US Macro Surprise data declined for the sixth straight week... to its weakest since January 2023...

Source: Bloomberg

But that 'bad news' prompted a run to record highs for risky stocks...

Source: Bloomberg

As the market seems to be completely discounting the collapse in soft survey data...

Source: Bloomberg

The bad news prompted rate-cut expectations to rise on the week (more for 2025 than 2024). Three full cuts priced in for 2025 and two cuts priced in for 2024...

Source: Bloomberg

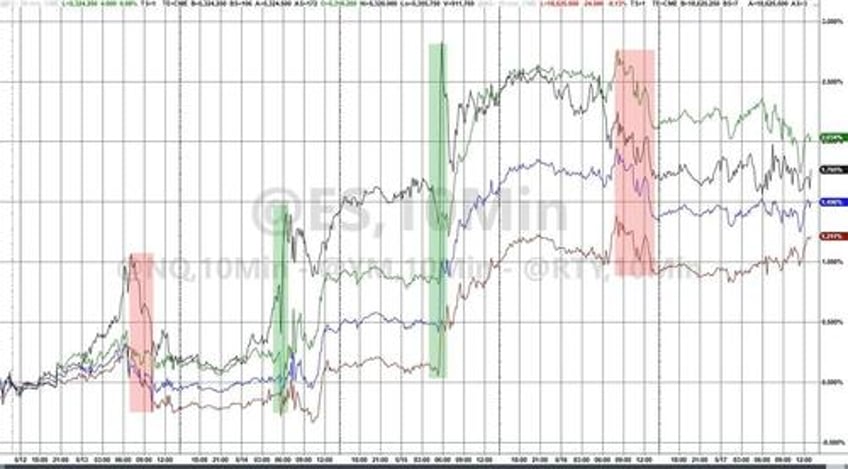

All of which sent stocks higher on the week led by Nasdaq. Friday saw the majors mixed to flat after a tumultuous week..

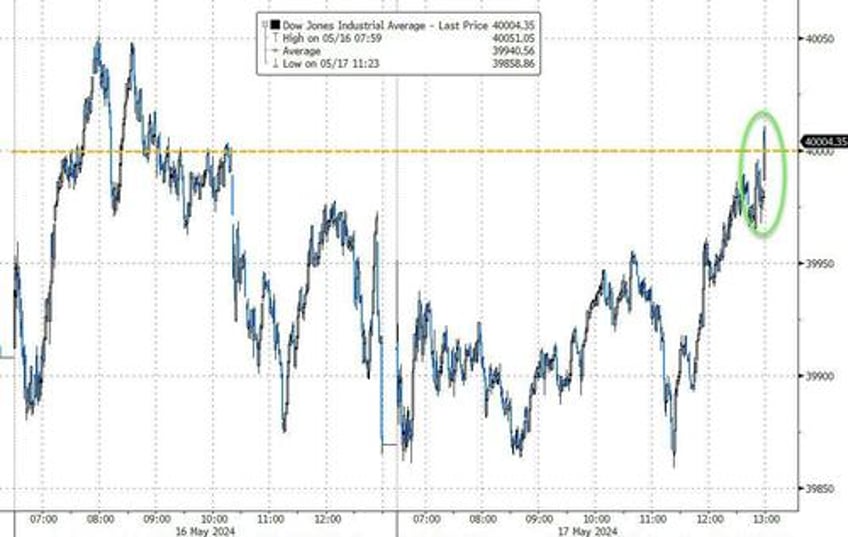

In the last few seconds, the algos took The Dow back above 40,000 for its first close above that historic level...

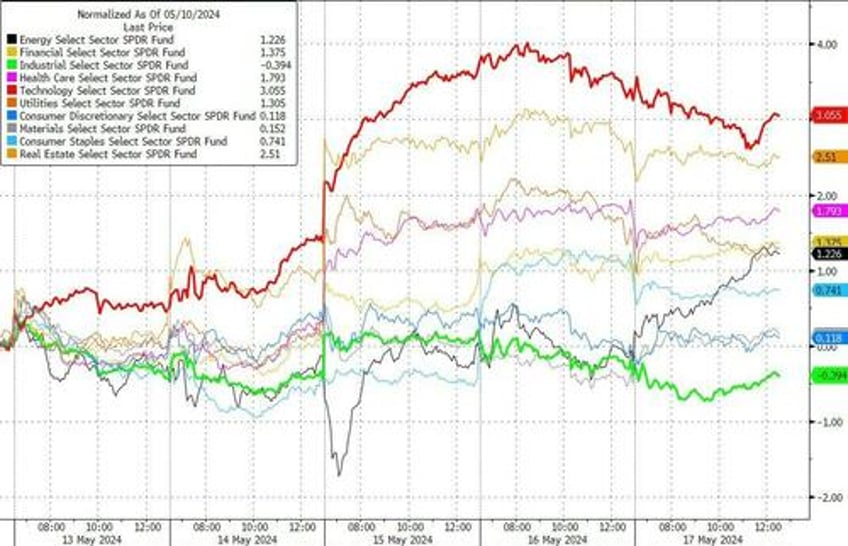

Industrials were the only sector to end the week red while Tech and Financials outperformed...

