- APAC stocks began the week mostly higher following last Friday's gains stateside; Nikkei 225 boosted by stimulus approval

- President-elect Trump picked hedge-fund manager Scott Bessent as Treasury Secretary; seen as a more market-friendly option

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.7% after the cash market closed higher by 0.7% on Friday

- USD is softer vs. all major peers, DXY sits just below the 107 mark, EUR/USD failed to move back onto a 1.05 handle

- Reports note Israel and Lebanon are close to an agreement which a source hopes will be announced within a couple of days

- Looking ahead, highlights include German Ifo, BoE’s Lombardelli & Dhingra, ECB’s Lane & Makhlouf, Supply from EU & US

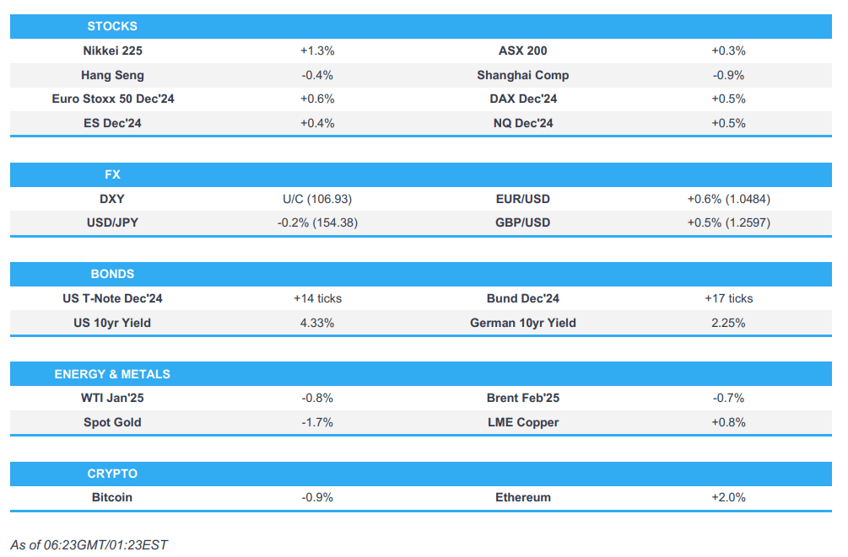

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained on Friday in which all major indices closed in the green and notable outperformance was seen in the small-cap Russell 2000 index, while sentiment was underpinned following encouraging US data as US PMI's beat forecasts thanks to a gain in the services sector and although the UoM Consumer Sentiment survey was revised down in November, it still topped the October level. Data also dictated treasury trade as the upside occurred in the morning after soft European and UK data releases before reversing course to reach session lows after the US PMI report.

- SPX +0.35% at 5,969, NDX +0.17% at 20,776, DJIA +0.97% at 44,297, RUT +1.80% at 2,407.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed’s Bowman voter said must avoid the temptation to limit the use of AI in finance which could chill innovation in the banking system, while she added AI has the potential to improve the reliability of economic data and can be a strong anti-fraud tool in the finance sector.

- US President-elect Trump named several new senior officials and cabinet nominees including hedge fund CEO Scott Bessent as Treasury Secretary, while he was also reported to pick Brooke Rollins to be Agriculture Secretary and nominated Rep. Lori Chavez-DeRemer for Labour Secretary.

- US Treasury Secretary nominee Scott Bessent prioritises policy of delivering Trump tax cuts and maintaining the dollar's position as the global reserve currency, while he said enacting tariffs and cutting spending will also be a focus. Bessent's policy priorities include making first-term cuts permanent, as well as eliminating taxes on tips, Social Security benefits, and overtime pay. Furthermore, he suggested pursuing 3% US GDP growth, aims to reduce US budget deficit to 3% of GDP by 2028 and seeks an additional 3mln bpd of US oil production, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks began the week mostly higher following last Friday's gains stateside and as markets reacted to news over the weekend that President-elect Trump picked hedge-fund manager Scott Bessent as Treasury Secretary which is seen as a nod to Wall Street and could potentially reduce the chances of severe tariffs with Bessent seen to have a gradual approach on tariffs.

