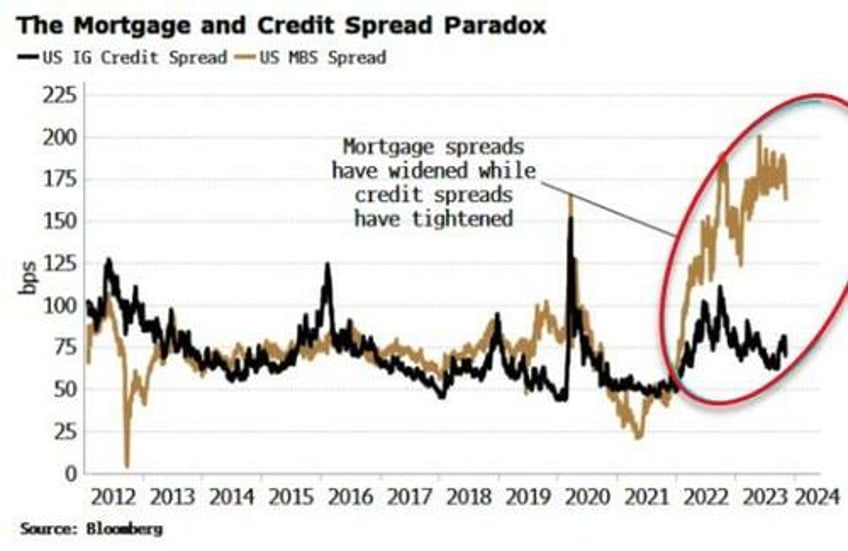

The growing divergence between mortgage and credit spreads is highly unusual and counter-intuitive: it’s not obvious why corporates should be getting less risky and mortgages more when rates have risen for everybody. It turns out the ultimate cause is inflation.

It has been said that anyone who says they understand quantum mechanics doesn’t understand quantum mechanics. That applies equally to markets. Just when you think you have a handle on things, a new head-scratcher pops up.

A current one is the growing divergence between spreads on mortgage-backed securities (MBS) and credit spreads. In recent years they have moved relatively closely together, but when the Fed is raising rates, credit tends to tighten across the board, and all risk spreads widen. However, in this cycle MBS spreads have blown out to GFC-wides while investment-grade credit spreads have been trending down.

What gives? To answer the question requires touching on several different markets – credit, mortgages, equity, fixed-income and volatility. Doing so will illuminate the connections between them to better understand the current backdrop, and why elevated inflation is the ultimate cause of this anomaly. It will also give us clues about what to look for when the mortgage-credit divergence is about to correct.

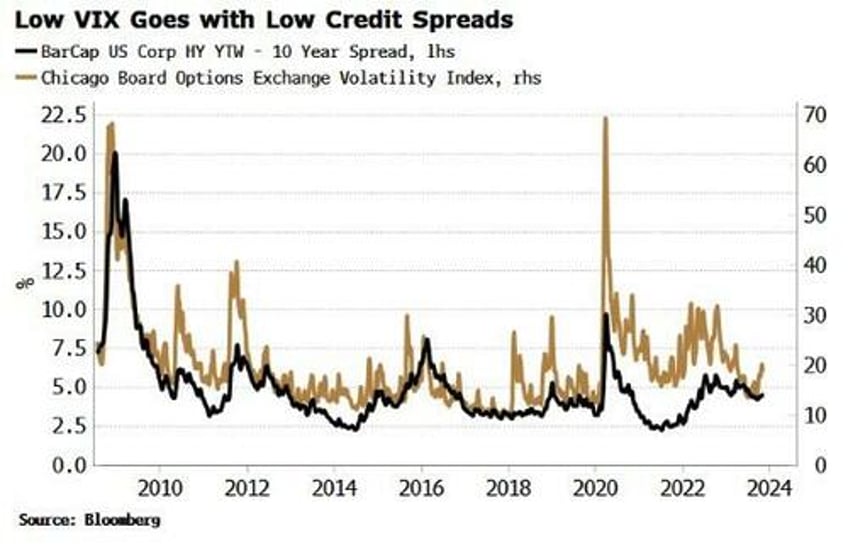

So first we have to answer why credit spreads have remained contained, given rapid Fed rate increases and mounting signs of underlying credit stress? A principal driver has been the relatively depressed value of the VIX.

