Inflation expectations among consumers polled in December by the New York Fed unexpectedly jumped at the 3-Year horizon, rising from 2.6% to 3.0%, the highest since 2023; the increase at the three-year horizon was broad-based across age, education, and income groups. At the same time, median 5-year inflation expectations declined to 2.7% from 2.9%, the lowest since March 2024. However, the decline at the five-year point was driven by respondents below age 40 and was most pronounced for those with a high-school education or less (who, we have learned lately, tend to be much more accurate about pretty much everything than their college educated peers). Inflation expectations also rose modestly at the 1-year horizon, where they increased from just below 3.0% to just above. The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) was unchanged at the one-year horizon, increased at the three-year horizon, and decreased at the five-year horizon. Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—increased at the one- and three-year horizons and declined at the five-year horizon.

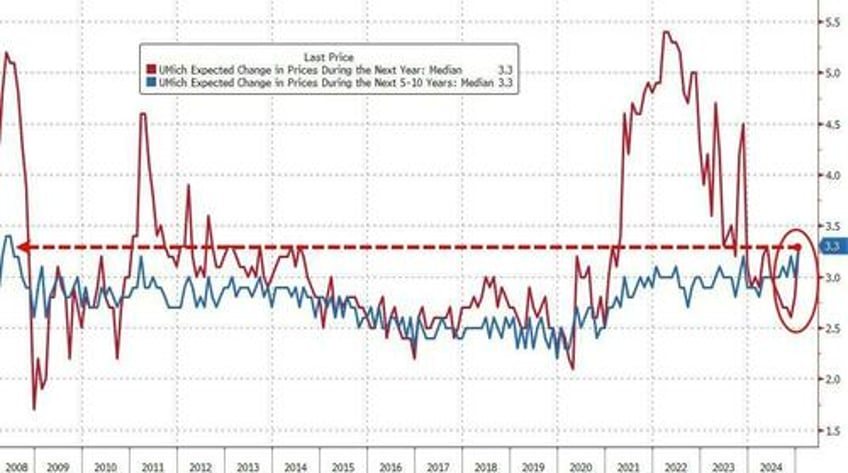

The findings follow the release of prelim results of the latest U of Michigan survey published Friday, which showed long-term inflation expectations, five to 10 years ahead, jumped this month to the highest since 2008 on concerns about potential tariffs from the incoming Trump administration. They also showed consumers see prices rising 3.3% over the next year, up half a percentage point from December’s survey.

The surge in inflation expectations comes as investors sharply scaled back recent bets on Fed rate cuts and the yields on benchmark 10-year Treasury notes have risen to the highest in over a year as inflation worries have seeped into financial markets. The surveys indicate households also remain uncertain about the central bank’s ability to return inflation to its target in the near term. Monthly data on consumer prices are due Wednesday from the Bureau of Labor Statistics.