Source: Bloomberg

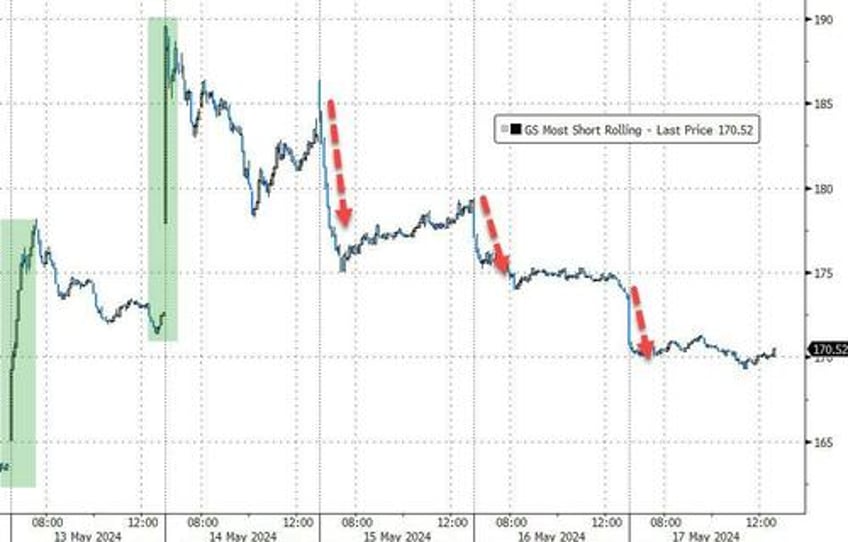

The short squeeze at the start of the week faded fast as the week progressed...

Source: Bloomberg

VIX was clubbed like a baby seal back to an 11 handle on the week - decoupling from stocks today...

Source: Bloomberg

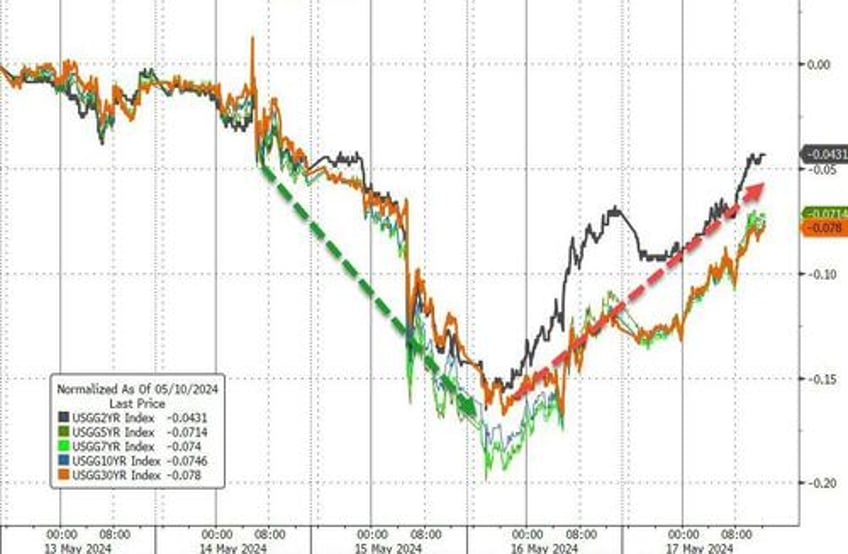

Treasury yields ended the week lower, despite the last two days seeing rates rise. The short-end modestly underperformed...

