Chip stocks tumbled pre-market, led by shares of Nvidia, after a US official confirmed that exports of the company's A800 and H800 chips will be restricted for sale to China, Bloomberg reports. The chips were specifically created for export to China following restrictions introduced by the Biden administration in October of 2022.

The rules restrict exports of chips to foreign arms of companies headquartered in China, Macau and other regions - however chips designed for consumer applications such as gaming, smartphones or laptops are not subject to the requirement.

According to report, the US Treasury Secretary, Commerce Secretary and National Security Advisor all notified China that the update to the Oct 2022 rule on chips and chip tools would impact exports of said newer chips.

The new rules also require companies to notify the US government before selling chips that fall below the controlled threshold, as Bloomberg reported earlier. Top-of-the-line chips are best for powering artificial intelligence models, a senior administration official said. But with a lot of money and a little jury-rigging, a whole class of slightly inferior chips could also be used for AI and supercomputing and therefore pose a national security risk, the official said.

The US wants to monitor that so-called gray zone activity, the official added, while declining to comment on the specific parameters of which chips will be affected. The administration will review company notifications within 25 days, the official said, to determine whether firms need a license to sell those chips to China. -Bloomberg

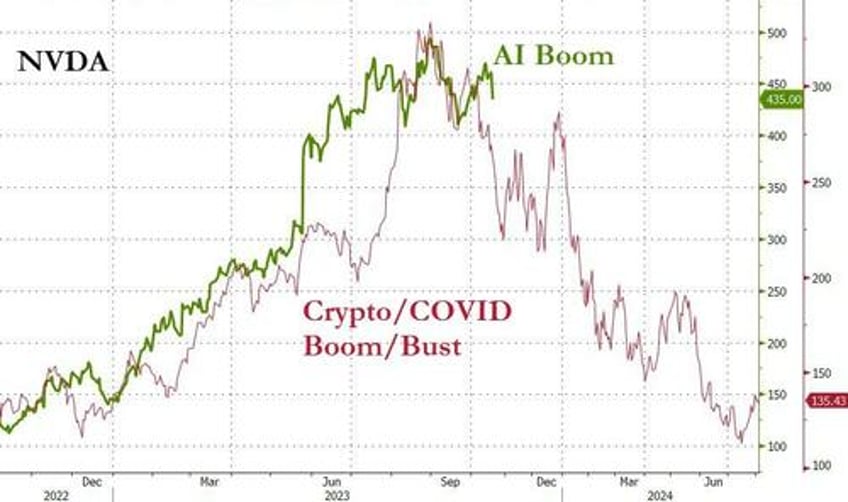

NVidia was down as much as 12% pre-market following the announcement, and as much as 7.2% during regular trade.

"It’s difficult to draw a bright line between military and commercial technology," said US Commerce Secretary Gina Raimondo ahead of the decision. "There are often dual-use technologies — and the same technologies that fuel commercial exchange, unfortunately, sometimes can also allow our competitors to modernize their military, surveil their citizens and solidify oppression."

Semis are not happy in general:

Will history rhyme?

As we noted on Friday, Reuters reported that the Biden administration was targeting a loophole that has allowed developers in China to purchase chips from the infamous Huaqiangbei electronics area in Shenzhen, a city in southern China.

The sources reportedly claim that the additional rules on AI chips will come out this month and will apply restrictions previously applied only to the U.S.’s top players like Nvidia and AMD but more broadly to all companies producing similar materials in the market.

Over the summer, the U.S. government applied additional rules to its largest chip makers, including Nvidia, which currently leads the market in chip manufacturing. It asked the companies to curb exports of their high-level semiconductor chips to “some” Middle Eastern countries, among other small details.

The majority of Nvidia’s revenue comes from the U.S., China and Taiwan, while less than 14% comes from all other countries combined.

Reuters' sources have said that the Biden administration is also trying to troubleshoot a loophole that allows Chinese parties access to U.S. cloud service providers like Amazon Web Services (AWS). According to the report, those solutions seem “less clear.”

In July, U.S. officials reportedly began their considerations on restrictions on access to cloud computing services such as AWS by Chinese companies in an effort to safeguard the country’s advanced technology.

The U.S. implemented its initial export controls on its most powerful semiconductor chip technology in October 2022.

On Monday, Chinese Foreign Ministry spokeswoman Mao Ning said during a regular press briefing in Beijing that China opposed "the US politicizing, instrumentalizing and weaponizing trade and tech issues."