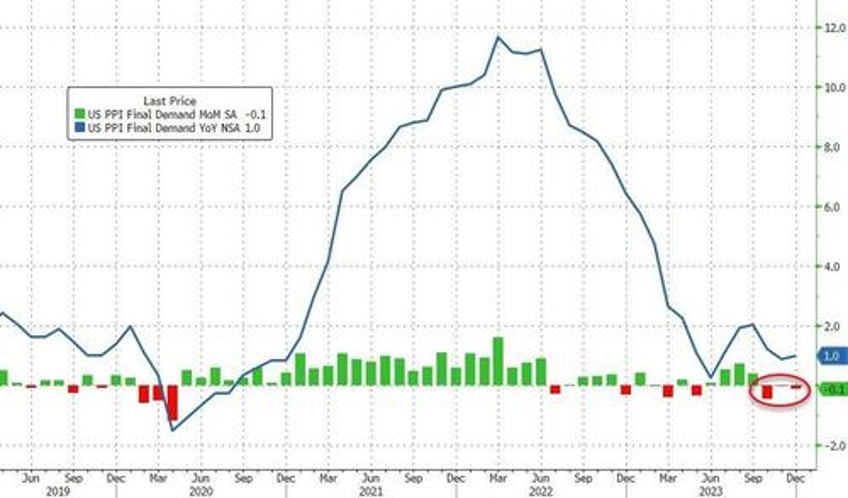

Following yesterday's hotter-than-expected CPI, this morning's Producer Price Index was expected to accelerate (headline not core). However, it did not - headline PPI actually decline 0.1% MoM (+0.1% MoM exp). That is the 3rd straight month of 'deflation' but inched PPI YoY up to +1.0%

Source: Bloomberg

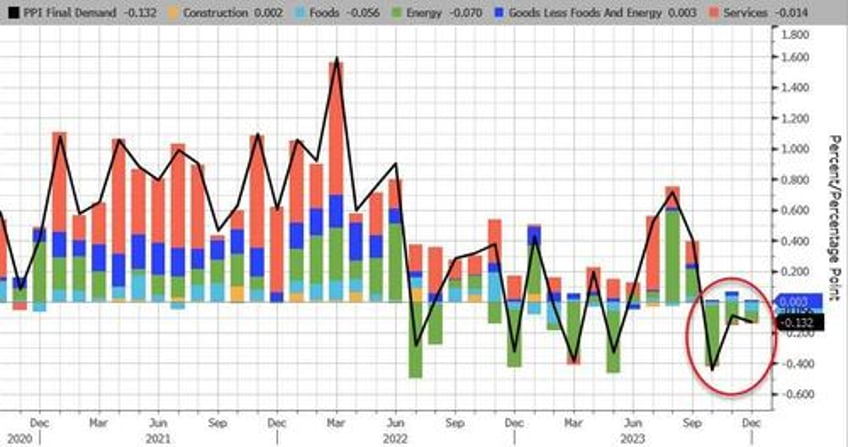

Energy and Construction cost deflation dominated the headline PPI MoM decline...

Source: Bloomberg

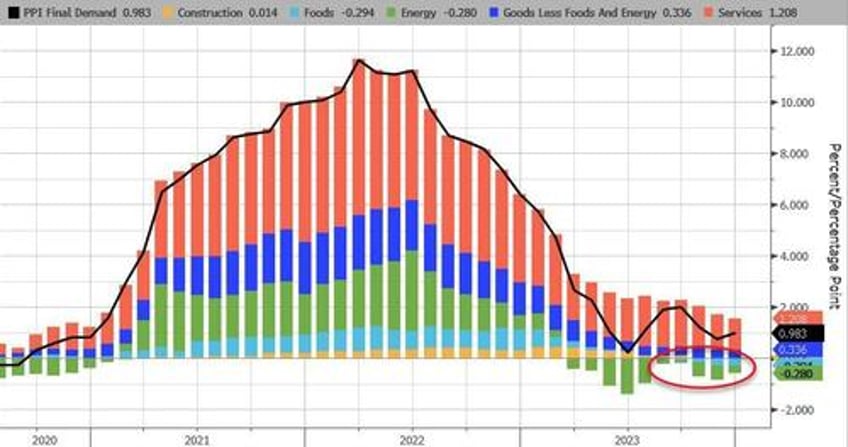

Energy and Food deflation dominated the slowing of the YoY PPI (though Services is re-accelerating)...

Source: Bloomberg

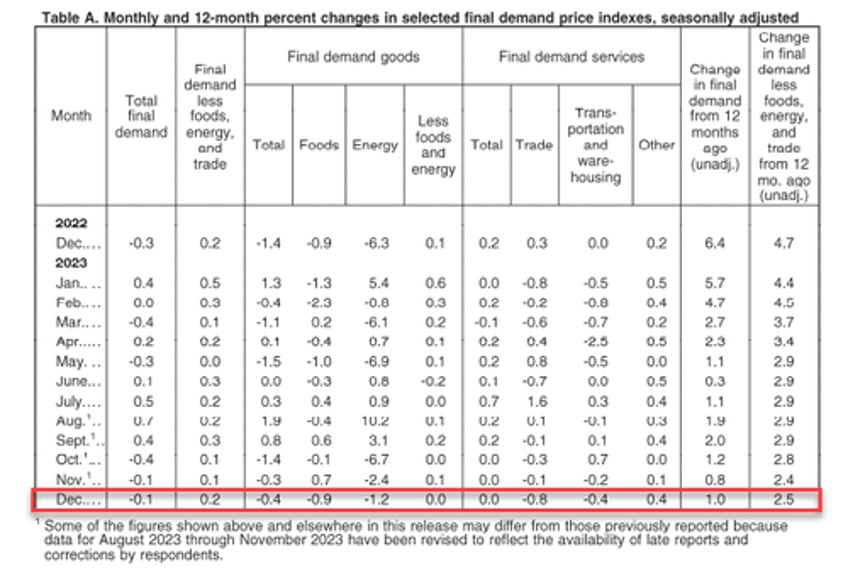

Excluding food and energy, the core PPI was unchanged MoM in December - the third month of unchanged in a row, which dfragged the Core PPI YoY down to +1.8% (the lowest since Dec 2020)...

Source: Bloomberg

Goods PPI deflated and Services was unchanged...

Half of the decrease in the index for final demand goods is attributable to prices for diesel fuel, which dropped 12.4%

Over 80% of the decrease in the index for unprocessed goods for intermediate demand can be attributed to a 13.2% drop in prices for crude petroleum.

Reminder, disinflation does not mean lower prices. Core producer prices are up 16.9% since President Biden came into office (and headline PPI up over 18%)...

Source: Bloomberg

Finally, the deflationary impulse remains for the headline PPI as 'intermediate PPI' remains below zero BUT it is starting to accelerate higher...

Source: Bloomberg

That's a little worrying given The Fed seems adamant it wants to cut in March to save the banking system from collapse.