Source: Bloomberg

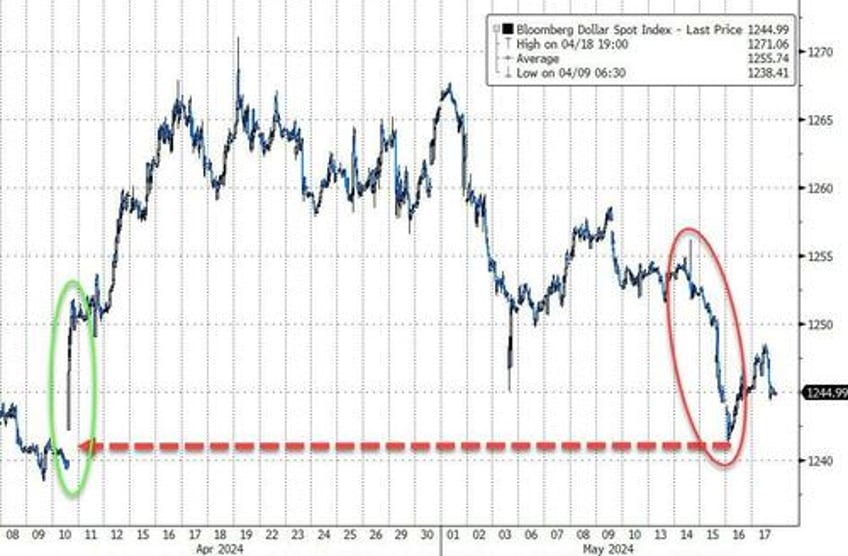

The dollar tumbled this week, erasing the gains since April's CPI print surge...

Source: Bloomberg

A big week for bitcoin with the largest cryptocurrency back above $67,000 to its highest in six weeks...

Source: Bloomberg

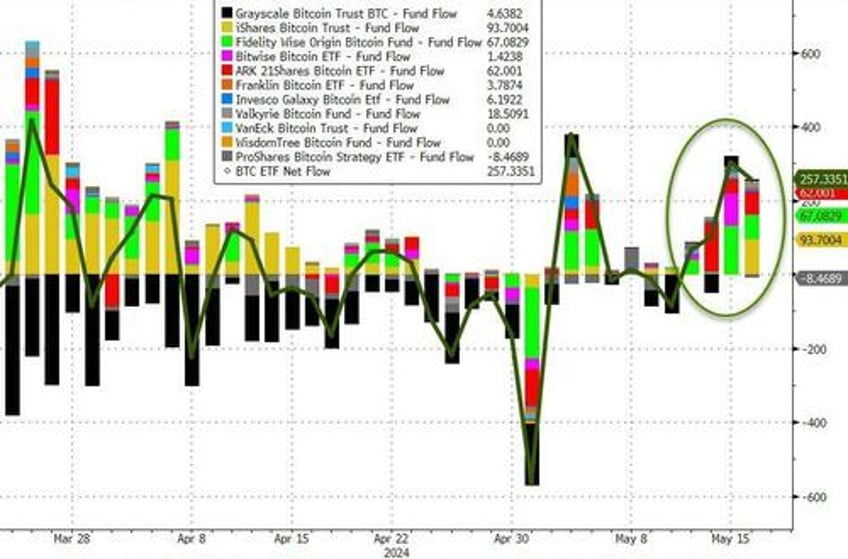

Bitcoin ETFs saw a solid week of inflows (for a change)...

Source: Bloomberg

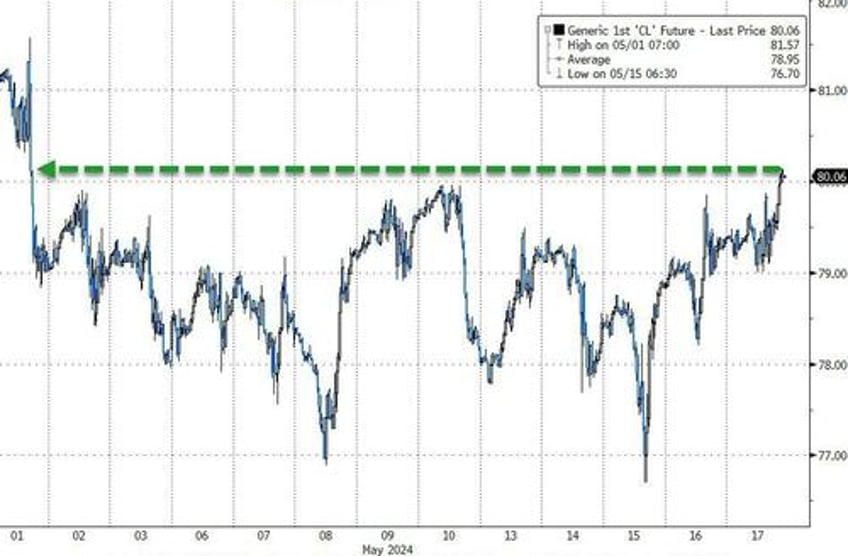

Oil prices bounced on the week with WTI back above $80 to two week highs...