Implied volatility, which the VIX is a measure of, is a direct input to models of how likely firms are to default. Credit spreads and the VIX typically move very closely together.

In turn, the VIX has been repressed for at least three reasons.

I have discussed two of them previously: low implied correlation and a rise in call option speculation.

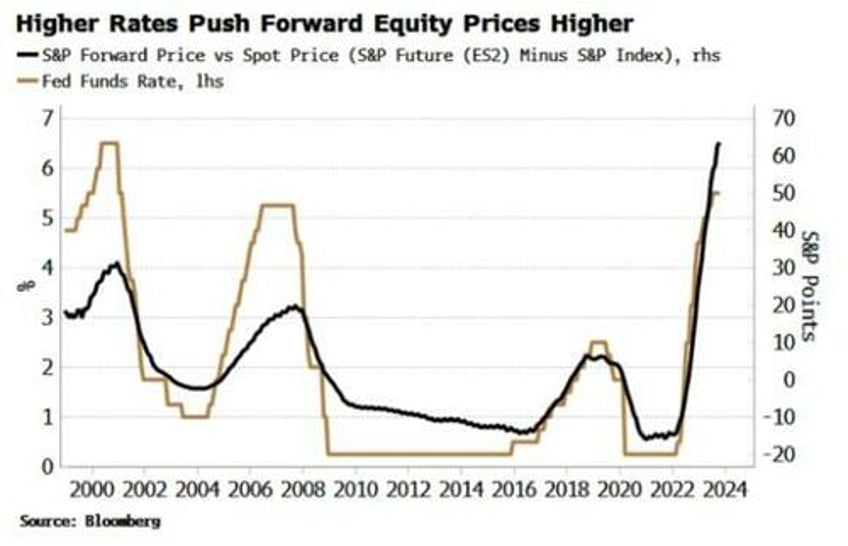

The third reason is the elevated level of forward rates of equity indexes.

The forward price has to take into account the carry cost of financing the position. As interest rates move higher, the cost of financing the position increases and this is reflected in higher forward prices. The current rate-hiking cycle has taken the spread between the second mini S&P future (i.e. the forward price of the S&P one to two quarters ahead) and the spot price of the S&P to at least 25-year highs.

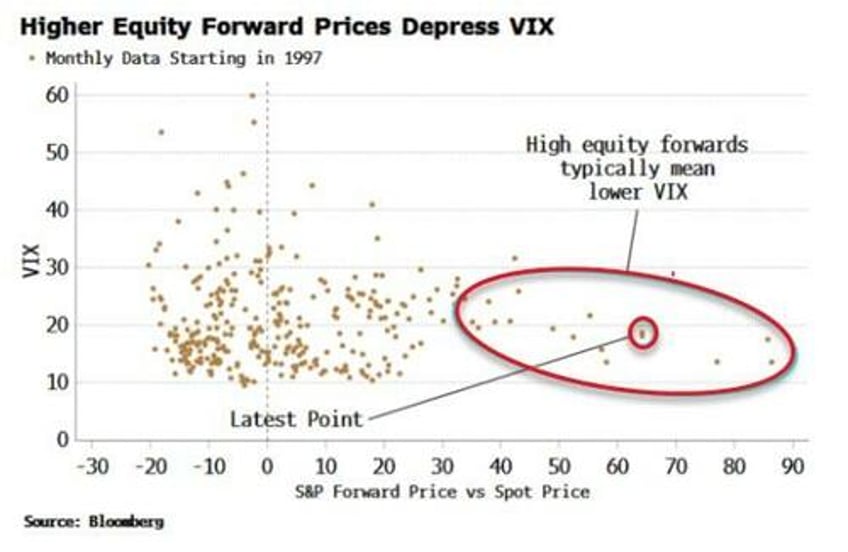

Where does the VIX come in? Options are priced not off the spot rate, but off the forward rate at the time of option’s expiry. Therefore a higher forward price has the effect of cheapening put prices and increasing call prices.

The VIX is an average of all options with an ~1-month expiry, but as downside protection tends to cost more, and a greater number of the puts outstanding are typically more out-of-the-money than calls outstanding (investors prefer to protect against larger price declines), this means higher forward prices keep a lid on the VIX.

