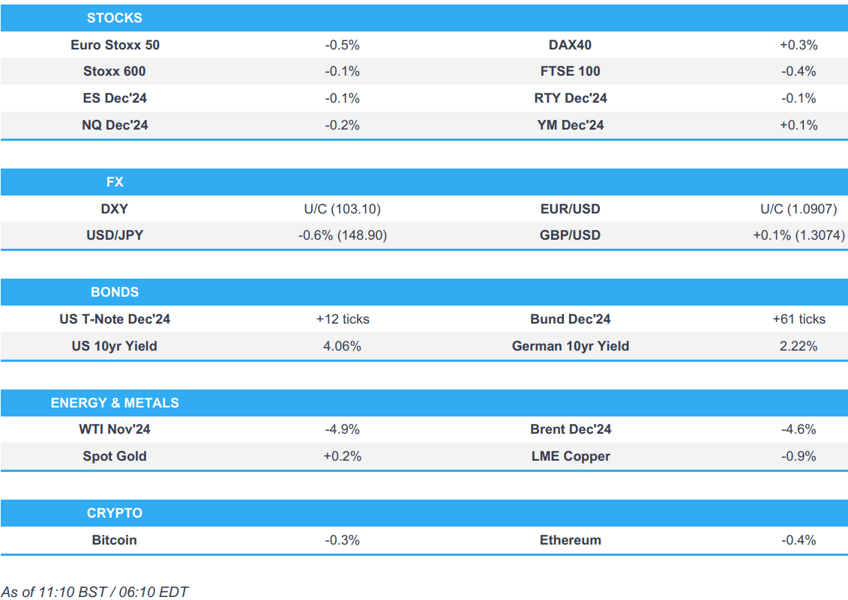

- European equities are mostly lower, with energy/mining names underperforming; US futures are mixed, with slight underperformance in the NQ.

- Dollar is flat, JPY outperforms whilst the Antipodeans are modestly lower.

- Bonds are firmer, continuing the modest rebound seen in the prior session, but also deriving support from lower oil prices.

- Crude is on the backfoot after constructive geopolitical updates, XAU is firmer and base metals are lower.

- Looking ahead, Canadian CPI, NZ CPI, NY Fed SCE, Fed Discount Rate Minutes, Fed’s Daly & Kugler, RBA’s Hunter, RBNZ’s Silk.

- Earnings from Johnson & Johnson, PNC Financial Services, Bank of America, Walgreens Boots Alliance, Goldman Sachs, Charles Schwab, Citigroup, United Airlines & LVMH.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.1%) began the session generally on a modestly firmer footing, but sentiment has waned as the session progressed, but with no fresh catalyst emerging in European hours.

- European sectors are mixed; Travel & Leisure takes the top spot, benefiting from lower oil prices, but also in a paring to some of the significant losses seen in the prior session. Telecoms follows closely behind, lifted by post-earning strength in Ericsson. Energy is found at the foot of the pile, alongside Basic Resources, which is hampered by continued Chinese demand fears.

- US Equity Futures (ES -0.1% NQ -0.2% RTY +0.1%) are trading tentatively on either side of the unchanged mark, taking a breather from the hefty gains seen in the prior session.

- US weighs capping NVIDIA (NVDA) and AMD (AMD) AI chip sales to some countries, according to Bloomberg. (Bloomberg)

- UBS Global Research has increased its 2024 year-end S&P 500 target from 5600 to 5850 and increased its 2025 target from 6000 to 6400

- Earnings include: Ericsson (headline beat, CEO pointed to increasing customer momentum and N. America stabilising)

- Unitedhealth Group Inc (UNH) Q3 2024 (USD): adj. EPS 7.15 (exp. 7.01), Revenue 100.8bln (exp. 99.28bln). FY adj. EPS view 27.50-27.75 (exp. 27.70), FY Revenue view (exp. 399.42bln); results which sparked marked pressure in the DJIA.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is mixed vs. peers alongside a lack of fresh macro drivers for the US other than comments from Fed's Waller who said the Fed should proceed with more caution on rate cuts than was needed at the September meeting. For now, DXY is holding above the 103 mark and within Monday's 102.91-103.45 range.