Source: Bloomberg

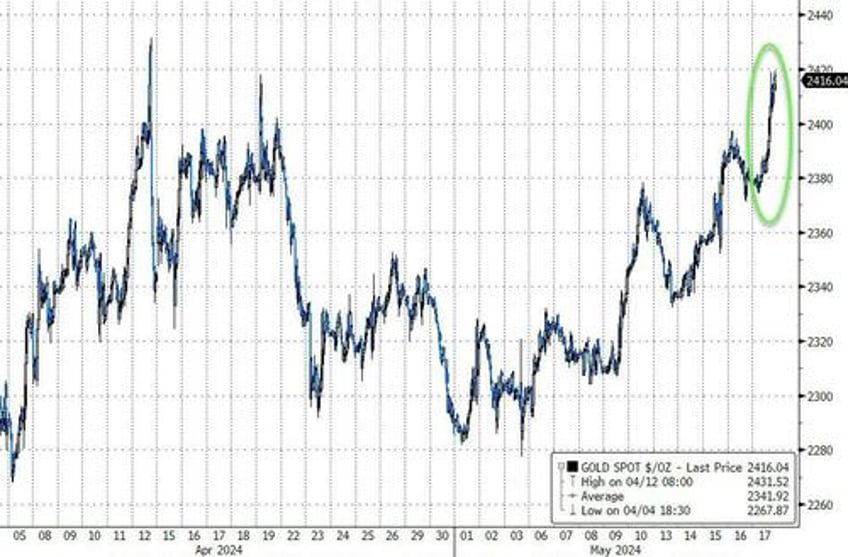

Gold surged to a new record closing high this week, its first close above $2400...

Source: Bloomberg

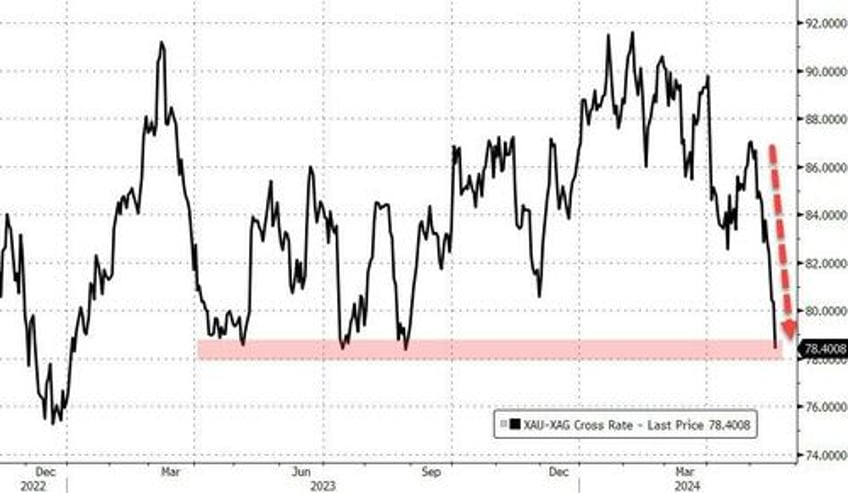

... but most notably, silver dramatically outperformed gold (topping $30) - its best relative weekly performance since August 2020...

Source: Bloomberg

While The Dow topped 40,000 for the first time, it remains a laggard compared to gold for the last few years...

Source: Bloomberg

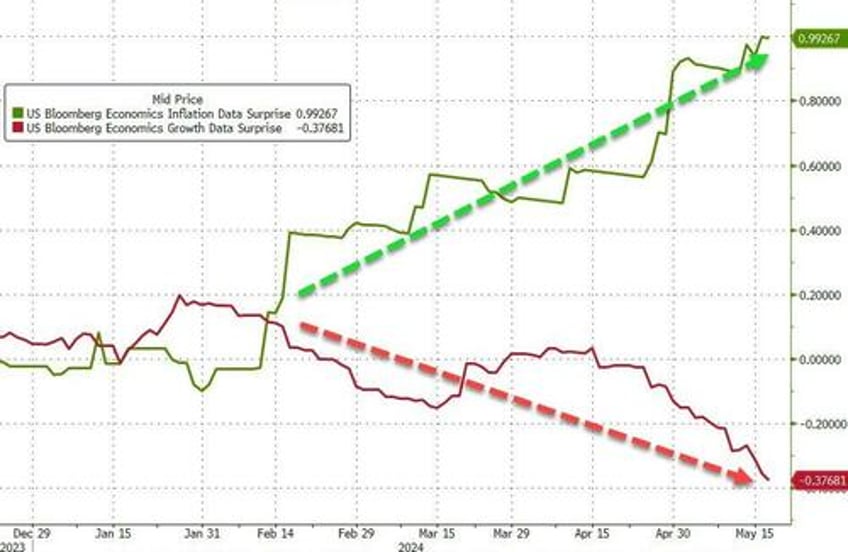

Finally, how much longer can the market (and The Fed) ignore the surge in inflation surprise data and just watch the de-growth with blinkers on...

Source: Bloomberg

...hoping that the 'bad news' is all that matters to lift rate-cut hopes.