- ASX 200 was led by outperformance in real estate and consumer-related sectors amid lower yields which saw financials lag.

- Nikkei 225 surged and briefly reclaimed the 39,000 level following the Japanese Cabinet's stimulus package approval and as equity markets saw a relief rally on the US Treasury Secretary nomination, although the Japanese benchmark moved off today's highs owing to yen strength.

- Hang Seng and Shanghai Comp were indecisive in a tight range with headwinds following the PBoC's CNY 550bln drain through its Medium-term Lending Facility operations and amid expectations of further US export restrictions on China, while automakers were supported by reports that the EU is said to be close to an agreement with China to abolish EV import tariffs.

- US equity futures (ES +0.4%) were boosted at the open as risk assets cheered US President-elect Trump's Treasury Secretary nomination.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.7% after the cash market closed higher by 0.7% on Friday.

FX

- DXY was pressured and the DXY slipped beneath the 107.00 level in reaction to the nomination of billionaire hedge-fund manager Scott Bessent for Treasury Secretary who is seen as a fiscal hawk and has advocated for tax reform and deregulation, while there are several key announcements for the US leading into the Thanksgiving holiday including US GDP, Core PCE and FOMC Minutes.

- EUR/USD took advantage of the weaker dollar but with upside capped by resistance at the 1.0500 level and amid quiet EU newsflow.

- GBP/USD briefly reclaimed the 1.2600 status as all major currencies benefitted from the weaker dollar, while PM Starmer noted in an op-ed that the government will set out “radical reforms” to tackle the rising outlays on benefits and will get to grips with the bulging benefits bill.

- USD/JPY extended on opening losses and retreated to sub-154.00 territory amid a flattening of US yields but later bounced off lows.

- Antipodeans gained amid the broad dollar selling but have since eased back from their intraday highs and New Zealand Trade Data and Retail Sales largely ignored, while participants await the RBNZ Rate Decision on Wednesday with the Shadow Board recommending a 50bps cut.

- PBoC set USD/CNY mid-point at 7.1918 vs exp. 7.2257 (prev. 7.1942).

FIXED INCOME

- 10yr UST futures gapped above the 110.00 level at the reopen following the news that Scott Bessent was nominated for Treasury Secretary, with the pick seen to potentially reduce the chances of severe tariffs and is seen as likely to cap US yields.

- Bund futures remained afloat after climbing above the 133.00 level and with a recent survey showing economists lowered their forecasts for German economic growth in 2025 to 0.6% from 1.2% which was the largest forecast downgrade for any major industrial economy in the survey.

- 10yr JGB futures conformed to the gains in global peers but with upside capped by a quiet calendar and outperformance in Japanese stocks.

COMMODITIES

- Crude futures were rangebound in the absence of major energy-specific catalysts and following mixed geopolitical headlines but then mildly retreated with reports noting Israel and Lebanon are close to an agreement which a source hopes will be announced within a couple of days.

- Nominations for gas flows into Slovakia from Ukraine and flows from Slovakia into Austria and the Czech Republic on Sunday were in line with levels seen in the previous days.

- Iraq said a 15-day halt in Iranian gas due to maintenance is cutting 5.5GW from the national grid.

- Spot gold fluctuated with early pressure seen as asset classes reacted to Trump's Treasury Secretary pick which saw prices dip beneath the USD 2,700/oz level although prices then fully recovered shortly after, before a bout of more aggressive selling ensued.

- Copper futures benefitted alongside the mild relief rally overnight but with further upside capped as sentiment in China lagged.

CRYPTO

- Bitcoin was choppy overnight but reclaimed the USD 98,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 900bln 1-year MLF operation (vs CNY 1.45tln maturing) with the rate maintained at 2.00%.

- White House said the National Security Adviser Sullivan and other senior officials met with telecom executives to share intelligence and discuss China’s cyber espionage campaign targeting the sector.

