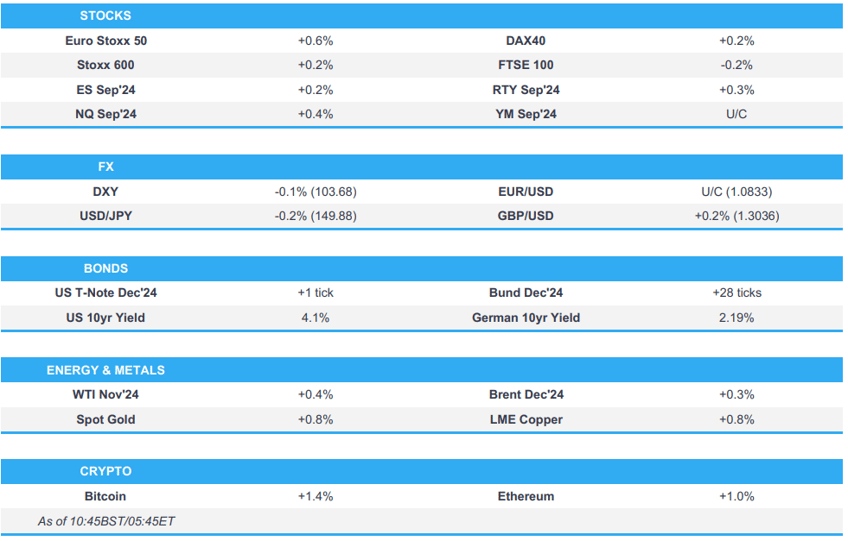

- European bourses mixed/firmer given China tailwinds; NQ +0.5%, driven by NFLX +5%

- USD is broadly softer vs peers, GBP outperforms after Retail data, Antipodeans benefit from China data & PBoC musings

- Fixed benchmarks relatively contained, Gilts initially hit on data while EGBs & USTs attempt to move higher

- Choppy trade for Crude into a weekend of potential geopolitical risk. Metals glean support from China

- Chinese sentiment was eventually lifted after comments from PBoC Governor Pan who reiterated that they could cut RRR further this year and noted expectations for a 20bps-25bps reduction in the Loan Prime Rates on Monday.

- Looking ahead, highlights include US Building Permits, Comments from Fed’s Bostic, Kashkari & Waller, Earnings from Regions Financial, Fifth Third Bancorp, Procter & Gamble, American Express.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

EUROPEAN TRADE

EQUITIES

- European bourses began the session mostly lower but this quickly began more of a mixed picture, Euro Stoxx 50 +0.5%; main theme is China strength which has driven strength in Autos, Basic Resources & Luxury names.

- FTSE 100 -0.2% is the modest laggard following stronger-than-expected Retail Sales which prompted strength in Sterling and weighed on exporters.

- Stateside, futures are in the green in relatively quiet trade, ES +0.2%; NQ +0.5% outperforms given Netflix +5% in pre-market trade after their earnings which topped estimates, driven by a 35% increase in ad-tier memberships.

- Apple (AAPL) iPhone 16 sales reportedly up 20% compared to iPhone 15, via Bloomberg; Pro & Pro Max sales +44% Y/Y

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly softer against peers, following the data driven gains seen on Thursday. DXY within yesterday's range and capped by that session's high which coincides with the 200-DMA at 103.78.

- EUR is marginally firmer, unreactive to a handful of ECB speakers and the latest SPF findings. Nearing the 1.0850 mark, shy of Thursday's 1.0873 best.

- GBP outperforms, following stronger retail metrics this morning. Though, the release doesn't really change the narrative of BoE cuts being more likely than not at the next few meetings. Insight potentially comes via Bailey next week. Cable hit a 1.3071 peak, but has since faded to 1.3050.

- USD/JPY briefly eclipsed 150.00 following firmer-than-expected Japanese CPI metrics overnight; currently towards the mid-point of 149.78-15028 parameters.

- Yuan firmer followed extensive PBoC commentary overnight and as it digests a raft of data with GDP and Retail numbers supporting; Antipodeans bid as such.

- PBoC set USD/CNY mid-point at 7.1274 vs exp. 7.1267 (prev. 7.1220).

- RBI has reportedly been supporting the INR in today's session, according to Reuters citing traders.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- EGBs are essentially unchanged; Bunds came under modest pressure alongside the complex broadly after hawkish UK retail data and as the PBoC-driven China tailwinds reverberated into Europe.

- Bunds around the 134.00 mark, resistance at 134.17 from Thursday with the WTD high thereafter at 134.25.

