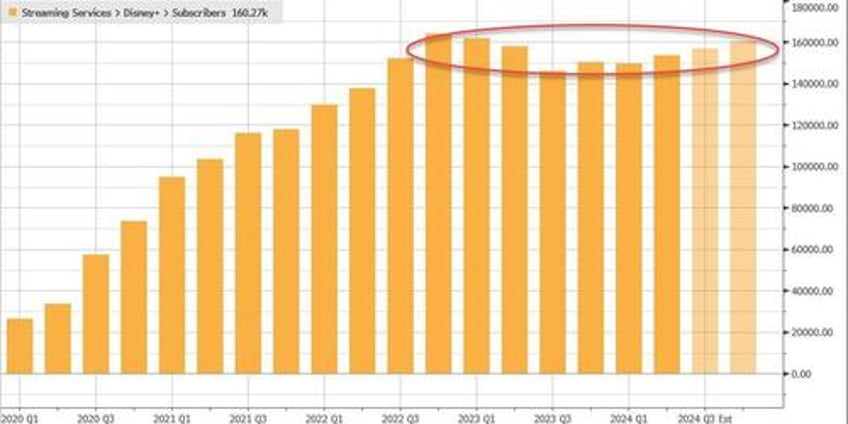

Disney reported fiscal second-quarter profits that exceeded estimates of the average analysts tracked by Bloomberg and raised its full-year earnings guidance. However, shares tumbled in early trading in New York as investors focused more on the Disney+ streaming service, missing its forecast for the quarter.

For the quarter ending March 30, the Disney+ streaming service reported 153.6 million subs, which fell short of Wall Street's expectations of 155.66 million. This is currently overshadowing any positive news from the quarter.

Earnings increased to $1.21 a share, excluding some items, in the quarter, beating the $1.12 average of analysts' estimates. Revenue in the first three months of the year increased by 1.2% to $22.08 billion, compared with analysts' forecast of $22.1 billion.

- Adjusted EPS $1.21 vs. 93c y/y, estimate $1.12 (Bloomberg Consensus)

- Revenue $22.08 billion MEET, +1.2% y/y, estimate $22.1 billion

Entertainment revenue MISS $9.80 billion, estimate $10.31 billion

Direct-to-Consumer revenue MEET $5.64 billion, estimate $5.64 billion

Sports revenue MISS $4.31 billion, estimate $4.33 billion

Experiences revenue BEAT $8.39 billion, estimate $8.18 billion

However, while the media giant added more than 6 million subscribers in the second quarter to its core Disney+ streaming offering, it was less than expected:

- Disney+ subscribers 153.6 million, estimate 155.66 million

And worse still, CFO Hugh Johnston said the company doesn’t expect to see core Disney+ subscriber growth in the current quarter and profitability in streaming will suffer due to due to additional expenses for cricket rights in India.

Disney bought the India business in 2019 as part of its $71.3 billion acquisition of most of 21st Century Fox.

“We are pleased with the progress we’re making in streaming, although, as we said before, the path to long-term profitability is not a linear one,” Johnston said on a call with investors.

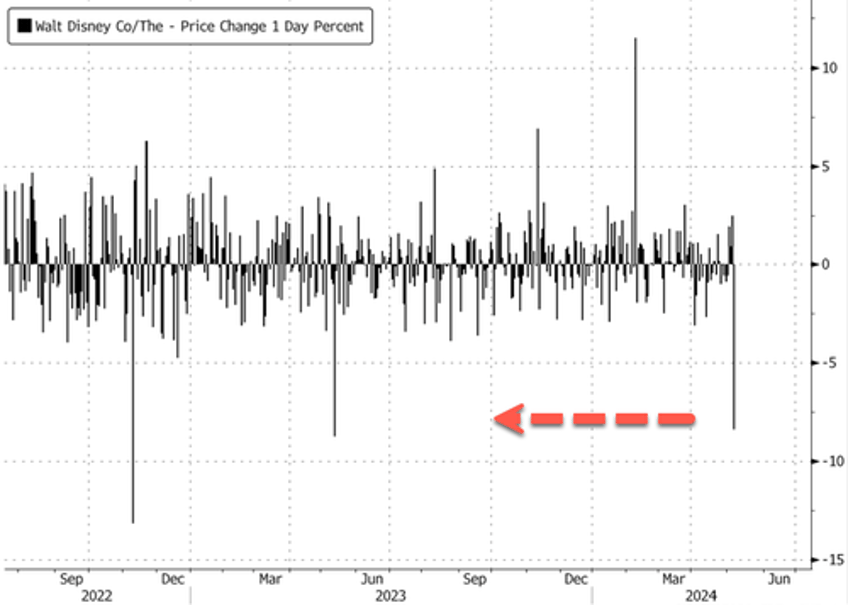

At the start of the cash session, Disney shares slid 8.5%. The latest rebound in the stock has hit heavy resistance at the $120 handle.

The 8.5% decline is the largest intraday tumble since May 11, 2023.

On the bright side, Disney’s theme parks saw revenue increase 10% in the second quarter and the segment posted a 12% gain in operating income.

But, once again, Johnston said he’s expecting little growth at parks in the current period, due to expenses such as a new cruise ship, before resuming growth later in the year.

Earnings in Disney’s theme-park division rose to $2.29 billion in the second quarter, driven by sharply higher results internationally, especially Hong Kong. Domestically the company’s cruise line and Disney World resort in Florida registered income growth, while California’s Disneyland saw weaker performance due to higher costs.

“While consumers continue to travel in record numbers and we are still seeing healthy demand, we are seeing some evidence of a global moderation from peak post-Covid travel,” Johnston said on the call.

The question remains, just how much can Disney put up park prices before demand literally disappears?

While McDonald's, Starbucks, and Tyson Foods have all reported low-income consumers dialing back purchases as inflation pinches pocketbooks, the Disney CFO claimed that:

"We're not seeing that in our portfolio of products," adding there hasn't been much of an impact after streaming prices were hiked earlier this year.

However, it's only a matter of time before Disney sees low-income or middle-of-the-road consumers pull back on streaming spending and outrageously priced park tickets amid rising stagflationary threats.