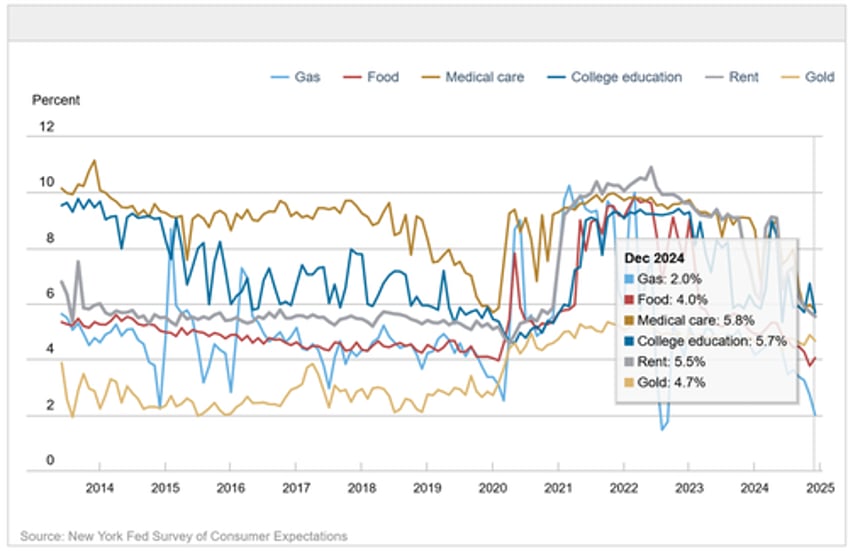

Year-ahead commodity price expectations for food increased by 0.2% point to 4.0%, while price expectations for other commodities declined. Year-ahead price expectations fell by 0.7% for gas to 2.0% (the lowest reading since September 2022) - good luck with that now that BIden has unleashed a barrage of Russian sanctions that will send oil prices soaring - by 1% point for the cost of college education to 5.7%, by 0.2% for the cost of medical care to 5.8%, and by 0.2 percentage point for rent to 5.5%.

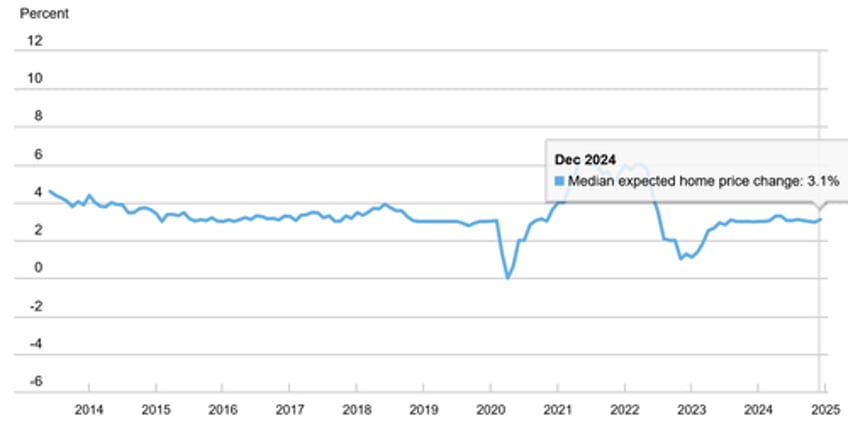

Median home price growth expectations increased by 0.1 percentage point to 3.1%. The series has held in a range from 3.0 to 3.3% since August 2023.

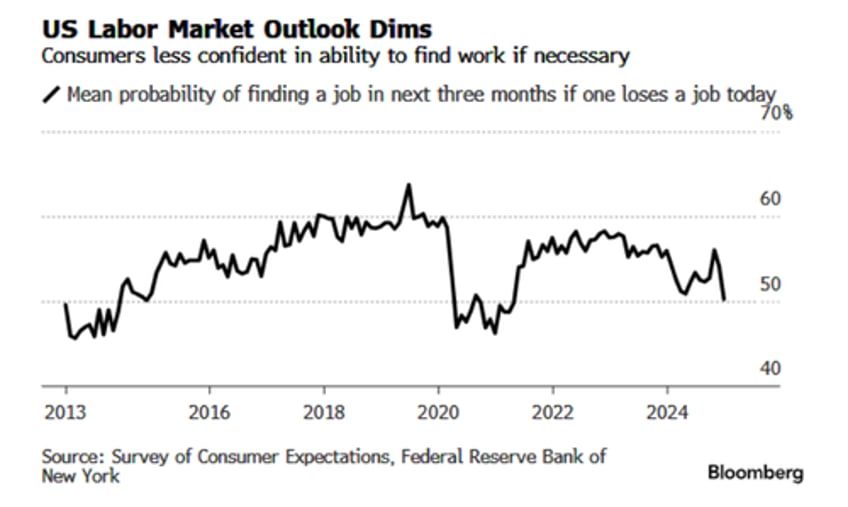

Separately, the New York Fed report showed mixed sentiment on the labor market: While the perceived likelihood of job loss fell, the chances of leaving one’s job voluntarily also declined (as the recent plunge in the JOLTS Quits data set showed) and the perceived chances of finding a new position in the event of job loss fell to 50.2%, the lowest level since April 2021, hardly a ringing endorsement of the validity of Friday's "red hot" jobs report, which as we will learn in a few months, was complete fake news.