Thus forward prices are helping to keep credit spreads in check, but it is also forward prices, this time for bond yields, that are part of the reason why the spreads on newly-issued MBS have blown out.

MBS spreads are the spread between US bond yields and mortgage bonds issued or guaranteed by government-sponsored agencies - Freddie Mac, Fannie Mae and Ginnie Mae. Given MBS and government bonds are both de facto guaranteed by the US Treasury, you might think the spread should be quite narrow, not the ~150 bps it currently trades at.

The reason is pre-payment risk.

Borrowers can typically pre-pay their mortgage at any point with no penalty, which means MBS holders may see some of their principal repaid early. As this is more likely to happen when rates are falling, which means cash returned can only be invested at a lower level, MBS spreads reflect this extra risk.

But MBS spreads have been widening even as rates have been rising. There are two reasons for this, as Harley Bassman describes in his latest Convexity Maven letter: an inverted yield curve and high fixed-income volatility. As Bassman explains, an MBS can be approximated by buying a 10-year bond and selling an out-of-the-money call option on it with a three-year expiry.

A flat or inverted yield curve means forward yields are lower, which in turn increases the price of the call option, and therefore depresses the price of the bond-option package, i.e. flatter yield curves will, all other things equal, reduce the price of MBSs.

Essentially, the call option captures the cost of the prepayment risk, and the lower forward price means a higher chance of prepayment.

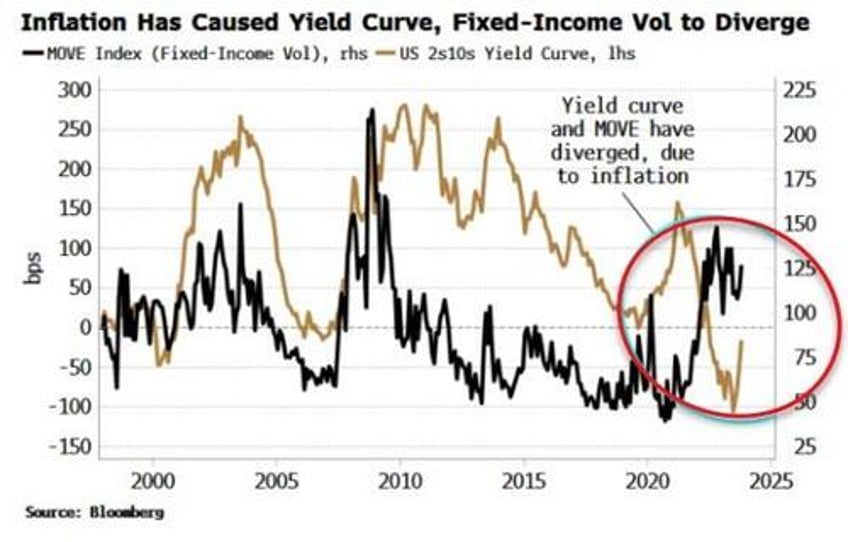

Cheapening MBS further is elevated fixed-income volatility, captured by the MOVE index.

Higher volatility means there is a greater chance of bigger moves in yield, and more so to the downside given the skew in bond options. That risk must be compensated for and is reflected in lower MBS prices and thus wider MBS spreads.

One last piece of the puzzle is why fixed-income vol has risen so much. Normally flat and inverted yield curves limit FI vol as there are fewer potential paths long-term rates can take to converge to short-term rates (as they eventually must do).

But this time FI vol has diverged from the yield curve.

The difference is inflation. The most elevated price growth since the 1980s has added more uncertainty to the path of rates, raising volatility.

Thus all roads lead back to inflation. It was inflation that led the Federal Reserve to hike rates, which raised equity forward prices, helping to depress the VIX. It was also higher rates that took the yield curve to its most inverted state in decades.

It’s unlikely the MBS and credit-spread divergence will last. MBS spreads should start to come in as the yield curve steepens, and fixed-income vol should ease back as inflation volatility falls. Credit spreads should eventually widen to better reflect the deterioration in underlying fundamentals.

Which happens first is hard to know, but either way, by the time this anomaly has resolved itself, there’ll no doubt be another one along to puzzle over.