- Gilts gapped lower by 10 ticks at the opening following strong retail data. A move which was modest in nature though and has proved to be short lived. Down to 97.27 at worst, but back to near unchanged and the 97.45 high, a point which is still someway off yesterday’s 97.96 best.

- USTs are in-fitting with EGBs/Gilts, pivoting the unchanged mark in a slim range into data and Fed speak. Yields are mixed but with overall action modest as the curve steepens a touch.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have been choppy in the European morning, going into a weekend of potential geopolitical risk following the death of the Hamas leader Sinwar. Benchmarks in a narrow sub-1/bbl range with gains of around USD 0.30/bbl each.

- Precious metals are bolstered, tailwinds coming from ongoing geopolitical risk and performance of China overnight. XAU remains above the USD 2.7k/oz mark, at a USD 2714/oz peak.

- Base metals also in the green, following the mentioned China developments where the PBoC Governor flagging a further cut to RRR and reductions to the LPR.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Retail Sales MM (Sep) 0.3% vs. Exp. -0.3% (Prev. 1.0%); Ex-Fuel MM 0.3% vs. Exp. -0.3% (Prev. 1.1%)

- UK Retail Sales YY (Sep) 3.9% vs. Exp. 3.2% (Prev. 2.5%, Rev. 2.3%); Ex-Fuel YY 4.0% vs. Exp. 3.2% (Prev. 2.3%, Rev. 2.2%)

- EU Current Account SA, EUR (Aug) 31.49B (Prev. 39.6B)

NOTABLE EUROPEAN HEADLINES

- BoE's Woods proposed allowing bonus vesting on a pro-rata basis after year one moving to a five-year bonus deferral period for senior bank managers, while he said proposals will support growth without undermining financial stability.

- Some large UK-based pension funds warned that being forced to invest in the UK would be ‘huge mistake’ which could reduce payouts to pensioners, according to FT.

ECB

- ECB's Vasle says there is no pre-commitment regarding the ECB's next steps, and that inflation would be back to 2% at sometime next year, according to Econostream.

- ECB's Muller says inflation will settle around the 2% mark, risks around services and wages remain. Near-term economic outlook hasn't changed significantly, growth to be more modest.

- ECB's Villeroy says "we have total optionality" for the upcoming meetings. Risk of durably undershooting on inflation is now as big as overshooting it.

- Some ECB governors at this week's meeting wanted to drop the pledge to keep policy tight, according to Reuters sources; view was based on the judgement that inflation could turn out to be lower than anticipated just a few weeks ago.- ECB SPF - Inflation: 2025 seen at 1.9% vs. prev. view of 2.0%, 2026 forecast remains at 1.9%. Growth: 2025 GDP forecast lowered to 1.2% from 1.3%, 2026 projection left at 1.4%.

- ECB Bulletin: "Main findings from the ECB’s recent contacts with non‑financial companies"; Contacts did not anticipate much change to the overall subdued growth dynamic in the short term

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu met with his security team at the PM office and later confirmed the death of Hamas leader Sinwar, while he added that Israel’s task is not complete and the war is not over with Israel to continue full force until its hostages are returned.

- White House said US President Biden and Israeli PM Netanyahu discussed how to exploit the Hamas leader Sinwar's death to bring hostages home and end the war, while they agreed to stay in close contact over the coming days.

- US Defense Secretary Austin said the death of Hamas head Sinwar provides an extraordinary opportunity to achieve a lasting ceasefire, while it also provides an opportunity to end the war, rush in more humanitarian assistance in Gaza, as well as bring relief and hope to Palestinians.

- US is to try and push a Gaza ceasefire proposal forward, while there have been no negotiations for a Gaza ceasefire for the past few weeks.

- US Secretary of State Blinken told Israeli President Herzog he is expected to arrive in the coming days in the region to discuss a ceasefire deal, according to Kann News.

- US sources cited by CNN noted that Washington still believes that the Israeli response to Iran may happen within days.

- Israel told mediators that it is open to ideas that could be put forward for a Gaza deal, according to Al Arabiya.

- Hezbollah said it is moving to a new and escalating phase in the confrontation with Israel.

- Speaker of the Iranian parliament told French newspaper Le Figaro that Tehran is ready to negotiate with Paris for a ceasefire in Lebanon, according to Sky News Arabia.

OTHER

- Russia is to test the combat readiness of one of its strategic nuclear missiles units, according to RIA.

- North Korean leader Kim said South Korea is an apparent hostile country, while he added that the changed nature of the South Korea-US alliance and different military manoeuvres highlight the importance of a stronger North Korean nuclear deterrent, according to KCNA.

