The Democratic Party has been pushing a narrative that President Trump is favoring his billionaire friends while leaving Main Street in the gutter. But if that's the case, why are some of the president's billionaire supporters complaining about the severity of his tariffs as main equity indices tumble worldwide?

In recent days, a video posted on TikTok and reposted on X shows Sen. Josh Hawley (R-MO) maneuvering around a 'gotcha moment' question from a journalist and pointed out how the American worker finally has a president "that has their backs - protecting their jobs and raising their wages - and someone has to fight for fair trade deals."

The journalist then asked Hawley: "Even though markets are falling - and the economy looks pretty concerning right now?"

Hawley fired back: "Wall Street banks don't like it [tariffs] - but I'm not too concerned about Wall Street. I'm concerned about working people in my state. And this is finally a chance to get a fair deal on trade."

Trying to get your "gotcha moment" with Josh Hawley will never yield results. pic.twitter.com/qw5jXuITWm

— The Disrespected Trucker (@DisrespectedThe) April 6, 2025

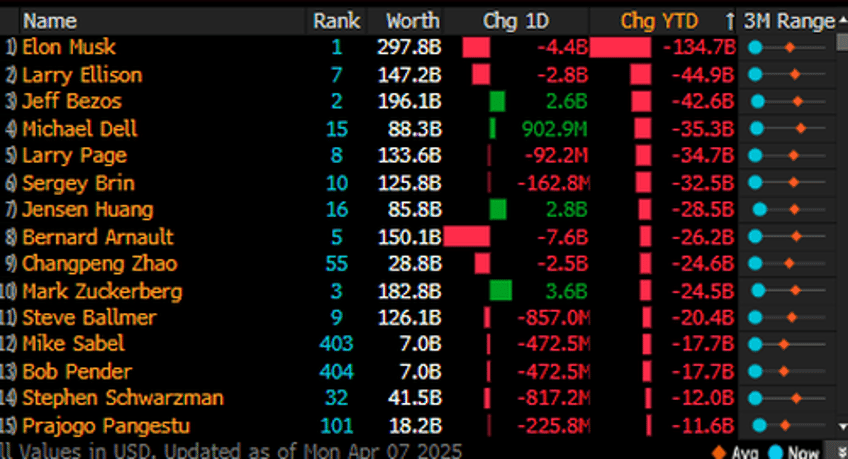

The deepening trade war has battered stocks as President Trump pushes for fair trade with key partners like China. The latest Bloomberg data shows that year-to-date losses among billionaires have been nothing short of a bloodbath.

The average net worth of the top 100 billionaires has slid since President Trump announced the "Liberation Day" tariff blitz nearly one week ago.

Trump's pro-worker, protectionist policies—aimed at defending American jobs, fulfilling the 'America First' agenda, and revitalizing U.S. manufacturing—have prompted concern from a number of billionaires, mainly because their net worth is heavily tied to the stock market.

Citing a list from Forbes, Elon Musk, Bill Ackman, Mark Cuban, Jamie Dimon, and other billionaires have questioned Trump's approach on the trade war:

Elon Musk: Trump's new right-hand-man hasn't explicitly spoken out against the tariffs, but the Tesla CEO shared a video early Monday of economist Milton Friedman touting free trade and the benefits of importing goods. He also deleted a post from over the weekend criticizing Trump's top trade adviser Peter Navarro for praising tariffs. Musk's brother (and Tesla board member) Kimbal Musk also criticized the tariffs as a "permanent tax" on Americans.

Jamie Dimon: The JPMorganChase CEO issued his annual letter to shareholders Monday morning, which expressed concerns about Trump's tariffs, saying that while there are some "legitimate reasons" for imposing them, they "will likely increase inflation and are causing many to consider a greater probability of a recession" and expressing concerns about the continued uncertainties around Trump's tariffs and how they will "affect America's long-term economic alliances."

Bill Ackman: The hedge fund manager is a longtime Trump supporter but has turned against the president's tariffs, railing against Trump's Commerce Secretary Howard Lutnick and how the Trump administration calculated the tariffs and calling for the White House to pause them, writing Sunday that if the tariffs do take effect, "We are heading for a self-induced, economic nuclear winter, and we should start hunkering down."

Daniel Loeb: While Loeb said in February he thought Trump's initial tariffs on Mexico and Canada wouldn't harm the stock market, the hedge fund manager has spoken out against Trump's more sweeping policy, most recently sharing a post Monday that noted the stock market chaos is "all in the head of 1 person. Who can change his mind at any time" and writing, "Exactly."

- Larry Fink: The BlackRock CEO suggested at the Economic Club of New York Monday that "the economy is weakening as we speak" and the market could fall another 20% from where it is now as a result of Trump's tariffs, CNBC reports. Fink suggested the U.S. is "probably in a recession right now," but he still expressed some optimism about the economy's long-term outlook, saying, "In the long run, this is actually more of a buying opportunity than a selling opportunity" and "the vitality of the United States will persist."

Expanding more on Ackman's comments on X earlier, he advocated for a "30, 60, or 90-day pause before the tariffs are implemented tomorrow to enable negotiations to be completed without a major global economic disruption that will harm the most vulnerable companies and citizens of our country."

Some have misinterpreted my thoughts on tariffs. I am totally supportive of President @realDonaldTrump using tariffs to eliminate tariffs and unfair trading practices of our trading partners, and to induce more investment and manufacturing in our country.

— Bill Ackman (@BillAckman) April 8, 2025

I am advocating for a… https://t.co/SnFt8ddv9F

So, who exactly benefits from an immediate pause in the trade war? Primarily those who own large amounts of stock—billionaires like Bill Ackman—not the average worker, who owns little to nothing.

Separate from the list is billionaire Ken Griffin, who blasted Trump's latest tariffs as a tax on the middle class, calling it a "huge policy mistake."

"Even if the dream of jobs coming back to America plays out, that's a 20-year dream. It's not 20 weeks. It's not two years. It's decades," Griffin said.

Maybe we should remind the billionaires about Treasury Secretary Scott Bessent's comments last week, pointing out that stocks first began to sink with China's "DeepSeek" moment earlier this year, calling the latest downturn "A MAG7 problem, not a MAGA problem."

Which way, Wall Street? MAG7 or MAGA?