One week ago, when stocks were still on pace to hit all time highs after a 2 year hiatus, a storm was already brewing in the trend-following community and as Goldman's Cullen Morgan calculated, CTAs were tentative sellers over the upcoming week (across all market scenario), and while they were likely to buy stocks over the coming month, should markets slide, they would be willing participants in any liquidation.

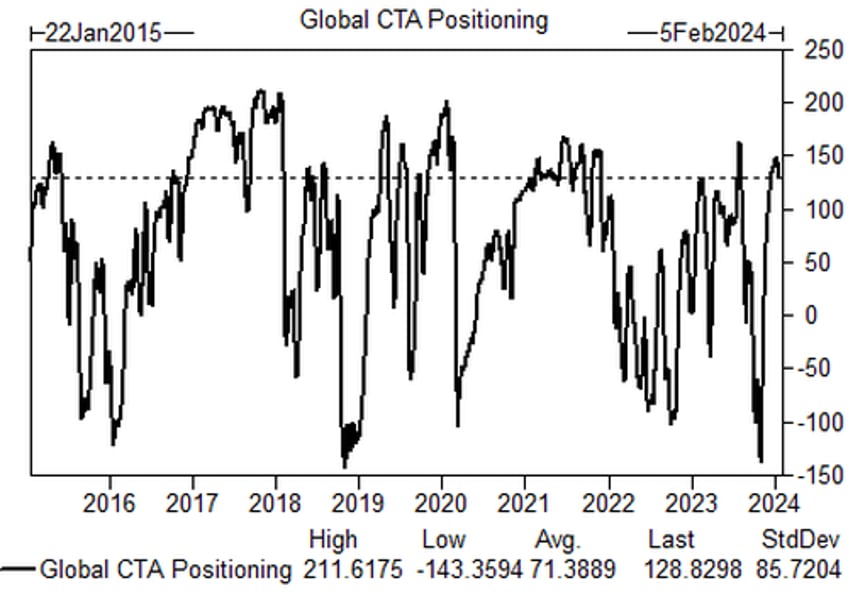

Fast forward to today, when stocks managed to levitate even higher (thanks to a short squeeze inspired by Taiwan Semi mid-last week which more than offset the CTA selling), and yet, the higher we rise, the more the pent up selling by the CTA community. Indeed, according to the latest note from Morgan (available to pro subs in the usual place), CTAs - which the Goldman trader has modeled as net long $129BN of global equities...