There was more bad news: among other labor market indicators, the NY Fed revealed that median one-year-ahead expected earnings growth decreased by 0.2 percentage point to 2.8%. At the same time, the mean perceived probability of losing one’s job in the next 12 months declined by 1.6 percentage points to 11.9%. The mean probability of leaving one’s job voluntarily in the next 12 months also declined by 2.0 percentage points to 18.2%. Both readings are the lowest since January 2024. The declines were most pronounced for the respondents with some college education and those with annual household incomes below $50,000.

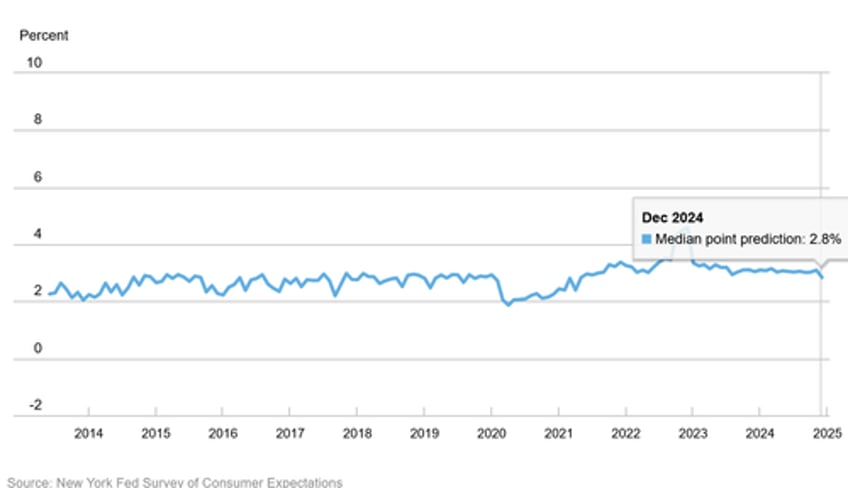

Turning to household finance, there was more weakness here too: the median expected growth in household income declined by 0.3% point to 2.8%, the lowest reading since May 2021. The series remains slightly above the pre-pandemic level of 2.7% from February 2020.

Meanwhile, median household spending growth expectations increased by 0.1 percentage point to 4.8%, remaining well above pre-pandemic levels.

Here are some more observations on the Household Finance part of the survey:

- Perceptions of credit access compared to a year ago deteriorated, with a larger share of respondents reporting tighter conditions. Expectations about credit access a year from now also deteriorated, with a smaller share of respondents expecting looser credit and a larger share expecting tighter credit a year from now.

- The median expected year-ahead change in taxes at current income level decreased by 0.4 percentage point to 3.0%, its lowest reading since October 2020.

- Median year-ahead expected growth in government debt declined by 0.3 percentage point to 5.9%, reaching the lowest level since January 2018 (good luck with that).

- The mean perceived probability that the average interest rate on saving accounts will be higher 12 months from now decreased by 1.5 percentage points to 25.2%.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now declined by 0.6 percentage point to 39.8%.

Finally, consumers are also growing more concerned about their ability to keep up with debt payments, according to the survey results. The perceived odds of missing a minimum debt payment over the next three months rose to 14.2%, matching the highest reading since April 2020. Those earning more than $100,000 reported the highest probability of missing a payment in more than 10 years.

Overall, consumer sentiment is becoming increasingly stagflationary as inflation refuses to drop (and remains sticky) while most other economic reading are starting to deteriorate: slowly at first, then all of a sudden...