CRYPTO

- Firmer, Bitcoin above the USD 68k mark at best alongside the generally constructive risk tone and continued focus on the 'Trump trade'; most recently, BTC has slipped marginally back below that level.

APAC TRADE

- APAC stocks followed suit to the mixed performance stateside as the region digested further support measures from the PBoC and a slew of Chinese data including mixed Q3 GDP, better-than-expected activity data and a further decline in House Prices. ASX 200 pulled back from recent record highs with Utilities, Consumer Discretionary and Tech leading the downturn seen across nearly all sectors. Nikkei 225 was indecisive around the 39,000 level with the upside capped following firmer-than-expected inflation. Hang Seng and Shanghai Comp outperformed but with gyrations seen as participants reflected on the slew of key data from China and with the large banks reducing interest rates on deposits by 25bps. However, sentiment was eventually lifted after comments from PBoC Governor Pan who reiterated that they could cut RRR further this year and noted expectations for a 20bps-25bps reduction in the Loan Prime Rates on Monday. Furthermore, it was initially reported that Pan announced the 7-day reverse repo rates would be lowered by 20bps and the interest rate on the Medium-term Lending Facility could be reduced by 30bps depending on market liquidity, although a major newswire later corrected this headline to state that Pan actually commented that the 7-day reverse repo rates and medium-term lending rates had already been lowered by 20bps and 30bps, respectively.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor Pan reiterated that they may further lower RRR this year by 25bps-50bps based on market liquidity and the LPR is expected to drop by 20bps-25bps on Monday, while it was initially reported that Pan said the 7-day reverse repo rates will be lowered by 20bps and the interest rate on Medium-term Lending Facility could be reduced by 30bps depending on market liquidity, although this was later corrected by a major newswire to state that Pan said the 7-day reverse repo rates and medium-term lending rates had already been lowered by 20bps and 30bps, respectively. Furthermore, the PBoC launched its Securities, Funds and Insurance companies Swap Facility operation in which the First batch of SFISF quotas exceeded CNY 200bln.

- PBoC, NFRA and CSRC held a meeting with major financial institutions on the implementation of incremental financial policies on October 16th, while the PBoC emphasised increasing support for financing small firms and implementing the swap facility. It was also reported that large Chinese banks lowered interest rates on CNY fixed-rate deposits by 25bps.

- China's financial regulator said financial institutions will be guided to continue increasing financial supply and fully support the economic recovery, while banks will be guided to cooperate in the extension, restructuring, and replacement of hidden debts, actively supporting efforts to resolve local government debt risks. There were also comments from the CSRC chairman that China is cracking down on illegal share reductions by shareholders and the CSRC has forced them to take responsibility and buy back shares, while they will further deepen reforms in capital market investment and financing.

- China stats bureau deputy chief says September economic indicators showed positive changes and China's foreign trade situation this year is better than expected but added that the foundation for the economic recovery is not solid yet. The official stated the implementation of a basket of policy measures will be sped up and optimism about the prospects of the property sector has increased after recent policy measures.

- IMF's Georgieva said China’s stimulus measures are in the right direction, but structural reforms are needed to drive domestic consumption, while she added that China should not rely on some miracle that would allow exports to keep driving growth given its massive size. Furthermore, she said China faces trouble if it tries to stick to an export-led growth model, with more trade tensions and slower growth, as well as warned that a failure to shift the economic model toward consumption risks medium-term annual growth falling below 4%.

- Japanese top currency diplomat Mimura said closely watching FX moves with a high sense of urgency and recent yen moves are somewhat rapid and one-sided, while excess volatility in the FX market is undesirable.

- BoJ Governor Ueda says Japan's economy is recovering moderately; likely to continue growing above potential; Financial markets remain unstable. Financial systems remain stable as a whole.

- Japan's largest labour union will seek wake hikes of at least 5% in 2025.

DATA RECAP

- Chinese GDP QQ (Q3) 0.9% vs. Exp. 1.0% (Prev. 0.7%); YY (Q3) 4.6% vs. Exp. 4.5% (Prev. 4.7%)

- Chinese Industrial Output YY (Sep) 5.4% vs. Exp. 4.5% (Prev. 4.5%)

- Chinese Retail Sales YY (Sep) 3.2% vs. Exp. 2.5% (Prev. 2.1%)

- Chinese China House Prices YY (Sep) -5.8% (Prev. -5.3%)

- Japanese National CPI YY (Sep) 2.5% vs. Exp. 2.4% (Prev. 3.0%); CPI Ex. Fresh Food YY (Sep) 2.4% vs. Exp. 2.3% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Sep) 2.1% vs. Exp. 2.0% (Prev. 2.0%)