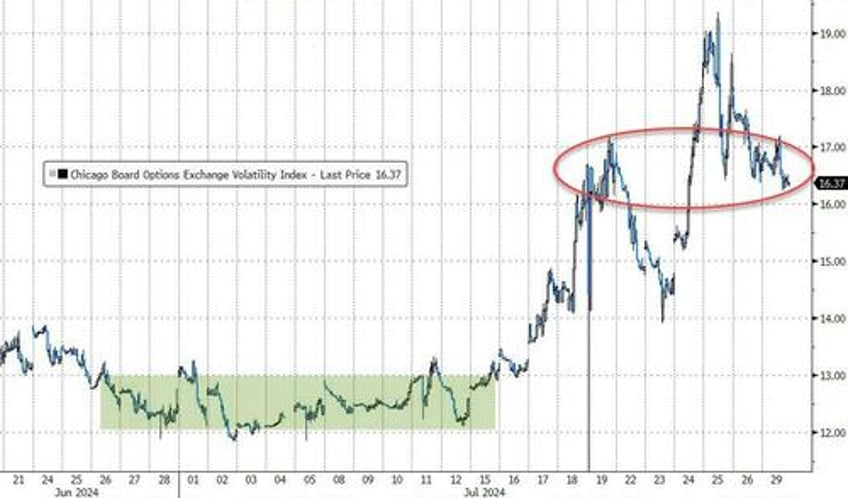

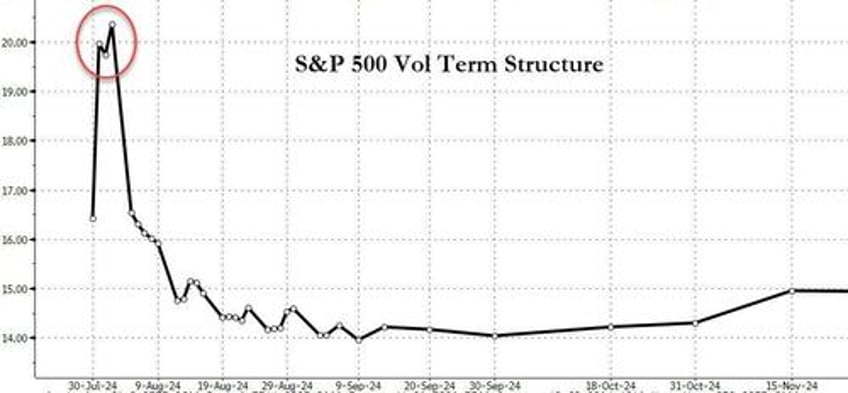

As the "busiest week of the summer" looms, VIX remained elevated...