- EUR is flat vs. the USD with not much in the way of follow-through from a mixed batch of ZEW data; focus no doubt will be on the ECB on Thursday. EUR/USD has made its way back onto a 1.09 handle but is yet to approach yesterday's 1.0936 peak.

- GBP is incrementally firmer with not much in the way of follow-through from the latest UK jobs report, which on the surface looked hawkish given the stronger than expected employment change and unexpected decline in the unemployment rate. However, the ONS stated in the release that the report may be overstating underlying employment growth.

- JPY is attempting to claw back some lost ground vs. the USD after USD/JPY stopped shy yesterday of the 150 mark, topping out at 149.98. USD/JPY has delved as low as 149.04 vs. yesterday's 149.01 trough.

- Antipodeans are both softer vs. the USD and towards the bottom of the G10 leaderboard. AUD/USD is just about holding above Monday's low at 0.6701 and the 0.67 mark. NZD/USD has extended its move below the 0.61 mark and 200DMA at 0.6093, ahead of the region's CPI later on.

- PBoC set USD/CNY mid-point at 7.0830 vs exp. 7.0840 (prev. 7.0723).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks are bid in a continuation of Monday’s modest rebound with upside today driven by marked crude pressure and Final inflation readings from France.

- Bunds at a 133.74 peak, resistance at 133.80 and 134.03, upside spurred by the crude moves (see commodities) and French final inflation which saw the harmonised numbers revised down and factor in favour of the doves into Thursday.

- Session high for benchmarks in the wake of remarks that the EU’s fiscal burden for upcoming Ukraine aide could be reduced if the US gets involved.

- Gilts gapped higher on the above energy angle and also the regions latest employment data which shouldn’t stand in the way of continued BoE easing; 96.71 session peak printed after a robust DMO tap.

- USTs firmer with the above applying, at a 112-07+ peak; yield curve mixed (returning from holiday outages for cash) with the short end seemingly propped up by Fed’s Waller on Monday while the long-end slumps given energy.

- UK sells GBP 2.25bln 4.375% 2054 Gilt: b/c 3.08x (prev. 2.89x), average yield 4.735% (prev. 4.329%), tail 0.3bps (prev. 0.9bps)

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are well into the red, weighed on at the beginning of the APAC session on reports that Israeli PM Netanyahu informed the US that their response to Iran will target military facilities, not nuclear or oil sites. The complex then took another leg lower after the IEA OMR saw a downgrade to their 2024 world oil demand view, primarily driven by China. Brent'Dec currently near session lows around USD 73.50/bbl.

- Spot gold is firmer, but only modestly so. At a USD 2654/oz peak, a point which is over USD 10/oz shy of Monday’s USD 2666/oz best.

- Pressured, base metals in the red across the board and 3M LME Copper within reach of USD 9.5k from a high point just shy of USD 9.7k.

- WSJ article on Chinese stimulus: "Absent from the measures are any significant moves to boost consumption. People close to the ministry say such measures are in the works but nothing substantial is imminent."

- IEA OMR (Oct): 2024 world oil demand growth forecast to 860k bpd (prev. forecast 900k); says China is the main drag on global oil demand growth, with China's demand expected to rise only 150k bpd in 2024. Full details.

- Russia's seaborne oil product exports in September are up 5% on the month, according to Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Average Earnings (Ex-Bonus) (Aug) 4.9% vs. Exp. 4.9% (Prev. 5.1%); ONS' Freeman "pay growth slowed once again, with last year's one-off payments made to many public sector workers continuing to affect the figures for total pay. However, earnings continue to rise faster than inflation."

- UK ILO Unemployment Rate (Aug) 4.0% vs. Exp. 4.1% (Prev. 4.1%); Employment Change (Aug) 373k vs. Exp. 250k (Prev. 265k)

- UK HMRC Payrolls Change (Sep) -15k (Prev. -59k, Rev. -35k)

- French CPI (EU Norm) Final YY (Sep) 1.4% vs. Exp. 1.5% (Prev. 1.5%); MM -1.3% vs. Exp. -1.2% (Prev. 1.2%)

- Spanish HICP Final YY (Sep) 1.7% vs. Exp. 1.7% (Prev. 1.7%); MM -0.1% vs. Exp. -0.1% (Prev. -0.1%)

