- APAC stocks were ultimately mixed despite the early momentum following the fresh record levels on Wall St and a bout of rate cuts by major central banks, with gains capped as participants awaited a potential Chinese fiscal stimulus announcement.

- FOMC cut rates by 25bps to 4.50-4.75%, as expected, in a unanimous decision and removed language about having gained greater confidence in inflation moving sustainably towards the 2% target. Fed Chair Powell said during the Q&A that the election will have no effect on policy decisions in the near term.

- US President-elect Trump is likely to allow Fed chair Powell to serve the remainder of his term, according to CNN. Fed Chair said he will not resign if Trump asks him to. (Powell’s term is set to end in May 2026).

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.2% after the cash market closed higher by 1.1% on Thursday.

- Looking ahead, highlights include French Trade Balance, Italian Industrial Output, Canadian Jobs, US UoM Prelim, Chinese Money Supply, Speakers including ECB’s Cipollone, BoC's Gravelle, Fed's Bowman & Musalem, Earnings from Richemont, Rightmove, International Consolidated Airlines Group, Paramount Global & Sony.

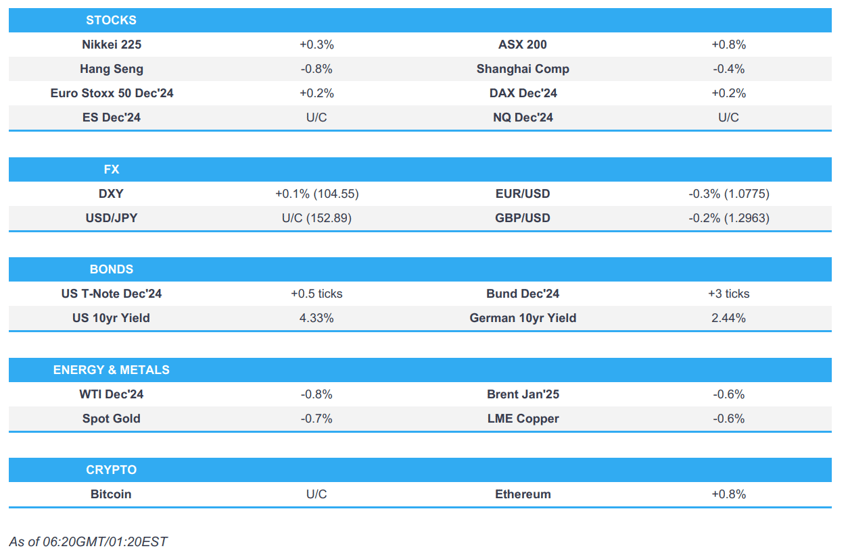

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks mostly extended on their post-election advances which saw the major indices notch fresh record highs with the tech-heavy Nasdaq 100 leading the advances amid gains across the mega-cap names and with outperformance in Communication Services, Technology and Consumer Discretionary.

- Outside of stocks, trade in general, was catalysed by an unwind of the recent extreme moves seen in the wake of the Trump victory, which resulted in a firm rebound for treasuries as yields softened and the dollar also weakened, while the FOMC's widely expected decision to cut rates and Powell's presser had little lasting impact across markets which mostly then continued with the earlier Trump fade.

- SPX +0.74% at 5,973, NDX +1.54% at 21,102, DJIA flat at 43,729, RUT -0.43% at 2,383.

- Click here for a detailed summary.

FOMC

- FOMC cut rates by 25bps to 4.50-4.75%, as expected, in a unanimous decision and removed language about having gained greater confidence in inflation moving sustainably towards the 2% target. FOMC said recent indicators suggest that economic activity has continued to expand at a solid pace and inflation has made progress towards the Committee's 2% objective but remains somewhat elevated.

- Fed Chair Powell said during the press conference that the economy is strong and the labour market remains solid, while inflation has eased substantially and they are committed to maintaining the economy's strength. Powell said the Fed took another step in reducing policy restraint and continues to be confident that with the recalibration of stance, inflation will move sustainably down to 2%. Furthermore, he said they can dial back policy more slowly if the economy remains strong and inflation is not moving to 2% or can move more quickly if the economy slows and inflation moves towards 2%.

- Fed Chair Powell said during the Q&A that the election will have no effect on policy decisions in the near term and since the September meeting, the main economic activity has been stronger and some of the downside risks to the economy have diminished. Powell also said they will want to see how long higher bond rates will be maintained and what they have seen so far, it is not a major factor and they are not at the stage where bond rates need to be taken into policy consideration, while they will make a decision on rates as they get to December and will be looking at incoming data and how that affects the outlook. Powell added they are in the process of recalibrating from a fairly restrictive level and asking themselves if that is where they need to be, as well as trying to steer between moving too quickly and moving too slowly. Furthermore, Powell said statement changes are not meant to be a signal with the change in statement 'omitting confidence' is not meant to convey anything about the stickiness of inflation and that they have gained confidence on inflation moving towards 2%, while he said he would not resign if asked to and noted risks are two-sided with the economy and policy both in a very good place.

NOTABLE HEADLINES

- US President-elect Trump is likely to allow Fed chair Powell to serve the remainder of his term, according to CNN (Powell’s term is set to end in May 2026). It was separately reported that Trump named Susan Wiles as White House Chief of Staff.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed despite the early momentum following the fresh record levels on Wall St and a bout of rate cuts by major central banks, with gains capped as participants awaited a potential Chinese fiscal stimulus announcement.