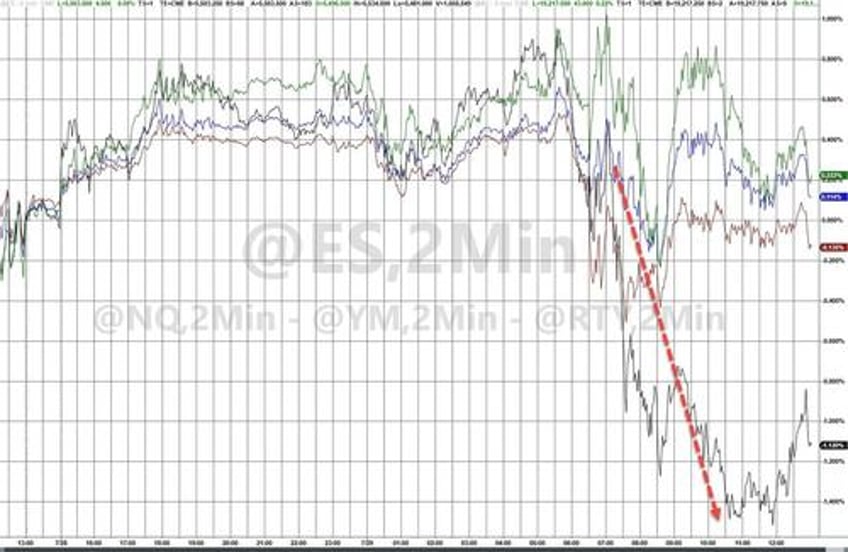

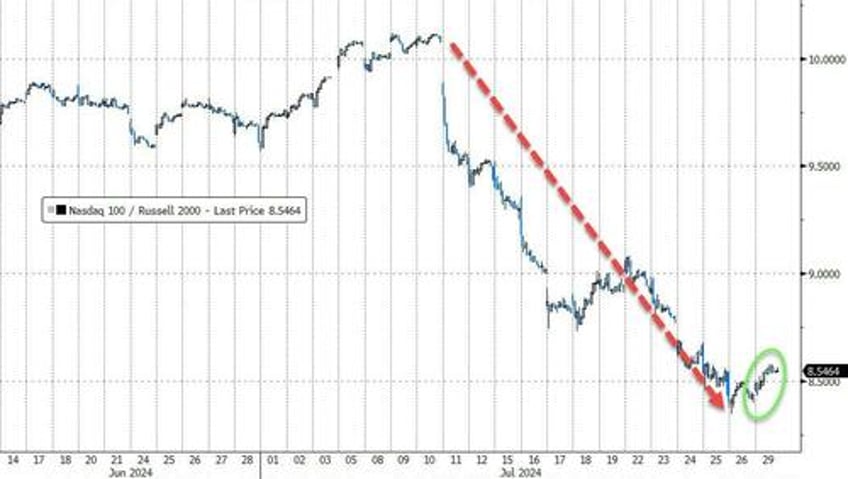

The plunge in Nasdaq/Russell 2000 took a brief respite today as the latter lagged. Nasdaq outperformed today, bouncing off unch early on. The Dow was unch by the close...

Goldman noted buyers on all sides:

Our floor tilts +5% better to buy with HF demand slightly outpacing LO demand

HFs are +7% better to buy concentrated in demand for HCare and Tech, followed by Cons Disc, Macro Prods & Utes. Supply is concentrated in Staples and a small sell bias in Fins

LOs are +3% better to buy but sector dispersion is VERY tight and in a +/-$60mm range with Macro Prods, HCare, Comm Svcs & Energy to buy vs. Fins, Cons Disc, Indust & Utes for sale. Tech flows are dead paired

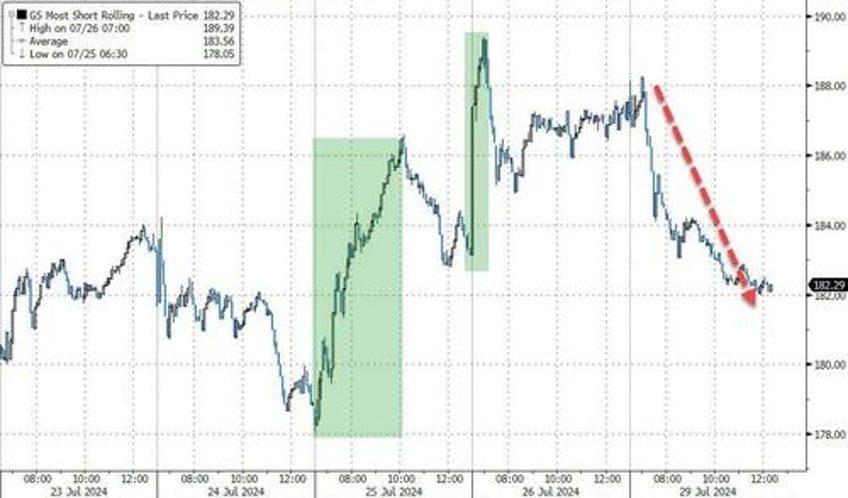

...but in context, it's a drop in the ocean...

Source: Bloomberg

...and it mostly appears the short-squeeze ammo ran out on Small Caps...

Source: Bloomberg

Bonds were vewy vewy quiet today with the long-end outperforming (30Y -3bps, 2Y unch)...