- German ZEW Economic Sentiment (Oct) 13.1 vs. Exp. 10.0 (Prev. 3.6); starting from a very poor assessment of the current situation the economic sentiment for Germany has risen in the latest survey; ZEW Current Conditions (Oct) -86.9 vs. Exp. -84.5 (Prev. -84.5)

- EU ZEW Survey Expectations (Oct) 20.1 (Prev. 9.3)EU Industrial Production MM (Aug) 1.8% vs. Exp. 1.7% (Prev. -0.3%, Rev. -0.5%); Industrial Production YY (Aug) 0.1% vs. Exp. -1.0% (Prev. -2.2%, Rev. -2.1%)

NOTABLE US HEADLINES

- Fed's Kashkari (2026 Voter) said they have made a lot of progress on inflation and the labour market is strong, while he added it is not worth it to have the unemployment rate shoot up. Kashkari also stated that he doesn't think China is remotely competitive with the US and is not at all worried that the yuan could replace the dollar as the global reserve currency. Furthermore, he said the US competitive position is very strong but it can't be taken for granted, as well as commented that Bitcoin has been around a dozen years and it’s still useless.

GEOPOLITICS

MIDDLE EAST

- Iranian government says "Our response will be at the right time and place and we will not hesitate or rush", via Al Arabiya.

- Israeli Broadcasting Corporation reports that a full agreement has been reached on the method, timing and strength of the response to an attack Iran, via Al Jazeera; the strike plan is awaiting the approval of the Ministerial Council for implementation.

- Israeli Broadcasting Corporation reports that a full agreement has been reached on the method, timing and strength of the response to an attack Iran, via Al Jazeera; the strike plan is awaiting the approval of the Ministerial Council for implementation.

- Israeli PM Netanyahu told the US that Israel will strike Iranian military, not nuclear or oil, targets, according to officials cited by The Washington Post.

- Israel Broadcasting Corporation cited Israeli PM Netanyahu's office stating that they listen to the views of the US administration, but will make decisions based on Israel's interests, according to Al Jazeera.

- UN Security Council expressed strong concern after several UN peacekeeping positions in Lebanon came under fire, while it urged all parties to respect the safety and security of UNIFIL peacekeepers and premises, as well as expressed deep concern for civilian casualties and the destruction of civilian infrastructure.

- US President Biden asked the National Security Council to inform Iran that any attempt on former President Trump's life would be considered an act of war, according to Fox News. The White House later said it has been closely tracking Iranian threats against Trump and former Trump administration officials for years, while it warned Iran will face severe consequences if it attacks any US citizen.

OTHER

- German official says if the US participates in the USD 50bln loan for Ukraine, the EU's share of the loan may be reduced.

- NATO Secretary General Rutte in his first visit to Ukraine mission, welcomed plans for temporary deployment of US long-range missiles to Germany from 2026, while he said NATO will not be cowed by Russian threats and will keep its strong support of Kyiv.

- North Korea blew up part of inter-Korean roads, according to South Korea's military. It was separately reported that South Korea's military fired warning shots south of the demarcation line after North Korea destroyed inter-Korean roads.

CRYPTO

- Bitcoin is modestly softer, taking a breather following the hefty gains seen in the prior session.

APAC TRADE

- APAC stocks traded mixed as most major indices followed suit to the gains stateside where a tech rally led the S&P 500 and Dow to fresh all-time highs, although Chinese markets lagged following weak trade data.

- ASX 200 climbed to a record high with advances led by the top-weighted financial sector and miners.

- Nikkei 225 outperformed and gapped back above the 40,000 level on return from the long weekend.

- Hang Seng and Shanghai Comp were pressured after weak trade data and stimulus disappointment, while trade frictions also lingered with the US mulling capping NVIDIA and AMD AI chip sales to some countries.

NOTABLE ASIA-PAC HEADLINES

- Chinese banks mull cutting rates on CNY 300tln of deposits as early as this week with the major banks to be guided by the PBoC's interest rate self-disciplinary mechanism to lower rates on a number of deposit products, according to Bloomberg.

- China began enforcing an up to 20% tax on overseas investment gains by the country’s ultra-rich.

- US weighs capping NVIDIA (NVDA) and AMD (AMD) AI chip sales to some countries, according to Bloomberg.

- China and NDRC are to hold a meeting on financing for small businesses on October 21st

- Reuters Poll, China: growth & CPI forecasts cut.