By Ye Xie and Amy Li, Bloomberg Markets Live reporter and strategists

On Oct. 16, 2007, the Shanghai Composite Index hit a record high of 6,092. Exactly 16 years later, the benchmark closed 50% below that record. On Chinese social media, ridiculing the poor stock-market performance has become a national pastime.

Even the recent arrival of the National Team – state-backed entities such as a sovereign wealth fund and pension funds — did little to shore up sentiment. To be fair, though, their support has been half-hearted, at best.

Despite data showing the economy is stabilizing, the stock market has continued to trade poorly. The announcement that a sovereign wealth fund was buying bank stocks and reports that Beijing is considering a gigantic stabilization fund barely made any difference.

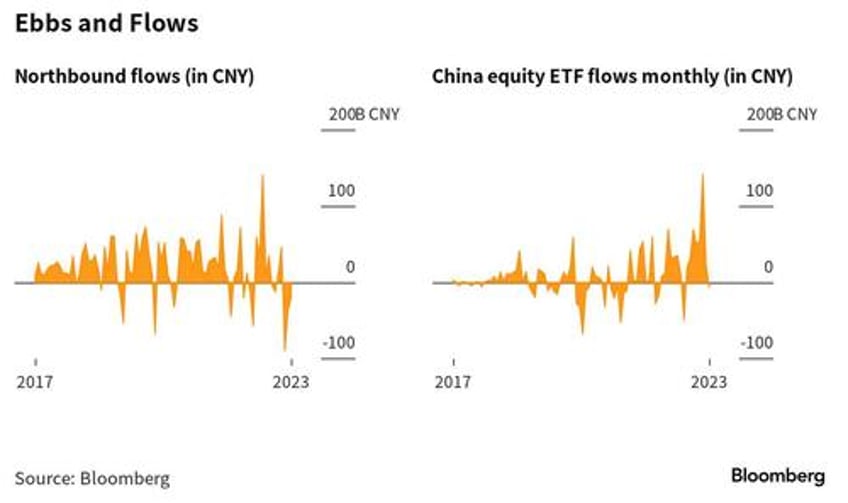

One headwind has been the relentless selling by foreign investors. They are on track to pull out from the northbound stock connect for a third consecutive month, which would mark the longest outflows since the Shenzhen and Hong Kong stock connection debuted in 2016. In August, a record 90 billion yuan ($12 billion) of funds flew out the door.

Coincidentally, August also saw a record inflow of 143 billion yuan into Chinese equity ETFs trading on the mainland. That was quite an unusual splurge, almost double the previous record.

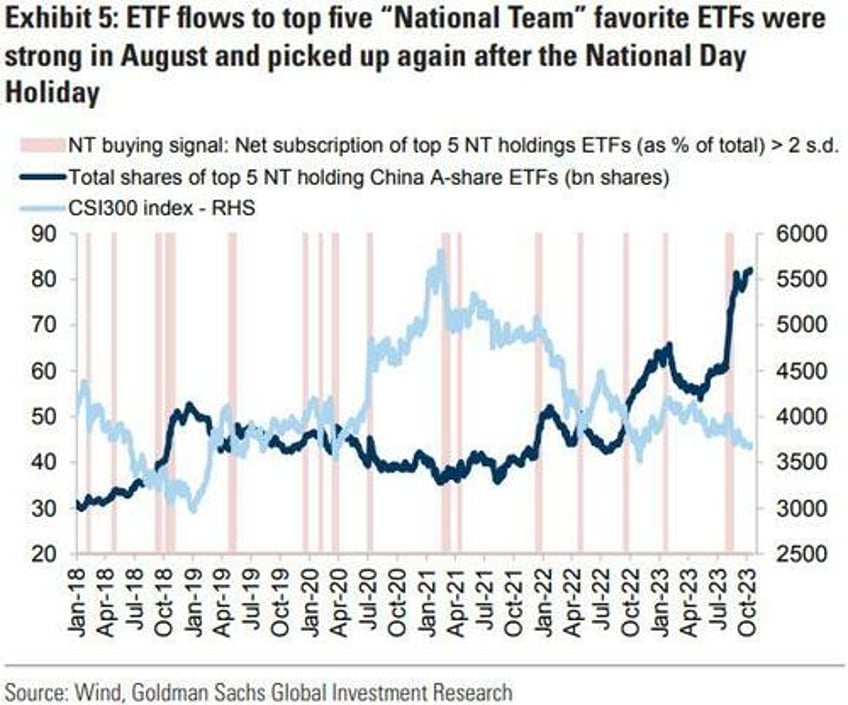

According to Goldman Sachs, the National Team — which collectively owns about 3.5% of the market value of local stocks — was largely behind the ETF purchases. The net inflows to the National Team’s top-five “favorite” ETFs surged by more than 90 billion yuan that month.

If that was the case, they have since become dormant. Investors added 23 billion yuan to ETFs in September, before withdrawing 6.5 billion yuan this month. If sustained, October would be only the second time on record when both ETFs and northbound connect registered net outflows.

It seems to suggest that support from the National Team was rather opportunistic and lukewarm. It steps in only when foreign outflows become sizable.