Source: Bloomberg

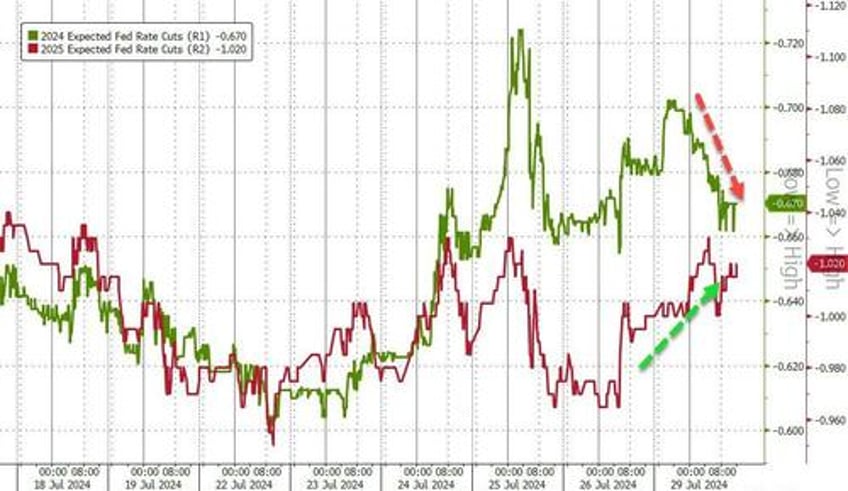

Rate-cut expectations rotated from 2024 to 2025 but overall were quiet...

Source: Bloomberg

But it was away from stocks and bonds where today saw some real action...

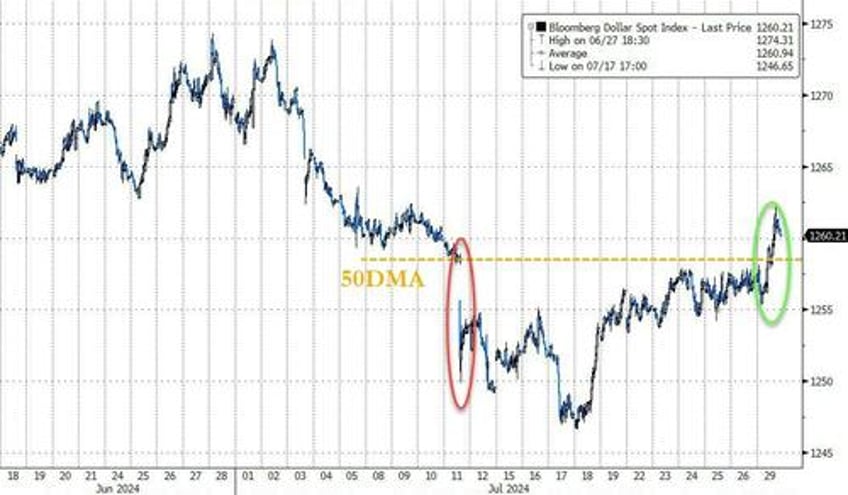

The dollar spiked back above its 50DMA...

Source: Bloomberg

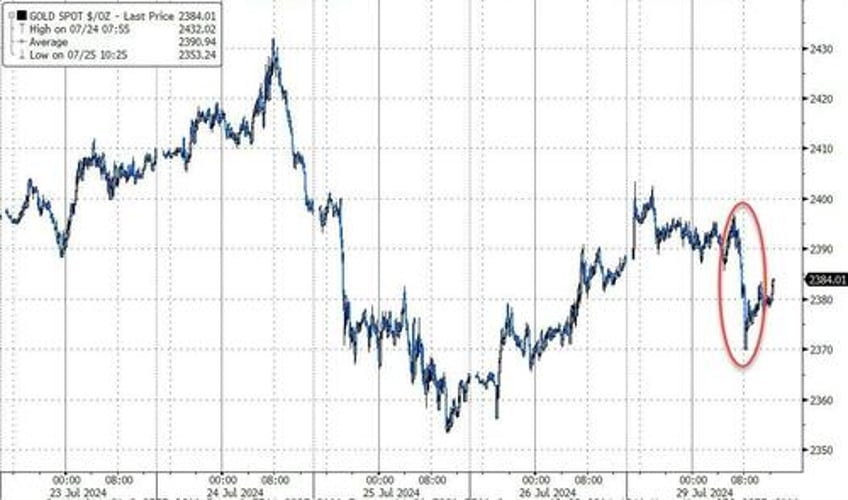

Dollar's gain was gold's loss...