DATA RECAP

- New Zealand Trade Balance (Oct) -1.5B (Prev. -2.1B, Rev. -2.2B)

- New Zealand Exports (Oct) 5.8B (Prev. 5.0B, Rev. 4.9B)

- New Zealand Imports (Oct) 7.3B (Prev. 7.1B, Rev. 7.1B)

- New Zealand Retail Sales Volumes QQ (Q3) -0.1% (Prev. -1.2%)

- New Zealand Retail Sales YY (Q3) -2.5% (Prev. -3.6%)

GEOPOLITICS

MIDDLE EAST

- Senior adviser to Iran’s Supreme Leader said Iran is preparing to respond to Israel, according to Tasnim.

- Iran will hold nuclear talks with the UK, France and Germany on Friday regarding nuclear and regional issues, according to an Iranian Foreign Ministry spokesperson cited by Reuters.

- Hezbollah said it launched a drone attack on Israel’s Ashdod Naval Base for the first time. It was also reported that Hezbollah announced 50 attacks on Sunday against bases, towns and gatherings of soldiers in Israel, according to Sky News Arabia.

- EU Foreign Policy Chief Borrell said they are ready to devote EUR 200mln to the Lebanese armed forces, while he added that they must pressure Israel and Hezbollah to accept the US proposal for a ceasefire.

- Israel's ambassador to the US said Israel and Hezbollah are nearing a truce agreement, according to Bloomberg.

- Israeli senior official said Israel's direction is to move towards a ceasefire agreement in Lebanon, while Israeli and US officials stated that Israel and Lebanon are on the cusp of a ceasefire agreement, according to Axios. It was separately reported by Asharq News that Israeli media stated Israel agreed in principle to the proposal for a ceasefire in Lebanon.

- Israel Broadcasting Corporation initially stated the green light has not yet been given on the Lebanon agreement and there are still issues that need to be resolved but it later cited an Israeli source stating the green light was given to complete a ceasefire agreement with Lebanon and they hope to announce it within two days.

- Israel recommended avoiding non-essential travel to the UAE after the body of Israeli rabbi Zvi Kogan was found. Israeli PM Netanyahu’s office said the murder was a heinous anti-Semitic terrorist act and PM Netanyahu said Israel will take all measures to hold accountable the murderers and those who sent them.

- Iran’s Embassy in the UAE said it categorically rejects allegations of Iran’s involvement in the murder of Israeli rabbi Kogan in the UAE, according to a statement cited by Reuters.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said on Saturday that Russian drones and missiles have damaged 321 Ukrainian port infrastructure facilities since July 2023 and 20 civilian ships from other countries were damaged by Russian strikes.

- Ukraine launched a mass attack on Russia's Kursk region with foreign-made missiles, according to a military analyst via Reuters.

- A fire broke out at an industrial enterprise after Ukraine's drone attack on Russia's Kaluga, according to the regional governor.

- Ukraine’s air force said air defences downed 50 out of 73 Russian drones, while Russian air defence reportedly destroyed 34 Ukrainian drones, according to a report on Sunday via Reuters.

- Russian President Putin and Turkish President Erdogan discussed trade and economic cooperation during a phone call.

- Russia is likely to name Alexander Darchiev as ambassador to Washington, according to Kommersant citing unidentified sources.

OTHER

- North Korea condemned US military drills as provocative and strongly warned the US to stop hostile activity in the region, while North Korea’s military will keep all options open and if necessary, take pre-emptive actions to defend the state, according to KCNA.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer said in an op-ed in the Mail on Sunday that the government will set out “radical reforms” in the coming week to tackle the rising outlays on benefits and will get to grips with the bulging benefits bill.

- Economists revised their forecasts for German economic growth in 2025 to 0.6% from 1.2% which is the largest growth forecast downgrade for the period in any major industrial economy as the Trump tariff threat rattles exporters, according to FT citing a Consensus Economics survey.

- ECB's Lane says monetary policy should not remain restrictive for too long, via Les Echos; rapid rises in rates have further slowed the housing sector and investment. Also, encouraged saving over consumption. A large part of getting inflation back to 2% will be completed next year.