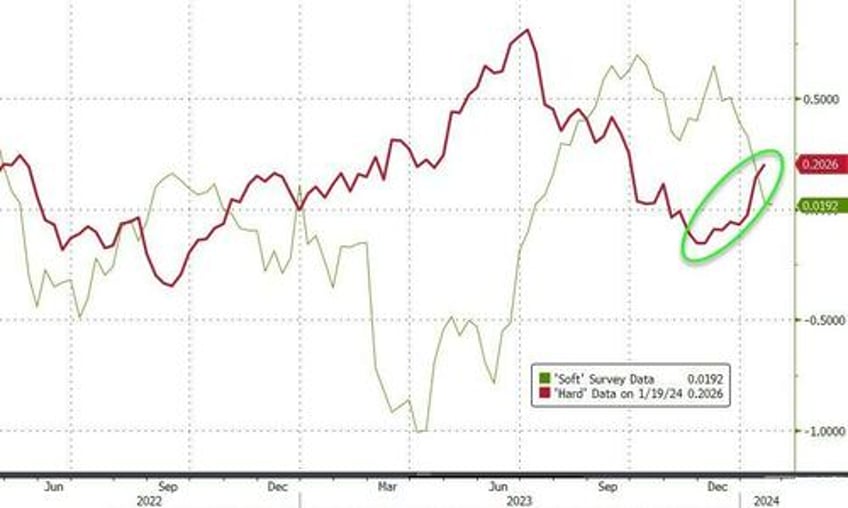

The last week or so has seen a tactical 'hawkish' reversion in USTs and STIRs to play for a re-pricing lower in March rate-cut expectations, following the recent 'hard-data resiliency' with Consumer and Labor, alongside modestly “hawkish” rhetoric (despite soft data weakness)...

And, as Nomura's Charlie McElligott highlights this morning, we are also seeing new upside being bot in SOFR Options for "dovish outcome"-hedging again, with Core PCE looming later this week.