Source: Bloomberg

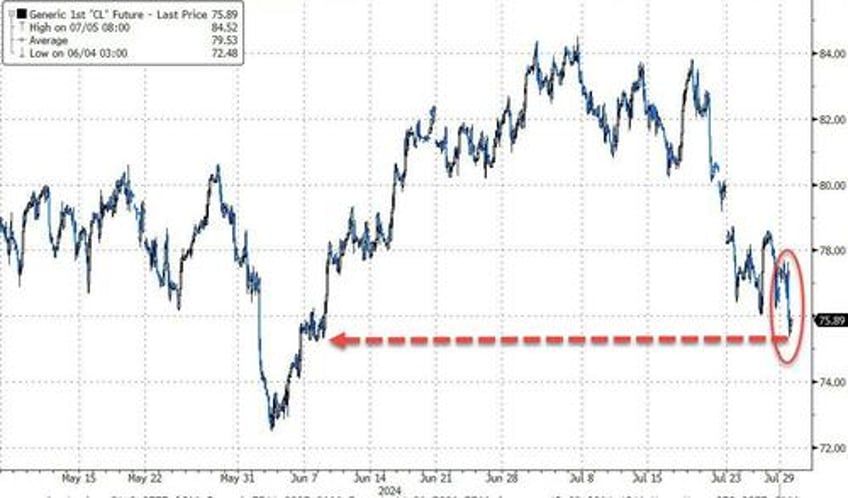

Crude prices also tumbled to near two-month lows...

Source: Bloomberg

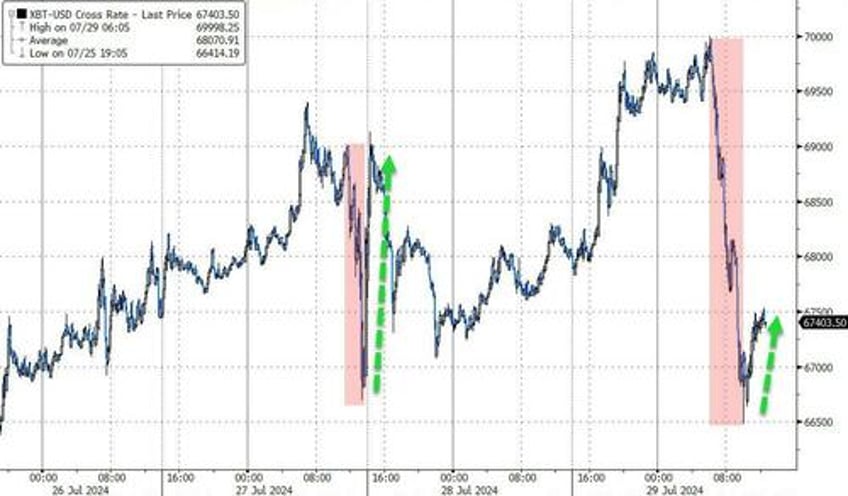

Crypto was clobbered as the Biden admin decided to transfer $2BN of BTC from its SIlk Road stockpile. For context, that knocked BTC from $70k to $66500 (basically the lows from the weekend's Trump address reaction)....

Source: Bloomberg

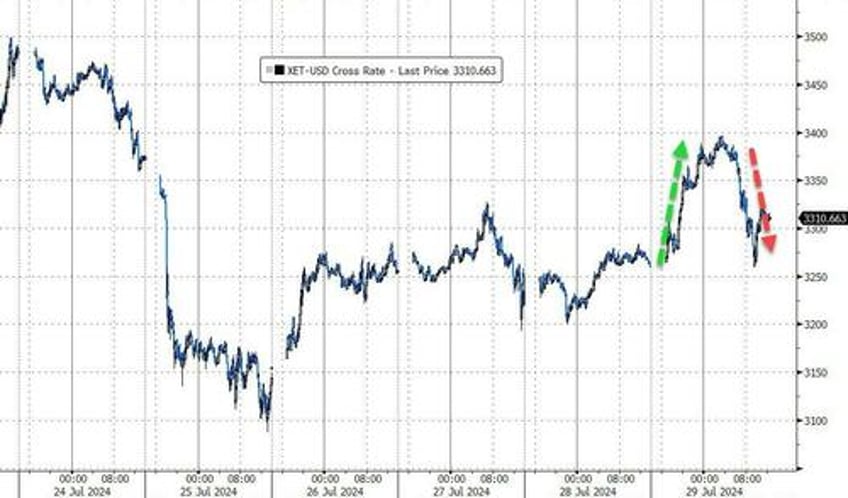

Interestingly, ETH outperformed BTC today (albeit roundtripping its own gains)...

Source: Bloomberg

Finally, the market is nervous about this week...

Source: Bloomberg

"over-hedged"?