from the underwhelming Chinese press conference.

- Bunds are firmer, taking directional impetus from USTs but primarily bouncing back from the marked pressure seen yesterday when the German coalition essentially collapsed. Stopped two ticks shy of the 132.00 mark but remains in striking distance.

- Gilts are directionally echoing peers but the modest outperformer. Action which comes as Gilts pare back the hawkish-skew from yesterday’s BoE. Gilts currently above the 94.00 mark but just off a 94.21 peak, resistance at 94.34 and 94.73 from Monday and last Friday.

- Click for a detailed summary

COMMODITIES

- A softer session for the crude complex complex thus far in a continuation of the weakness seen overnight following yesterday's choppy performance but with price action contained amid light oil-specific newsflow and against the backdrop of ongoing geopolitical risks. Weakness this morning also emanated from China's NPC press conference which was overall a damp squib - China’s much anticipated NPC Standing Committee meeting concluded today with an announcement on a debt swap plan to rein in hidden local government debt, whilst future fiscal stimulus was promised. Brent trades towards the lower end of a USD 74.45-75.61/bbl.

- Precious metals are softer across the board after rebounding yesterday as the dollar softened on a Trump trade fade, with the broader commodity complex overall underwhelmed by the Chinese NPC press conference.

- Base metals are lower across the board following the underwhelming Chinese NPC announcement which omitted specifics regarding sizes of fiscal stimulus, although China's Finance Minister said China will roll out new policy measures.

- US President-elect Trump reportedly intends to drastically increase sanctions on Iran and throttle its oil sales, via WSJ citing sources.

- Click for a detailed summary

NOTABLE DATA RECAP

- French Trade Balance, EUR, SA (Sep) -8.266B (Prev. -7.371B, Rev. -7.718B); Imports, EUR (Sep) 56.853B (Prev. 57.028B, Rev. 57.008B); Exports, EUR (Sep) 48.587B (Prev. 49.657B, Rev. 49.290B); Current Account (Sep) -2.1B (Prev. -0.6B, Rev. -1.2B)

- Italian Industrial Output MM SA (Sep) -0.4% vs. Exp. -0.2% (Prev. 0.1%); Industrial Output YY WDA (Sep) -4.0% (Prev. -3.2%)

NOTABLE US HEADLINES

- Trump named Susan Wiles as White House Chief of Staff.

GEOPOLITICS

MIDDLE EAST

- "Deputy Speaker of the Lebanese Parliament to Sky News Arabia: A ceasefire is possible within a few weeks", according to Sky News Arabia; details light

- Iranian Supreme Leader said Iran should put an end to Israel and make a sound decision on responding to its attack, according to Sky News Arabia.

- Israeli PM Netanyahu is aware of serious violence against Israeli citizens in Amsterdam and directed that two planes be sent immediately to assist citizens in Amsterdam after reports of Israeli football fans being attacked by assailants chanting 'Free Palestine'. Furthermore, Israel's Foreign Minister asked his Dutch counterpart to help get Israelis out safely following the security incident in Amsterdam.

- Israeli occupation forces stormed the city of Dhahriya, south of Hebron in the West Bank, according to Al Jazeera.

CRYPTO

- Bitcoin is relatively steady and holds just beneath USD 76k.

APAC TRADE

- APAC stocks were ultimately mixed despite the early momentum following the fresh record levels on Wall St and a bout of rate cuts by major central banks, with gains capped as participants awaited a potential Chinese fiscal stimulus announcement.

- ASX 200 outperformed its major peers amid gains in nearly all sectors and with financials kept afloat post-ANZ earnings.

- Nikkei 225 traded higher but with gains capped after a contraction in household spending and the recent currency rebound.

- Hang Seng and Shanghai Comp wiped out early gains despite the HKMA's 25bps lockstep rate cut with price action cautious as participants awaited the conclusion of the NPC Standing Committee's session and potential stimulus announcement.

CHINA NPC PRESS CONFERENCE

- China's top lawmakers have approved the local debt swap plan; to raise the local gov't debt ceilings to replace existing hidden debts, via Xinhua.

- China's NPC Vice-Chairman says they intend to raise the local gov't debt ceiling by CNY 6tln. Moves to reduce local gov't debt will help to promote growth, expect to save CNY 600bln in interests for local gov'ts over five years; In addition to the 6tln debt limit approved, the local debt repayment resources will be directly increased by 10tln. New debt quota will help to replace existing debts. Will help to increase the local debt ceiling. Will raise the end-2024 local gov't special bond ceiling to CNY 35.5tln from CNY 29.52tln. Debt burdens in some regions are "big & heavy". Must resolutely curb new "hidden" debt.

- China's Finance Minister (Q&A): must resolutely curb new "hidden" debt; China Government debt burden relatively low and still has relatively big room to raise debt; will increase counter-cyclical measures. Will roll out new policy measures. Will issue measures to support the property market. To implement more forceful fiscal policy in 2025. Will soon issue special sovereign bonds to replenish the capital of big state banks. Issue special local bonds to support the purchase of idle land and unsold flats. Will issue ultra-long special treasury bonds.

NOTABLE ASIA-PAC HEADLINES

- PBoC says they will firmly guard against the risk of exchange rate overshooting. Further interest rate cuts face dual constraints of net interest margin and exchange rate

- PBoC Q3 Monetary Policy Report: Reiterates monetary policy is to be flexible & targeted. To enhance the guiding role of central bank policy rates. To keep expanding monetary policy toolbox. Sticking to accommodative monetary policy stance. Maintain yuan exchange rate. To further improve monetary policy framework

- China's MOFCOM says China made progress in talks with EU on EV tariffs, with technical talks next week.

- Hong Kong Monetary Authority cut its base rate by 25bps to 5.00%, as expected, in lockstep with the Fed.

- China's Ambassador to the US Xie Feng said there are no winners in tariff wars, trade wars, science and technology wars, and industrial wars, while he added that the Taiwan issue is the first red line that cannot be crossed in Sino-US relations and words must match deeds. Furthermore, he said no challenge can stop China’s progress and that any containment and suppression will only "hit a wall."

- Japanese Finance Minister Kato said they will closely monitor the impact of Trump policies on the Japanese economy, while he wouldn't comment on the FX level but reiterated it is important for currencies to move in a stable manner reflecting fundamentals and that they will take appropriate steps on excessive moves.

- Sony (6758 JT) 6-month (JPY): Net 570bln, +36%; Operating 734bln, +42.3%; PBT 767bln, +43.8%.

- Softbank (9434 JT) 6-month (JPY) Sales 3.15tln, +7.4% Y/Y, Op. Income 585.89bln, +13.9% Y/Y; Sees FY Net Income 510bln (prev. guided 500bln); Op. Income 950bln (prev. guided 900bln)

- China Q3 (USD) Prelim current account surplus 146.9bln (prev. 54.5bln Y/Y), via China FX Regulator

- Acer (2353 TT) Oct consolidated revenue TWD 18.82bln Year to October +10.1%

DATA RECAP

- Japanese All Household Spending MM (Sep) -1.3% vs. Exp. -0.7% (Prev. 2.0%); YY -1.1% vs. Exp. -2.1% (Prev. -1.9%)