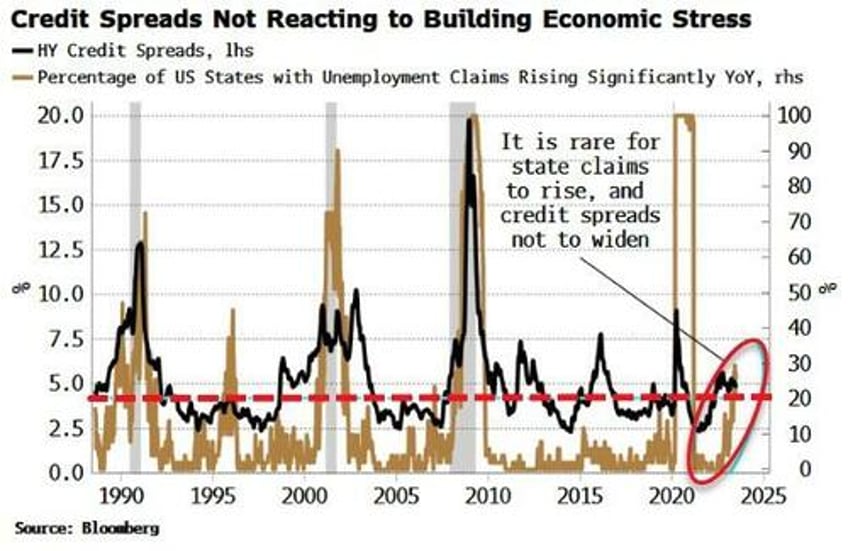

A pervasive deterioration in unemployment claims across US states continues to show economic weakness is bubbling under the surface, while being inconsistent with credit spreads that continue to idle.

Claims data was released yesterday and came in slightly lower than expected, reflecting a fall in WARN notices, while continuing claims were to the upside.

Nonetheless, the greatest leading information content comes not from the headline claims and continuing claims data, but what is happening at a state level.

On this basis, claims over the last 6-8 weeks have been consistent with an oncoming recession. The percentage of states showing a significant rise in claims fell again this week, but still remains above the recession threshold. The same metric for continuing claims remains near its recent highs, and significantly above its recession threshold.

A recession might be less severe than initially expected, but it is still on its way, quite possibly very soon.

What is becoming increasingly glaring is the subdued behavior of credit spreads. Rising state claims typically precede wider credit spreads. Firms try to hold on to labor as long as possible when the economy is weakening, but this stresses cash flows and thus causes spreads to widen. Labor hoarding has been a notable feature of this cycle, so it’s possible the underlying stresses that are building are greater than normal.

Credit spreads’ lack of response to underlying economic weakness is jarring.

Private credit has grown significantly in size in recent years and may be delaying the usual mechanisms of price discovery.

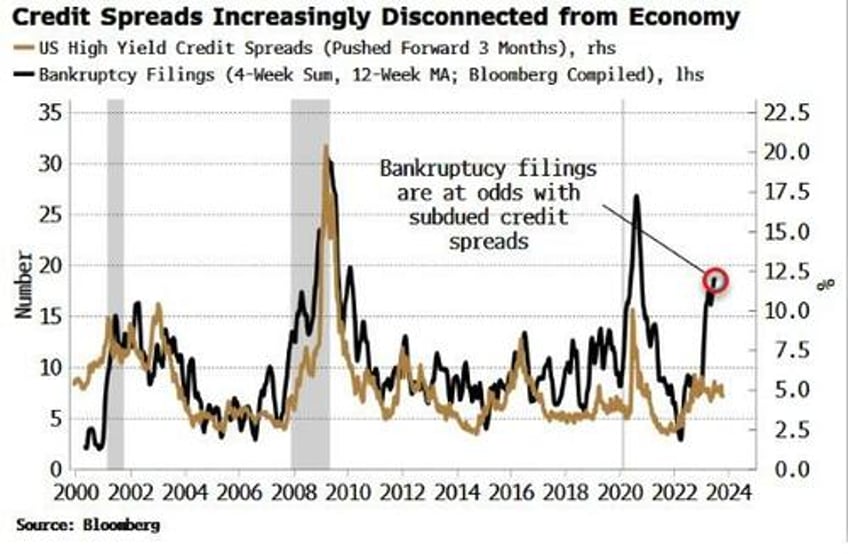

A rise in bankruptcy filings is also at odds with credit spreads where they are. Spreads thus look prone to an abrupt widening as they catch up to fundamentals.

The big, unanswered question is will the fallout in credit be enough to turn what currently looks like a recession on the milder side, into something more serious? Keeping an eye on the labor and credit markets will be key to monitoring this risk.