Ahead of today's closely watched 3Y auction, many were wondering if we would see the fingerprint of a Chinese treasury boycott and/or liquidation in the results from today's sale. Well, here is the data that the Treasury released moments ago.

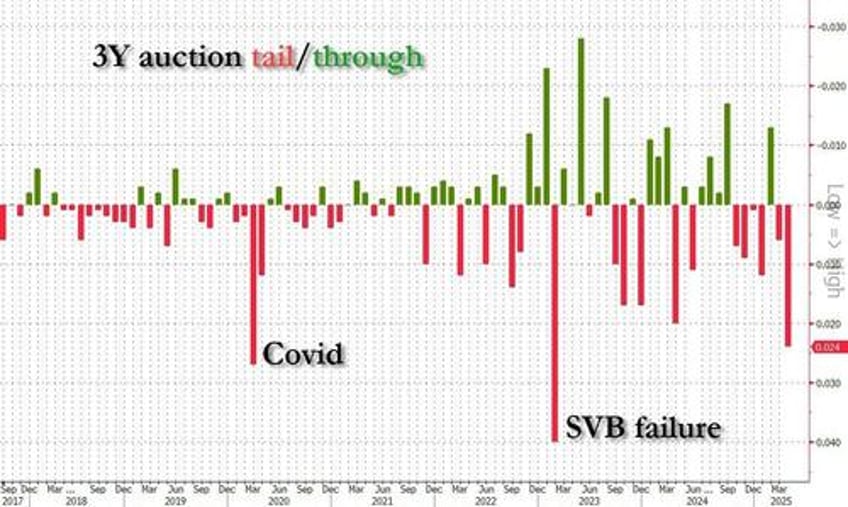

The sale of $58 billion in 3Y paper priced at a high yield of 3.784%, down from 3.908% last month, but massively wider than the When Issued, which at 3.760%, meant we had a 2.4bps tail. As the chart below shows, there were only two bigger tails previously: Covid, and the 2023 SVB failure/banking crisis. So yeah, superficially, this was not a good auction.

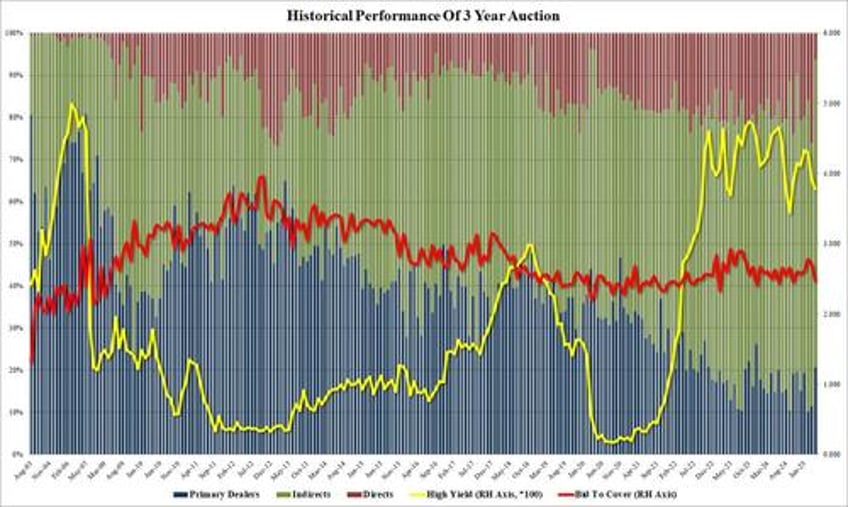

The bid to cover also tumbled, from 2.70 to 2.47, the lowest since October.

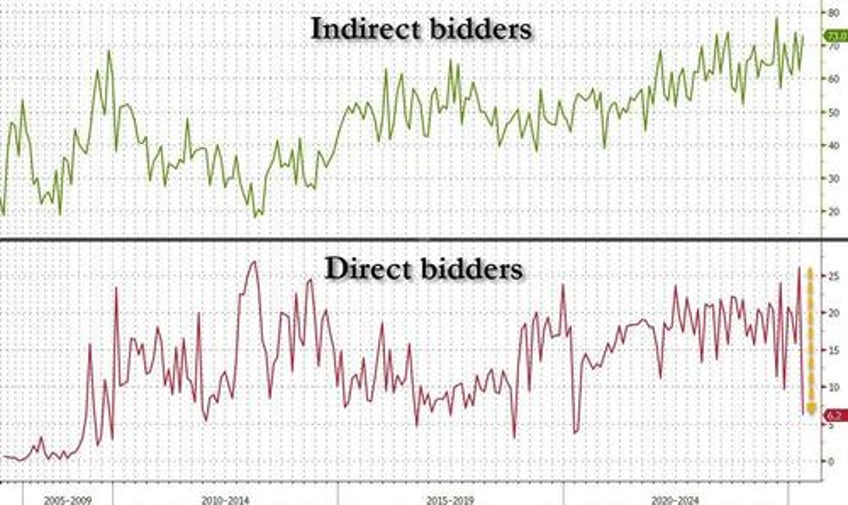

But it was the internals that everyone was paying attention to and specifically, everyone was focusing on the Indirect award to see if China would boycott today's auction. Yet while many were expecting a big move (lower) in the indirect award, that did not happen; instead Indirects rose to 73.0%, up sharply from 62.5%. and one of the highest on record. So nothing to worry about? Not exactly: there was a plunge in demand, but not by the Indirects who accepted $42.2BN of the $57.8BN notional (after SOMA): instead, it was plain vanilla domestic Directs, who unexpectedly collpsed to just 6.2% from 26.0% last month, which was one of the lowest on record!

So yes, there was broad aversion to today's auction... just not where people expected it.

Bottom line: this was a very ugly auction, with just Covid and SVB 3Y auction uglier, although the silver lining is that while Direct demand collapsed, at least the foreign bid was in place for now. The question how much longer foreigners will keep funding the US budget deficit is not going away any time soon.