After last month's shocking retail sales surge, which erupted by a whopping 0.6% MoM (smashing the exp. +0.1%) and up for the 5th month in a row which not even the most optimistic Wall Street bulls had anticipated, expectations have been for a sharp slowdown in spending, especially now that households with a "higher education" have to set aside hundreds of dollars in what would previously have been discretionary spending toward student loan repayment.

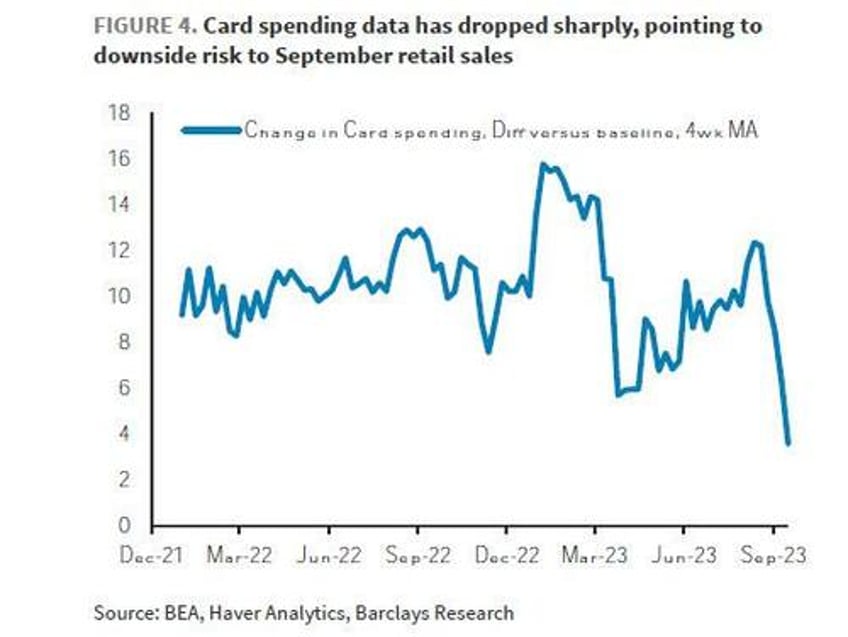

And indeed, as we reported two weeks ago, according to the latest card data from the major US banks, credit card spending had fallen off a cliff as both the following Barclays...