- ASX 200 outperformed its major peers amid gains in nearly all sectors and with financials kept afloat post-ANZ earnings.

- Nikkei 225 traded higher but with gains capped after a contraction in household spending and the recent currency rebound.

- Hang Seng and Shanghai Comp wiped out early gains despite the HKMA's 25bps lockstep rate cut with price action cautious as participants awaited the conclusion of the NPC Standing Committee's session and potential stimulus announcement.

- US equity futures traded sideways after having plateaued at around record levels.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.2% after the cash market closed higher by 1.1% on Thursday.

FX

- DXY traded sideways after giving back some of the large gains incurred in the post-Trump win and with the FOMC providing very little surprises as the Fed cut rates by 25bps to 4.50%-4.75%, as expected, while the buck was also indecisive in the wake of Fed Chair Powell's presser where he downplayed the recent rise in Treasury yields and kept the options open for the December meeting.

- EUR/USD mildly faded the recent rebound after failing to sustain the brief reclaim of the 1.0800 status.

- GBP/USD lingered at a sub-1.3000 level but held on to most of the prior day's gains in the aftermath of the BoE meeting where the Bank announced a widely expected 25bps rate cut and said it will ensure the Bank Rate is restrictive for sufficiently long.

- USD/JPY prodded yesterday's lows and breached through support at the 153.00 level to the downside.

- Antipodeans eased back following their recent outperformance as risk sentiment gradually waned and with participants awaiting a potential fiscal stimulus announcement from China.

- PBoC set USD/CNY mid-point at 7.1433 vs exp. 7.1452 (prev. 7.1659).

FIXED INCOME

- 10yr UST futures remained afloat after rallying yesterday as bonds rebounded and yields pared from Trump victory extremes, while the FOMC rate cut announcement and post-meeting presser had little lasting impact on the treasury complex.

- Bund futures traded rangebound following mixed German/EU data and the recent whipsawing through the 131.00 level.

- 10yr JGB futures lacked firm direction but were kept afloat amid the contraction of Japanese household spending data.

COMMODITIES

- Crude futures were lacklustre following yesterday's choppy performance but with price action contained amid light oil-specific newsflow and against the backdrop of ongoing geopolitical risks.

- Spot gold took a breather after rebounding yesterday as the dollar softened on a Trump trade fade.

- Copper futures pared some of the prior day's notable gains amid the mixed risk appetite and as participants await the potential fiscal stimulus announcement at the conclusion of the NPC Standing Committee session.

CRYPTO

- Bitcoin was rangebound and oscillated around the USD 76,000 level after recently surging to record highs.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong Monetary Authority cut its base rate by 25bps to 5.00%, as expected, in lockstep with the Fed.

- China's Ambassador to the US Xie Feng said there are no winners in tariff wars, trade wars, science and technology wars, and industrial wars, while he added that the Taiwan issue is the first red line that cannot be crossed in Sino-US relations and words must match deeds. Furthermore, he said no challenge can stop China’s progress and that any containment and suppression will only "hit a wall."

- Japanese Finance Minister Kato said they will closely monitor the impact of Trump policies on the Japanese economy, while he wouldn't comment on the FX level but reiterated it is important for currencies to move in a stable manner reflecting fundamentals and that they will take appropriate steps on excessive moves.

DATA RECAP

- Japanese All Household Spending MM (Sep) -1.3% vs. Exp. -0.7% (Prev. 2.0%)

- Japanese All Household Spending YY (Sep) -1.1% vs. Exp. -2.1% (Prev. -1.9%)

GEOPOLITICS

MIDDLE EAST

- Iranian Supreme Leader said Iran should put an end to Israel and make a sound decision on responding to its attack, according to Sky News Arabia.

- Israeli PM Netanyahu is aware of serious violence against Israeli citizens in Amsterdam and directed that two planes be sent immediately to assist citizens in Amsterdam after reports of Israeli football fans being attacked by assailants chanting 'Free Palestine'. Furthermore, Israel's Foreign Minister asked his Dutch counterpart to help get Israelis out safely following the security incident in Amsterdam.

- Israeli PM Netanyahu reportedly sent a message to the White House after he fired Gallant and noted he did not intend to fire the IDF chief, according to Walla News. However, senior officials in the Biden administration admitted it is not certain that they believe the promise but as a result, the administration is expected to extend the deadline for Israel to improve the situation in Gaza.

- Israeli occupation forces stormed the city of Dhahriya, south of Hebron in the West Bank, according to Al Jazeera.

OTHER

- Ukrainian President Zelenskiy said if no action is taken in response from allies, more troops from North Korea will be deployed, while he's not aware of any details of plans to end the war fast and did not discuss it with Trump.

- Russian President Putin in his speech congratulated Trump on winning the US elections and said the desire to restore relations with Russia and facilitate the end of the Ukrainian crisis deserves attention. Putin said he doesn’t think it is wrong to hold a call with Trump, while he is not against it if some world leaders seek to restore contact and said they are ready to speak to Trump. It was separately reported that Putin said they are ready to restore relations with the US but the ball is on the US' side.